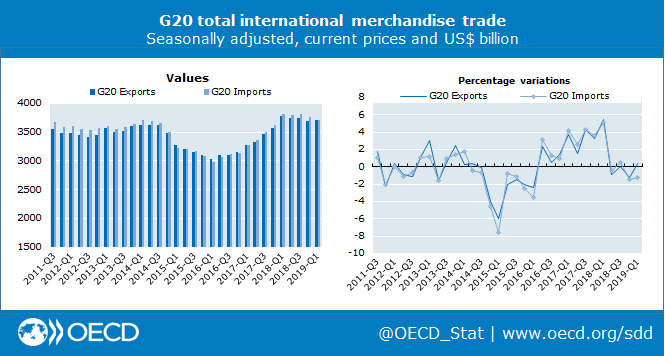

The Organization for Economic Cooperation and Development (OECD) warned that recent escalations in trade tensions between the US and China had stalled global growth.

It seems this year’s major theme from the OECD is the deepening of the trade war starting to disrupt the volume of global trade (something we highlighted in a piece called: Global Trade Collapsing To Depression Levels), weighing on consumer demand worldwide, and hurting economic output in both developed and emerging markets.

“Let’s avoid complacency at all costs,” OECD Secretary-General Angel Gurria said. “Clearly the biggest threat is through the escalation of trade restriction measures, and this is happening as we speak. This clear and present danger could easily have knock-on effects.”

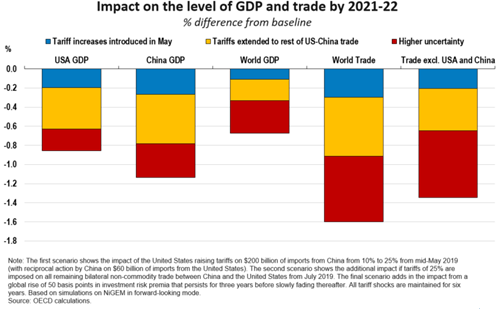

Relations between both countries deteriorated earlier this month when President Trump announced that he would increase tariffs on $200 billion in goods from 10% to 25%. In a tit-for-tat effort, China responded by raising the tariffs on $60 billion of US goods.

The OECD suggests that a re-escalation of the trade war could damage smaller economies and accelerate the global synchronized decline.

OECD experts warn trade tensions are unraveling complex global supply chains, could wipe out entire industries in less developed countries as three decades of globalization are reversed.

In a CNBC interview last week, Gurria said the OECD had cut 1% of its global growth predictions over the previous 12 months. Last year, it forecasted a 3.9% growth rate in 2019, but now, it has been reduced to 3.1% amid trade tensions.

“Uncertainty is the greatest enemy of growth and when you don’t have investment because of trade uncertainties, then of course as a rule of thumb, growth will come down and this is what’s happened in a relatively short period of time. It’s really a very bad scene today, it’s a very great source of concern,” he said.

“Why do you invest? You invest to produce, to sell, to get a reasonable profit. But if you do not know if you’re going to have access to the market, you don’t know what tariff you’re going (to face) or whether there will be access at all, then what you do then if you’re a responsible investor is that you hold back, if you’re a responsible consumer you hold back,” Gurria said.

“Investment is the seed of the growth of tomorrow and this is why, after a short period of time, we’ve had this enormous cut in the projections of growth going forward.”

OECD experts warn if President Trump slaps a 25% tariff on additional $300 billion of imported Chinese goods, many third-world countries’ economies would collapse.

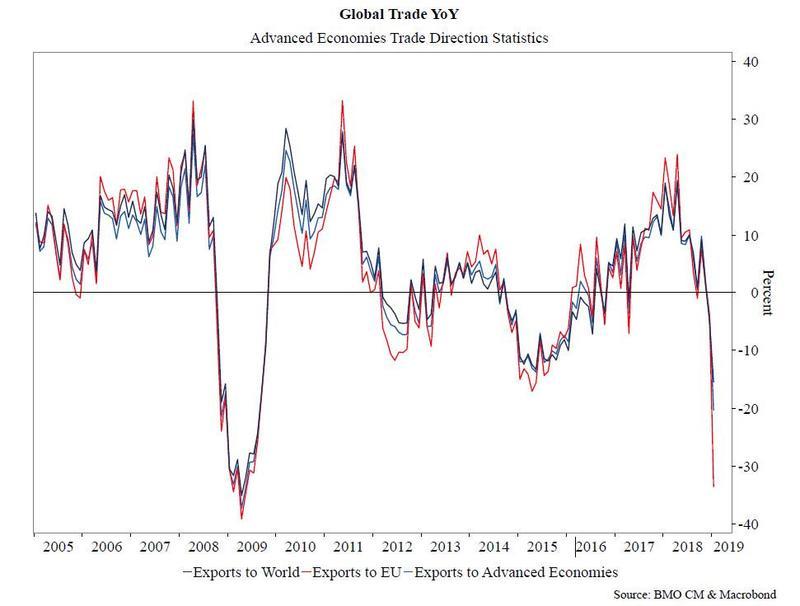

And the best way to visualize the OECD’s warning about the global slowdown is through a chart on the YoY changes in global trade as measured by the IMF’s Direction of Trade Statistics, courtesy of BMO’s Ian Lyngern. It shows the collapse in global exports as broken down into three categories:

- Exports to the world (weakest since 2009),

- Exports to advances economies (also lowest since 2009), and

- Exports to the European Union (challenging 2009 lows).

In short, even before the latest round of trade escalation, global trade had tumbled to levels last seen during the financial crisis. One can only wonder what happens to global trade and smaller economies along critical supply chains after the latest escalation in the US and China trade war…

via ZeroHedge News http://bit.ly/2YY0A4e Tyler Durden