Powell: “There was not much support for cutting rates now at this meeting. It would be better to see more before moving.”

How much moar will the market demand now?

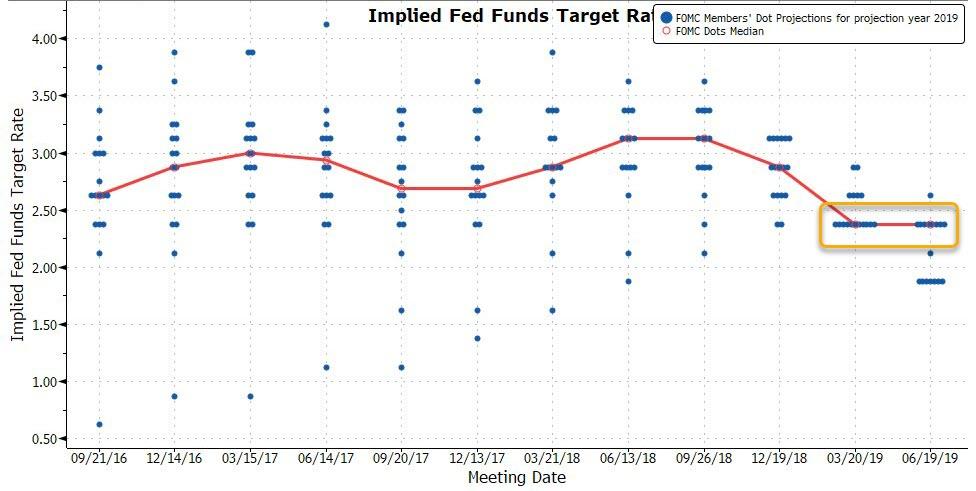

Just how dovish was it? While 8 Fed members now see at least one cut in 2019, the median rate expectation did not change (not that dovish)…

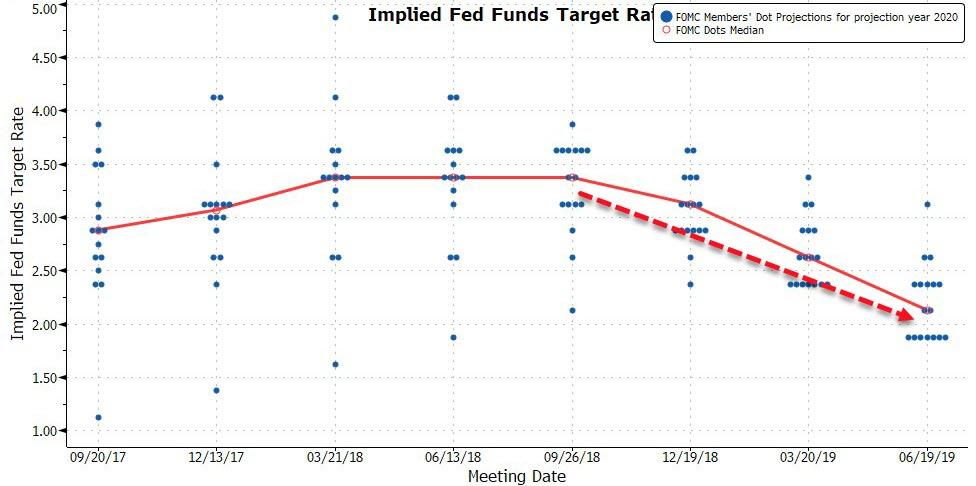

But 2020 median rate expectations did continue to slide…

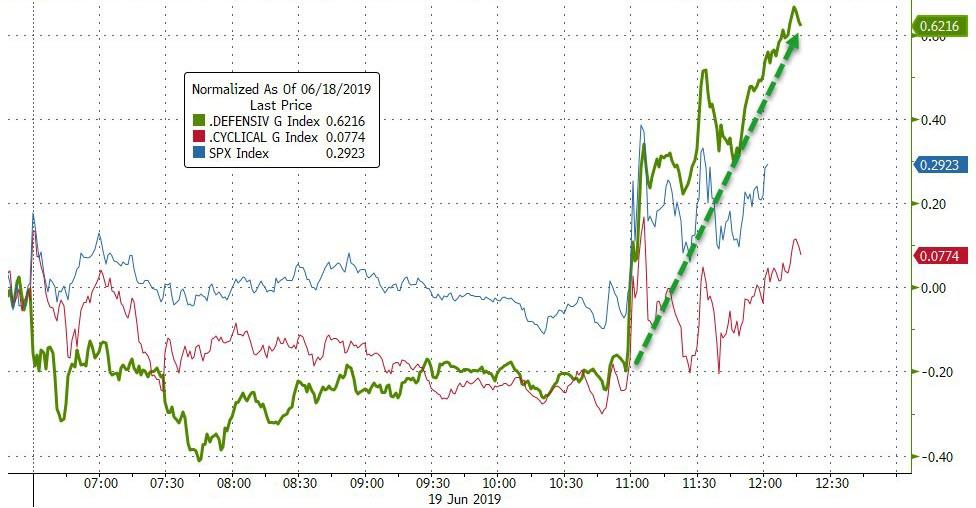

US equity markets trod water for most of the day until the FOMC statement, and even then did not surge as so many had hoped on Powell’s dovishness…

Stocks overall ended higher on the day… (thanks to a panic bid around 1540ET)

The S&P is less than 1% from record highs

Thanks to a huge buying program that suddenly appeared…

Defensive stocks soared on the Fed statement and the initial cyclical spike faded…

S&P Utilities closed at a record high.

Financials slumped into the red after The Fed…

Bonds and stocks keep diverging further…

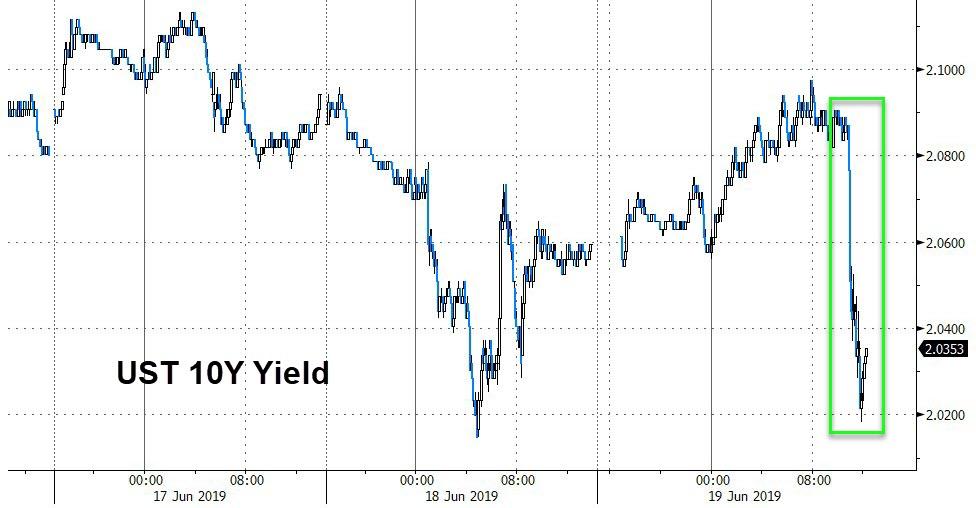

Treasury yields plunged on the Fed statement…

With 10Y testing yesterday’s cycle spike lows with a 2.01% handle…

And 2Y Yields crashed over 10bps to its lowest since Nov 2017…

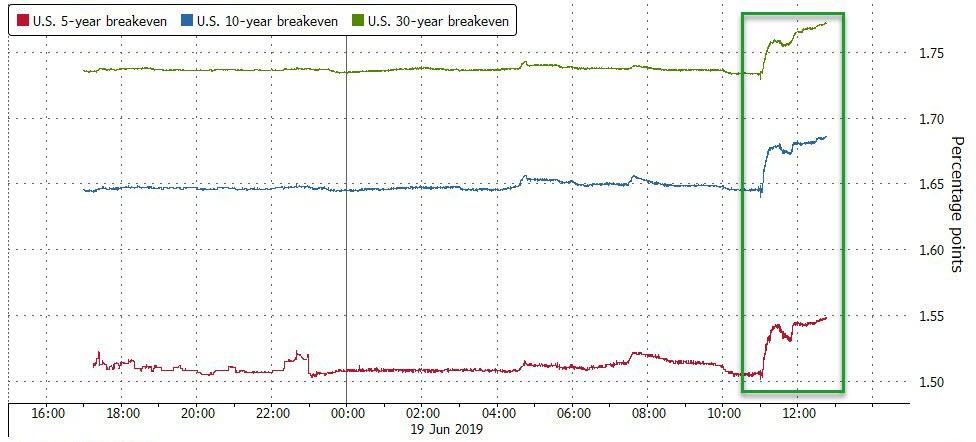

Inflation Breakevens jumped after The Fed statement…

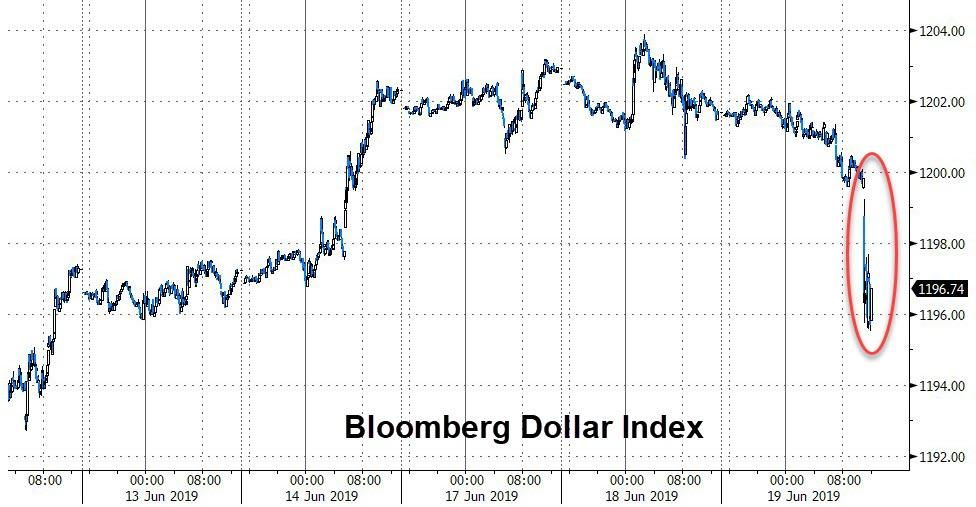

The Dollar tumbled on the Fed Statement

Cryptos trod water today (with Bitcoin hovering around $9100)…

Commodities all rallied on the Fed statement…

Investors rushed into gold as the dovish Fed statement struck, pushing the precious metal back above $1350 once again…

But it appeared the machines were working hard

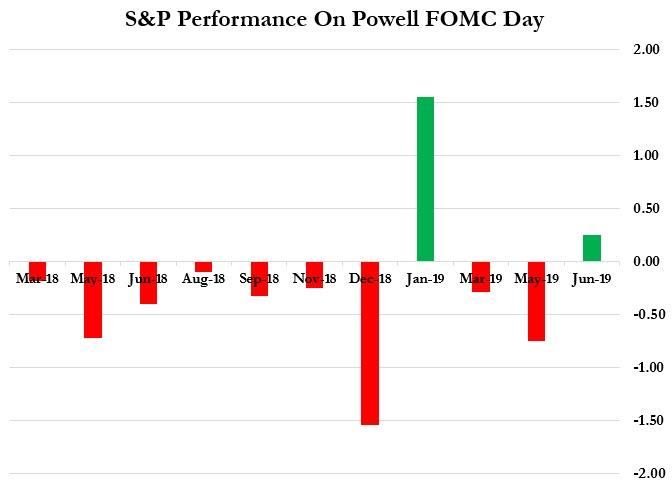

Finally, we note that this is only the 2nd time in Powell’s 11 meetings that the S&P closed green on FOMC day…

As Fed rate-cut expectations accelerate lower…

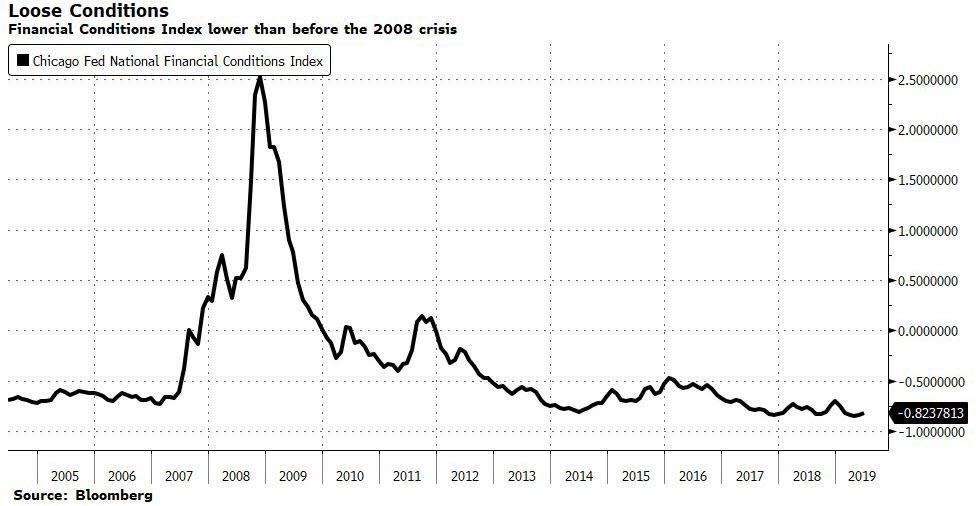

And The National Financial Conditions Index shows that things are already about as loose as can be, lower than before the 2008 financial crisis.

And that’s before The Fed cuts. As Bloomberg’s Cameron Crise noted, John Williams suggested a few weeks ago that the Fed wouldn’t be beholden to bond markets. I guess he was wrong.

via ZeroHedge News http://bit.ly/2WTWdWk Tyler Durden