Three weeks ago, at the start of June, we mocked Goldman’s economics team for having come up with “Schrodinger’s Fed Funds”, when with Powell telegraphing an imminent easing cycle, the team of Jan Hatzius et al refused to throw in the towel and change its long-running forecast of no rate cuts in 2019 and one rate hike in 2020 even though at the same time it said that its “modal path” called for at least one rate cut by 2020. In other words, Goldman – which last December predicted 4 rate hikes in 2019 – was hoping to have its cake and eat it too.

Schrodinger’s Fed Funds: Goldman expects both 2 more rate hikes (modal path) and 1 more rate cut (expected path) at the same time pic.twitter.com/jAJM3S198Q

— zerohedge (@zerohedge) June 3, 2019

This followed just one month after Goldman, whose predictions in recent years have been absolutely disastrous, said that “the next move is more likely to be a hike than a cut, with the next rate increase coming after the election in 2020Q4, followed by another hike in 2021.”

Goldman: “the next move is more likely to be a hike than a cut, with the next rate increase coming after the election in 2020Q4, followed by another hike in 2021.”

— zerohedge (@zerohedge) May 1, 2019

And so, with Powell dropping hint after hint that the hawkish Fed chair of 2018 is no more, and has been replaced with Trump’s spineless footstool, we predicted two weeks ago, on June 7, that Goldman would finally capitulate as the Fed made clear that it is only a matter of time before rate cuts begin.

Goldman will capitulate today and project rate cuts

— zerohedge (@zerohedge) June 7, 2019

We were wrong… but by only 12 days because moments ago following today’s capitulation by Powell, Goldman has similarly capitulated and in the latest humiliation for the predictive abilities of Goldman’s economics team, which is now competing with Gartman for batting -1.000, Goldman writes that it now “expects cuts in July and September, as well as an end to balance sheet runoff in July. Our base case is for moves in 25bp increments, but a 50bp cut is possible if the news flow disappoints and/or Fed officials feel compelled to get ahead of bond market pricing (which currently implies a 32bp cut in July). Conversely, the hurdle appears to be very high for the committee to forego a cut in July”

Admitting that its weekend analysis that the Fed would disappoint the market was dead wrong, Hatzius writes that “the Fed… delivered a dovish message, even relative to market expectations” as “seven of the 19 participants projected 50bp of easing this year, and the statement provided an unqualified “will act as appropriate” signal that cuts are now likely.”

Separately, with Powell “strongly suggesting” that runoff will conclude as soon as the Fed delivers a rate cut, Goldman now expects that “the end of balance sheet runoff will be moved forward by two months, with an announcement at the July meeting that halts runoff in early August.”

While it is hardly relevant, considering just how gruesomely wrong Goldman has been about, well, everything, here is Goldman’s take on “what were the most important takeaways from today’s meeting” starting with…

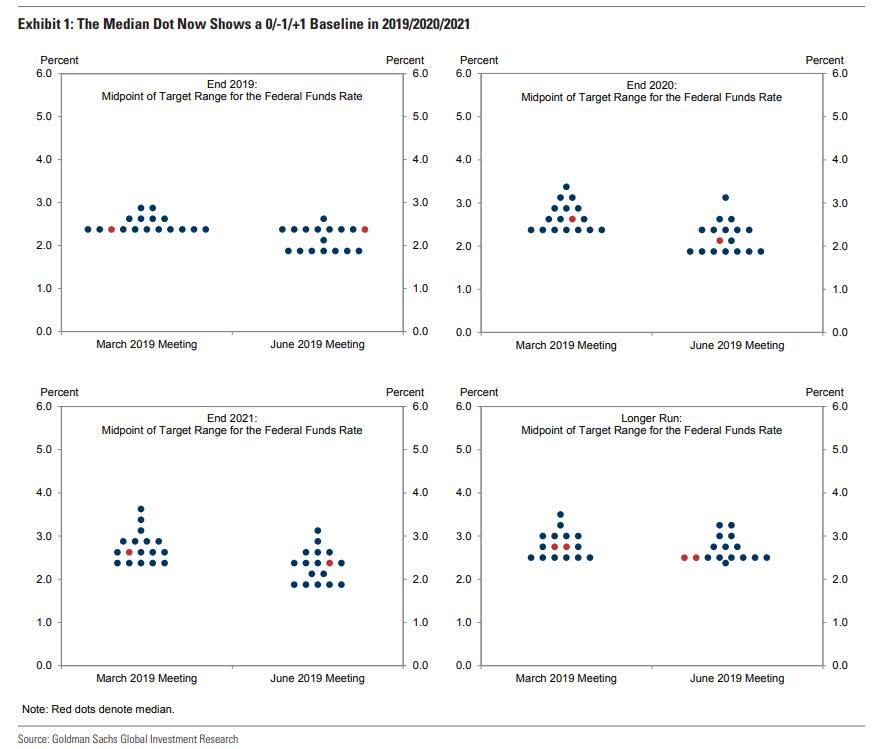

1. The magnitude of the declines in the dots, the starkness of the change in Chair Powell’s tone relative to the May press conference, and the unqualified “will act as appropriate” phrase in the statement. First, eight participants projected at least one cut in 2019, including seven who saw a 50bp move, and the majority of the Committee now projects a cut by 2020 (see Exhibit 1).

And while this would imply a divided committee, in the press conference Powell suggested that there was a broader consensus moving in the direction of rate cuts and did nothing to discourage the interpretation that his own dot is calling for lower rates this year.

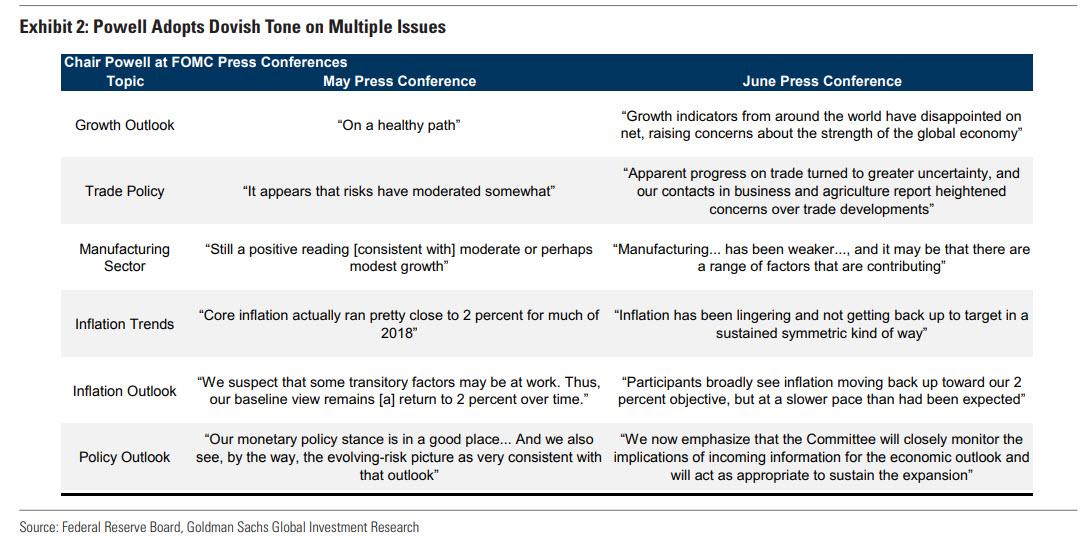

2. Second, the tone of the June press conference was much more dovish relative to the May press conference, at which Powell refused to discuss cases in which the Fed might cut rates and did not express immediate concern about downside risks to inflation expectations. As shown in Exhibit 2, Powell offered quite a different take today on several central issues.

What is bizarre, as we noted earlier, is that despite the sharp divergence in the dot “camps”, most of the changes in the Summary of Economic Projections were similar to our expectations, with the exception of lower projected core inflation next year (-0.1pp to 1.9%) and a surprising upgrade to the GDP projection (+0.1pp to 2.0% for 2020 growth). In other words, the Fed is cutting even with the economy firing on all 8 cylinders.

3. Third, when comparing the Fed’s statement to his redline, Hatzius points out that the phrase “will act as appropriate” was not qualified by the words “as always,” as it had been in Chair Powell’s speech at the Fed conference in Chicago on June 4. This kind of language, unless qualified, usually presages policy action Hatzius writes.

* * *

Here Goldman makes an interesting observation, asking why the Fed would cut rates if its baseline outlook remains “favorable”? The answer, according to Hatzius, is that growth concerns are the primary justification, with low inflation lowering the hurdle required for Fed action.

After all, Powell kicked off the press conference by emphasizing the Committee’s “overarching goal” of sustaining the expansion. Powell also offered a list of uncertainties that could warrant accommodative policy, ranging from global growth and trade policy to relatively minor headwinds such as the grounding of the Boeing 737 MAX and the drop in oil prices (-$10 since the May meeting).

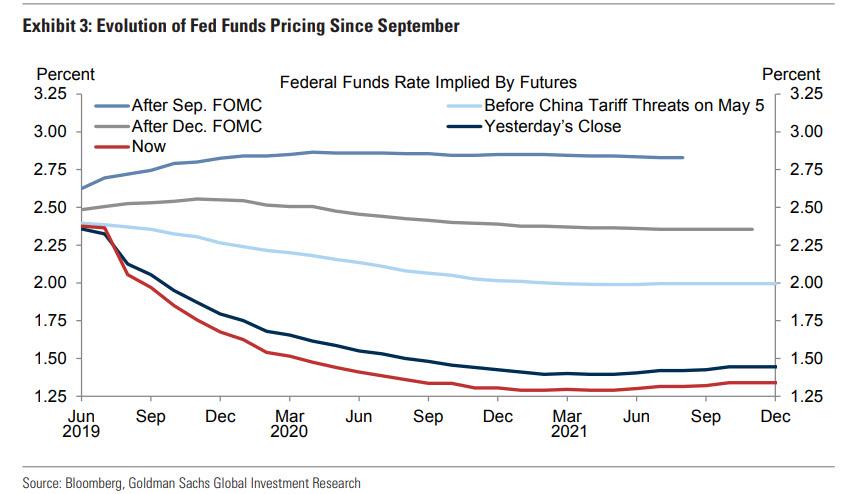

As Goldman concludes, the statement and press conference strongly suggest that at least part of the Fed leadership believe rate cuts are appropriate. As shown in Exhibit 2, the Treasury market now views even larger cuts as likely.

So now that even Goldman accepts a rate cut is coming, the next question is whether it will be a single (25bps) or double (50bps) in July. Here Goldman predicts just one cut (so bet it all on 50bps) , as “Insurance cuts” that are more preemptive in nature “tend to be 25bp”, with larger cuts saved for circumstances in which the economy already appears at risk of sliding into recession. According to Hatzius, the rationale is that providing accommodation gradually in small doses “seems more natural when the motivation is to provide insurance against ongoing uncertainty rather than to provide a large immediate boost to growth.”

The punchline? Goldman’s admission that the Fed has not only capitulated, but also abdicated its role of being ahead of the market instead of being dictated to by it. Case in point, “the results of today’s meeting suggest that many FOMC participants are increasingly influenced by the expectations embedded in bond market pricing and other outside influences.”

This means that any time the bond markets wishes to, it can force the Fed’s hand from now on… even if it results in making the biggest cheap liquidity-driven asset bubble of all time even bigger.

So with the bond market already discounting a 32bp rate cut at the July meeting, and if expectations continue to creep toward 50bp, “the FOMC might well deliver a 50bp cut for fear of disappointing the market, even if the economic data do not paint a particularly worrisome picture.”

For those who still don’t get the picture.

The apparent influence of the bond market recalls the well-known comment by political strategist James Carville: “I used to think that if there was reincarnation, I wanted to come back as the president or the pope or as a .400 baseball hitter. But now I would like to come back as the bond market. You can intimidate everybody.” Carville spoke in the 1990s when the bond market worried about upside inflation risk, but the same basic logic might apply today.

And…

… if it is true that the Fed’s decisions have become increasingly responsive to bond market expectations, it might prove hard to stop cutting. The bond market might continue to price cuts even if downside risks merely linger, the White House is likely to continue calling for lower interest rates, and the idea that “an ounce of prevention is worth a pound of cure” when the effective lower bound limits the ability to respond to recessions might continue to gain popularity in monetary policy discussion. This creates a risk that easing will remain the path of least resistance beyond September.

Translation: the bond vigilantes are back, only this time it is not to push rates higher, but to make sure the Fed wins the race to the bottom, even as the biggest asset bubble of all time gets even bigger, creating a “huge risk” that in just a few months the Fed will be forced to intervene and to stop the ensuing melt up or risk losing all credibility.

via ZeroHedge News http://bit.ly/2RlI2rY Tyler Durden