About 1 in 5 cardholders in New York City has a five-figure credit card balance, making it one of the nation’s most debt-burdened cities, reported CompareCards.

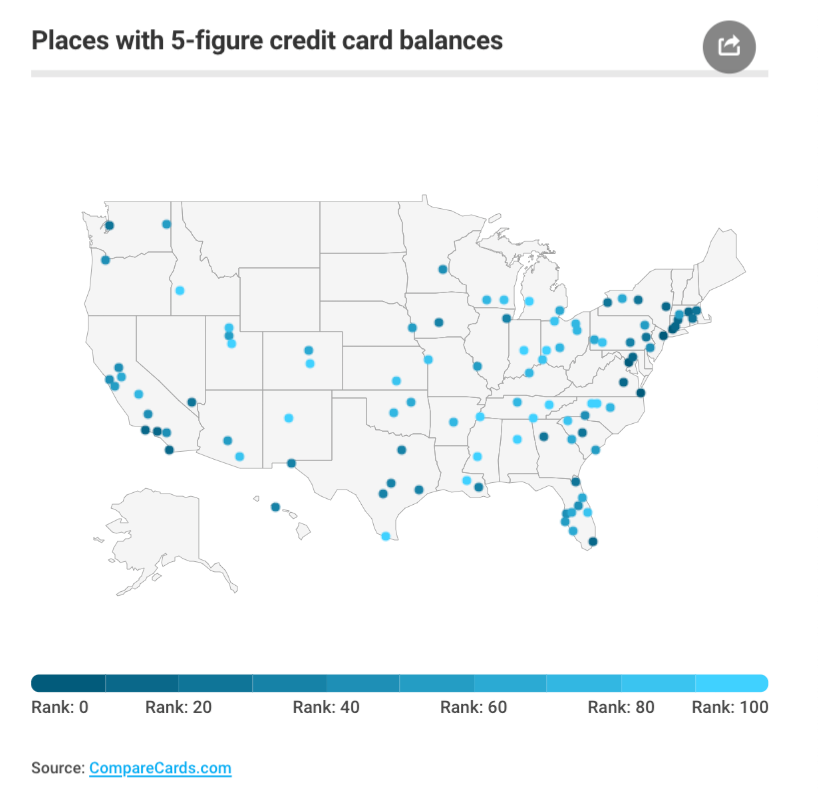

The study analyzed 1.2 million anonymized credit reports from LendingTree in 100 of the largest metropolitan areas across the country. It found a majority of the cities with the most significant percentages of people with five-figure credit card debt are located in metro areas on the East and West Coast.

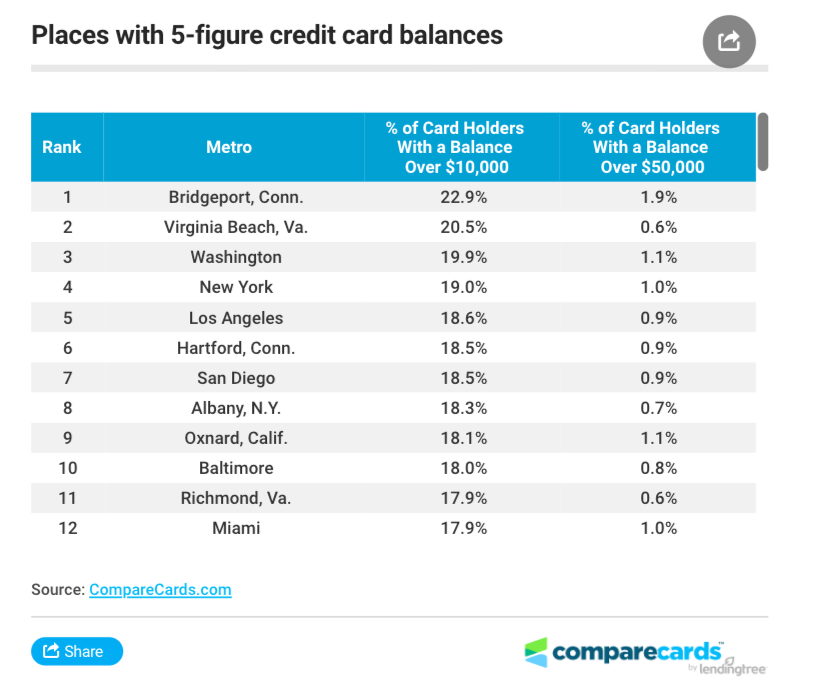

Bridgeport, Connecticut had the highest rate of cardholders with five-figure debts at 22.9%. Virginia Beach, Virginia had 20.5% and Washington, DC with 19.9%, the survey revealed. New York City was ranked fourth with a rate of 19%.

CompareCards said cities with high credit card balances also had high levels of income inequality.

Of the five metro areas with the highest percentage of cardholders with five-figure card balances, three — Bridgeport, New York, and Los Angeles — are among those with high wealth inequalities.

The study investigates: Why is Bridgeport number one? Well, the wealth disparity between Greenwich and Bridgeport (separated by 29 miles) is some of the widest in the nation.

“When you have a large number of people like that in the same city or metropolitan area with a large number of people with poor credit who either can’t get credit or just get small lines of credit that prevent one from running up a high balance, you get a situation like we see in Bridgeport: a high percentage of people with high balances,” the report reads.

Furthermore, this is all happening as credit card charge-offs have spiked to a seven-year high, indicating US consumers are in far worse shape than assumed.

Regular readers may recall that two years ago we wrote that “Credit Card Defaults Surge Most Since Financial Crisis.” And while this deteriorating trend had more or less plateaued for much of 2018, it has taken another big step higher in 2019 and as Bloomberg reports “red flags are flying in the credit-card industry after a key gauge of bad debt jumped to the highest level in almost seven years.”

That said, a crisis is undoubtedly brewing in cities where five-figure credit card balances are high. On the other hand, with overall interest rates in the US still near historic, record lows, and possibly reverting to the zero lower bound before the next recession, it seems millions of consumers are sleepwalking into insurmountable debts ahead of the next downturn.

via ZeroHedge News http://bit.ly/31KWcYo Tyler Durden