Authored by EconomicPrism’s MN Gordon, annotated by Acting-Man’s Pater Tenebrarum,

A Distorted Landscape

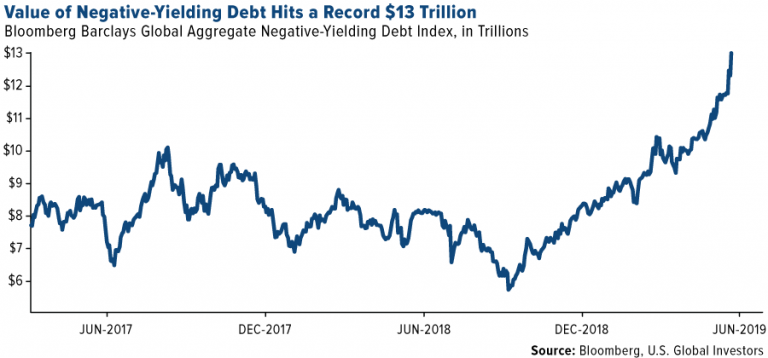

One of the more remarkable achievements of fake money creation is that it distorts and disfigures the world in odd and uncanny ways. Dow (not quite) 27,000. Million dollar shacks. Over $13 trillion in subzero-yielding debt. You name it. Any and every disfiguration is possible with enough fake money.

The global stock of outstanding government bonds with negative yields-to-maturity reaches a new record high of more than $13 trillion – this is insanity writ large. [PT]

However, when it comes to the full range of ways fake money distorts the economic landscape, asset price inflation is merely a cheap facade. The real, mega-disfigurations pile up in the arena of international trade. What’s more, they extend well beyond a gaping trade imbalance.

Currency wars, competitive devaluations, and the race to the bottom are all hazards formed out of the confluence of fake money, foreign exchange markets, and international trade. So, too, the impetus for tit for tat trade tariffs and trade wars ties back to the deceit and deception of fake money. Still, these facets aren’t the half of it.

To better understand what exactly fake money has wrought, a brief detour is in order. You see, a world under the influence of fake money is a strange and curious place. The clearest path between two points is not always a straight line.

Thus, before we get to how Beijing is using fake money to cannibalize the U.S. transit market, we deviate to the fake capitalism of the technology sector. This may be an old and tired story. But it offers important context for understanding the world at large…

Benevolent Investors

The 21st century has brought forth many absurdities. But none is perhaps greater than the popular delusion that profits don’t matter. That growth is somehow the sole determinant factor of a stock’s value.

This goes counter to our antiquated conception of capitalism. We still believe that current and future profits are critical to the growth of a company. Yet, according to the voting machine of the market, and the bubble economy of the technology sector, profits mean diddly squat. Technology investors even have a decade of rising portfolios to prove it.

Take Spotify, for instance. During the first quarter of 2019, the music streaming service delivered revenue of $1.5 billion. But, to do so, they produced earnings of negative $142 million.

Spotify since its IPO – yet another profitless wonder of the modern-day version of the tech bubble. This is highly reminiscent of the late 1990s, when the initial wave of dotcom companies that had come to the market was valued on the basis of “eyeballs”. A few of these lottery tickets had phenomenal growth and eventually made investors rich, but the vast majority of them simply went under when the NDX suffered an 80% wipe-out from 2000 – 2002. [PT]

Nonetheless, investors piled into Spotify like it was gushing cash. Year to date, its share price is up 25 percent. Mind you, this is for a company with trailing twelve month earnings per share of a negative $7.63. Somehow, the company has a market capitalization over $26 billion.

Naturally, we are suspicious of the business model. You cannot make up for negative earnings with greater volume. But in the bubble economy of the technology sector this is of little concern to investors.

What matters to technology investors is that the business has the appearance of innovative growth. Hence, Spotify, and many other technology companies, exist solely off the benevolence of investors.

Without question, this is old news. But it is important to revisit it. For in being rewarded for their losses, Wall Street’s most popular technology companies are able to cannibalize their competitors and control niche markets.

An hourly chart of UBER since its IPO – the stock recently reached a new post-IPO high. Wall Street just loves giant loss-making companies these days – UBER is losing money hand over fist and its survival is predicated on investors continuing to fund its losses for a long time to come. We imagine that maintaining this business model would become quite difficult should interest rates ever rise again (not an impossibility). [PT]

How Beijing Uses Fake Money to Cannibalize the U.S. Transit Market

Perhaps the greatest innovation of the technology sector has been the great lengths it has gone to destroy capital. No doubt, many unique and creative endeavors have been undertaken to this end. The opportunities are limitless.

For example, the technology sector business model is currently being exploited by the Communist Party of China to the detriment of the economic and security interests of U.S. citizens.

Adding insult to injury, this is taking place on the U.S. taxpayer’s dime.

Specifically, Chinese state owned enterprises (SOE), like China Railway Rolling Stock Corporation (CRRC), have been booking large metropolitan taxpayer funded transit contracts in cities across the US. For clarification, a Chinese SOE is a Chinese company backed by the Communist Party of China. The Alliance for American Manufacturing offers the particulars:

“CRRC already has won contracts to build rail transit in Boston, Philadelphia, Los Angeles and Chicago — and did so by significantly underbidding its rivals. In Philadelphia, for example, CRRC outbid its next closest competitor, Canadian company Bombardier, by $34 million. Its bid was $47.2 million lower than South Korea’s Hyundai Rotem, which already had a manufacturing presence in the city.

“CRRC can underbid its competitors so significantly because China’s goal isn’t to make money from individual transit contracts, as a company operating in a free market would. Rather, it wants to dominate the entire global transit industry, and is working to do so by entering and quickly dominating markets in other countries, including in the United States.”

CRRC, weekly – the 5-year price chart of this giant Chinese SOE is fatally reminiscent of the chart of the South Seas Company from 1720 to 1725. Nevertheless, CRRC has in the meantime become the largest rolling stock manufacturer in the world, eclipsing former market leaders like Siemens and Alstom. [PT]

Similar to technology sector businesses, which operate at a loss and cannibalize competitors, CRRC and other Chinese SOEs can operate at a loss and cannibalize the U.S. transit market. But instead of benevolent investors backstopping them, Chinese SOEs are backstopped with fake money from Beijing.

From what we gather, Senate Minority Leader Chuck Schumer is on the case – calling for a federal probe into CRRC’s efforts to design New York City subway train cars. But this misses the point entirely.

So long as fake money is accepted for goods and services, the extreme distortions and disfigurations will continue. Beijing’s use of fake money to cannibalize the U.S. transit market is merely the logical progression of a degraded condition.

via ZeroHedge News https://ift.tt/2Xb3Isd Tyler Durden