Pensions across the U.S. are falling deeper into a crisis, as the gap between their assets and liabilities widens at the same time that investment returns are falling, according to Bloomberg.

Chief Investment Officer Ben Meng told the board of the California Public Employees’ Retirement System last week: “For the next 10 years, our expected returns are 6.1%, not 7%.”

And if you think you’ve seen panic now, just wait until he finds out that Calpers’ target of 7% – lowered in 2016 – is still a pipe dream.

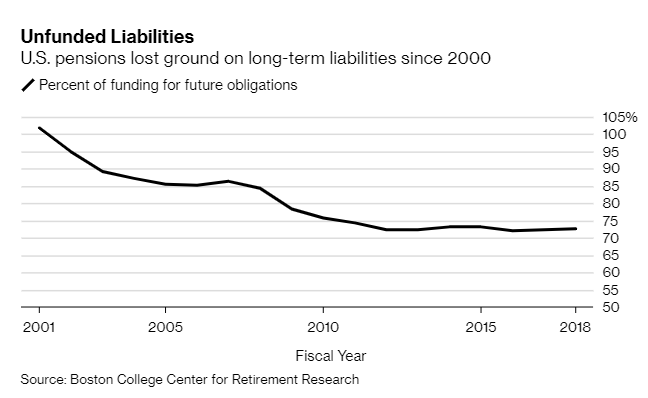

Put simply: the record, decade long bull market hasn’t been enough to save pensions. The average U.S. plan has only 72.5% of its future obligations in 2018, compared to more than 100% in 2001. The Center for Retirement Research at Boston College attributes the deficit to “recessions, insufficient government contributions and generous benefit guarantees.”

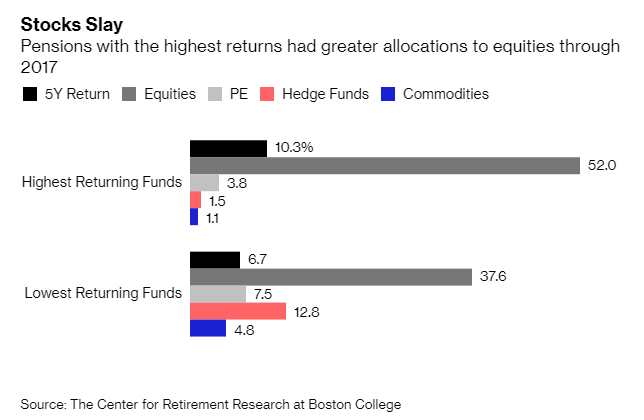

Jean-Pierre Aubry, associate director said: “The really bad plans went heavily out of equities after the financial crisis.”

Pensions that aggressive bet on stock outperformed funds that moved money into alternative investment vehicles, like hedge funds.

Andrew Junkin, president of Wilshire Consulting, said: “Sometimes diversification, while it’s the right strategy, makes you look dumb.”

And this success isn’t a guarantee in the future, either.

Phillip Nelson, asset-allocation director at pension advisory firm NEPC said: “The discussion we have internally is over the next ten years is do you see an equal amount of Fed support and profit margins increasing by another 50% from this level? Both seem really unlikely to us.”

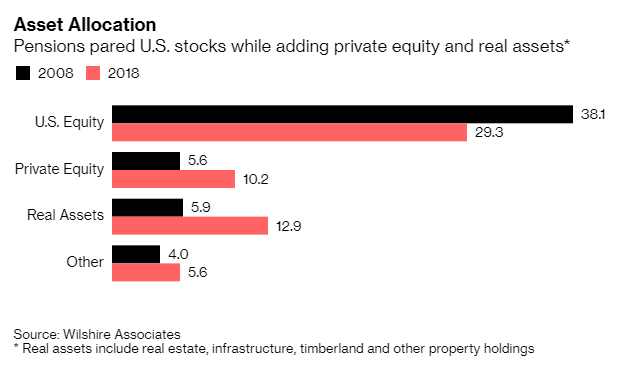

Public pensions have increased their exposure to PE to 10.2% on average in 2018. This is up from 5.6% in 2008, a trend that will probably continue. Many pension funds, like the Texas Teachers’ Retirement System, are hiring new staff to manage private equity. Their fund invests 40% of its portfolio in alternatives.

Mohan Balachandran, senior managing director of asset allocation at Texas Teachers said: “Our pension liability duration is 20-plus years. We felt that we could invest for the long-term in some of these vehicles where your money’s locked up for seven to 12 years.”

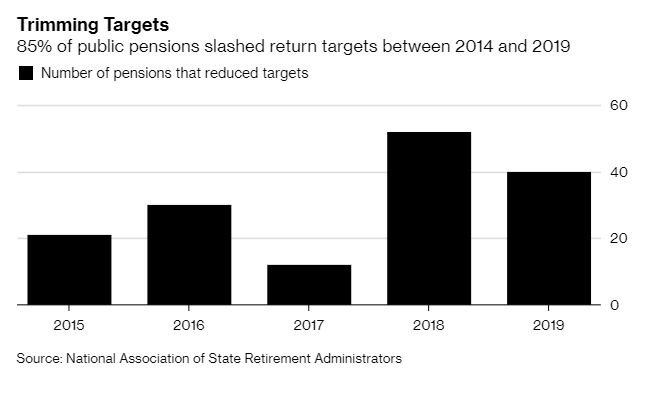

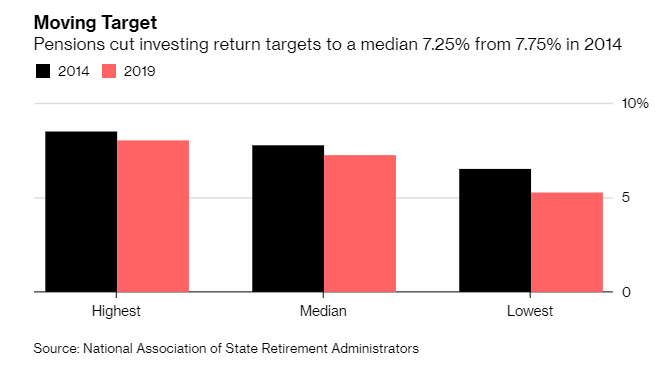

Now, about 85% of the 129 public pensions in the U.S. have cut return assumptions since 2014. These targets are expected to continue moving lower.

Keith Brainard, research director at the National Association of State Retirement Administrators said: “Each month and each quarter that goes by with low inflation and interest rates remaining low provides more ammunition to justify lower investment returns.”

And lower assumptions aren’t always well received by taxpayers, despite lowering the risk for pension funds. Often, they lead to money out of the pockets of taxpayers to cover the difference.

The Kentucky Retirement Systems’ plan for 123,000 employees in non-emergency jobs could be one of the worst off systems in the U.S. It currently only has $2 billion in assets for $15.6 billion in liabilities. The burden has resulted in government service cuts, pay freezes and a falling headcount.

Executive Director David Eager said: “We call it the death spiral. You can’t earn your way out of this.”

via ZeroHedge News https://ift.tt/2LrI6p7 Tyler Durden