Authored by John Butters of Factset

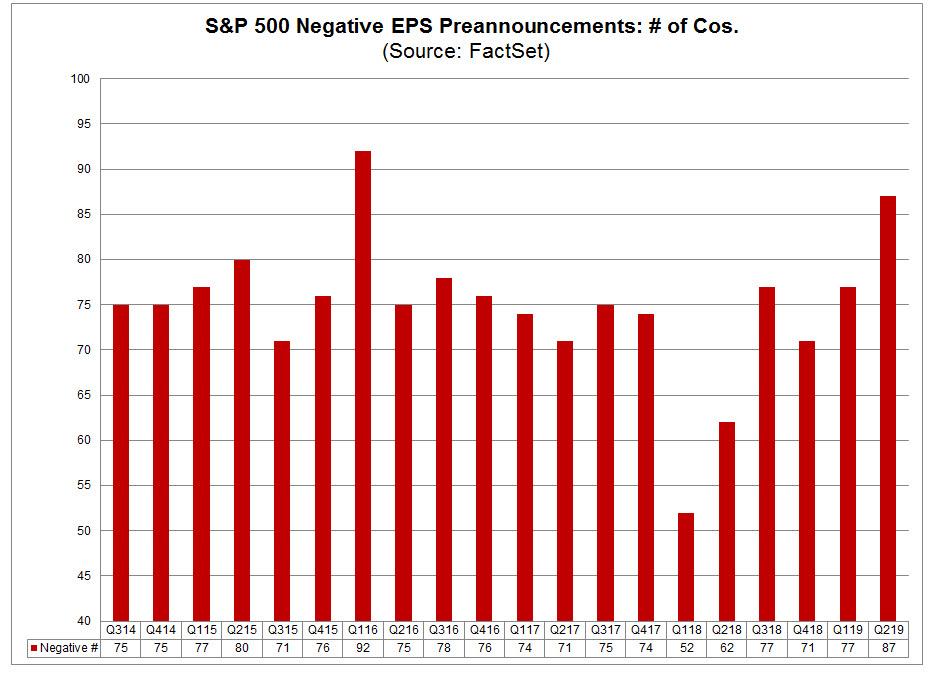

Heading into the end of the second quarter, 113 S&P 500 companies have issued EPS guidance for the quarter. Of these 113 companies, 87 have issued negative EPS guidance and 26 companies have issued positive EPS guidance.

The number of companies issuing negative EPS for Q2 is above the five-year average of 74. In fact, if 87 is the final number for the second quarter, it will mark the second highest number of S&P 500 companies issuing negative EPS guidance for a quarter since FactSet began tracking this data in 2006 (trailing only Q1 2016 at 92).

What is driving the unusually high number of S&P 500 companies issuing negative EPS guidance for the second quarter?

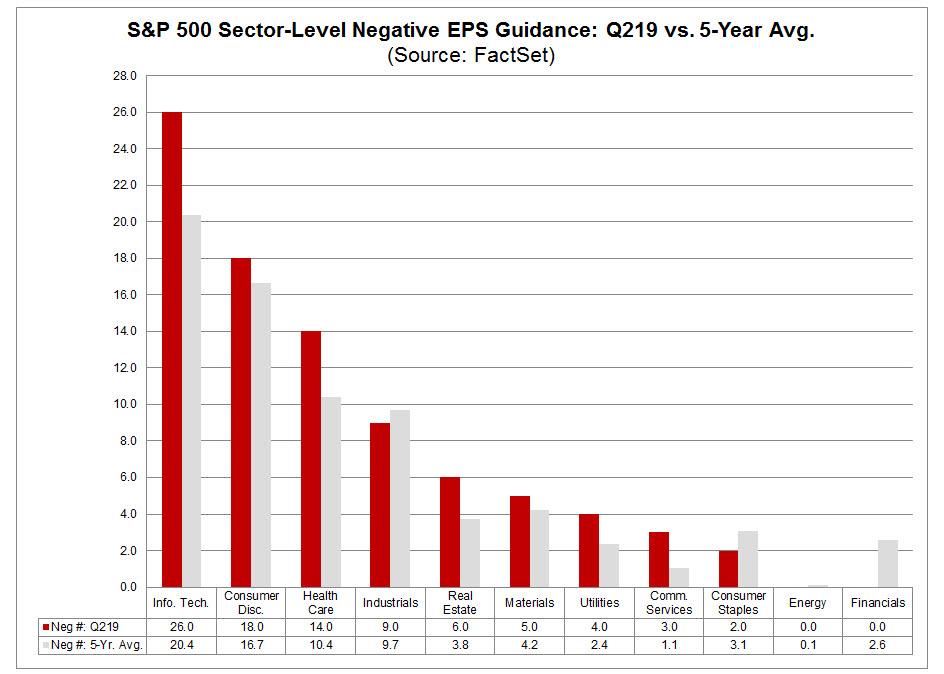

At the sector level, seven of the 11 sectors have seen more companies issue negative EPS guidance for Q2 2019 relative to their five-year averages. However, the Information Technology and Health Care sectors are the largest contributors to the overall increase in the number of S&P 500 companies issuing negative EPS guidance for Q2 relative to the five-year average.

In the Information Technology sector, 26 companies have issued negative EPS guidance for the second quarter, which is above the five-year average for the sector of 20.4. If 26 is the final number for the quarter, it will tie the mark (with multiple quarters) for the second highest number of companies issuing negative EPS guidance in this sector since FactSet began tracking this data in 2006, trailing only Q4 2012 (27).

At the industry level, the Semiconductor & Semiconductor Equipment (9) and Software (6) industries have the highest number of companies issuing negative EPS guidance in the sector. In the Health Care sector, 14 companies have issued negative EPS guidance for the second quarter, which is above the five-year average for the sector of 10.4. At the industry level, the Health Care Equipment & Supplies (8) and Life Sciences Tools & Services (5) industries have the highest number of companies issuing negative EPS guidance in the sector.

The term “guidance” (or “preannouncement”) is defined as a projection or estimate for EPS provided by a company in advance of the company reporting actual results. Guidance is classified as negative if the estimate (or mid-point of a range estimates) provided by a company is lower than the mean EPS estimate the day before the guidance was issued. Guidance is classified as positive if the estimate (or mid-point of a range of estimates) provided by the company is higher than the mean EPS estimate the day before the guidance was issued.

via ZeroHedge News https://ift.tt/2XhBbGt Tyler Durden