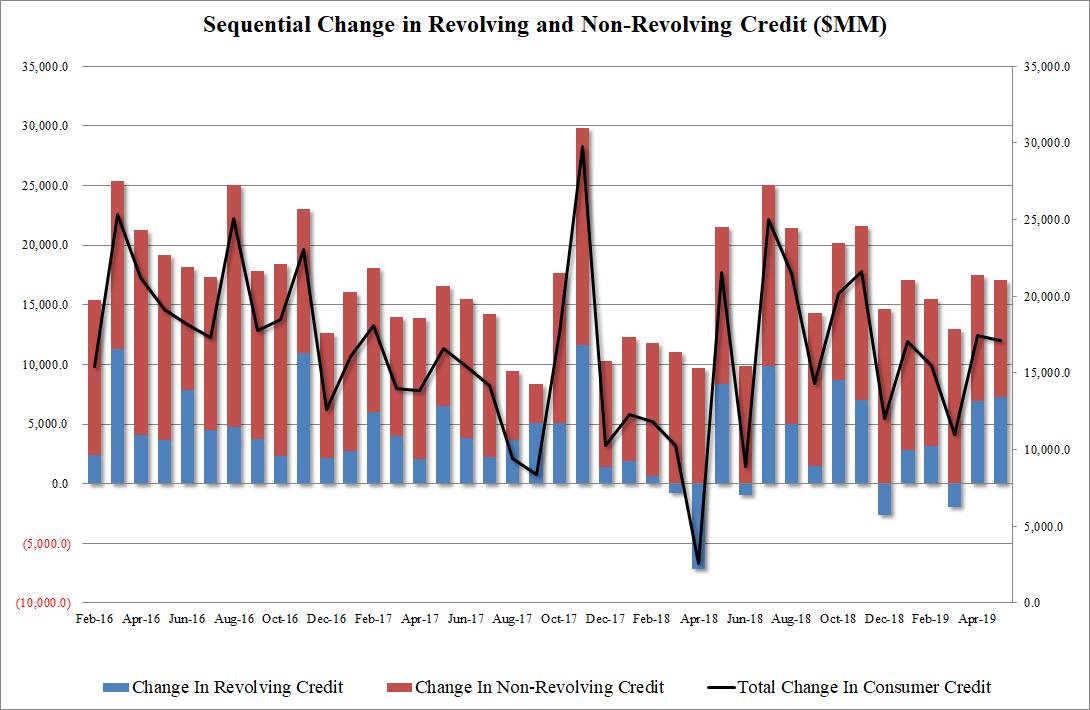

Two months after an unexpectedly poor March consumer credit print, when just $10.3 billion (since revised to $10.9 billion) in revolving and non-revolving debt was created to fund another month of US purchases on credit, moments ago the Fed reported that in May, things went back to normal, as total consumer credit jumped by $17.1 billion – just shy of April’s $17.5 billion – the highest since November’s $21.6 billion, and to a new all time high in consumer credit of $4.088 trillion, which in turn was up 5.2% from a year earlier, rising roughly twice as fast as overall GDP.

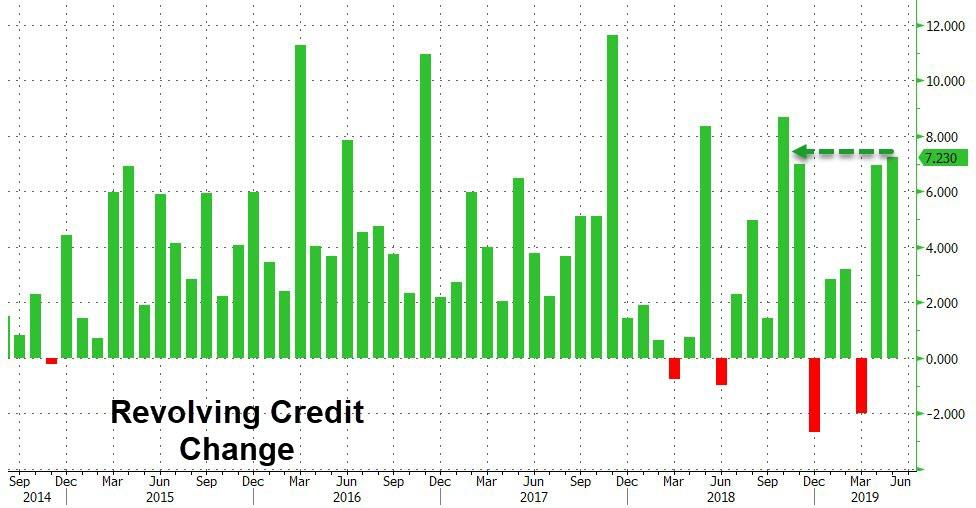

This was entirely thanks to a surge in credit card debt as the latest revolving credit print was a whopping $7.2 billion injection, up from a draw of $2 billion in March, and from $7 billion in May, and not only more than all the credit card debt issued in the first three months of the year but the highest since last October when Americans were racking up credit card debt to pay for Thanksgiving.

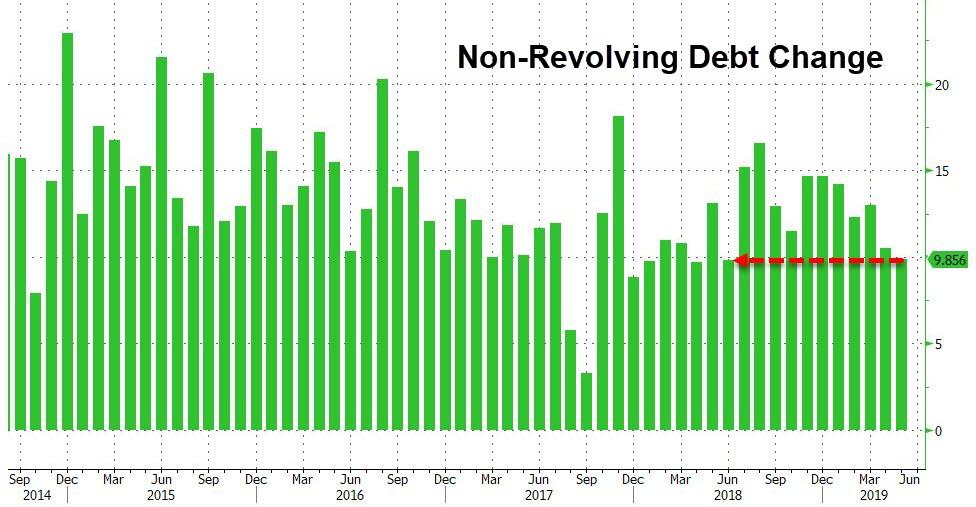

Meanwhile, as credit card debt soared, nonrevolving credit – auto and student loans – posted a surprisingly soft print, with only $9.9 billion in new debt created. This was over $600 million below last month’s print, and the lowest since June 2018.

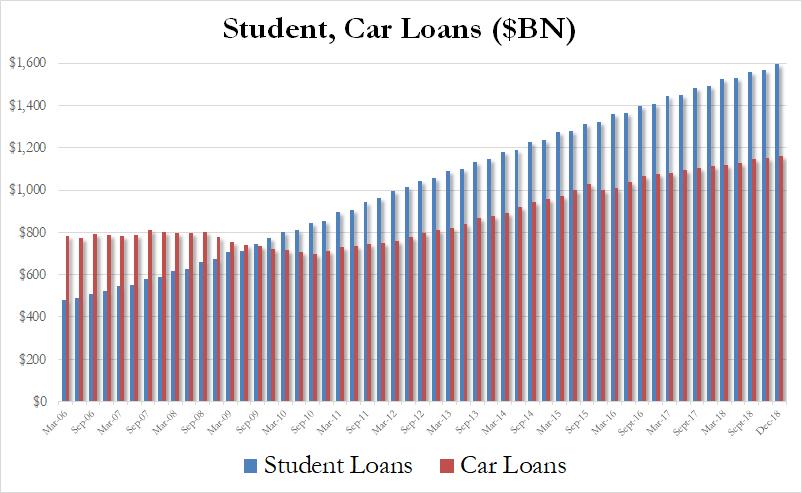

And while the combined April and May rebound in credit card use may ease concerns about the financial stability and propensity of the US consumer to spend, one place where there were no surprises was in the total amount of student and auto loans: here as expected, both numbers hit fresh all time highs with a record $1.6 trillion in student loans outstanding, a whopping increase of $30 billion in the quarter, while auto debt also hit a new all time high of $1.16 trillion, an increase of $8 billion in the quarter.

In other words, whether they want to or not, Americans continue to drown even deeper in debt, and enjoying every minute of it.

via ZeroHedge News https://ift.tt/2JAL4W5 Tyler Durden