Authored by Sven Henrich via NorthmanTrader.com,

Well, at least it’s all out in the open now. Nobody even bothers about growth or earning anymore (at least for now).

It’s all about the Fed, markets by central committee. Don’t take my word for it, just look at the headlines:

Dow Futures Drop Because the Fed Might Not Cut Rates After All https://t.co/4EjmBaxPG6

— Barron’s (@barronsonline) July 8, 2019

This @CNBC headline illustrates what is consensus expectation: Yes economic conditions are likely to will get harder but #investors can continue to rely on the power of #CentralBanks to drive asset prices higher –that is, an ever widening gap between fundamentals and valuations! pic.twitter.com/AV5wpdxxcm

— Mohamed A. El-Erian (@elerianm) July 8, 2019

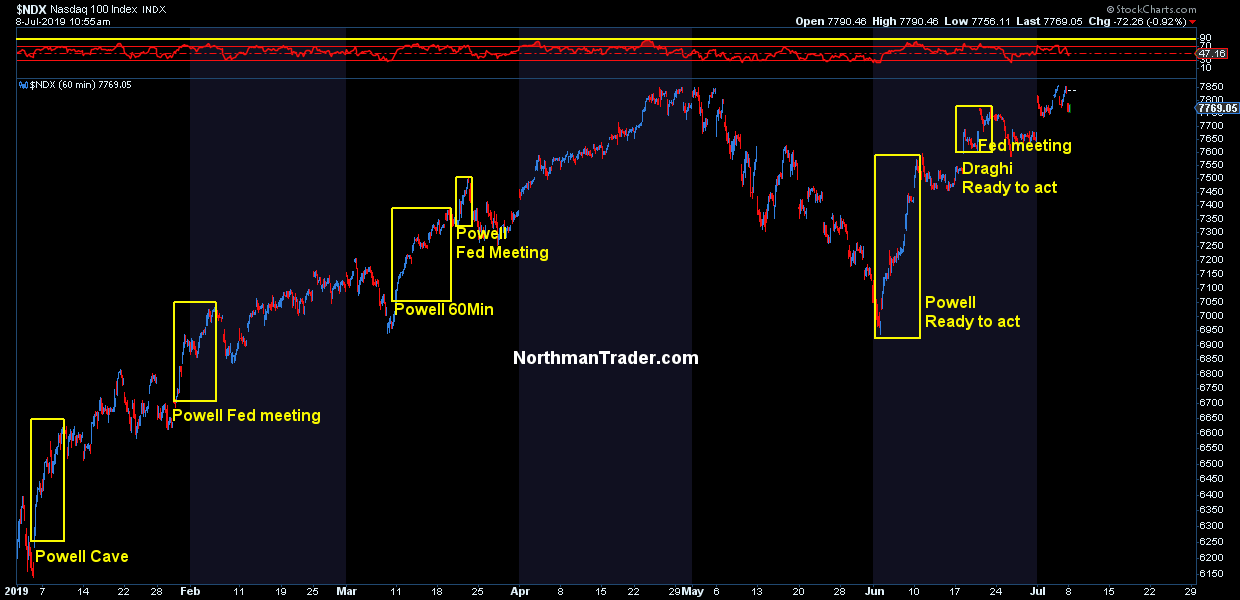

It’s just the extension of what we’ve seen all year:

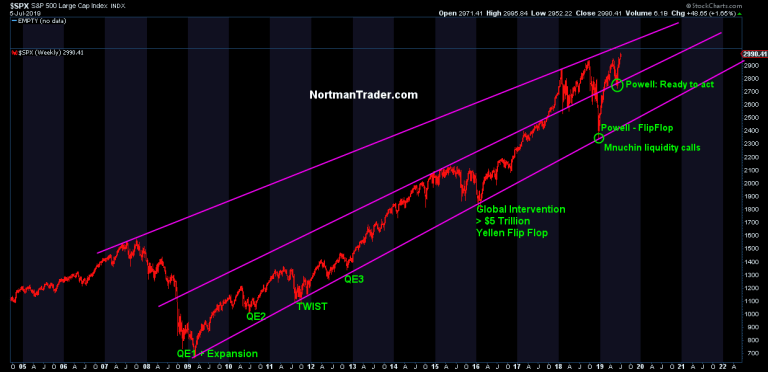

…or since 2009 for that matter:

And for now the machines continue on their programmed mission to buy no matter what:

Wall Street is chasing the billions of dollars of stocks bought and sold on autopilot in the dying minutes of every trading day https://t.co/aZsw16AuHY via @markets

— Robert Burgess (@BobOnMarkets) July 8, 2019

My current technical outlook remains the same as outlined in Sell Zone.

The Distortion continues.

But look closely, the market construct is fragile. It’s all a bunch of rising wedges, bear flags and open gaps.

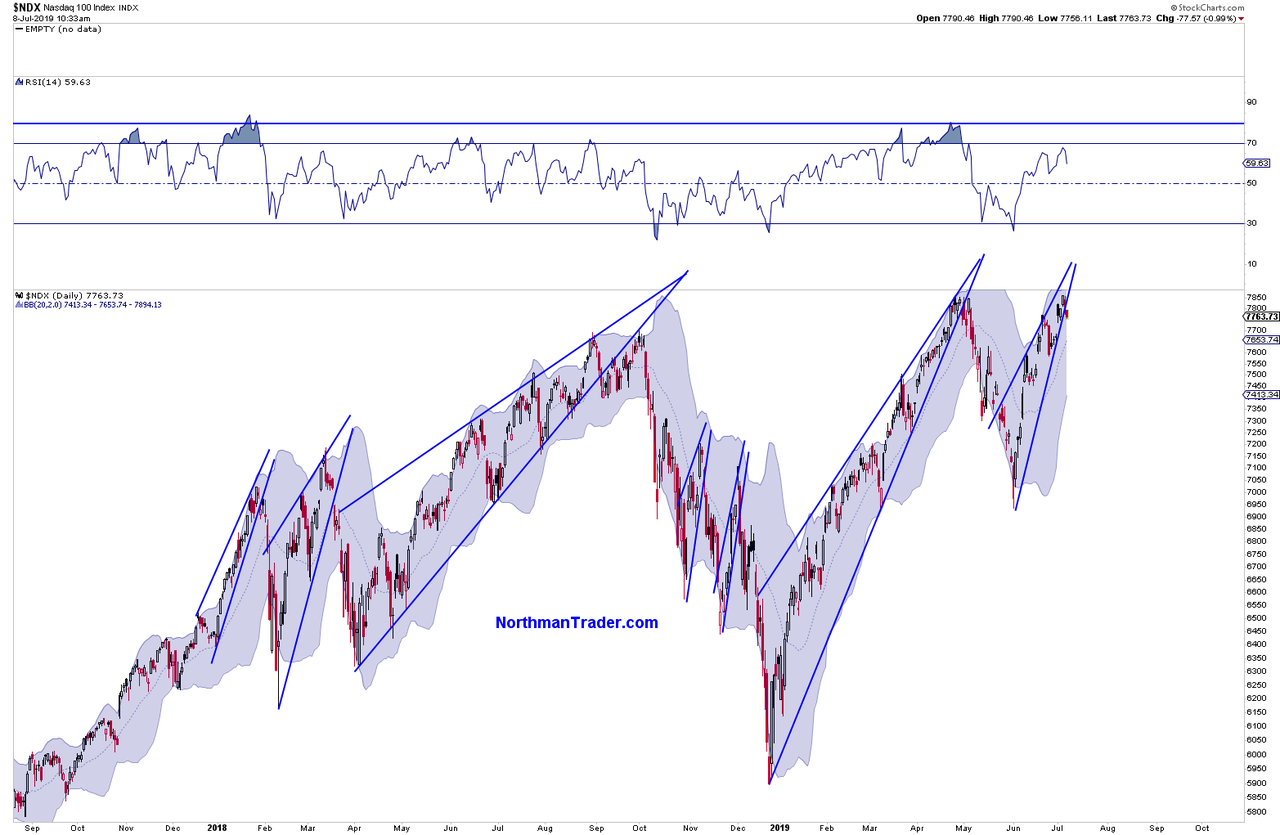

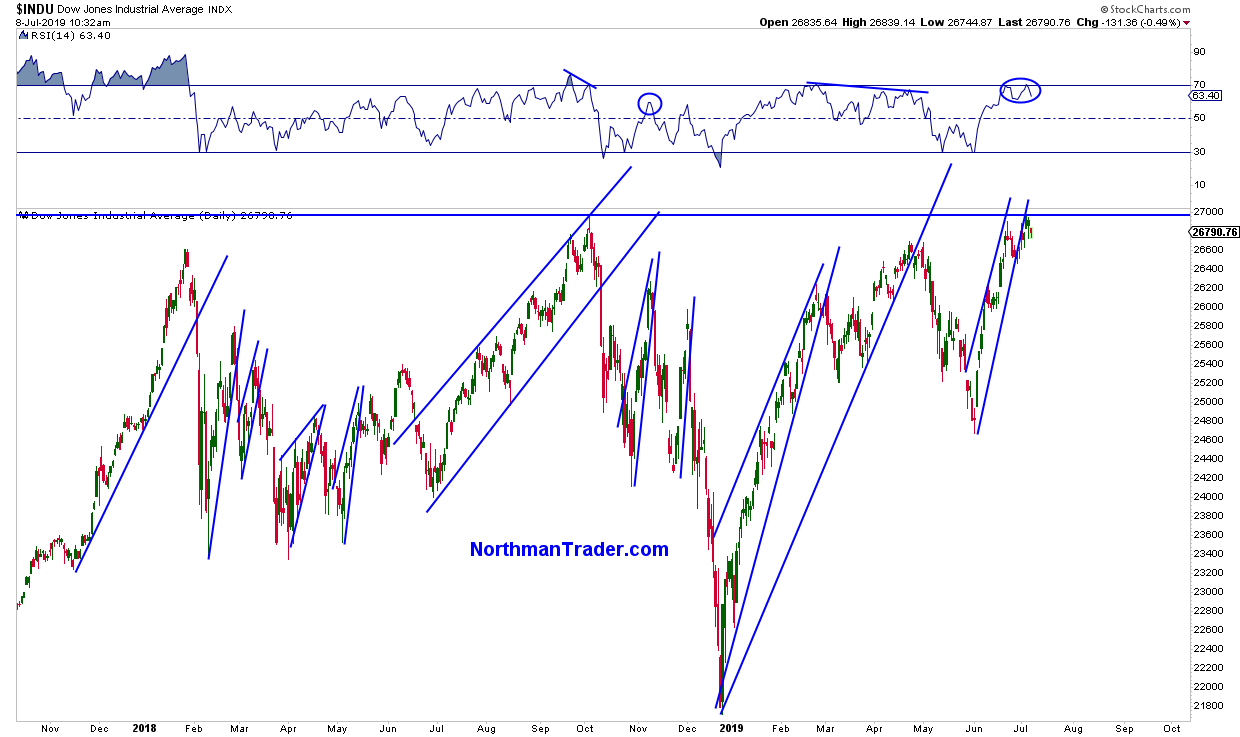

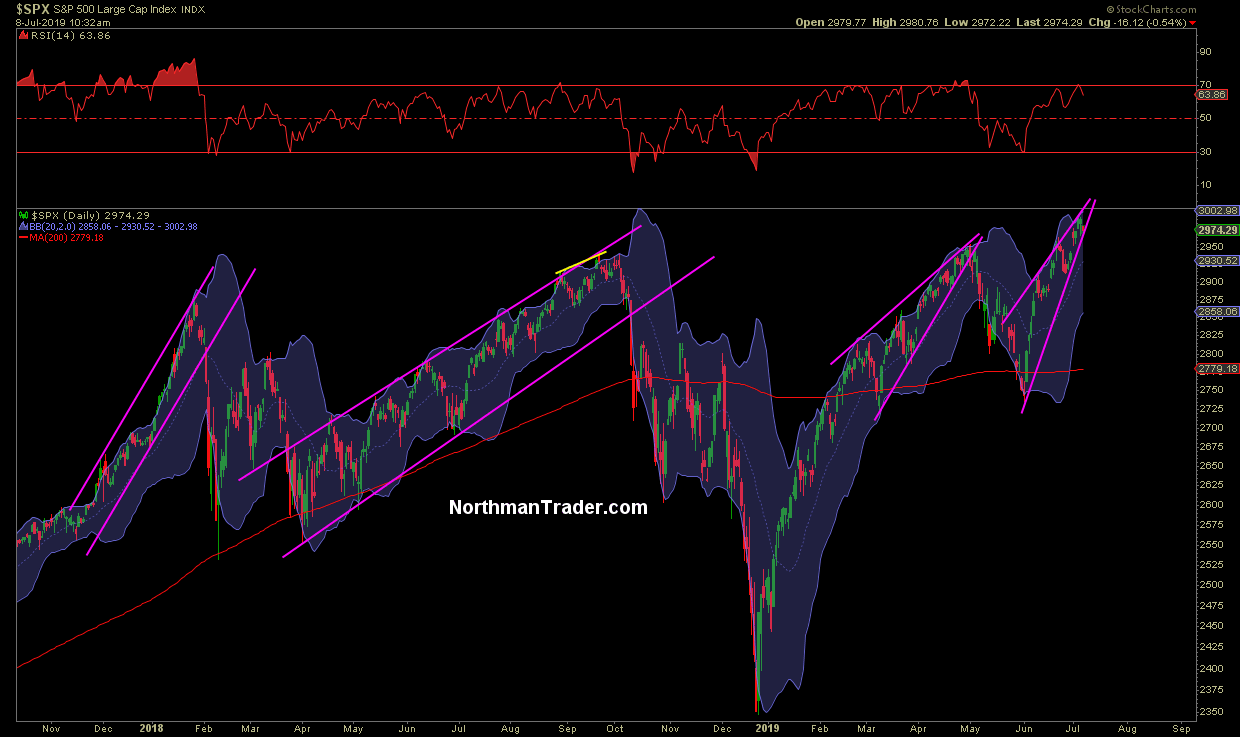

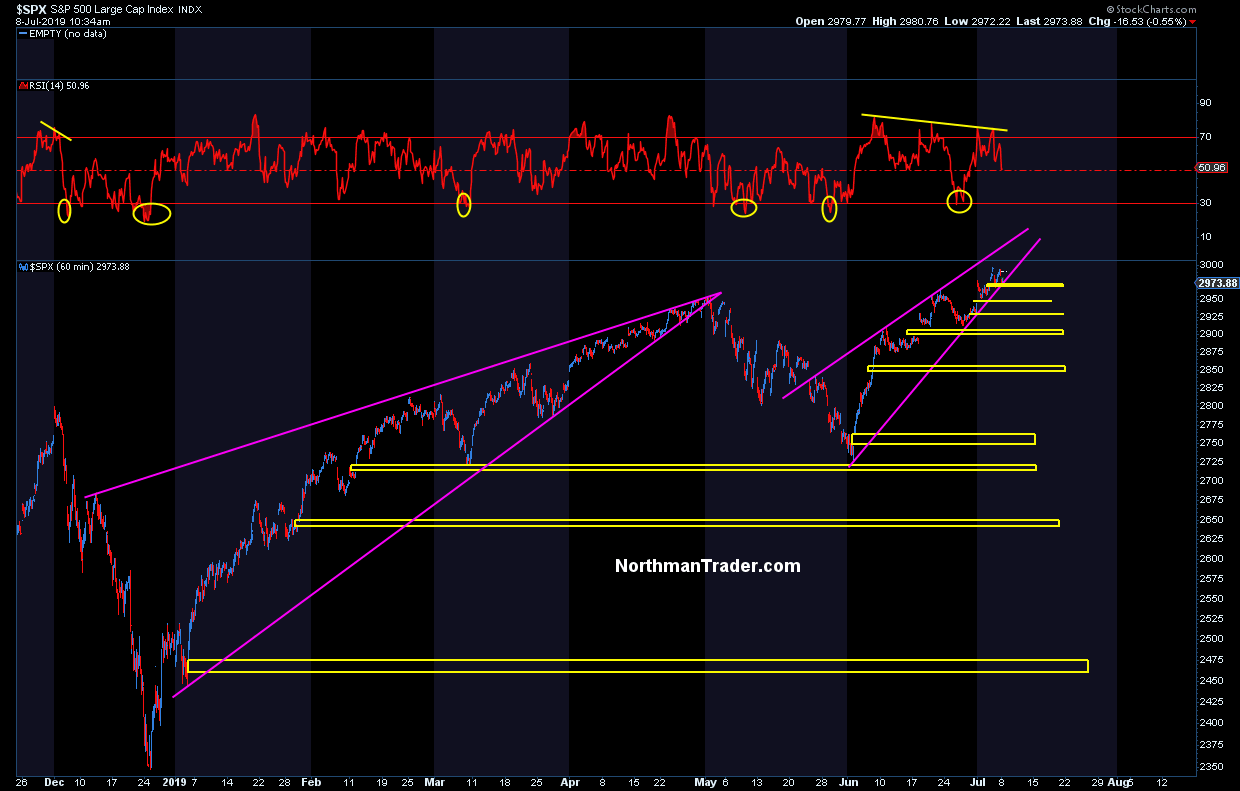

Indeed rising wedges have been the hallmark of the market’s action for the past year and a half:

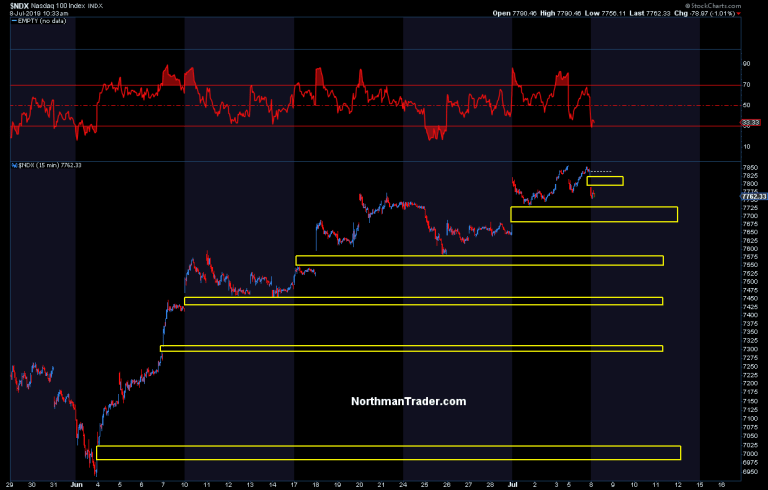

$NDX:

$DJIA:

$SPX:

They’ll squeeze and squeeze until they eventually break.

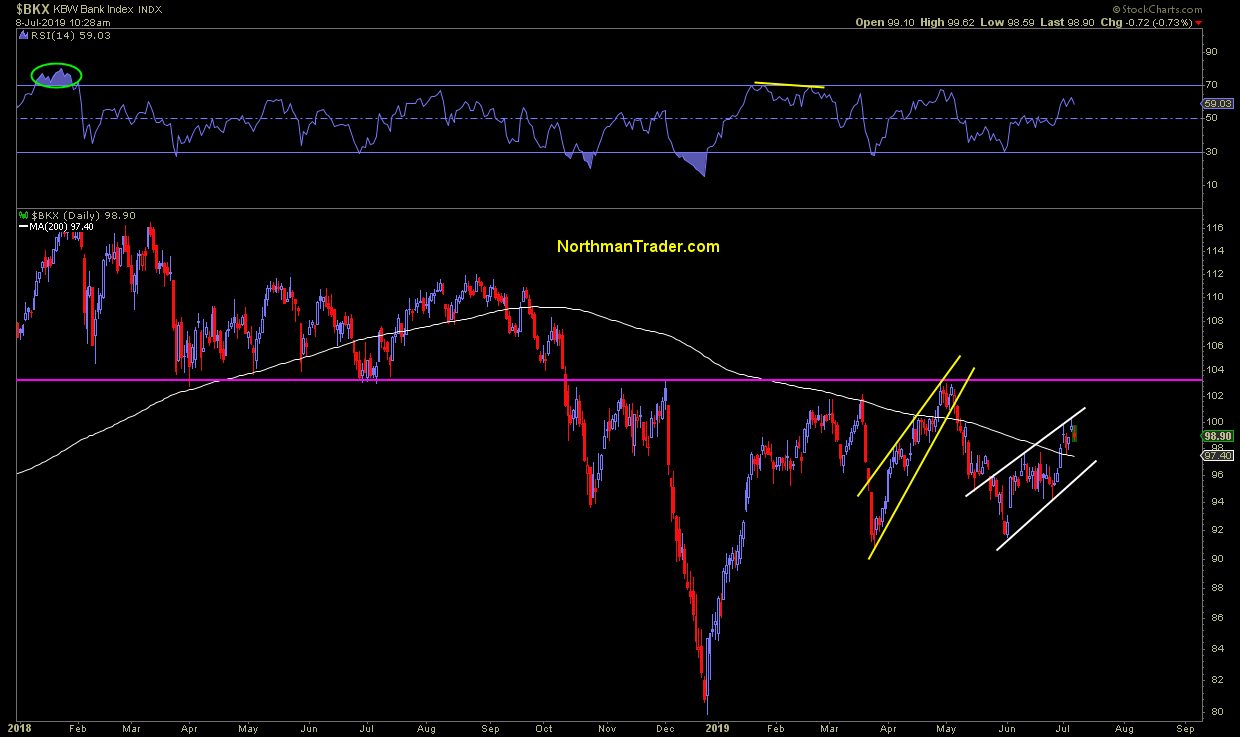

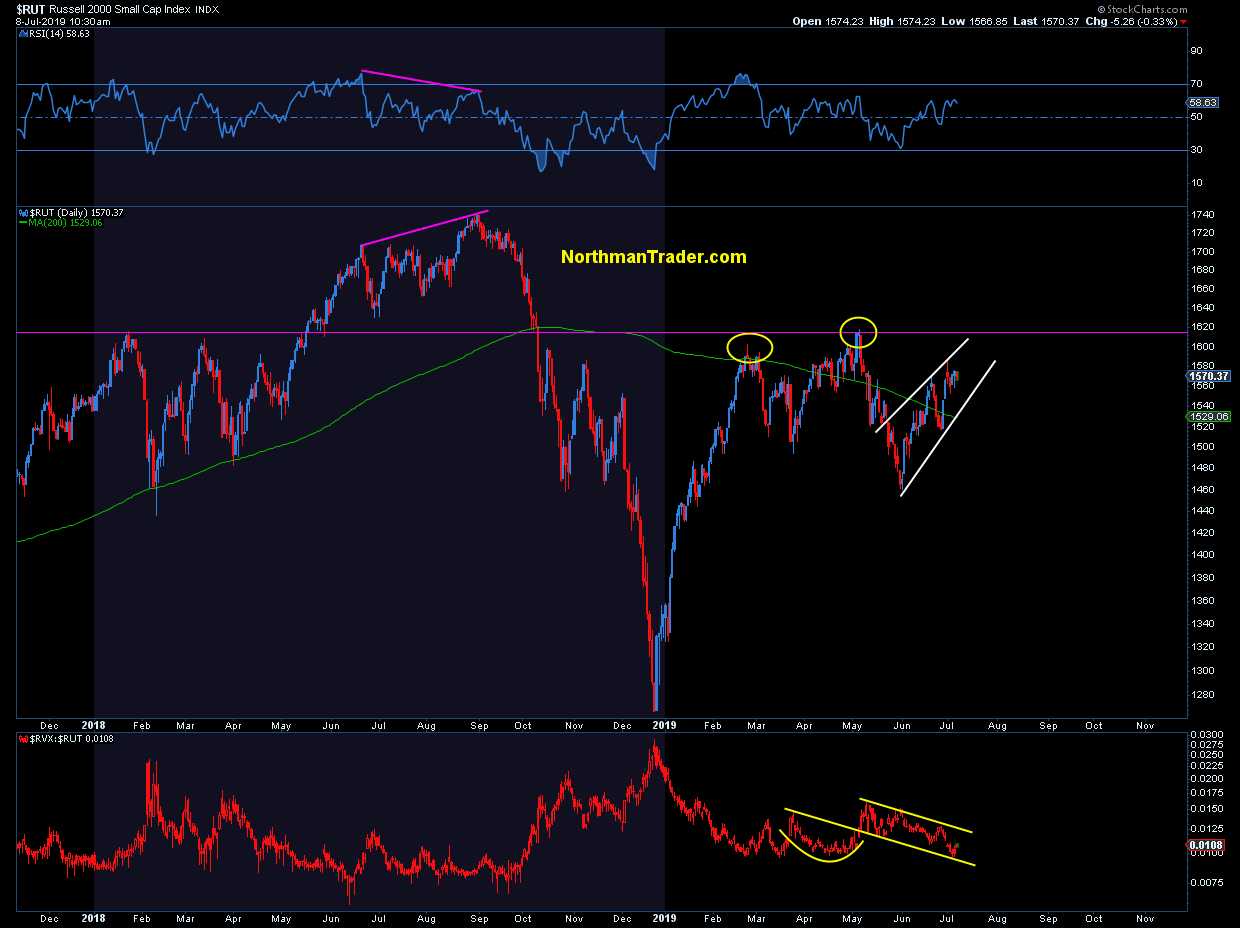

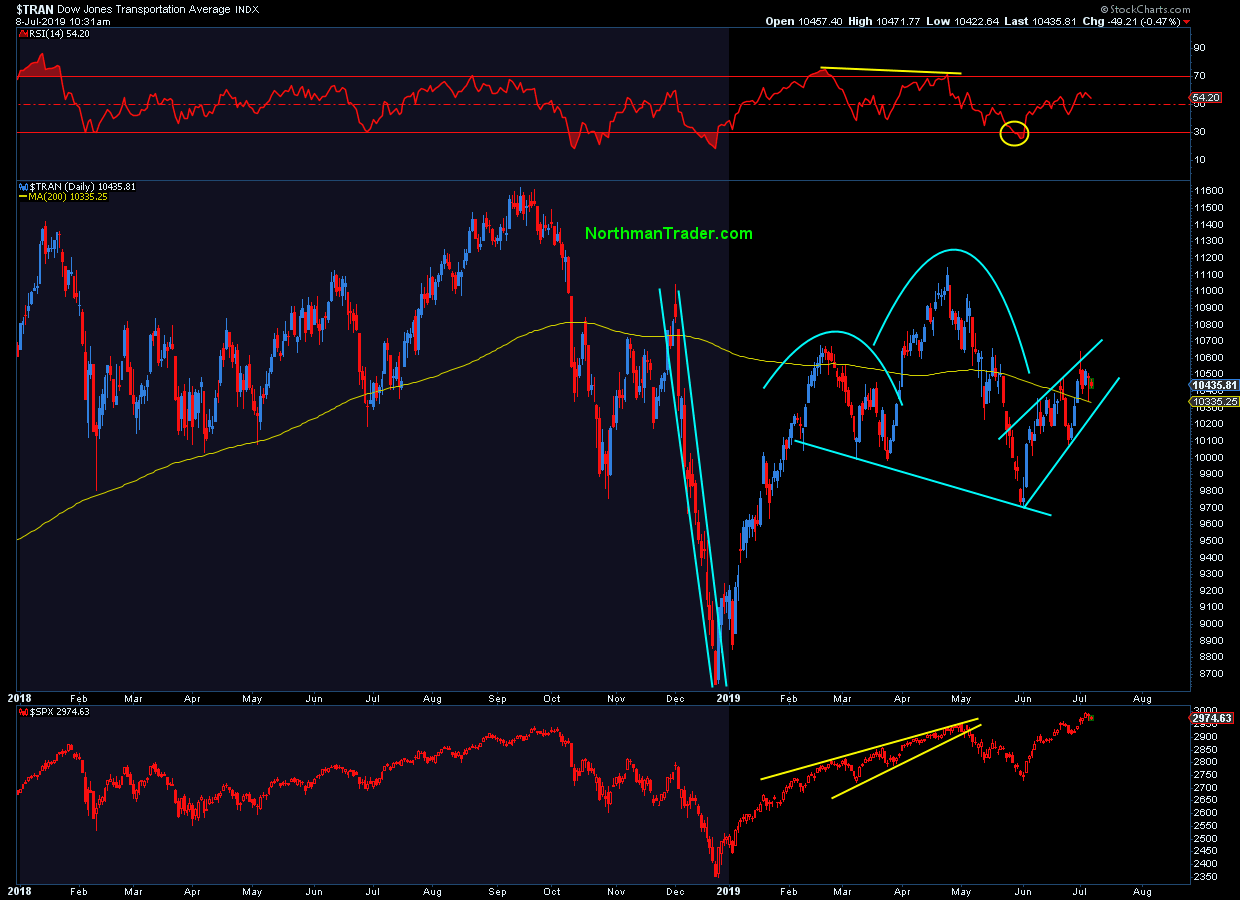

And underneath the big 3 main indexes we have bear flags:

$BKX:

$RUT:

$TRAN:

And in between all of these patterns we have an array of open gaps below:

And now a couple above. Markets of the gaps. Wedges, flags & gaps. Swell.

But don’t worry, the Fed has our back. Right? Right.

After all we have Jay Powell to look forward to this week, over and over again no less, 2 congressional testimonies and a speech plus dovish Fed minutes.

Who needs earnings and growth. Well maybe Deutsche Bank, the bank with the largest derivatives book on the planet.

18,000 being laid off. How’s that going? Well, you already know:

— Sven Henrich (@NorthmanTrader) July 8, 2019

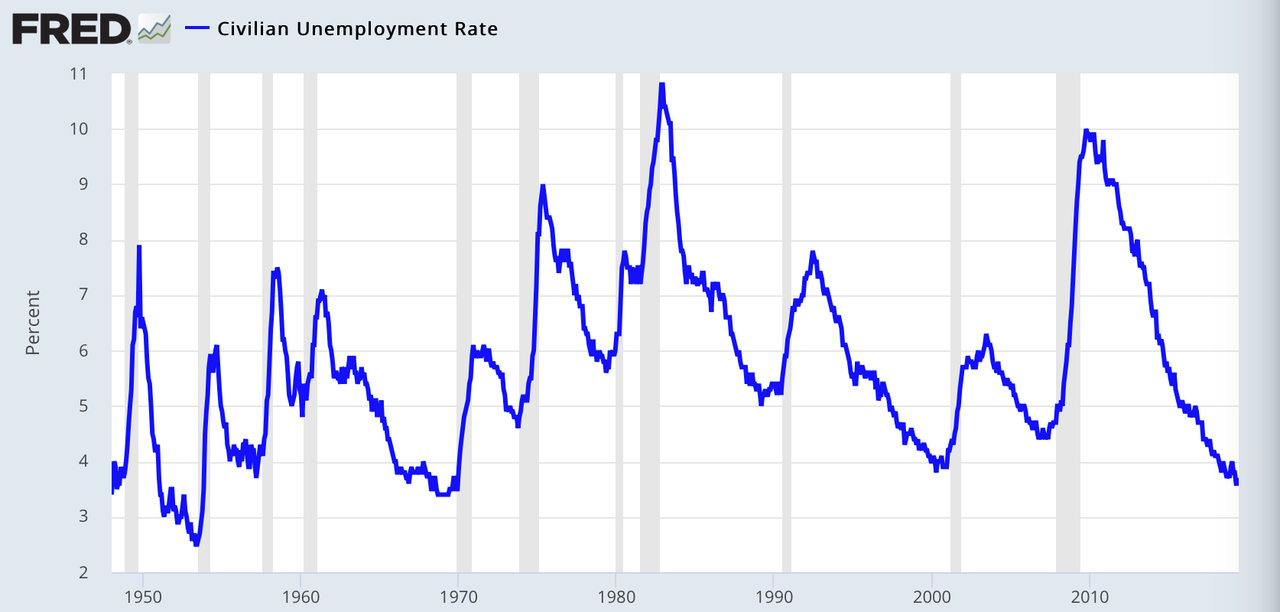

Maybe the Fed can keep the 3.6% unemployment fantasy going for a while. Maybe not.

Jay Powell will tell us this week that he can.

Last year he also told us he can raise rates this year.

He couldn’t.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via ZeroHedge News https://ift.tt/2NJiVRK Tyler Durden