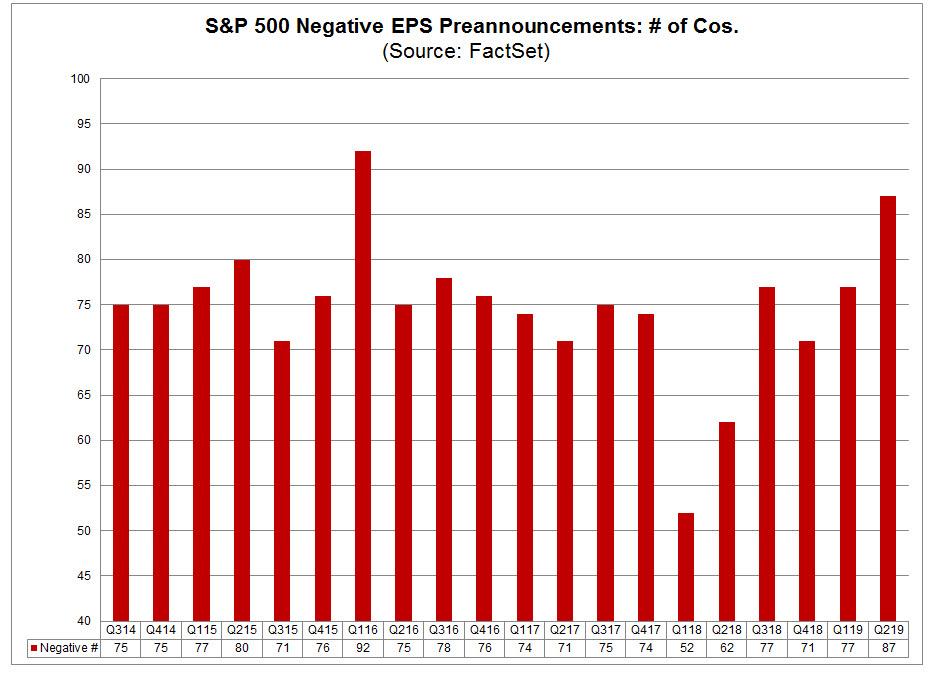

One of the biggest walls of worry facing the market, now that both the US-China “ceasefire” and the Fed’s dovish reversal are in the rearview mirror, is just how bad the coming earnings season will be. As a reminder, last week we showed using Factset data, that the number of companies issuing negative guidance had risen to the second highest on record.

And if Monday’s guidance cut from German chemical giant BASF is any indication, the wall of worry can’t be high enough as the upcoming earnings season will be nothing short of disaster.

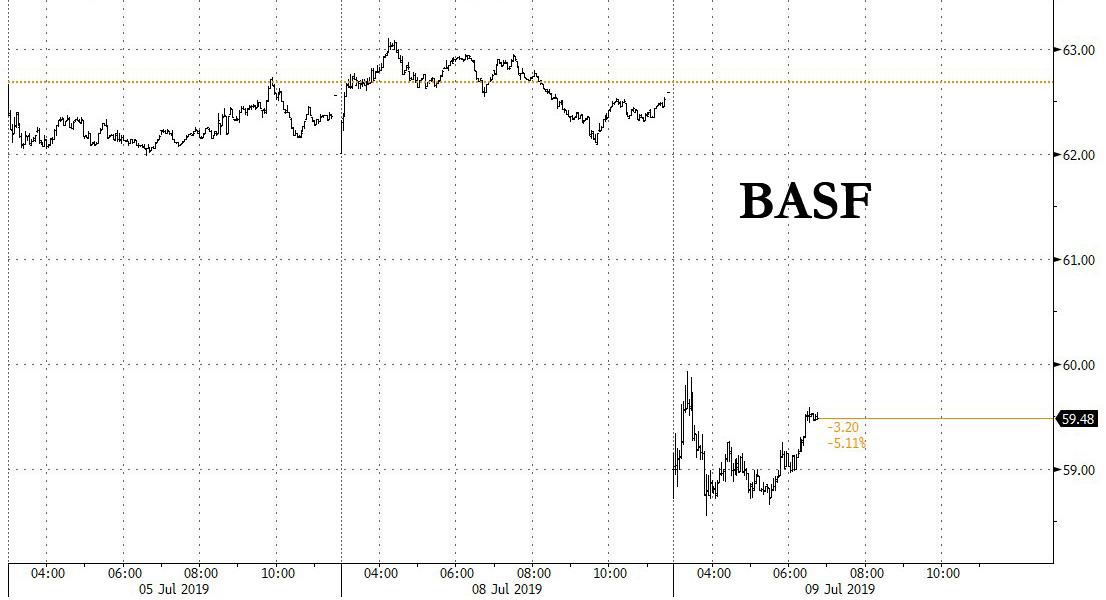

For once Goldman got a prediction right, when on Friday the bank initiated BASF with neutral rating, noting its caution on near-term earnings outlook, and seeing an “increased likelihood of a guidance reduction” going into 2Q. As it turned out, Goldman was spot on, because on Tuesday shares of the German chemical company plunged after it issued what one trader described as a “shocking” profit warning, blaming a slowdown in global economic growth and industrial production, the recession in the global automotive industry and the trade war between the United States and China; the company also blamed adverse weather conditions in the U.S. also hit demand for agricultural products.

As a result, BASF now expects Q2 EBIT of just €500 million, a whopping 60% below consensus expectations. For the full year, BASF expects EBIT before special items to decline by 30%, compared with a previous estimate for growth of between 1% and 10%. The top line gets whacked too as BASF now expects a slight decline in 2019 sales compared with the full year 2018 vs previous forecast of slight sales growth of 1-5%.

The stock plunge hit the entire sector and pressured European stocks across the board. BASF shares were trading 5% lower at €59.43, while peer chemical producers Covestro AG and Wacker Chemie AG both tumbling more than 5%. The chemical industry – the worst-performing sector on the Stoxx Europe 600 – dropped 1.6%.

Wall Street – which of course was caught completely by surprise – was shocked by the announcement with the penguins immediately cutting price targets on the chemical giant:

Morgan Stanley, equalweight; PT EUR77

- Magnitude of downgrade of earnings was greater than anticipated

- Expects investors to question FY2020 EBIT expectations, as well as status of balance sheet given co.’s commitment to stable and rising dividend

Jefferies, hold; PT cut to EUR62 from EUR69

- Would not be surprised if company reprises “visibility is pitch black” theme on 2Q earnings update

- Also cites the magnitude of the earnings downgrade as key, not the cut itself, noting peer commentary made the earnings outlook change unsurprising

Citi cuts price target to EU75, saying both “size and longevity of the demand shock is way beyond broker’s initial estimates“

- Says there’s likely an element of “kitchen sinking” this year

- Calls upon BASF’s management to present a detailed plan to return to growth.

- Notes higher one-time costs highlight restructuring plan is accelerating

- Says question is if capex will be cut; “for now,” lower earnings will affect short-term cash- flows and Citi’s valuation

Finally, Bernstein said the warning was “worse than feared” and predicted more pain to come in the second half.

The obvious question is if a relatively stable company, which nobody expected to post such a shocking guidance cut, and which never issued even a peep as to what was coming is in such deep trouble, what does that mean for the rest of publicly traded companies, all of which are subject to the same headwinds? We’ll find the answer next Tuesday when Q2 earnings season officially begins.

via ZeroHedge News https://ift.tt/2YGtXIw Tyler Durden