From Bloomberg Market Live commentators and former Lehman trader, Mark Cudmore

The asymmetric reaction function of equities to data is likely to shift toward the downside, and do so soon.

Equity bulls have been crowing as bad data caused stocks to rise in recent weeks, thanks to the perception that it guarantees easier Fed policy. They should enjoy their moment as this evolution has been seen before and it doesn’t always end well for shares.

In “normal” markets, where rate policy is deemed as roughly appropriate for the economy, strong data is positive for stocks, and weak data is negative.

When the economic outlook deteriorates sharply, benchmark policy rates suddenly appear inappropriately high, leading to a risk-averse environment. This is what we saw in the U.S. in May after the trade war escalated.

As the consensus grows that policy needs to be eased to counteract the slowdown, we enter a scenario where marginal bad data prints are good for stocks because they are seen accelerating the central bank’s response.

During this period, policy expectations become the primary driver of returns because the poor economic outlook is acknowledged. This makes the asymmetric reaction function for stocks biased more toward gains than losses because we know easing is coming and it’s just a matter of how much, how quickly. This is the situation we’ve been in since early June.

If we get to a stage where aggressive easing is priced and yet the economic outlook remains uncertain, then we evolve into a more symmetric but counterintuitive reaction function: good news is bad for stocks and bad news is good. The aftermath of Friday’s jobs data suggests that’s where we are now.

This phase normally lasts until it either becomes clear the economy will pick up again, or that the Fed easing priced in won’t be sufficient to prevent a severe slowdown.

In the positive scenario, we return to the “normal” world of good news is good and bad news is bad.

But in the negative scenario, where easing fails to boost the economy, then suddenly it becomes the worst possible world for equities. With policy makers perceived as impotent, bad news is very bad for stocks, while marginal data beats won’t provide much uplift. I witnessed this environment from the front row in 2008 as a trader at Lehman Brothers.

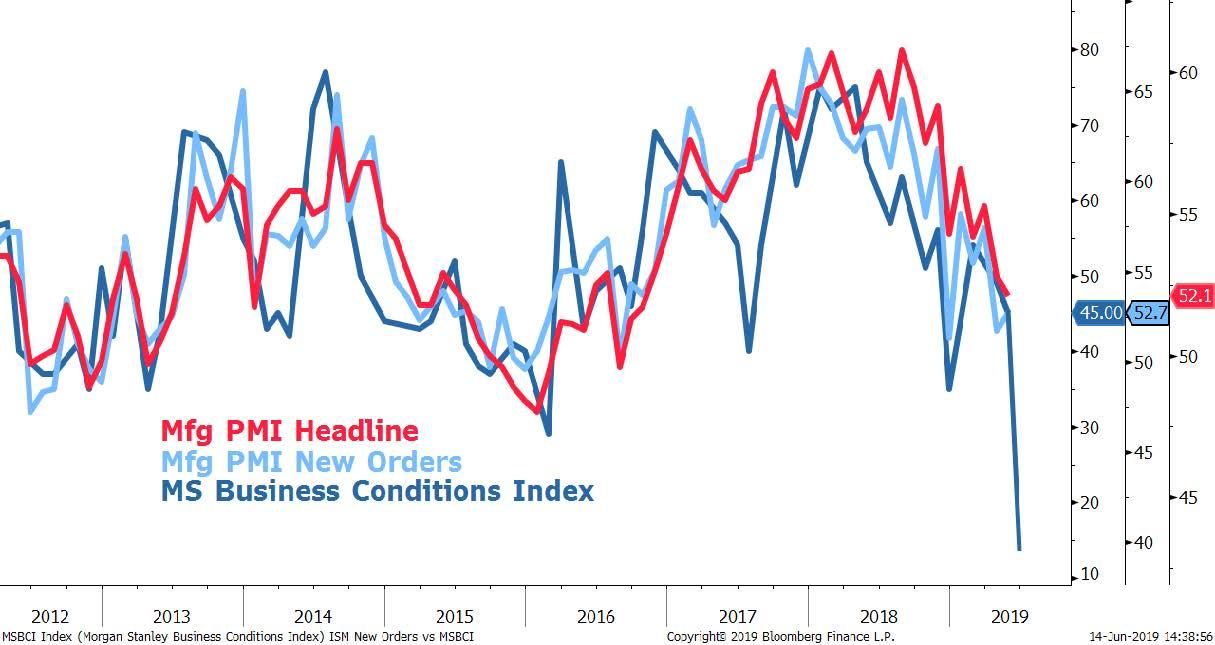

The jury is still out on which way we’re going in 2019. I stick with my bearish view that the recent collapse in trade and manufacturing foreshadows the end of the economic cycle and the Fed won’t be able to save us.

And just to add a little spice to the mix: For the first time I can remember, it appears that the U.S. and China are going through this data reaction function evolution in tandem.

via ZeroHedge News https://ift.tt/2LISj0L Tyler Durden