Authored by Jeffrey Snider via Alhambra Investments,

Even though it was everywhere, one of the primary things that struck me about the peak period for Reflation #3 was how ridiculous it got. If you have a strong argument, there’s no need for so much hyperbole. But it wasn’t just that, it had become openly ridiculous.

Interest rates had nowhere to go but up, “they” said. Fine, it was always possible. But inflation, we were repeatedly told, was the only outcome, the definite product of skillful monetary handling leading to a biblically tight labor market. And to prove it, there would be no data just the strongest possible wording?

There was scarcely a day that didn’t go by without some anecdotal story of the labor shortage. If it had been real, there wouldn’t have been any need for them. The data on its own would’ve more than sufficed. The hearsay was clear overkill.

Therefore, if you really understood what was happening, what officials, Economists, and especially bond kings were actually saying wasn’t that an inflationary breakout was occurring right then – it was going to happen at some point before much longer. Even at its height, this was always a future property.

That’s why the anecdotes; the stories about a labor shortage were absolutely, certainly, guaranteed eventually to lead to the data backing them up. Except, you got the sense “they” were trying a little too hard to make the case. It was far less assured than anyone let on. Rather than being 100% convincing as was intended, the evident lunacy made it all the more questionable.

The first time I used the term “inflation hysteria” it was in reference to money velocity. In February 2018, someone thought it was a good idea to dredge up the equation of exchange and the unscientific concept of velocity in order to “prove” the inflationary case – which somehow still needed to be proved even six weeks into 2018. Something about sharks jumping.

I wrote:

In other words, these calculations for velocity give us no additional information beyond that which we already know from pretty much everything else. Like the M’s behind these numbers, they’ve been obsolete for a very long time. Appealing to money velocity as a basis for inflation expectations in 2018 is another one of those highly desperate over-interpretations that have become quite common.

It wasn’t honest analysis, it was trying way, way too hard. There was always a tinge of desperation about the thing. More emotional pleading for inflation than dispassionate rational consideration about how realistic its chances (ignoring, of course, bond curves). Again, if the argument was solid there was no need to be so absurd and hysterical.

In fact, the impossible is now the best case. Rate cuts have entirely replaced the increasing number of rate hikes inflation hysteria would’ve required; shocking, I know.

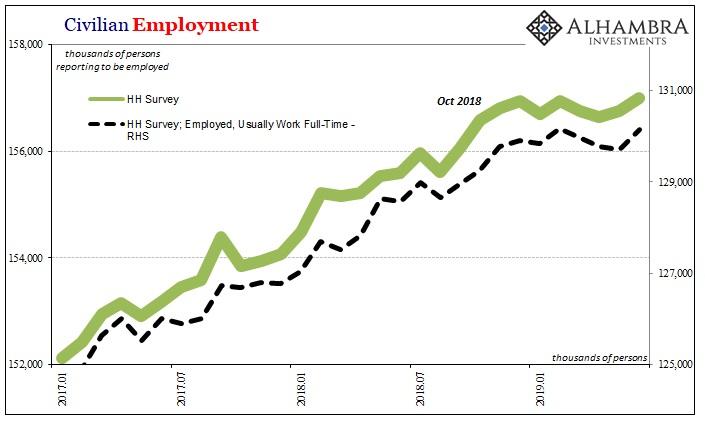

Because of this gigantic shift in mainstream expectations, as 2019 now progresses without any inflationary scenario, instead of anecdotes about labor shortages and whatnot the over-interpretation of events leads instead to how the growing downside can’t really be any downside.

Here’s one example from Canada using last Friday’s payroll numbers (thanks M. Simmons):

But perhaps an even more significant economic indicator for [Bank of Canada’s] Poloz and Wilkins on Wednesday will be last Friday’s U.S. jobs data that put Canada’s in the shade. There, a slight uptick in recent record low unemployment rates was overwhelmed by a tornado of job creation exceeding forecasts that had already been considered optimistic.

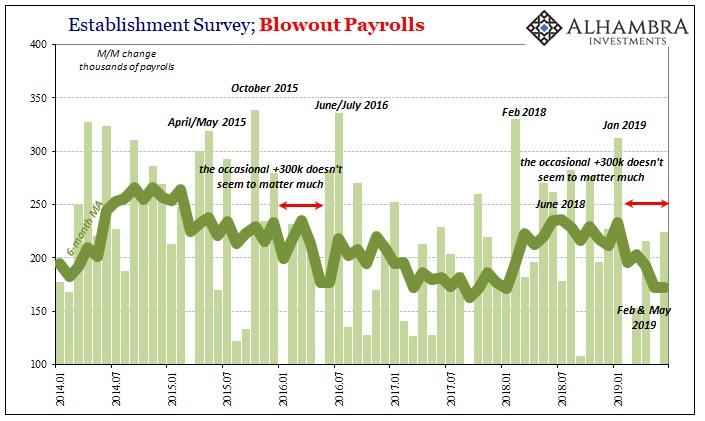

A tornado of job creation! If things were as bad as the bond market view, how come the US economy just unleashed its massive employment engine, they ask?

This one actually blows away the LABOR SHORTAGE!!!, and I don’t mean the data.

This is not the accidental misinterpreting of murky figures; a tornado of job creation is pure and intentional fantasy, turning data into something that just isn’t there. At least the labor shortage nonsense was keeping to eventual outcomes.

This is one mark of a new chapter. Inflation hysteria died out slowly by the end of 2018, with US central bankers among the last holdouts. Only, a new form of madness is taking its place: rate cut rationalizing.

Nothing to see here, no reason to be alarmed because the economy is still booming. Didn’t you see the tornado? Rate cuts are just insurance to make sure the positive winds of the boom don’t dip by any substantial amount.

There’s always some leeway, some literary license for hyperbole so long as it doesn’t stretch the boundaries of reason. A “tornado of job creation” is something altogether different. Like money velocity in 2018, if there was any realistic chance that was the case there’s no need to be so openly ridiculous about it.

If you have to be so obviously hysterical and nonsensical about your position, then you aren’t exactly confident in it. Inflation hysteria itself was a big clue it wasn’t real. And now the labor shortage which didn’t exist has been spun into a tornado of sheer make-believe.

via ZeroHedge News https://ift.tt/2Lamu1l Tyler Durden