Oil prices gained modestly on the day, with WTI rallying up to $58 ahead of tonight’s API inventory data, despite another tanker being seized (by Egypt this time).

“Given the continued presence of sanctions and tensions between the U.S. and Iran, the ongoing trade war between the U.S. and China, and the potential for an economic slowdown, oil prices are likely to remain volatile in the short term,” said Michael Laitkep, an analyst at Alerian, which tracks energy infrastructure companies.

But for tonight, and tomorrow morning, all eyes are on the fundamental side…

API

-

Crude -8.129mm (-2.5mm exp)

-

Cushing -754k

-

Gasoline -257k

-

Distillates +3.690mm

Crude inventories were expected to drop in the last week (after 3 previous weeks of draws) but the huge 8.1mm crude draw was a big surprise (everyone is ignoring the distillates build for now)…

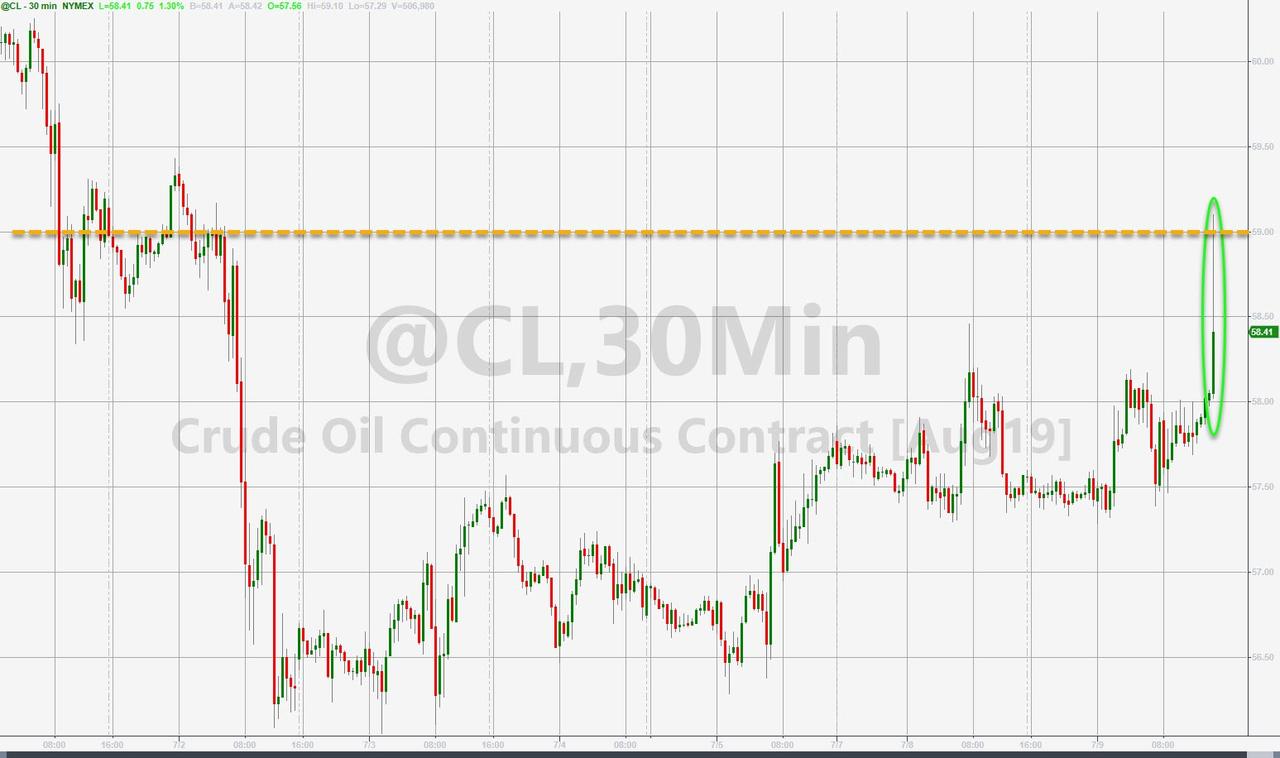

WTI hovered around $58.00 ahead of the print, and exploded higher (above $59) on the huge draw…

The initial spike has faded a little after running the $59 stops…

“There is a strong case to paint a bullish as well as a bearish picture depending on one’s view on the general state of the world economy and politics,” said Tamas Varga, an analyst at PVM Oil Associates Ltd. in London.

Powell’s testimony will be watched closely for an indication of whether the Fed is likely to cut U.S. interest rates at its next meeting on July 31, with energy market hope for growth gains.

via ZeroHedge News https://ift.tt/2Jy0rhP Tyler Durden