With yesterday’s late ramp failing to push the Dow into the green, the Industrial Average is set to open lower for the 4th day – it’s longest stretch of losses since March – as global stocks treaded water on Wednesday amid depressed volumes while Treasury yields rose around the globe and the dollar was steady, as investors waited to hear whether the world’s most powerful central banker would confirm or confound expectations for a U.S. rate cut this month. As a reminder, all eyes are on Powell today, as he kicks off two days of testimony in Congress, with traders hoping for further signals on the direction of Fed rates as markets price in a quarter-point reduction in July.

The MSCI index of world stocks was little changed after three days of losses, although Europe’s subdued start reflected pre-event caution rather than how the day would pan out. U.S. futures traded slightly lower, alongside European shares, as investors awaited Fed Chair Powell’s speech later today.

Europe’s Stoxx 600 index resumed a decline, down 0.3%, after briefly trimming losses following news that the European Commission cut its euro-area economic outlook, strengthening the case for more monetary stimulus as bad news tried desperately to be good news. This failed with a bang after French industrial production was substantially stronger than expected by consensus of 0.2%, with total output rising 2.1%, making the case for more easing weaker and hitting stocks. Defensive sectors are among worst performers after leading the recent rally as bond yields continued to rebound. Real estate, food-and-beverage shares and utilities fell the most, while banks and energy shares rose. London’s FTSE edged up 0.2% and France also rose after better-than-expected French industrial data, while Germany’s Dax lagged with a loss of 0.4%.

Earlier in the session, Asian stocks edged up, led by technology and communications; markets in the region were mixed, with Taiwan advancing and India retreating. Japan’s Topix fell 0.5% for a third day of losses, as Recruit Holdings, Fanuc and Nintendo weighed on the gauge. Machine tool makers declined after a trade group reported that orders slumped the most in almost a decade. The Shanghai Composite Index declined 0.4%, with PetroChina and Industrial & Commercial Bank among the biggest drags while Chinese blue chips barely budged as data showed inflation remained subdued. China’s factories barely escaped deflation in June while consumer prices gained. The S&P BSE Sensex Index dropped 0.3%, driven by Larsen & Toubro, Axis Bank and Tata Consultancy Services. U.S. President Donald Trump criticized India’s decision to impose higher tariffs on a slew of American goods.

While few expect fireworks, there is the possibility that Powell will surprise to the hawkish side today after last week’s stellar jobs report. Still, a worrying lack of inflation – as measured by the BLS if not real-world inflation which keeps rising – is one reason investors are counting on Powell to sound suitably dovish when he testifies to Congress on Wednesday. Futures still fully price in a 25-basis-point cut at the Fed’s July 30-31 meeting, but they no longer suggest a half-point move. They had implied a 25% probability of an aggressive cut before an upbeat U.S. jobs report on Friday.

“I think the market seems to be veering toward a less dovish message from Powell than was the prevalent a couple of weeks ago,” said BoNY Mellon strategist Neil Mellor, who still thought the Fed would cut by 25 basis points this month — the first U.S. cut since the financial crisis — but whether it keeps going was much less clear. “The real interest is what happens thereafter,” Mellor said. “If we are talking about a stronger dollar, then we have to bear in mind comments from President Donald Trump last week, who said, ‘Well, perhaps we should start manipulating the dollar.’”

Overnight, Atlanta Fed President Raphael Bostic said the central bank was debating the risks and benefits of letting the U.S. economy run “a little hotter.” Meanwhile, U.S. and Chinese trade officials held “constructive” talks on trade by phone on Tuesday, White House economic adviser Larry Kudlow said.

Oil and treasury yields jumped, as the cooling in rate fever saw bonds give back a little of their rally. Yields on two-year Treasuries rose to 1.917% from their recent low of 1.696% and Europe’s benchmark yields up around five basis points. The Italian market is outperforming after the country obtained strong demand for its bonds.

That in turn has helped the dollar index against a basket of currencies rebound to 97.500 from a June low of 95.843. The dollar also gained to 108.92 yen though the brighter French data helped the euro gain to $1.1225 still down from its $1.1412 level of just a couple of weeks ago. The Mexican peso began to recover after sliding on Tuesday when Finance Minister Carlos Urzua suddenly resigned, citing “extremism” in economic policy. The Canadian dollar was on the defensive before a Bank of Canada meeting, in case policymakers tried to slow the currency’s recent rally.

Elsewhere, gold fell 0.3% to $1,393.68 per ounce as the dollar gained, while Bitcoin rose back over $13,000.

Oil prices rose on Middle East tensions and news that U.S. stockpiles fell for a fourth week in a row. Brent crude futures gained 64 cents to $64.80. U.S. crude was up 82 cents to $58.65 a barrel. MSC Industrial and Bed Bath & Beyond are among companies reporting earnings.

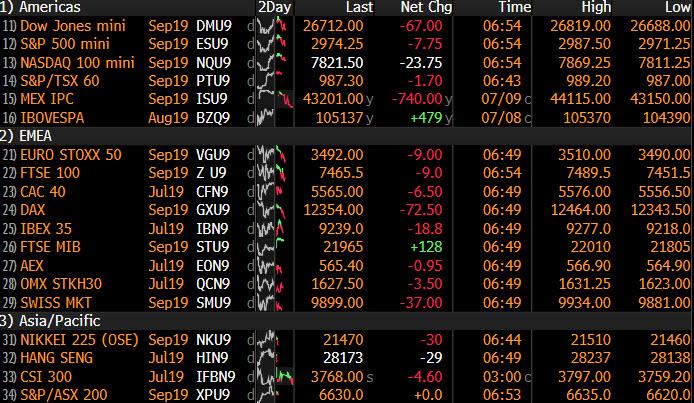

Market Snapshot

- S&P 500 futures down 0.2% to 2,977.50

- STOXX Europe 600 down 0.2% to 387.30

- MXAP up 0.1% to 159.01

- MXAPJ up 0.4% to 522.16

- Nikkei down 0.2% to 21,533.48

- Topix down 0.2% to 1,571.32

- Hang Seng Index up 0.3% to 28,204.69

- Shanghai Composite down 0.4% to 2,915.30

- Sensex down 0.3% to 38,598.04

- Australia S&P/ASX 200 up 0.4% to 6,689.79

- Kospi up 0.3% to 2,058.78

- German 10Y yield rose 5.3 bps to -0.301%

- Euro up 0.1% to $1.1224

- Italian 10Y yield fell 5.1 bps to 1.378%

- Spanish 10Y yield rose 1.9 bps to 0.439%

- Brent futures up 1.8% to $65.29/bbl

- Gold spot down 0.3% to $1,393.15

- U.S. Dollar Index down 0.1% to 97.40

Top Overnight News from Bloomberg

- President Trump has grown concerned that the strengthening U.S. dollar is a threat to his economic agenda and has asked aides to cast about for ways to weaken the greenback, according to people familiar with the matter

- Jerome Powell is likely to leave Fed rate cuts firmly on the table when he appears before Congress this week, even though the latest U.S. jobs report dialed down the urgency to ease borrowing costs.

- Looking at Italy’s debt market, you’d be forgiven for thinking that the embattled nation’s problems were firmly behind it. Bonds had their best week in more than six years, and yields are at the lowest since 2016, prompting the government to lock in bargains by issuing 50-year debt on Tuesday

- U.K. MPs narrowly passed a measure aimed at stopping the next Prime Minister forcing the country out of the European Union without an agreement, against their wishes

- U.S. Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin spoke on the phone with their Chinese counterparts, marking the first high-level contact after their presidents agreed to resume trade talks

- China’s factories barely escaped deflation in June while consumer prices gained

- Oil jumped as a report showing a reduction in U.S. crude inventories tightened a supply outlook that’s being threatened by rising tension in the Middle East

- Members of Britain’s Parliament delivered a sharp warning to the country’s next prime minister after narrowly passing a dramatic result Tuesday: they will not allow him to pursue a no- deal Brexit without a fight

- French industrial output surged in May, indicating the euro area’s second-largest economy resisted the region’s broader manufacturing downturn. Industrial production jumped 4% from a year earlier, the strongest increase since 2017, beating even the most optimistic prediction in a Bloomberg poll of economists

- The U.K. economy rebounded in May as car factories resumed work following Brexit-related shutdowns. GDP rose 0.3% after a decline in the previous month, the Office for National Statistics said Wednesday

Asian equity markets traded somewhat mixed following a similar lead from Wall St. as participants await fresh clues on Fed policy from the upcoming Fed Chair Powell congressional testimony and FOMC minutes release. ASX 200 (+0.4%) was led higher by outperformance in the tech sector and as financials rebounded from yesterday’s capital buffer pressure with the Big 4 also helped after S&P provided more favourable outlooks on their credit ratings, while Nikkei 225 (-0.1%) was indecisive with sentiment at the whim of a choppy currency. Elsewhere, Hang Seng (+0.3%) and Shanghai Comp. (-0.4%) lacked firm direction with initial upside seen after reports USTR Lighthizer and Treasury Secretary Mnuchin conducted a phone call with China Vice Premier Liu He which was said to have gone well and was constructive. However, the mainland briefly gave back the gains following liquidity outflows and as participants digested mixed inflation data in which PPI printed flat Y/Y which was softer than expected and lacked growth for the 1st time in nearly 3 years. Finally, 10yr JGBs were lower as they tracked the downside in T-notes and amid a lack of BoJ presence in the market today.

Top Asian News

- Feud Atop Asia’s Biggest Budget Carrier Starts Getting Ugly

- Thailand Is Taking Steps to Curb Inflows Amid Baht’s Rally

European indices are tentative this morning [Euro Stoxx 50 U/C], taking a similar stance to their Asia-Pac counterparts in awaiting testimony from Fed’s Powell later in the session. Once again, the Dax (-0.4%) is underperforming its peers, though not to the same extent as in the prior session, as BASF (-0.7%) continues to weigh after yesterdays profit warning as does Bayer (-1.0%) after the Co. state they are continuing, and on track with exiting the animal health business. Sectors are mixed with the notable outperformers being Energy names, in-line with the broader complex following yesterdays larger then expected API draw, while the Financial sector is also benefitting from some consolidation in Deutsche Bank after the Co’s restructuring plans were unveiled over the weekend (+2.1%), with other banking names being lifted as well this morning. As such, the FTSE MIB (+0.5%) is leading the bourses this morning with gains in the index stemming from strong Italian banking names this morning. Elsewhere, European semiconductors have benefitted from Taiwan Semiconductor’s strong monthly sales with the likes of Infineon (+2.0%), and STMicroelectronics (+2.2%) benefitting.

Top European News

- Atlantia Said to Consider Taking 35-40% Stake in Alitalia: Sole

- U.K. Economy Returns to Growth in May as Car Production Gains

- Superdry Plunges After Warning of Sales Drop in Reset Year

- Italy’s Wondrous Bonds Cover Up Budget Challenges Still Ahead

In FX, the Dollar is somewhat softer vs G10 counterparts on balance as the clock ticks down to the first semi-annual testimony from Fed Chair Powell and minutes to June’s FOMC policy meeting that in theory should be relatively redundant barring any major revelations that supplement or contradict the tone of his text and Q&A. The DXY just dipped under 97.350 and close to technical support around 97.312 (55 DMA) having held below/respected daily chart resistance at 97.680 yesterday.

- CHF/GBP/EUR – The major outperformers, albeit marginal, with Usd/Chf drifting back down towards 0.9900 and the Franc also outpacing the Euro within a 1.1140-20 range despite some rare Eurozone data beats via French and Italian ip that have underpinned the single currency in Usd terms, but not threatened stops said to be in place on a break of 1.1240 or the 55 DMA (1.1233). Meanwhile, the Pound has rebounded a bit more firmly from another test of early 2019 ‘flash crash’ lows against the Buck and 0.9000+ vs the Euro in the wake of a raft of UK data, as firmer than forecast 3 month rolling and y/y GDP prints appear to have overshadowed misses in other metrics. Cable is nudging back up towards 1.2500, but could be capped by some option expiry interest spanning 1.2495 and the big figure.

- CAD/NZD – The Loonie has bounced from recent lows vs its US peer against the backdrop of firm oil prices, but more in anticipation that the BoC will retain a hawkish stance or bias in comparison to the Fed chair. Usd/Cad has eased back towards 1.3100 with options indicating a 75 pip break-even for the policy pronouncements that coincide with Powell’s presentation, although his text will be released at 13.30BST and for previews of both events see the Ransquawk Research Suite. Elsewhere, the Kiwi has staged an even more impressive recovery from what looks to have been a stop-driven plunge overnight through 0.6600 vs the Greenback to circa 0.6570, and the allure of mega expiries at 0.6610 may well be the catalyst as 2.4 bn rolls off at the NY cut.

- AUD/JPY/NOK – All on the defensive, as the Aussie only just survived a test of 0.6900 with the aid of cross-winds from the aforementioned Kiwi nosedive and Aud/Nzd reclaiming 1.0500+ status before reversing again, while the Yen got to within 2 pips of 109.00, but is now off worst levels as offers at the big figure remained untouched and hefty expiry interest (1.7 bn at the strike) also kept the headline pair in check. The Norwegian Krona weakened in wake of softer than expected inflation data, but Eur/Nok pulled up just shy of a key chart level in the form of the 100 DMA at 9.7147.

In commodities, WTI and Brent are firmer on the day and currently just below session highs, with WTI remaining around the USD 59.00/bbl level after the complex benefitted from the larger than expected headline API draw last night at -8.129mln vs. Exp. -3.1mln, with participants now looking to today’s EIA release for confirmation of this. An additional factor for this mornings upside is the ongoing weather situation in the Gulf of Mexico, where the NHC are currently stating that there is a 90% chance of a cyclone forming within the next 48 hours; as such multiple production platforms have begun evacuating workers and shutting production. As a reference point, the Gulf of Mexico accounts for around 15% of the US’s total production. Gold (-0.2%) remains capped below the USD 1400/oz level and has thus-far failed to benefit from the mild dollar weakness as participants await Fed Chair Powell’s testimony and the FOMC minutes later in the session. Elsewhere, a Brazilian court has ruled that Vale must remedy all damages from January’s dam collapse, with no monetary value being set as the judge did not believe it is yet possible to quantify the compensation figure.

US Event Calendar

- 7am: MBA Mortgage Applications, prior -0.1%

- 8:30am: Powell Testimony to House Financial Services Panel Released

- 10am: Wholesale Inventories MoM, est. 0.4%, prior 0.4%; Wholesale Trade Sales MoM, est. 0.3%, prior -0.4%

- 10am: Fed’s Powell Testifies Before House Financial Services Panel

- 1:30pm: Fed’s Bullard To Speak at Washington University in St. Louis

- 2pm: FOMC Meeting Minutes

DB’s Jim Reid concludes the overnight wrap

Thanks for all your emails and calls yesterday about the future of research at DB after some difficult decisions were announced over the weekend about the firm’s direction. We want to reiterate that DB Research will remain at the forefront of the firm. As well as FIC, Macro, QIS, Data Science, and Thematic research, DB is still committed to providing extensive and top-quality Company Research coverage in Europe and the US. DB will combine Equity Research and Research Sales into a newly formed Company Research and Advisory Group to strengthen ongoing connectivity with institutional clients. So if you are a consumer of any of our research and have any questions, please let me know and we can try to answer them.

While a mild dose of risk aversion has returned to markets this week the reality is that it’s been very quiet for newsflow with investors mostly waiting for today’s main event. Indeed Fed Chair Powell is due to make his semi-annual monetary policy testimony before the House Financial Services Committee at 3pm BST this afternoon (10am EDT). As our US economists highlighted in their preview here , in the past the testimony had largely adhered to the outcomes of the latest FOMC meetings and on that we’re due to receive the latest FOMC minutes after Powell’s testimony. Our colleagues expect Powell to reiterate the relatively upbeat assessment of the labour market but if questioned more closely about the underlying details, they would not be surprised if Powell were to sound a mild note of caution about the recent downshift in hours worked. As for inflation, they expect Powell to reiterate the same concerns the FOMC highlighted at the last meeting, namely wage growth and weaker global growth holding down inflation around the world.

Friday’s employment report saw the market re-price back towards a 25bps cut at the meeting later this month (currently 27bps priced in) and it does feel like it would take a very big dovish surprise from Powell today to change that from here. However the Q&A with Congress in particular will warrant a close watch all the same. Yesterday, we got comments from Philadelphia Fed President Harker which were, at the margin, hawkish. He said that “there’s no immediate need to move rates in either direction at this point” and noted that trimmed-mean measures of inflation are at or near target. Harker is near the centre of the committee, so his hesitation to endorse a cut is significant.

Back to markets where yesterday the S&P 500 (+0.13%) squeaked out a positive gain despite trading in the red for the most of the session. The DOW (-0.08%) retreated slightly, largely due to poor performance by MMM (-2.06%), which has a large share in the index. There was better news for tech stocks, with the NASDAQ (+0.54%) retracing some of its recent underperformance to close higher. Again though, volumes were around 20% below the usual daily average. In Europe the STOXX 600 (-0.51%) also ended in the red while there was a sharper loss for the DAX (-0.85%) primarily as a result of a profit warning from BASF. Bond markets were also quiet with 10y Treasuries (+1.4bps) and Bunds (+1.2bps) both a whisker higher in yield – the latter unaffected by the ECB’s Lane reiterating that “substantial accommodation is still required.” BTPs (-5.2bps) were stronger after Italy’s reopening of its 50-year bond. As for credit, HY spreads in the US were +2bps wider while in commodities oil (+0.59%) was a shade higher. EM assets fell again, with FX and equities down -0.15% and -0.30%, but there were outsized moves in Mexican assets after Finance Minister Urzua resigned, citing dissent on economic policy issues. The peso weakened -1.15% versus the dollar and Mexico’s benchmark equity index slid -1.75%.

Overnight, Bloomberg has reported that US Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin spoke on the phone with their Chinese counterparts Vice Premier Liu He and Commerce Minister Zhong Shan, yesterday. China’s Ministry of Commerce confirmed the conversation in a brief statement this morning, saying the two sides “exchanged opinions on implementing the consensus reached in Osaka” by Presidents Xi Jinping and Donald Trump. Meanwhile, the White House economic adviser Larry Kudlow said that the discussions were “constructive,” and added that officials are planning more meetings but that no details have been confirmed while saying, “hopefully we can pick up where we left off but I don’t know that”. He also said that the US government would ease restrictions on Huawei by relaxing the licensing requirements and added that Xi had agreed with Trump to scale up purchases of US products, including soybeans and wheat, along with possibly energy as part of a “good-faith” move to show how open China is to resolving trade differences. Elsewhere, Kellyanne Conway, counsellor to President Trump, said yesterday before the news reports started pouring in about the phone call, that US officials will continue to speak with their Chinese counterparts on trade issues and perhaps make a trip there “shortly.”

This morning in Asia markets are largely trading higher with the Hang Seng (+0.32%) and Kospi (+0.61%) leading the gains while the Nikkei (-0.04%) and Shanghai Comp (-0.02%) are trading flattish in directionless trading. Elsewhere, futures on the S&P 500 are broadly unchanged while WTI crude oil prices are up +1.31% as the American Petroleum Institute report showed a continued draw-down in US crude stockpiles while tensions in the Middle East continued to rise as Iran’s chief of staff for armed forces vowed yesterday to respond to Britain’s seizure of the tanker, highlighting the risks to shipping in a waterway that about a third of all seaborne petroleum travels through. In terms of data we’ve also had the latest inflation numbers out of China where June CPI printed in line with expectations at 2.7% while PPI was unchanged yoy against expectations of a +0.2% rise yoy.

In other overnight news, Turkey’s President Erdogan said that there is need for a “complete revision” at the country’s central bank by saying that “the central bank is the most important linchpin in the finance leg of economy. Unless we make a complete revision there and put it on a strong foundation, we may face serious troubles there.” He justified firing the previous central bank governor by saying that Turkey paid a “heavy price” for Cetinkaya’s mistakes, which included a failure to communicate with markets and his inability to inspire confidence while adding, “This became intolerable, after which we made an assessment of it with our friends led by the Treasury and Finance Minister, and then we came to the conclusion that making a change here would be beneficial.” The Turkish lira is trading broadly unchanged at 5.7339.

Back to yesterday where we did get some Brexit related news. The first was Labour’s Corbyn confirming that the Labour Party would back a new referendum on any exit deal and also campaign to stay in the EU rather than leave on terms negotiated by the Conservatives. However they still feel they can get a better Brexit deal and their position is still not clear if we were to see a general election. Later on in the day, parliament voted 294-293 in favour of the measure requiring the Government to give fortnightly updates on power-sharing in NI to parliament this autumn. That will in theory make it more challenging for the next Prime Minister to force a no-deal Brexit by suspending Parliament. It’s difficult to say how much that changes the dynamics, but it feels likeSeptember/October will have the ability to see a constitutional crisis here in the UK. Sterling fell to an intraday low of $1.244 yesterday which was the weakest since April 2017 and this morning is hovering at $1.2454.

Over on the continent, the German newspaper Sueddeutsche Zeitung reported that Chancellor Merkel plans to announce a new investment plan to channel billions of euros into the country’s less developed regions. The unconfirmed plans would be the biggest in decades and would reportedly focus on digital infrastructure, public transport, and job creation. It remains to be seen how such a plan would be financed, and given previous false dawns regarding German fiscal expansion, it may be worth waiting for official confirmation.

Finally, there was a small amount of data out yesterday. In the US the June NFIB small business optimism reading declined 1.7pts to 103.3 but did still come in a little bit better than the consensus of 103.1. Later on the May JOLTS reported showed that job openings slowed slightly in May to 7.32m after expectations were for a rise. That said, since we know that employment data improved in June so this is fairly stale now.

To the day ahead now where the obvious highlight is Fed Chair Powell’s testimony this afternoon. Outside of that we’ve also got scheduled comments from the Fed’s George as we go to print right now and Bullard this evening. The FOMC minutes this evening are the other highlight. As for data releases, May industrial production prints are due in France, Italy and the UK this morning along with the May GDP reading for the latter. In the US the May wholesale inventories print is the only release of note. Elsewhere the BoC meeting is due this afternoon while the BoE’s Tenreyro is also due to speak.

via ZeroHedge News https://ift.tt/2XCZGOn Tyler Durden