Via Bloomberg’s Richard Breslow,

What a unique situation we get to witness over the next two days. The market assumes that the FOMC meeting is being held early. And that is largely true. With the one caveat that if the reaction of asset prices isn’t to their liking they will get a second bite at the apple to adjust the message. Which is one big reason, even among those who fear Fed Chairman Jerome Powell just might be less dovish than expected [ZH: he wasn’t!], there remains a strong buy the dip mentality.

All eyes, as they say, will be on the gaps to lower yields from the end of May.

Whether the gaps get filled at all, or hold if tested, will tell you a lot about market dynamics. The real answer comes down to whether investors conclude prices got too far ahead of the economic data or have faith that the year-long trend will continue.

What happens in the very short-term is anyone’s guess, and largely irrelevant. But it will take a lot, lot, lot to turn long-term bond bulls into anything else. And that certainly won’t be his, or any other central banker’s, intention. If anything, willing to openly concede that supporting financial conditions is part of the game plan has fully emerged into the mainstream. The practice of doing so no longer has to be a poorly kept secret.

With fewer monetary resources at their disposal than they would like, they need the market to continue doing a chunk of their work for them. Which is understandable given the lack of faith that effective fiscal policy will be on hand.

There are a couple of things to keep in mind.

Should we come out of the testimony with the 25 basis point cut, or even a bigger one, seemingly baked in the cake, assume that the chances of them taking it back in the foreseeable future are exceedingly small. That is true whatever the explanation for the move. And no talk of data-dependence is going to change that.

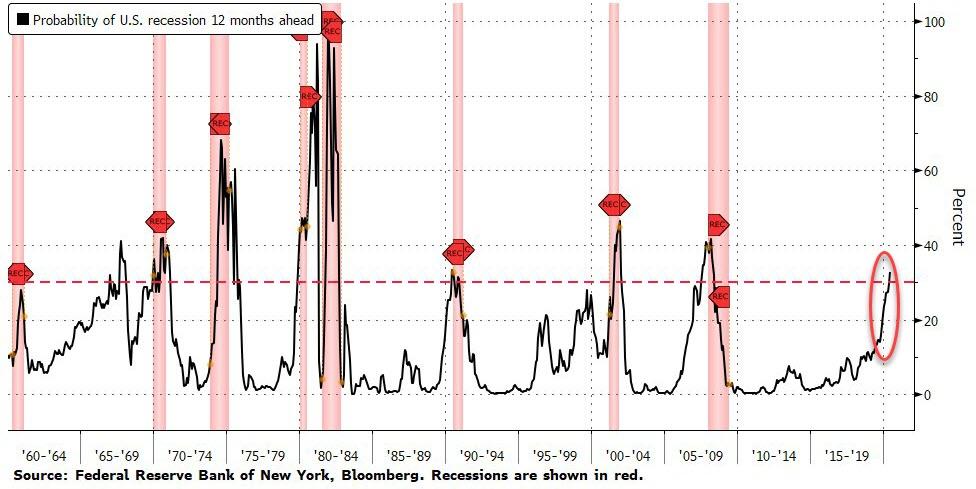

Take it as confirmation that, whatever the projected pace of rate changes, the market correctly understands, and will continue to price this, as merely the prelude of things to come. Talk of inflation is a red herring. The subtext of all of this is how to ward off a potential recession.

It doesn’t even matter if the debate about whether one is imminent or not is unsettled. Because their keep-them-up-at-night reality is worrying about what they can effectively do should one happen. And the fact of life with recessions, all of the predictive models notwithstanding, is they are, in fact, notoriously difficult to predict. And don’t require an aging economic cycle to occur.

The term “global headwinds” has become unfortunate. It’s too broad as to be useful and risks just being a cliche. Because in today’s world, credit events in Europe or Asia, trade disputes and a lot of other risks are just as likely to be the cause. These are things the Fed has no control over. And don’t have to rise to the level of black swans to be the trigger.

The Fed’s struggle is all about trying to figure out if there is any way to make a potential recession as mild as possible. They probably feel they can deal with a mild one with the resources at hand. But a bad one is going to be a problem. Especially because their unspoken reality is that QE loses its oomph over time. And that sell-by date is rapidly approaching. They have to figure out when, and how fast, they should spend the rate room they have. And, perhaps, reconsider whether they should have been hiking a lot earlier than they had the gumption to do.

via ZeroHedge News https://ift.tt/32ins0R Tyler Durden