A quiet day for sure but the trends remain – dollar and gold higher together, bond yields fading, and stocks clinging near record highs…

Powell better not let the world down!!

Chinese stocks trod water overnight…

UK’s FTSE exploded higher as the pound plunged, Italy underperformed in Europe but the rest of the majors were flat…

And a mixed bag in US stocks too with The Dow clinging to some semblance of positivity as Small Caps and Nasdaq underperformed…

FANG Stocks erased Friday’s gains…

It’s Beyond Meat’s earnings tonight – make or break time for shorts who are paying 144% borrow…

The S&P continues to dramatically outperform the broadest US equity index – not exactly what one would hope for in a broad-based re-acceleration in growth…

Treasuries were bid after Europe closed and ended lower in yields on the day (but traded in a very narrow range)…

30Y Yields erased the losses from Draghi’s disappointment…

The dollar rallied once again – nearing its highest since May 2017…

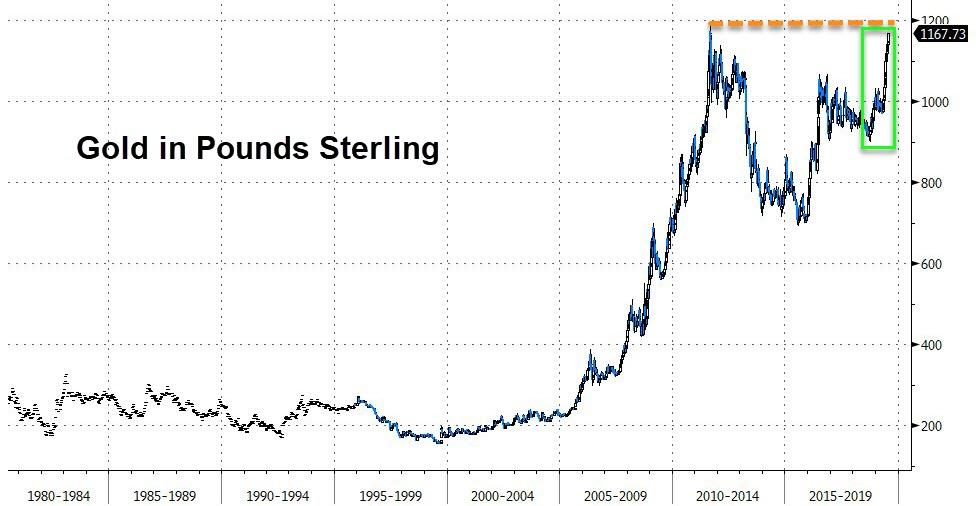

Cable was clubbed like a baby seal today as no-deal expectations ramp up…

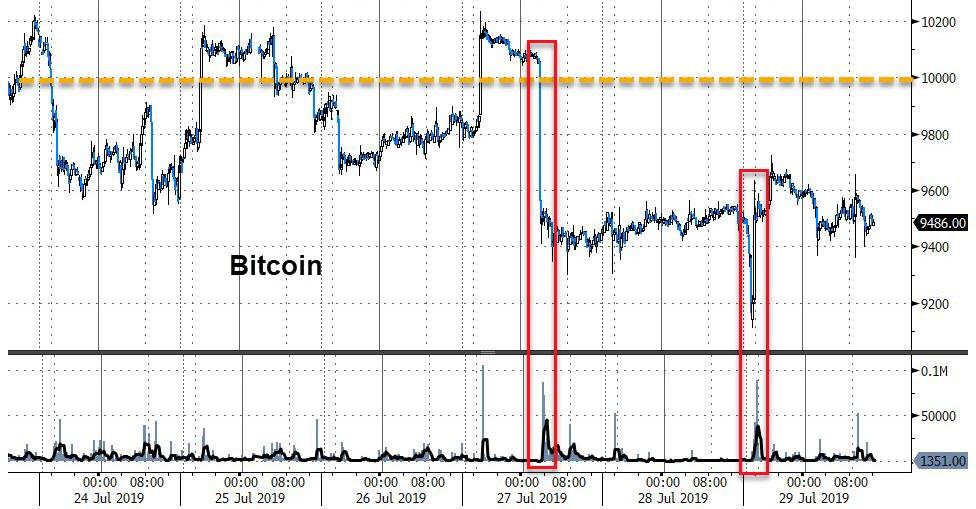

Cryptos had a flash-crashy like move overnight but recovered from that – although they remain lower from Friday…

With Bitcoin holding back below $10,000…

Despite dollar gains, commodities managed gains with Crude and Copper leading but PMs rallying towards the US close…

Gold spiked up to pre-Draghi levels…

Oil was volatile intraday testing below $56 and up to $57…

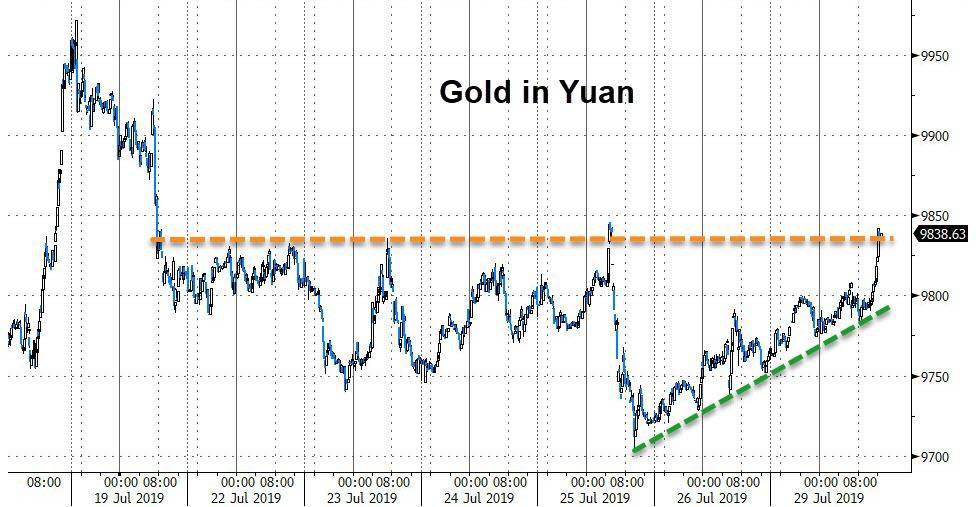

Gold in Yuan jumped up to recent resistance…

And gold in Sterling is very close to a record high…

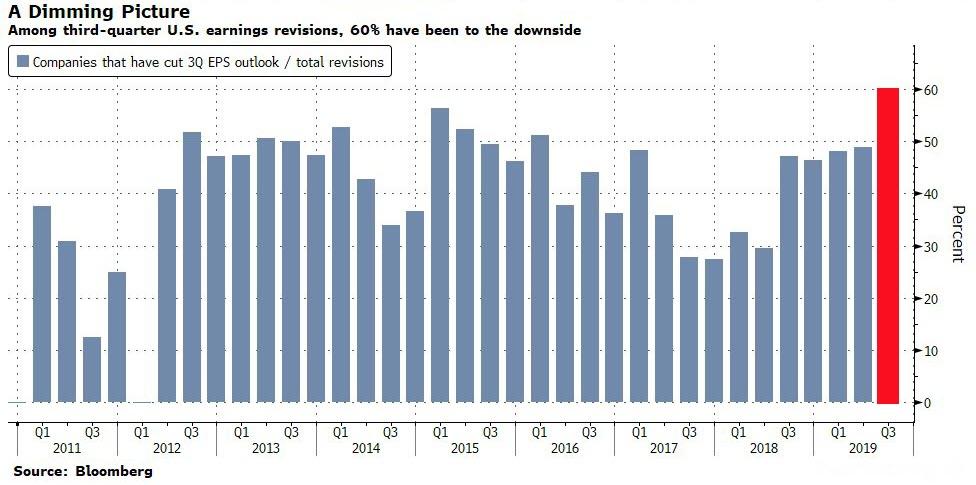

Finally, there’s this… While the S&P 500 is up 20% YTD, earnings expectations for the next 24 months has slumped…

As 60% of companies have cut Q3 EPS expectations in recent weeks…

Will traders sell the Fed news?

via ZeroHedge News https://ift.tt/2Y7ku0C Tyler Durden