It’s not just the melting ice cube known as Deutsche Bank that that is laying off recession-level numbers of traders: according to Bloomberg, Citigroup is also preparing hundreds of job cuts at its slumping trading division as more of the world’s largest firms respond to dormant clients and the rise of the robots with across the board layoffs.

According to the report, Citi – which plans to slash jobs across both its fixed-income and stock trading business over the course of 2019 – will let go at least 100 jobs in its equities unit, or almost 10% of that division.

The mass terminations are not a surprise in light of the chronic decline in Wall Street trading revenues as numerous clients simply refuse to allocate capital to stocks at current levels and pursue the S&P bubble beyond 3,000, certain it’s only a matter of time before the market crashes. As we noted two weeks ago when the big moneycenter banks reported Q2 earnings, the biggest Wall Street banks are facing an identity crisis, pressured by the lowest first-half trading revenue in more than a decade as they contend with reticent clients spooked by a global trade war even as volatility in asset prices hovering around record lows. In other words, despite near perfect trading conditions, bank trading revenues are plunging. One can only imagine what happens if and when trading conditions are even modestly “impaired.”

According to Bloomberg, Citi’s revenue from equity trading tumbled 17% to $1.6 billion for the first half of 2019, driving a 5% drop in total trading. That was lowest equity total among major U.S. firms, according to Bloomberg Intelligence.

Meanwhile, Citigroup executives said this month they would continue to cut costs in the second half of the year after trimming more than analysts expected last quarter.

“We’re going to do everything within our power” to meet a goal of a 12% return on tangible equity this year, CEO Mike Corbat said after the bank announced earnings on July 15.

Citi joins Deutsche Bank, which made the biggest move earlier this month, when the firm announced it was exiting all of equities trading as part of restructuring that included 18,000 job cuts. Other major banks in Europe, including HSBC Holdings Plc and Societe Generale SA, have also announced the layoffs of hundreds of workers in an atmosphere that may be the gloomiest since the financial crisis, yet the S&P is withing spitting distance of new all time highs.

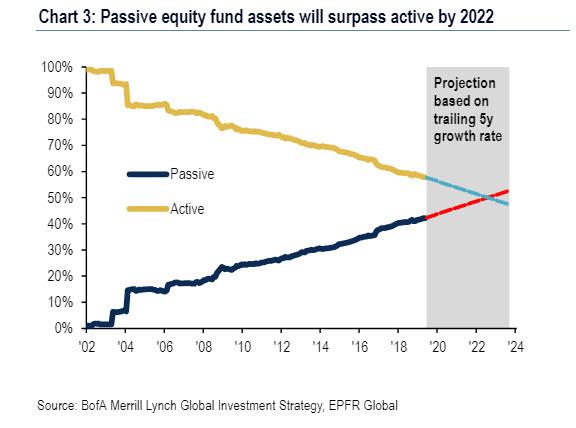

Ironically, in an environment of already depressed liquidity, these layoffs will result in even less prop and flow trading, leading to even lower liquidity, even more accentuated and sharp moves when volatility does spike, resulting in even greater trading losses during the next market correction or bear market, assuring even greater layoffs next time round, as the world finally realizes what we have been saying for the past decade: the market is broken, and between the Fed and algos propping it up, there is simply no need for human traders any more, especially now that Passive investing will overtake Active…

… in just over three years, assuring that carbon-based traders are now a threatened species.

via ZeroHedge News https://ift.tt/2SMtUsA Tyler Durden