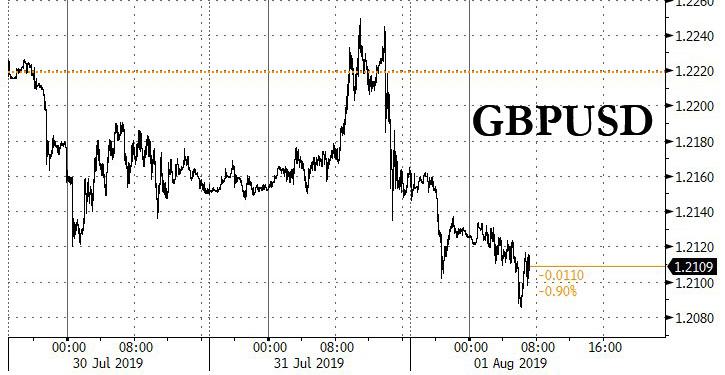

With the pound tumbling below 1.21 ahead of today’s BOE announcement, traders indicated a virtual certainty that the central bank would be dovish, and why not when even the Fed had cut rate less than 24 hour earlier. So it was perhaps a modest surprise – even if the outcome was as consensus expected – that the BOE did not cut rates, and instead voted unanimously to keep rates at 0.75% and to keep asset purchases unchanged, while noting that it is less confident than usual about the outlook for the economy because of Brexit while offering little new insight into the impact of how it would react to a “no deal” outcome.

Specifically, when it comes to its view on Brexit, the MPC specifically excluded the possibility of no deal, assuming a smooth Brexit and reiterated that interest rates will need to gradually rise to bring inflation to target. while noting that evidence suggests that uncertainty over the UK’s future trading relationship with the EU has become more entrenched.

Among its other underlying assumptions of projections, the BOE’s MPC notes that projections are impacted by an inconsistency between the Bank’s smooth Brexit assumption underpinning the forecasts and the prevailing market asset prices on which the forecasts are also conditioned.

- On rates, the BOE maintained the view that on the basis of the assumption of a smooth Brexit and some recovery in global growth (new inclusion), the MPC continues to judge that increases in interest rates, at a gradual pace and to a limited extent, would be appropriate to return inflation sustainably to the 2% target. The response to Brexit, whatever form it takes, will not be automatic and could be in either direction

- On domestic growth, the BOE maintained the view that Q2 growth is expected to be flat. On the basis of current Brexit assumptions, underlying output growth is expected to be subdued in the near-term. Thereafter, GDP is expected to accelerate to robust growth rates as Brexit-related uncertainties dissipate.

- On Global Growth, the BOE noted that global trade tensions have intensified since May and global activity remains soft

- On inflation, after falling in the near-term, CPI is expected to rise above the 2% target, with CPI to reach 2.4% by the end of the three-year forecast period.

- On labor/wages, the central bank said that the Labur market remains tight and annual pay growth has been relatively strong

These comments were the bank’s first since Boris Johnson became prime minster on a mission to leave the European Union on Oct. 31 with or without new trading arrangements in place. If there’s no deal, the BOE merely noted again that the pound will fall, inflation will accelerate and growth will slow.

While that BOE’s non-committal forecast and lack of Brexit discussion meant Governor Mark Carney avoids a political headache, it disappointed others who are looking for more clues as to how the BOE might respond to no deal.

That communications problem has dogged the governor for some time. To account for the market currently pricing in a rate cut because of the greater chance of a bumpy departure from the EU, the BOE gave some stylized forecasts based on higher pound and interest rates. They show much slower inflation than the central scenario.

“The increased uncertainty about the nature of EU withdrawal meant that the economy could follow a wide range of paths over coming years,” the BOE said. “The appropriate path of monetary policy would depend on the balance of the effects of Brexit on demand, supply and exchange rate.”

Meanwhile, as Brexit keeps the BOE in wait-and-see mode, the world’s biggest central banks are turning dovish as global growth cools and trade tensions persist. The Federal Reserve on Wednesday delivered a quarter-point cut and suggested there’s more to come. The European Central Bank is looking at adding more stimulus as early as September.

Acknowledging the weaker global backdrop, the BOE lowered its forecast for economic growth this year, sees slower export growth and weak business investment persisting into 2020. In the stylized forecasts, one quarter-point rate hike over the next three years brings inflation below the 2% target. That compares with a central forecast, based on the market’s expectation of a quarter-point cut, for inflation to pick up to 2.4%. The forecast also sees excess demand at a whopping 1.75%. As Bloomberg notes, in normal circumstances, that would imply that the BOE should be raising rates soon. But given the uncertainty around Brexit, all nine policy makers deemed the current stance appropriate.

With cable having collapsed by a record amount heading into today’s decision, the pound barely moved after the announcement of the decision not to cut rates.

via ZeroHedge News https://ift.tt/3360SZw Tyler Durden