Gold is having its best year since 2016, soaring over 17% year-to-date, outpacing stocks, bonds, and the dollar.

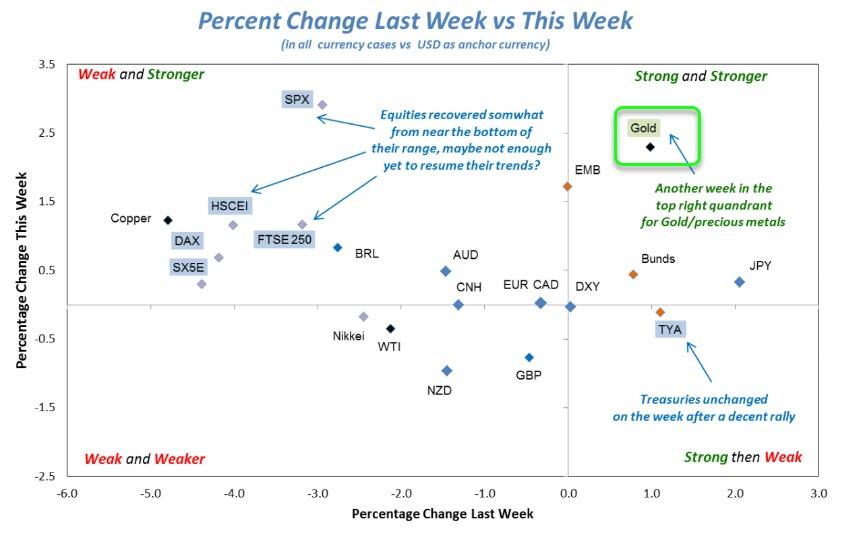

And Gold is strong and getting stronger.

“We’re now going from trade wars almost into currency wars,” said Whitney George, president of Sprott Inc., a precious metals-focused fund.

“Gold is a currency, but it’s nobody’s obligation, so it will stand tallest when everyone else is trying to debase their currency to be competitive globally.”

Analysts are jumping on the bullion bull market bandwagon:

Goldman have a six-month gold forecast of $1,600;

Citi has said it will rise to the same $1600 level in 6 to 12 months; and,

Bank of America Merrill Lynch sees prices climbing toward $2,000 within two years, topping the all-time record of $1,921.17 reached in the spot market in 2011.

Goldman’s technical chartists see the break above 1,453 was bullish in nature.

As has been discussed in previous updates, needed it to break higher than 1,453 in order to avoid this looking like a complete ABC rise from the Aug. ’18 low. Having done so, this now opens up the possibility of a longer-term projection target up at 1,568-1,595.

…the next near-term resistance is up at 1,528-1,539

The move since Jul. 17th looks like an incomplete iii of v waves up. What that means is that any near-term pullback should still be considered corrective and counter-trend.

Would use support at 1,484 and 1,468 as levels from which to consider bullish exposure. Shouldn’t retrace/make contact with the top of wave i at 1,453. In other words, the market needs to pullback further than 1,453 to think that a top might actually be in place.

Could eventually continue up towards 1,600.

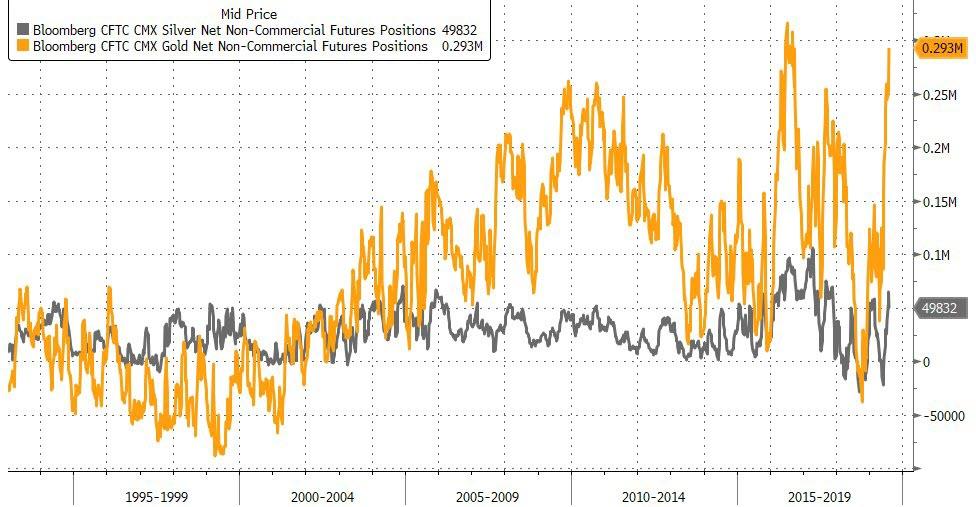

But its not just analysts that are piling in. Large speculators’ net positioning in gold is near record highs and silver positioning is also soaring.

In other words, specs are largely all-in, and as the world shifts to an easing cycle, this sets the scene for more bullish gold pressure as negative-yielding global debt levels will inevitably rise.

“When we have global deflation concerns and the slowdown in global economic activity and governments are all running to devalue their country’s currency to try to stimulate economic growth, they’re dealing with negative interest rates, and that’s been driving gold,” said Frank Holmes, chief executive and chief investment officer of U.S. Global Investors,

And finally, as Bloomberg reports, traders and analysts have switched to a strongly bullish position, with 69% expecting price gains, and none bearish for the first time since March, according to a recent survey.

via ZeroHedge News https://ift.tt/2YZqRTf Tyler Durden