It’s been a bad year for China, and it’s only getting worse.

With Beijing suffering an escalating trade war with China which has crippled local economic sentiment, slammed growth to record lows, and unleashed a currency devaluation (and currency war) sparking fears of capital flight even as PPI inflation turned negative slamming corporate profits as soaring pork and fruit prices sent CPI soaring and made future rate cuts by the PBOC extremely complicated, cuts desperately needed by a banking sector caught in an interbank funding freeze that culminating in a record three bank bailouts in three months while plain vanilla corporate defaults soar to an all time high, the only thing that China had going for it was the world’s most aggressive credit creation machine, which back in January injected a gargantuan 4.64 trillion yuan ($684 billion) in total credit, more than the GDP of Vietnam, and sparked hopes of a 2nd Shanghai Accord and that China would finally reincarnate the long missing Chinese Credit Impulse which back in 2009 saved the world from all out depression.

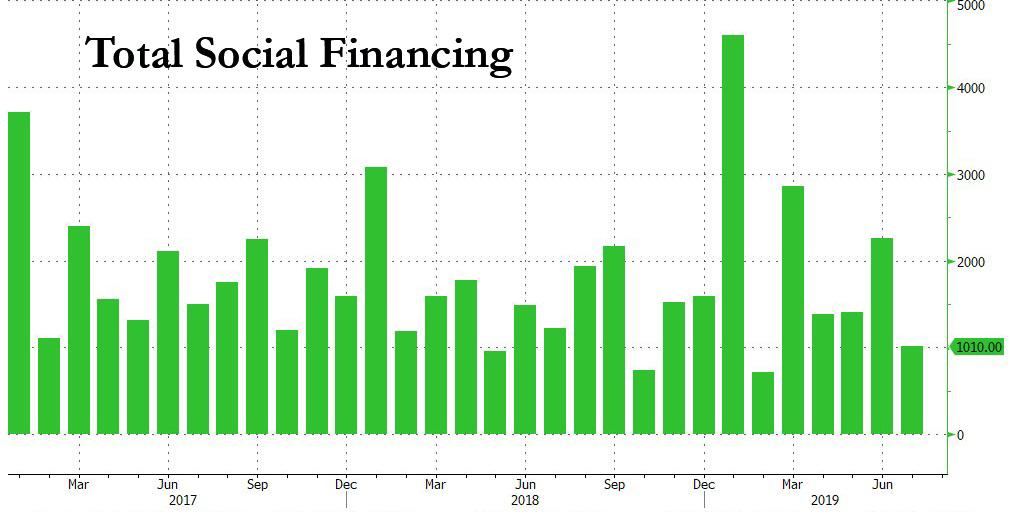

But it was not meant to be, because to great trader disappointment, this morning Beijing reported that Beijing credit creation dynamo sputtered again and in July credit numbers came in significantly below expectations, for both new yuan loans and the all-important total social financing number:

- New CNY loans were RMB 1.060 trillion in July vs. consensus of RMB 1.275 trillion. The growth rate slowed again, with outstanding CNY loan growth dropping to 12.6% yoy in July from 13.0% yoy in June.

- Total social financing RMB 1.010 trillion in July, a whopping miss to consensus of RMB 1.625 trillion. This number, also, decline with the PBOC reporting that TSF stock growth was 10.7% yoy in July, vs. 10.9% yoy in June.

More disappointing, this was the second weakest TSF print of 2019…

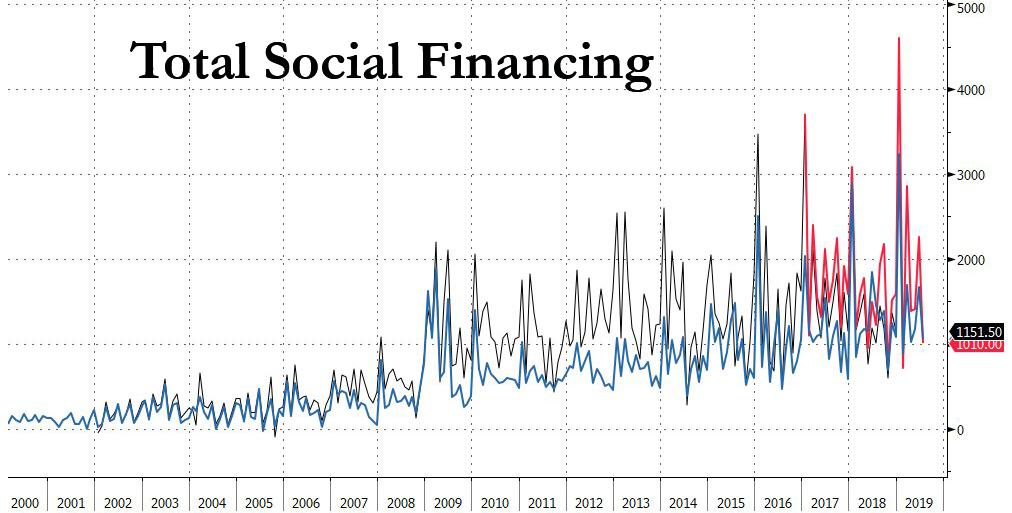

… and one of the lowest prints in recent years, coming at the worst possible time – just when China desperately needs much more liquidity to offset the slowing macro environment.

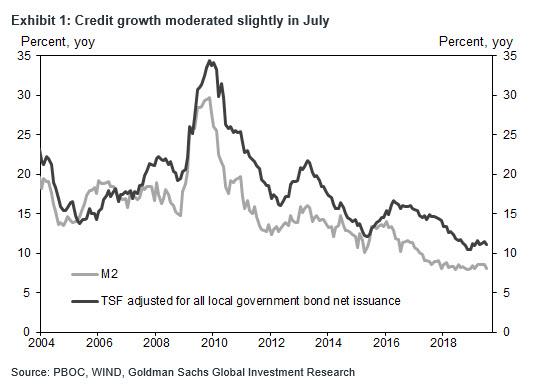

On the monetary side, the broader, M2, aggregate rose just 8.1% yoy in July vs the 8.4% consensus estimate, just shy of all time lows.

As Bloomberg reported over the weekend, the PBOC’s unexpected coyness in the credit market is likely the result of the Beijing’s hopes to hold on to some dry-powder for the coming winter in case trade war escalates further, while Nomura’s Ting Lu noted that “…Beijing simply cannot afford to stop easing yet.”

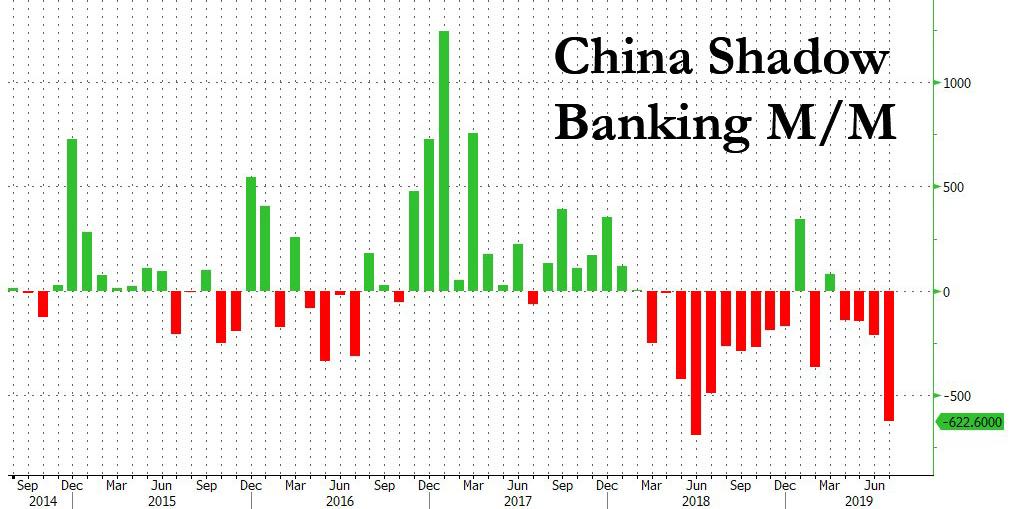

Some more details from Goldman: adjusted TSF stock growth slowed down to 11.1% yoy in July, mainly dragged by the decline in banker’s acceptance bill (RMB -456bn, the largest decline since July 2016) a key component of China’s “shadow” banking system, which continues to shrink as shown below.

Goldman thinks the slowdown in money and credit growth in July was likely intentional:

Policymakers marginally tightened policies on the back of the following positive factors: activity growth was strong in June; the liquidity stress related to Baoshang Bank’s takeover was gradually fading; trade negotiations appeared to be going smoothly at the time.

On the other hand, the impact of the tighter policy stance was likely larger than policymakers had expected, and according to Goldman, it’s likely they took administrative actions towards the end of the month to boost credit supply. Without these actions, data would have been even weaker. One downside of quantity-based administrative measures is that commercial banks may take actions to satisfy government demand, but which don’t necessarily support real economic activities. While this is true whenever the government takes administrative action, it is especially important when the push is very late in the month and there is a lack of other complimentary measures such as a lower interbank rate.

And while next month’s data may be stronger, for now expect continued downside surprises, and according to Goldman, July activity growth data to be released on Wednesday will likely be weak too, especially in light of the soft credit growth data today. Given sequential growth already appears to be tracking at the low end of the target GDP growth range of 6-6.5%, it is very likely that the policy stance is likely being loosened again in August to support economic growth, especially since downward pressures on the economy have clearly increased – trade tensions escalated further, and after the news on Bank of Jinzhou and Hengfeng Bank, interbank market participants could still be worried about liquidity risks.

But while Goldman rationally expects an easier policy stance going forward, at least until National Day (October 1st), a far bigger surprise would be if the PBOC refuses to comply with demands to inject much needed liquidity into the system… or is simply unable to, as the existing system leverage has never been higher. If that is the case, run, as the world’s biggest credit creation engine – that which almost singlehandedly managed to offset the depression that had gripped the western world in 2008/2009 – can barely raise off its lows.

Until the red line in the chart above fails to post a substantial increase – and certainly rise above the downward trendline – there is absolutely no hope for a global reflationary impulse and readers should keep buying bonds even if rates approach zero and eventually dip negative.

via ZeroHedge News https://ift.tt/2KK5k7U Tyler Durden