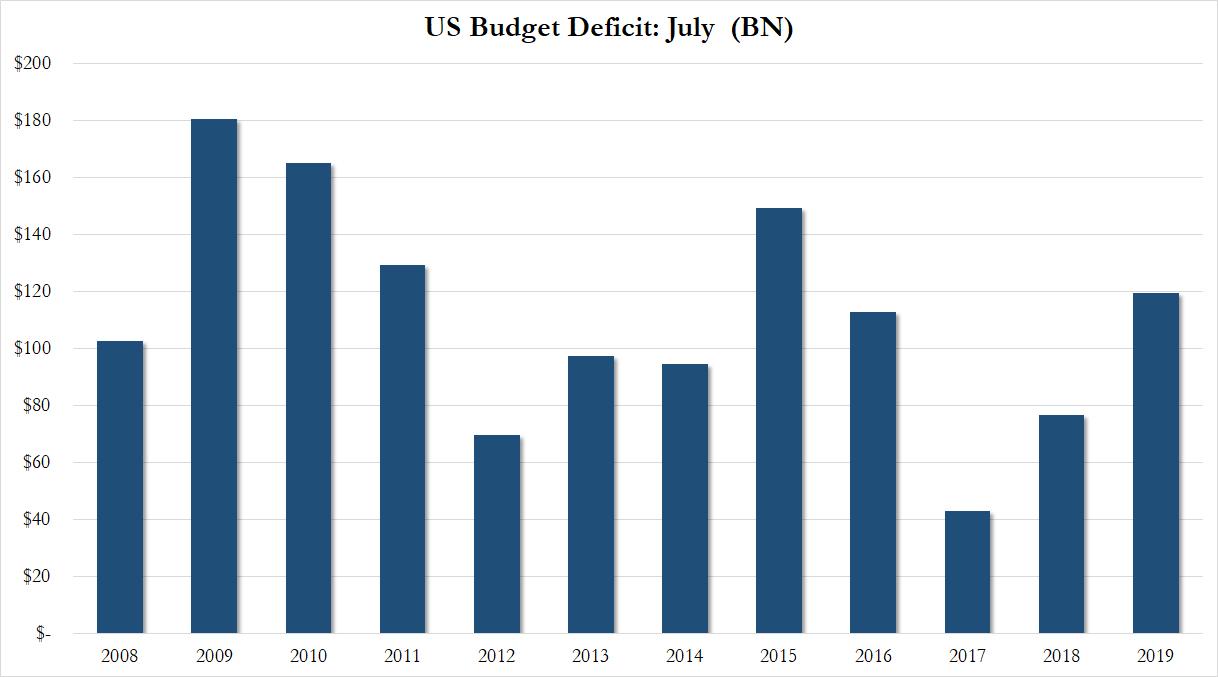

There were no surprises in the US budget deficit for July, the 10th month of fiscal 2019: it came in just as consensus had expected, at $120 billion, and about 55% higher than the $76.9BN deficit reported in July 2018. This was the 2nd biggest July deficit in the past 8 years…

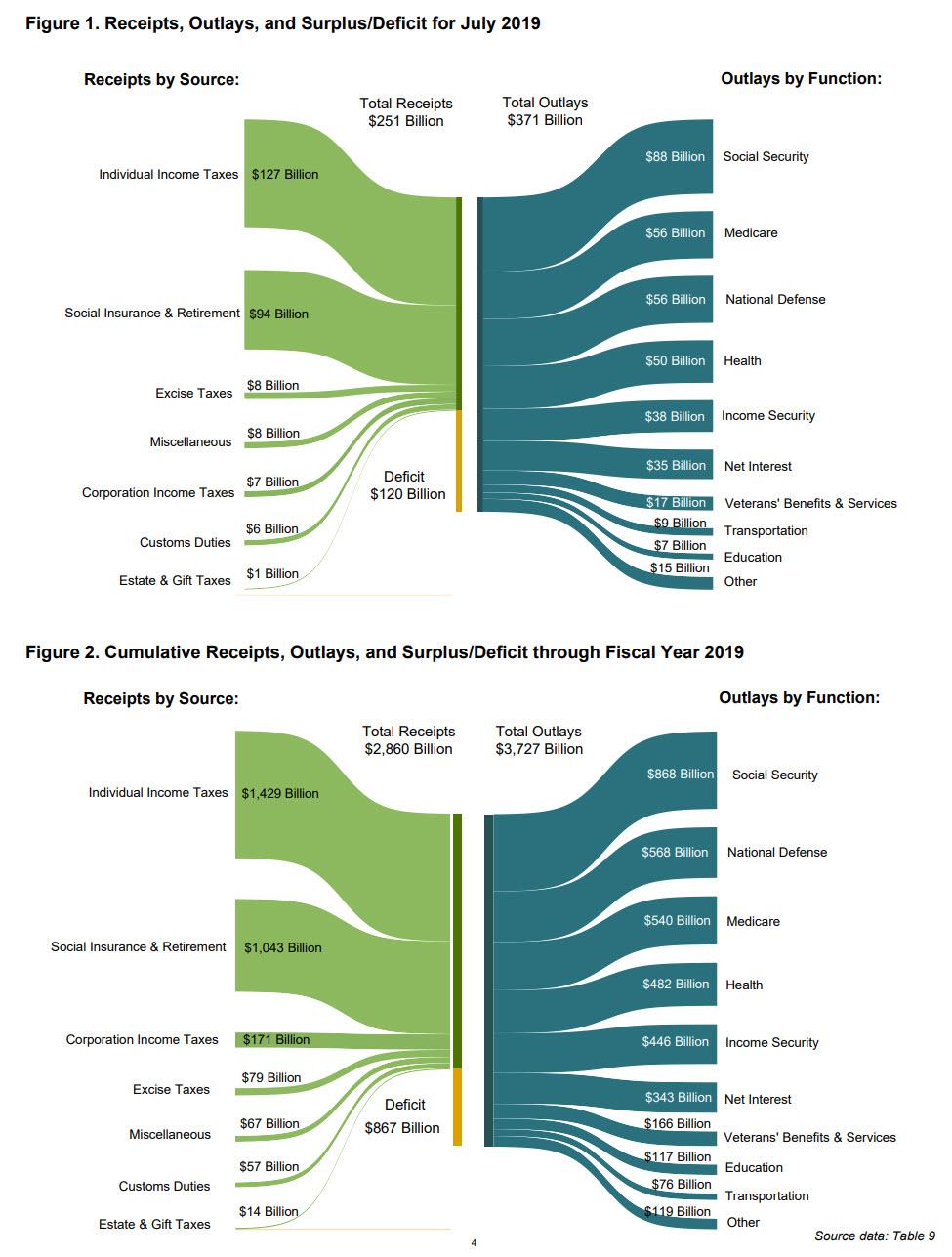

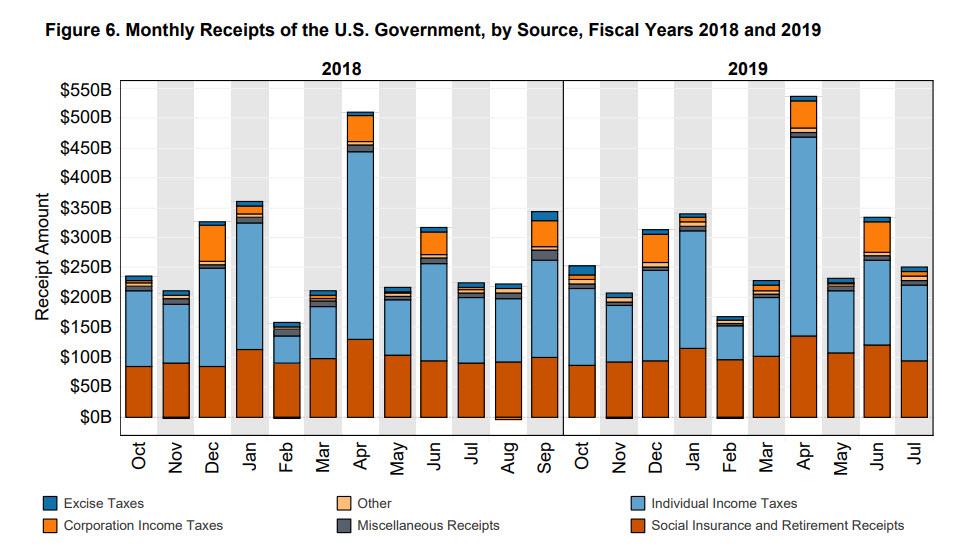

… and was the result of $251BN in government receipts in July, up 11.6% from the prior year, however offset by $371.0BN in government outlays, a rate of increase double that of revenues, or +22.8% from a year earlier. The biggest sources of government revenue were individual income taxes (127BN) and social insurance/retirement ($94BN), while the biggest outlays were social security ($88BN), Medicare ($56BN), National Defense ($56BN) and Health ($50BN).

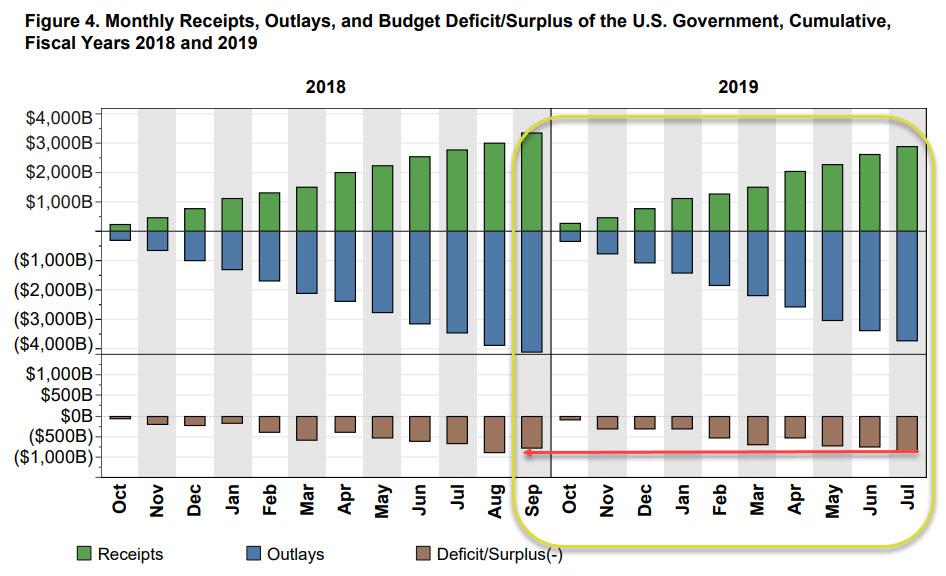

On a year-to-date basis, for the first 10 months of Fiscal 2019, receipts were up 3.4%, while outlays increased more than double by 8.0%. More notably, on a cumulative basis, the US budget deficit for the 10 months of fiscal 2019 was $867 billion, surpassing the $779 billion deficit for all of fiscal 2018, with more months of deficit spending in 2019 to go.

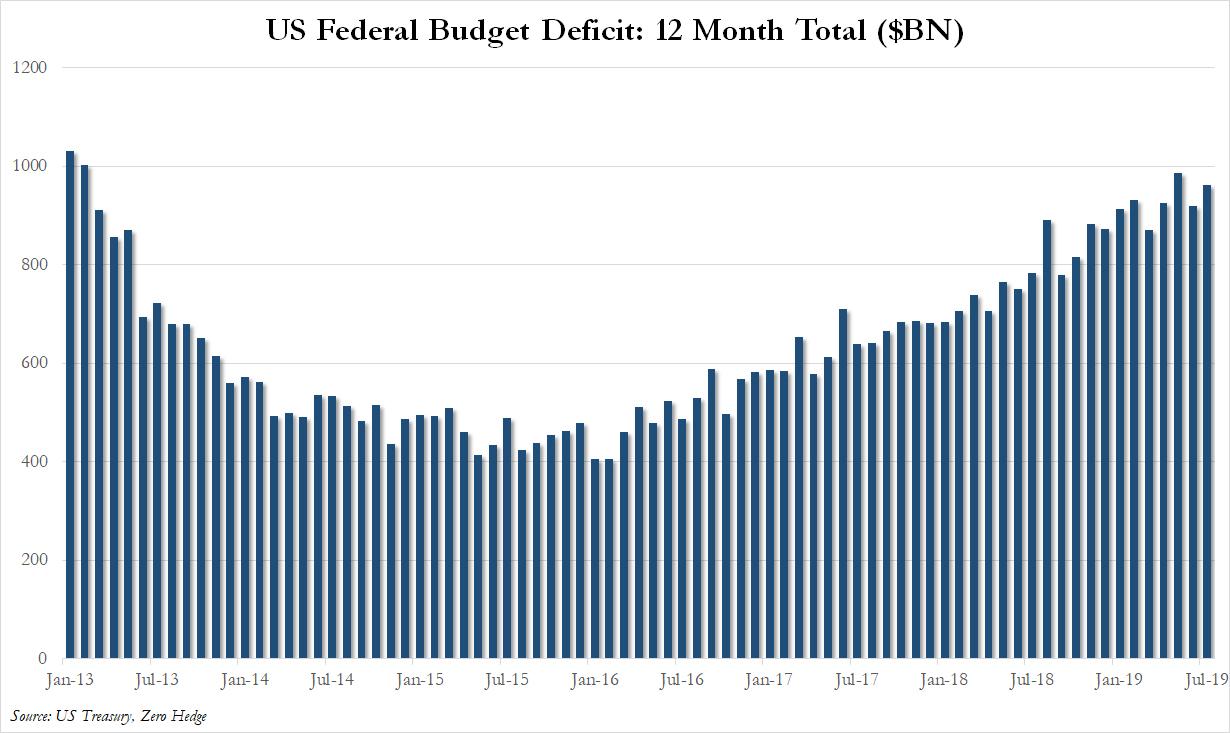

As shown below, the ballooning budget deficit shows no sings of slowing and is set to surpass $1 trillion in just a few months: as of July 2019, the US deficit on an LTM basis was just shy of $1 trillion, or $962 billion to be precise, a number that was last surpassed in early 2013, and which will again be surpassed in by the calendar winter. After that, it will never drop below $1 trillion again.

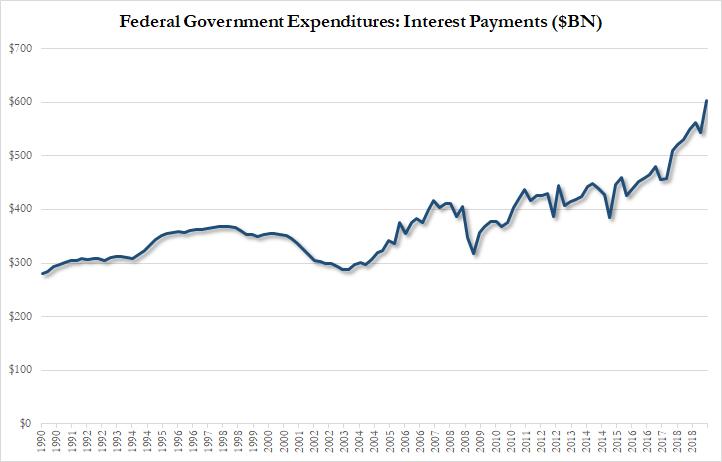

Finally, and perhaps most concerning, is that for the first ten months of this fiscal year, interest payments on the U.S. national debt hit $497 billion, $43 billion, or 9% more than in the same four-month period last year and the most interest ever paid in the first third of the fiscal year. According to the Treasury’s forrecast, interest expense on U.S. public debt is on track to reach a record $577 billion this fiscal year, more than the entire budget deficit in FY 2014 ($483 BN) or FY 2015 ($439 BN), and equates to 2.7% of estimated GDP, the highest percentage since 2011.

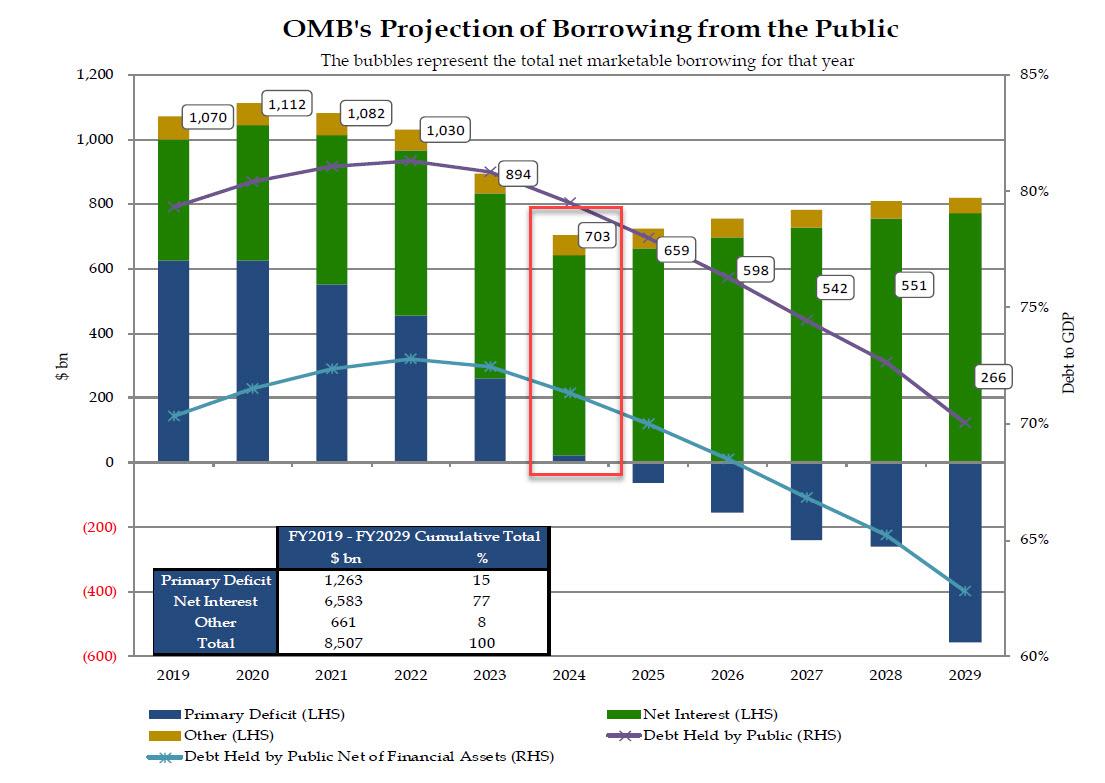

As a reminder, two weeks ago we showed readers that according to the US Treasury, starting in 2024 when the primary deficit drops to zero according to the latest projections (of course, this will never happen as the US will never run a balanced primary budget in the current financial paradigm), all US debt issuance will be used to fund the US net interest expense…

… which depending on the prevailing interest rate between now and then will be anywhere between $700 billion and $1.2 trillion or more.

via ZeroHedge News https://ift.tt/2MeLvJs Tyler Durden