Authored by Andy Xie via The South China Morning Post,

The US president has so far managed to keep the market buoyant by offering economic hope to calm nerves. As China’s economy continues to slow, and more multinationals begin to feel the pain, the tipping point may not be too far off…

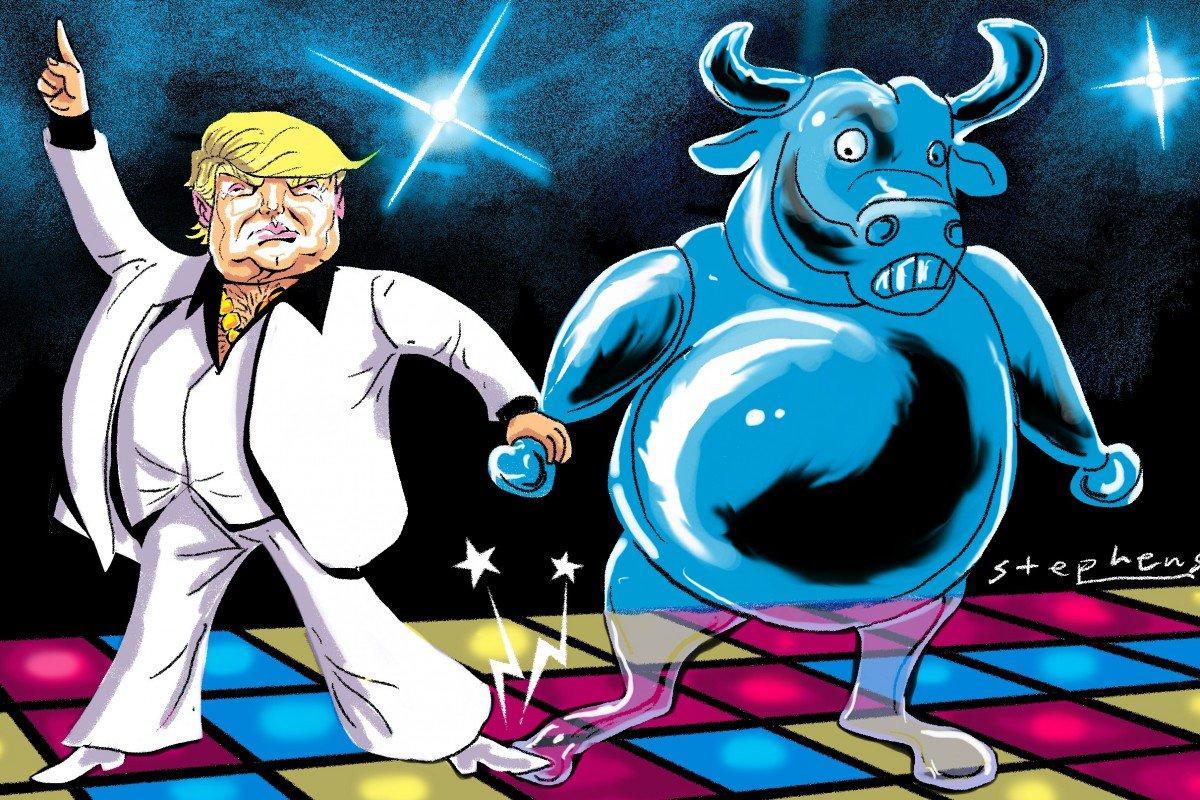

It is now clear that no deal is likely in the US-China trade war. As the rivalry morphs into a cold war, the close economic ties between the two are simply untenable. However, US President Donald Trump is still talking up a deal , if not this year, then in 2020. He is trying to keep the US stock market bubble afloat. If the market stays up, he is likely to be re-elected. If not, it is “Adios, Trump”.

The US market has gone through another convulsion over recession prospects. Both the market and Trump thought that a Fed rate cut would revive the market. It may have had the opposite effect. The Fed’s move has only magnified the recession fear. Why would the Fed cut rates otherwise?

As the US unemployment rate is still at a historical low, the recession fear may seem odd. But, now is not a normal time. After the 2008 global financial crisis, the global economy has come back with more debt and more asset bubbles. In a bubble economy, recession is a self-fulfilling expectation.

The property bubble in China and the stock bubble in the US have led the global economy since 2008. The US stock market surpassed 100 per cent of GDP in 1996 for the first time in history and was above 150 per cent at the recent peak. The cyclically adjusted price-to-earnings ratio (Cape) recently went over 30. It would appear that the US stock market was 50 per cent hot air based on historical valuation metrics.

The market bubble pumped up the value of Amercia’s US$30 trillion pension assets, which still has a shortfall of US$3-4 trillion. Like Trump said, if the market pops, Americans could kiss their pensions goodbye. As baby boomers are retiring en masse, massive pension shortfalls will surely lead to recession and even political turmoil.

China’s property bubble is bigger than the US stock bubble. It is likely to be over five times GDP in value. The hot air in the price accounts for more than 50 per cent. Most of China’s debt, which now tops 300 per cent of GDP, is backed up by property. It can keep going only if the debt continues to rise faster than GDP. Any deleveraging campaign, which the country tried a couple of years ago, would pop the bubble.

The Chinese government can intervene in a market process in all of its aspects. It can restrict buying and selling. It can change expectations by massaging statistics or media content. The end goal seems to be to stage a silent explosion, adjusting the market without people realising it, like slowly boiling a frog. Chinese bubbles don’t burst; they just fade away.

The adjustment in China’s property market was the main factor in the global economy slowing. The Trump bull market has mitigated some of its fallout in the past two years. If the Trump bull market bursts, a global recession is inevitable and could be quite deep.

And a debt crisis may return in Europe. With national debt at 131 per cent of GDP, Italy looks really dicey. A global downturn could tip it over, which would blow up Europe’s banking system.

Trump has succeeded in keeping the stock market afloat by always dangling some hope whenever it became jittery. A trade deal was always a couple of weeks away. Now, no one believes that. He is trying to talk about a deal in 2020 to see if the market would buy it. As a backup, he is talking about a cut in payroll tax. If neither works, he will come up with something else. This high-wire act will last all the way through next year’s election season.

So far, Trump has been lucky. Usually, a bubble pops when it stops rising. Trump has managed to keep it in the range over the past year. He may not be so lucky in the coming months. As China’s economy continues to slow, more and more multinational corporations will report bad earnings numbers. The tipping point for speculators to run for the exit may not be too far off.

If and when a recession arrives, it would be difficult for the world to come out of it. The structural problems that led to the 2008 global financial crisis have only become worse. Debt leverage has risen among all major economies.

The world agrees on only one solution – which is, the central banks releasing more money during a recession. It works by raising asset prices – that is, creating another bubble. Maybe it will work again. But Sino-US rivalry makes it less likely.

Since the end of the cold war in 1989, the world has experienced one bubble after another. There was a deflationary impact from the collapse of the Soviet bloc, less competition for resources, which made monetary policies more bubble-prone.

The vanishing fear factor was probably a major contributor, too. Animal spirit thrives during prolonged peace. Another cold war would put the fear factor back on the table and hold the animal spirit in check. Hence, another bubble-led recovery may not be forthcoming.

Indeed, more monetary stimulus may lead to rising inflation expectations, like in the 1970s, and trap the world in stagflation.

Ladies and gentlemen, it is time to get your polyester suit and platform shoes ready. Saturday Night Fever may be coming back.

via ZeroHedge News https://ift.tt/2PeFXRm Tyler Durden