Authored by Menno Middeldrop and team, from RaboBank Research

- The Dutch coalition government is reportedly considering a EUR 50 bn investment fund to support economic growth, to be financed by borrowing at negative rates

- Many details are yet to be determined, but the Netherlands should have sufficient fiscal space to finance additional investment spending on this scale in the years ahead

- This represents a notable shift from the debt-averse political consensus in the Netherlands and it could increase pressure on Germany to use fiscal policy to support growth.

News leaked last week that the Dutch coalition government is considering setting up a fund for investing in economic growth. Details are scarce, but media reports suggest a fund of up to €50 bn that would most likely be announced along with the rest of the Dutch budget in mid-September. It could be financed by borrowing from the market and spent on growth-friendly initiatives in areas such as infrastructure, innovation and education. Policy makers appear keen to capitalize on negative rates along the entire Dutch state yield curve.

Despite potential new borrowing, Dutch state debt levels would still be modest compared to other European countries and below the 60% Maastricht debt limit. The degree to which the fund actually results in additional investment and whether this will help growth, will depend on the governance around it.

From an international perspective, the idea of a government investment fund could impact the debate about the role of fiscal policy in supporting growth, in particular the special role of investment (in contrast to spending on (re-)current items). With limited space for additional ECB stimulus, the central bank has called on countries with available fiscal space to use their budget to support growth. The central bank’s policies have also made negative yields possible, giving governments an opportunity to finance such policies. The Netherlands has always been seen as squarely in the debt-averse camp, along with Germany. So this initiative could increase pressure on Germany to use its fiscal policy more actively, especially as the need for investment in infrastructure and digitalisation are seen as more acute there

Government investment fund: more questions than answers

The investment fund was initially reported by the Dutch newspaper De Telegraaf and later confirmed by other sources. The headline figure of EUR 50 bn remains indicative. Other details are also missing, probably because they remain to be worked out. But the main idea is clear: the government should make use of negative interest rates on Dutch government bonds to invest in things “such as” infrastructure and innovation. Apparently outlines of an idea were discussed between the coalition partners in the run-up to the state budget (to be released on 17 September) and were favourably received.

Since then there has been a widespread discussion on the topic in the Dutch media. The majority of responses have been supportive, based on the need to boost productivity growth in the Netherlands and the opportunity to borrow at negative rates. But there were also critics who felt that this was a distraction from the more immediate need to spend on income policies for the middle class or who cited earlier unsatisfactory experiences with a similar investment fund financed by natural gas income. Nevertheless, if the reports were a trial balloon to gauge the support for such a plan, there seems to be plenty of scope for the government to explore the idea further. And indeed, there is still much to be worked out and how the scheme is designed will be crucial for its impact and success. Open questions include the following …

What is the fund for?

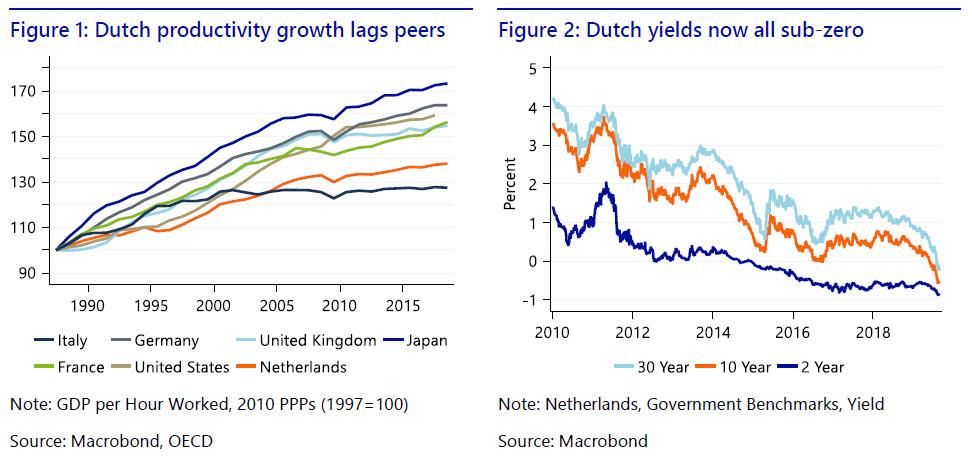

Generally reports suggest that the focus of the fund should be on supporting the long-term growth potential of the economy. This is a welcome goal, as productivity growth has been slow in developed countries in general and in the Netherlands in particular (Figure 1).

It is not quite clear what types of projects would be funded. Infrastructure, innovation, education and green energy have been named. Since the idea of a fund was reported, proposals like moving Schiphol, the national airport, into the North Sea (to circumvent spatial and environmental growth constraints at its current location) and building a high speed railway line to the north of the country have also been revived.

Should the fund be purely focussed on long-term investment or can it also play a role in stimulating the economy during a recession? Many press reports cited the possibility of an imminent recession as a motivation for the fund. However, the set of projects that make sense from a cyclical stimulus perspective – things like “shovel-ready” infrastructure projects – is smaller than the set that could support long-run growth.

How and when will it be financed?

The idea of the fund came shortly after the entire Dutch government yield curve, including the 30 year rate, moved below 0 percent (Figure 2). The possibility of borrowing money from the market and getting paid for the privilege has captured the imagination of the Dutch public and politicians alike. Some reports suggested the fund might be immediately stocked by borrowing from the market. Perhaps this reflects a sense that this opportunity to borrow at negative rates is a fleeting aberration. However, tasking the DSTA with prefunding this vehicle appears fanciful. First of all, it would undermine the Dutch State’s long-held policy of being a steady and reliable issuer. Furthermore, negative rates are a double edged sword. They may be an effective subsidy for borrowers, but are also a penalty for those looking to invest in liquid assets. As such, it makes better sense to raise capital as and when projects require financing.

Who will decide that the fund invests?

Should the “fund” be financed on-the-go then one might wonder, what’s the point? Dutch governments could easily invest in long-term growth projects using the regular budget. Establishing a separate fund should probably be seen as a commitment device to making the necessary investments, not just for the current governments but also for those in the future.

The Netherlands has an experience with a similar setup and several Dutch economists have cited this experience as a reason to be sceptical of this new idea. Natural gas revenues were supposed to be allocated separately from the rest of the budget on investments that would “strengthen the economic structure” of the Netherlands. However, it appears that the investment spending from the fund merely substituted for investment out of the regular budget. Furthermore, part of the fund was raided to finance regular state spending. It also lacked a strong strategic investment framework.

Without clear rules on what the new fund can spend its money on an who decides what counts as an appropriate investment, a repeat of these earlier experiences seems likely. An independent government agency with an investment spending mandate would be the most effective way to avoid this, but it is far from clear this will be politically feasible.

Fund unlikely to break the budget

Regardless of the exact structure, a fund of the scale proposed is likely to fit within the fiscal space the Dutch government has. We do expect that spending under the fund would fall under the EMU budget rules and that the Dutch government would be keen to stick to them. However, according official (CPB) estimates the EMU surplus will be 1.2% of GDP this year and the debt ratio will be 49% of GDP. Investments spending of EUR 50 bn, which is about 6% of GDP, could be easily accommodated if it were spent over several years and would still see debt stay below the 60% Maastricht threshold. Given the ongoing demand for safe-haven bonds in line with the elevated level of geopolitical tension, and with the ECB widely expected to soon wade in and further reduce the de facto supply of such bonds, an incremental funding programme for the proposed investment vehicle is also unlikely to weigh on spreads. As stated, we consider that a wholesale market-based prefunding of the fund, as speculated about in certain corners of the press, looks to be a flight of imagination.

Growth-effect depends on how wisely money is spent

Investment spending from a government fund like this could have both a short-term and a long-term growth impact.

In the short term, extra investment spending would boost GDP-growth directly and through a multiplier effect through private sector spending. The size of this effect depends on the state of the economy. Currently, the government is finding it difficult to implement its existing investment plans due to the tight labour market. However, as the economy weakens we expect unemployment to rise and there to be more space for this type of spending. More slack in the economy should also result in a stronger multiplier effect and reduce the risk of crowding out private sector investment. Indeed, if many of the risks facing the Dutch economy currently come to pass, the extra spending would be welcome stimulus.

The long term effect on growth (and thus indirectly on debt-sustainability) will depend on how wisely the government invests these funds. Investment in infrastructure, research and education could all benefit long-run economic growth. However, there are also strong cases to be made for investing in expanding the housing supply and in making growth more climate friendly. The social returns on such investments would justify their (negative) funding costs, but wouldn’t translate into higher growth of potential GDP.

Is this what the ECB had in mind?

The ECB has called on countries in the euro-zone with fiscal space to do more to stimulate growth. The ECB might thus welcome the plans from the Netherlands. However, it does not look like the Dutch government has classic stimulus measures in mind, that would boost aggregate demand in the short term. Not to mention, that the Netherlands is too small to influence overall Eurozone GDP enough to factor into the ECB’s calculus by itself.

It is also doubtful that the ECB’s call for more fiscal support to the economy has influenced Dutch politicians. Rather than seeing this as a question of fiscal-monetary policy coordination, another way to look at it would be to see it as part of the monetary policy transmission channel. The ECB has helped to create, at first low and now negative yields on Dutch government bonds through its negative deposit rate, its bond purchases and by stoking expectations of more easing to come. Due to deep-seated political preferences the Dutch government has so far not responded much to these incentives, but sub-zero rates are apparently a game-changer for Dutch politicians.

Pressure on Germany to invest more could increase

A Dutch investment fund would in itself not change much for the rest of the euro-zone. It could have an influence, however, on the debate regarding German fiscal policy. The Netherlands and Germany have always seen to be in the same club of countries that support conservative fiscal and monetary policy. An investment fund in the Netherlands could increase the pressure from other EU countries, the European Commission, the ECB and the IMF on Germany to do more. It could also play a role in the debate in Germany itself. Already there are signs that the political mood in Germany is shifting towards more investment (and possibly this has influenced the mood in the Netherlands as well). A long-term investment fund or program would arguably also be more politically palatable in Germany than straightforward stimulus. It would also be more welcome, given the consensus that Germany lags behind in digitalisation and needs more infrastructure investment. While from the perspective of the ECB and the euro area as a whole, coordinated investment across the currency union, targeting projects with the highest potential returns in regions with high unemployment, could be considered optimal policy. But that would require an even bigger shift in attitudes about fiscal policy.

via ZeroHedge News https://ift.tt/2UmgkNy Tyler Durden