Global Manufacturing massacre catches up to ‘Murica and stocks and bond yields tumble (after markets were seemingly surprised that Trump and Xi shot tariffs at each other – as they said they would – over the weekend)…

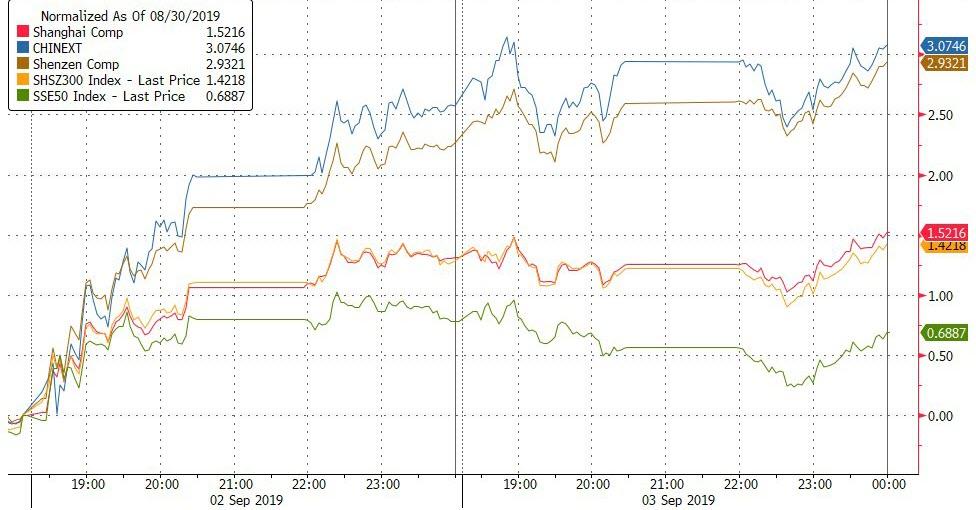

China was largely flat overnight, after a strong Monday…

Source: Bloomberg

Europe slipped into the red overnight with only Italy holding Monday’s gains…

Source: Bloomberg

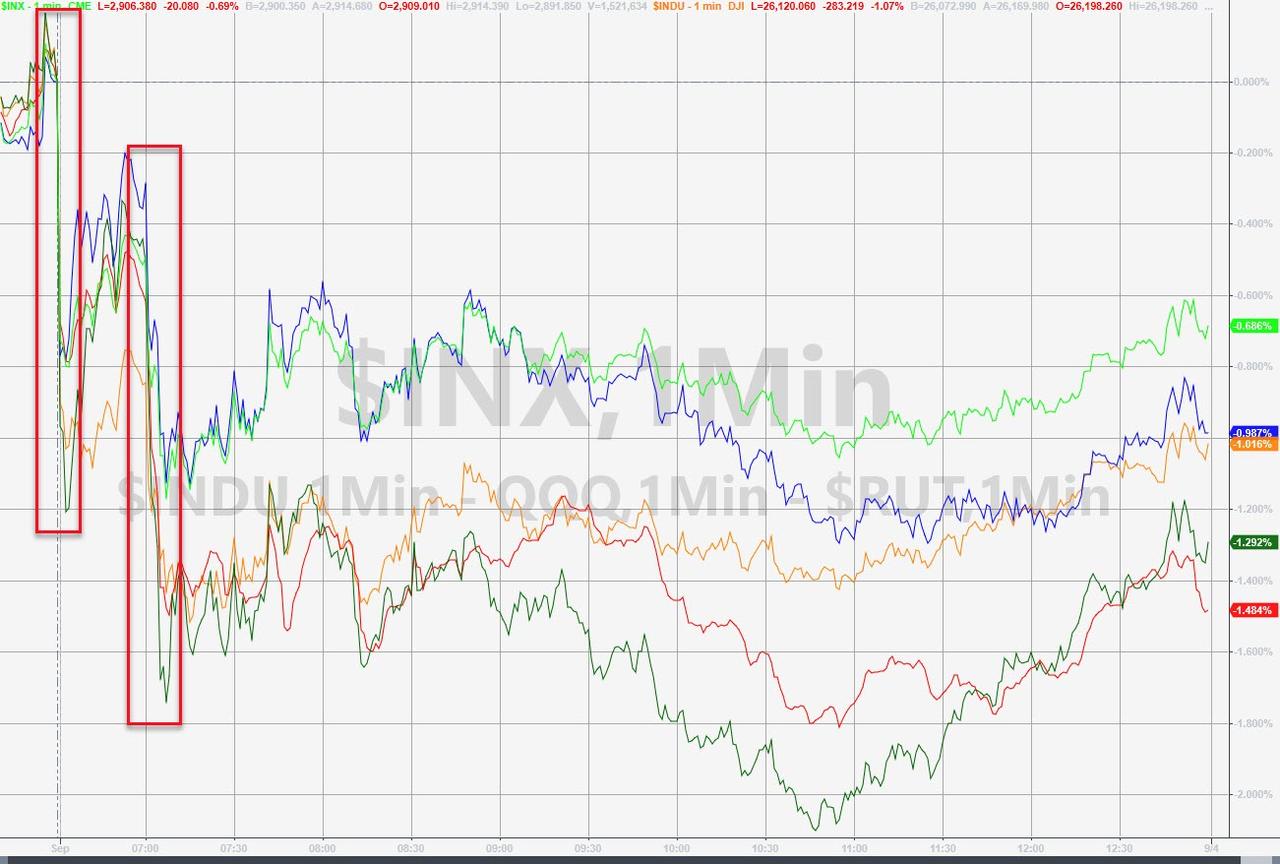

On the day, all US major indices were red (with Small Caps and Trannies underperforming)…

NOTE – the initial down opening was weakness from trade headlines and the second leg down was the ISM manufacturing contraction.

Stocks have erased all of last week’s “fake” phone call with China spike and are back in the red from Trump’s tariff tantrum

All the major US equity indices are back below their 100DMAs (Small Caps < 200DMA)...

A Quintuple Top?

Cyclicals dominated the market moves today…

Source: Bloomberg

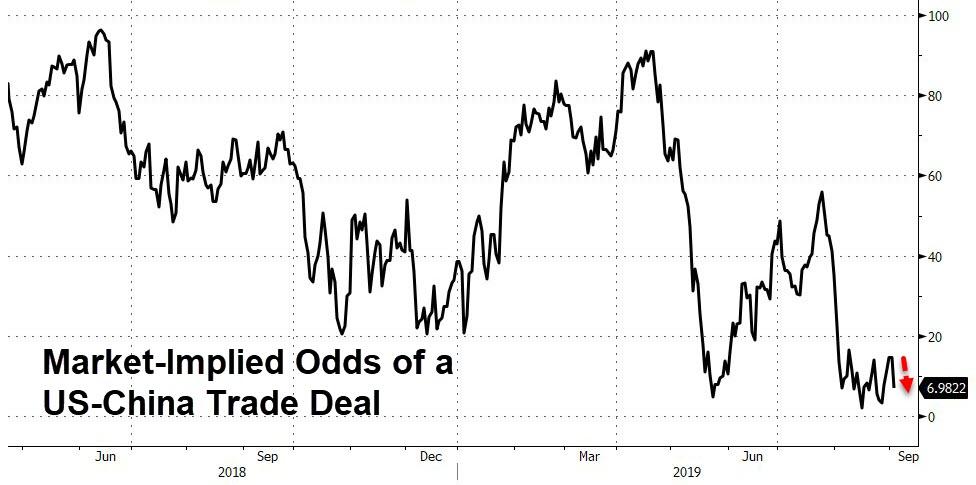

The market implied odds of a US-China trade deal have tumbled back towards zero…

Source: Bloomberg

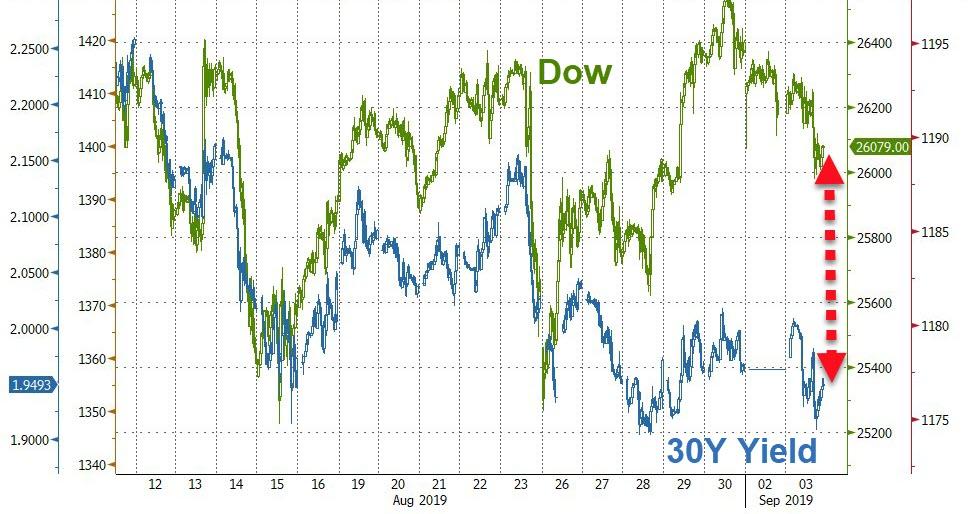

Are bonds and stocks starting to recouple?

Source: Bloomberg

Treasury yields tumbled on the day (with the short-end outperforming)…

Source: Bloomberg

30Y Yields briefly topped 2.00% overnight but rejected that quickly to end the day notably lower…

Source: Bloomberg

The yield curve (2s10s) steepened back out of inversion (but of course 3m10Y – the more accurate indicator – remains dramatically inverted)…

Source: Bloomberg

After 6 straight days higher, the dollar index slipped lower today…

Source: Bloomberg

Yuan rallied inatrday, erasing last night’s tumble…

Source: Bloomberg

EUR rallied after ECB’s Mueller said there was no strong case to resume bond-buying…

Source: Bloomberg

Cable tumbled overnight (below $1.20 for first time since 2017) then rallied back into the green as BoJo lost his govt majority on Lee’s defection…

Source: Bloomberg

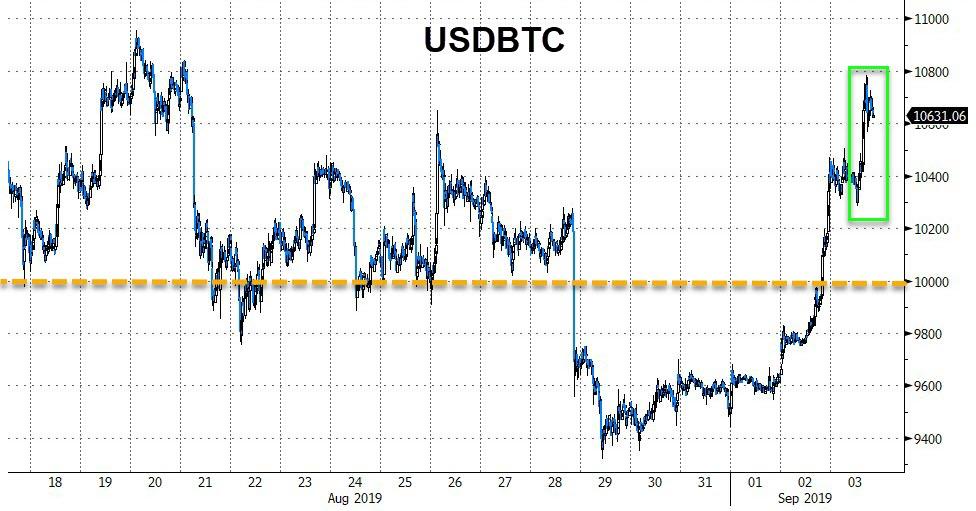

Cryptos rallied today, extending yesterday’s gains, helped by news that a Bitcoin ETF is finally coming…

Source: Bloomberg

With Bitcoin spiking back up to almost $10,800…

Source: Bloomberg

Very mixed picture in commodity-land as crude and copper dropped and PMs popped (led by Silver)…

Source: Bloomberg

Spot gold prices spiked up to $1550…

Source: Bloomberg

But it was silver that really exploded (2nd biggest spike since July 2016, Brexit vote)…

Source: Bloomberg

Crashing the gold/silver ration back to its lowest since Aug 2018…

Source: Bloomberg

WTI Crude plunged 3% intraday, back below $54, will it pull back into the recent range?

Finally, we note that it’s not like the ISM Manufacturing signal should have been unexpected as Trucking indicators and Treasury yields have been signaling this was imminent for weeks…

Source: Bloomberg

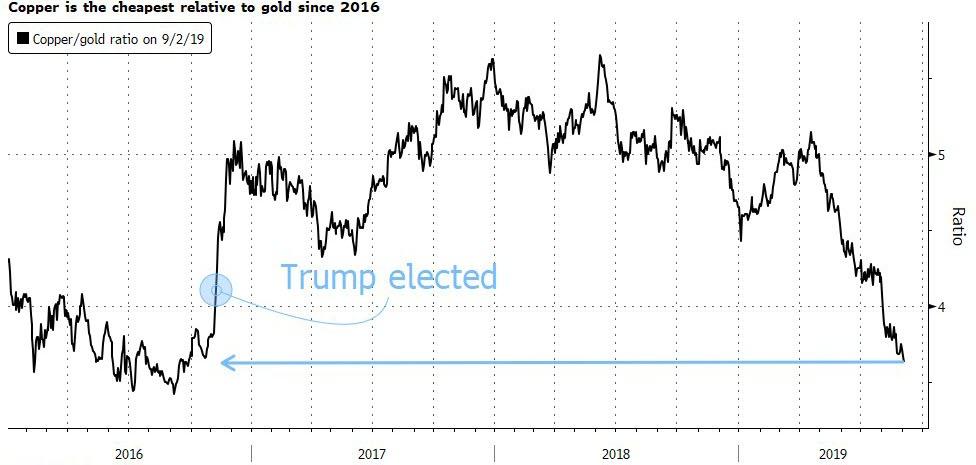

And as Bloomberg’s Eddie van der Walt notes, the copper/gold ratio is extending the year’s declines, turning its back on the Trump-trade era and now focusing lingering economic risks, with 2016 lows coming into play.

Source: Bloomberg

It now takes only 3.6 ounces of gold to buy a ton of copper, that’s down from more than 5 ounces earlier this year. Changes in the ratio between the two metals are a useful barometer of investor risk appetite, as the one acts as a haven and the other is an input into industrial applications.

via ZeroHedge News https://ift.tt/2LgSkYY Tyler Durden