With the drumbeat of a looming recession growing louder by the day – whether due to ongoing trade war or the late-cycle slowdown which finally pushed the all-important US mfg ISM into contraction today – and prompting banks such as UBS to drastically slash their GDP forecast to a whisker above recession in H1 2020, it’s just a matter of time before the chorus turns universally pessimistic.

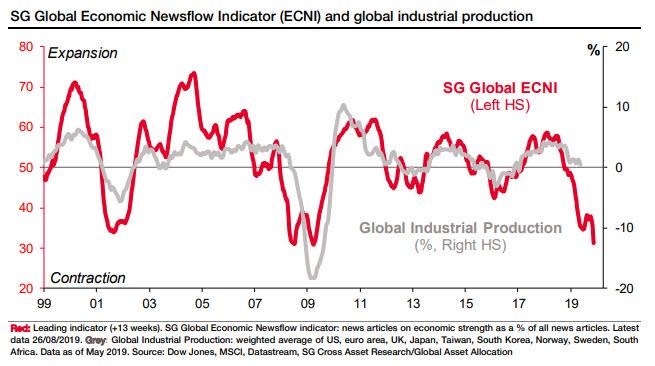

Taking a bold step in that general direction, was SocGen which today reported that after another sharp drop-off in August, the bank’s proprietary newsflow indicator (a “big data” approach to a variety of key market themes such as economic momentum, monetary and fiscal policy, inflation and risk, and which regularly leads the financial market by a few months) has collapsed signaling “severe damage to global growth momentum.”

As the bank explains, looking at this ominous indicator, for most developed and emerging markets that it follows (42 in total), levels are well below equilibrium (at 50), suggesting strong contraction in activity. Europe is the region most impacted, with France and Germany touching the lowest levels since 2001. But the US, Japan and China are also concerned, just 3.9%, 4.4% and 8.5% above their historical lows respectively. On paper, this justifies a cautious stance on so-called leading indicators, such as the ISM manufacturing index and the IFO business climate, which still look overly optimistic in comparison with the French bank’s data. In fact, if anything the SocGen global eco newsflow indicator (ECNI) is at levels last observed during the bursting of the dot com bubble in 2001 and the housing and credit bubble of 2008.

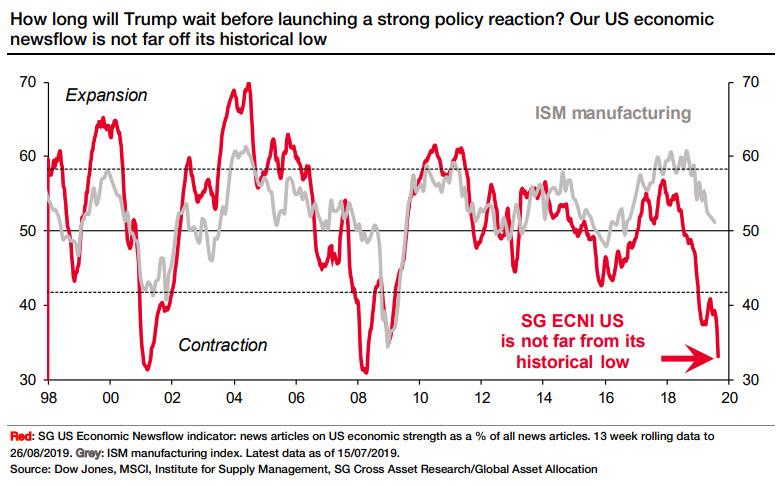

And while US sentiment data have only just now cracked below the critical 50-support level that indicates expansion, the chart below shows that the US ECNI is not far from its all time low (the last time the red line was here, the stock market was about to crash).

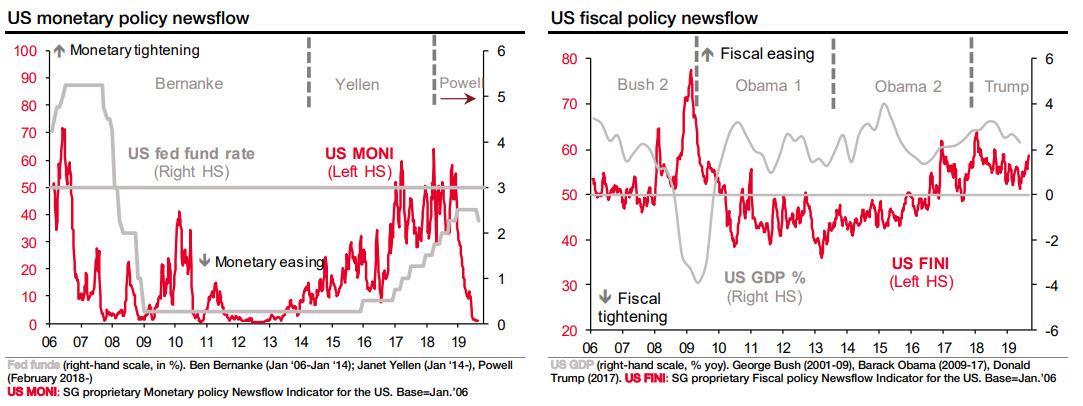

There is a silver lining to this data: as SocGen strategist Arthur van Slooten writes, such a sharp deterioration typically increases the probability of policy easing. Why? Because while the current economic cycle – the longest on record – may have lacked vigour, its growth horizon is suddenly darkening rapidly, and in view of presidential elections in the US next year, Trump may be increasingly tempted to prop up growth once again according to SocGen.

Indeed, as SocGen cautions, its US monetary policy newsflow indicator (MONI) has moved toward full easing, however, the bank’s US fiscal newsflow indicator (FINI) has been slower to react…

… suggesting that the debate about fiscal policy has only just started, and certainly points to aggressive easing.

The bottom line, according to the French bank, is that Trump must now decide: “If Trump is serious about his chances of re-election next year, it seems increasingly likely that, at some not-too-distant point in the future, he will have to choose between winning the trade war or lending maximum support to ailing economic growth.” And since he has no other choices, SocGen is increasingly preparing for an “nice” if unexpected Christmas present, courtesy of the White House…

via ZeroHedge News https://ift.tt/2Lw08oW Tyler Durden