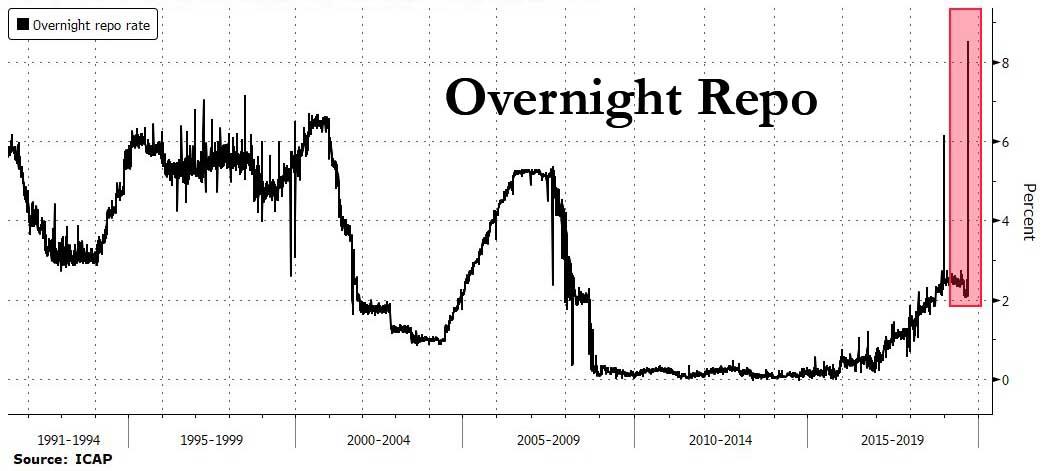

“Nobody Knows What’s Going On”: Repo Market Freezes As Overnight Rate Hits All Time High Of 10%

Back in the summer of 2013, China’s banking system was on the verge of collapse when its overnight repo rates briefly soared to the mid-20% range, prompting the central bank to take emergency intervention to avoid a funding freeze.

As of this morning, the US is halfway there.

After we reported yesterday that “something snapped” as chaos hit the report market, and the overnight repo rate exploded as high as 7% for a variety of reasons including:

- elevated UST supply,

- bloated dealer balance sheets and year-end regulatory constraints

- a banking system near reserve scarcity,

- investors selling bonds back to dealers, and

- banks and money-market funds to make their quarterly tax payment.

… on Tuesday this paniced funding shortage has intensified to never before seen levels, as overnight repo has now hit 10% and shows no signs of slowing.

While specific prints are scarce as the bid/ask spread is a massive 2% at last check, Reuters has GC repo at 10%, while Bloomberg’s own pricing sources show the key funding rate soaring by more than 600 basis points to 8.53%, based on ICAP pricing, after opening around 7%.

Putting this move in context, overnight GC repo has not only just had its biggest surge in history, but it is printing at the highest level in decades!

Not even the rates experts are stumped, with one STIR trader saying “nobody knows what is going on”, and desks are simply watching what appears to be a relentless dollar funding squeeze as one or more entities are in desperate need for funding and will pay any price for it (even though it is neither month nor quarter end yet).

As a reminder, commenting on Monday’s just as shocking move, BMO rates strategist Jon Hill said that “secured funding markets are clearly not functioning well,” adding that a jump like this, one which is not happening during the traditional quarter end window dressing period, is “bordering on chaos.”

It is thus safe to say that secured funding markets are now officially broken.

Separately, Bloomberg points out that the Libor replacement rate, SOFR, or Secured Overnight Financing Rate, which is backed by overnight GC repo transactions, also jumped to 2.43% Monday from 2.20%, New York Fed data show. That’s the highest since July 31, and it is odd because it is taking place as the Fed already cut rates once and is expected to cut rates again tomorrow by at least 25bps.

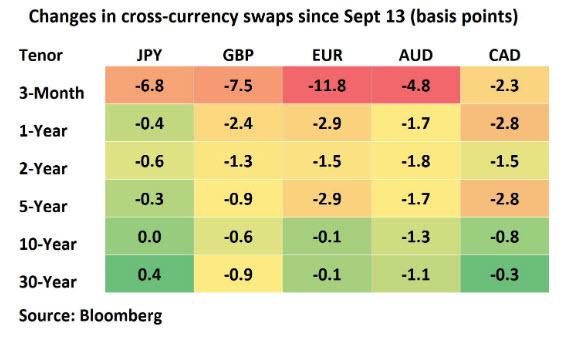

Meanwhile, as we warned last Friday, the funding shortage has now spilled over into money markets, making dollar funding much more expensive, as any USD-based cross-currency swap spike. As Bloomberg notes, “demand for the dollar is showing up in swap rates from euros, pounds, yen and even Australia’s currency. As an example, the cost to borrow dollars for one week in FX markets while lending euros almost doubled.”

Just like Monday, while there was no immediate catalyst, as we explained on Friday, the reason behind Monday’s GC repo explosion is a combination of factors including the settlement of the mid-month Treasury coupon auctions that pushed collateral into the repo market, even as cash is leaving the funding space as corporations have withdrawn cash parked with banks and money-market funds to make their quarterly tax payment.

The funding shortage was made worse by an unexpected ill-timed event, because just as companies were withdrawing cash from money markets to pay corporate tax, a glut of new bonds appeared on the market as the U.S. government sold some $78 billion of 10- and 30-year debt last week. And with just $24 billion of bonds maturing in the period, this became one of three occasions this year when the imbalance between debt redemption and cash needed to buy new Treasuries exceeded $50 billion, according to Bloomberg.

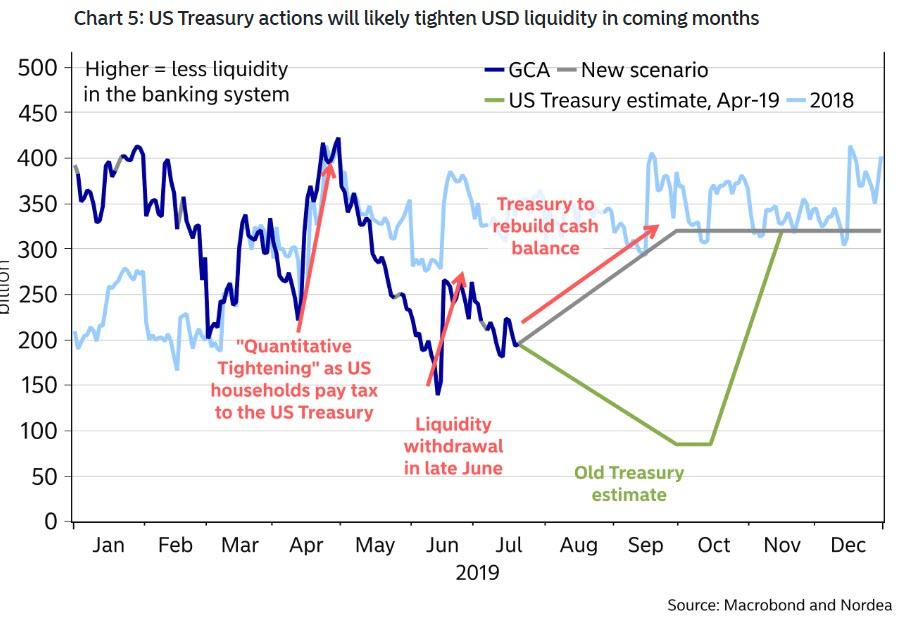

But the biggest reason for the creeping dollar shortage is that as discussed extensively previously, following the recent debt ceiling deal, the Treasury is aggressively pushing its cash balance higher while depleting the amount of bank reserves in the system.

“Repo pressure is almost entirely a settlement story with $54 billion of net supply in Treasury coupons landing on already very crowded dealer balance sheets,” wrote Blake Gwinn, head of front-end rates at NatWest Markets, adding that the tax deadline probably exacerbated the situation.

The drop-off in reserves and fund outflows is driving up funding rates and is starting to spill into the fed funds market because repo’s attractive yields can draw some lenders away from the unsecured market.

Which again brings us the $64 trillion question: as a reminder, on Friday we concluded by asking rhetorically, “how to determine if the dollar funding squeeze will cause another major risk off episode?” Here, BofA said that as the Fed starts to test these reserve lows, “we expect funding markets to react by showing further Treasury cheapening, widening of FRA-OIS, and narrowing of front-end spreads & SOFR-FF basis.”

However, once the Fed responds by engaging in repo or outright UST purchase operations we expect these markets to move in the opposite direction. We suggest clients continue to trade these themes tactically and consider moving out of UST cheapening positions as fed funds rises towards the IOER +15 to +20 bps level.

We also said that “if the Fed wants to front-run the funding shortage, and aggressively inject liquidity into the system, nothing prevents it from following in the ECB’s footsteps and hint at another round of QE in the near future: not only would that send stocks soaring in the asset bubble’s “Icarus song”, but it would also make Trump happy, if only until it all comes crashing down.”

The problem for the Fed is that following today’s massive move in repo higher, it now appears that the Fed is once again behind the curve, and this time the funding squeeze could have dire consequences for not only the economy but the market, as the broken repo plumbing means that despite $1.4 trillion in excess reserves, one or more banks are suddenly left without liquidity, which as we explained over a month ago in “Forget China, The Fed Has A Much Bigger Problem On Its Hands”, the only alternative Powell may soon have is to restart QE.

Tyler Durden

Tue, 09/17/2019 – 08:45

via ZeroHedge News https://ift.tt/32PtLIu Tyler Durden