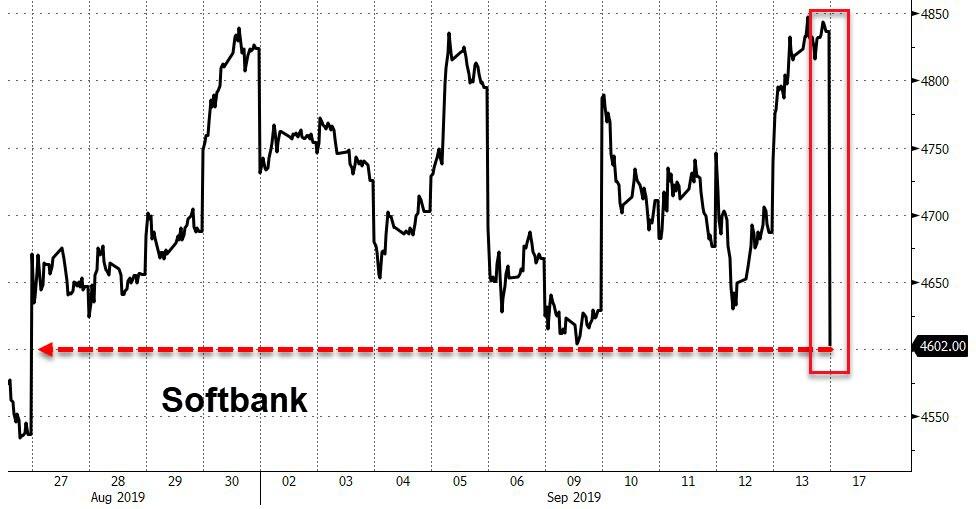

Softbank Shares Tumble As Investors Waver Over New Fund After WeWork Farce

Update (2020ET): Softbank shares are opening down around 5% on news about the nervousness of investors.

* * *

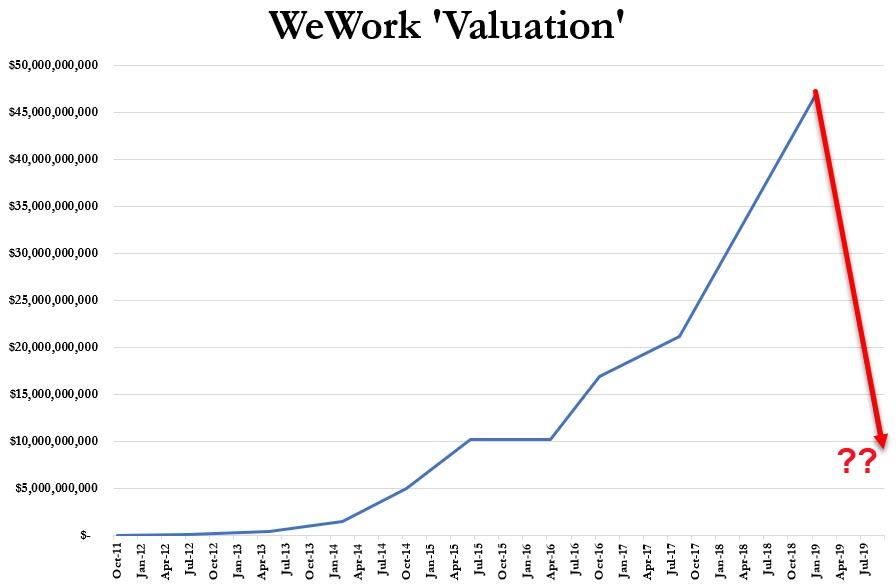

Update (1830ET): Masayoshi Son may have even bigger problems as it appears the WeWork IPO is at best delayed a month.

Which is understandable…

What will Masayoshi Son do now?

* * *

It seems finding a new multi-billion-dollar greater-fool is harder than you – or Masayoshi Son – thinks.

As Softbank scrambles to support/beg/ponzi its stake in WeWork within its massive Vision Fund, Bloomberg reports that the fund’s biggest backers – largely middle-eastern sovereign wealth funds – are reconsidering how much to commit to its next investment vehicle. As Bloomberg details:

Saudi Arabia’s Public Investment Fund, the first fund’s biggest backer with $45 billion, is now only planning to reinvest profits from that vehicle into the second fund, according to people familiar with the talks.

Abu Dhabi’s Mubadala Investment Co., which invested $15 billion, is considering paring its future commitment to below $10 billion, the people said, asking not to be identified in disclosing internal deliberations.

Any signs of doubt among these massive investors would make fundraising for SoftBank Chief Executive Officer Masayoshi Son’s Vision Fund 2.0 increasingly difficult.

However, before we write Masayohsi Son’s epitaph, Bloomberg notes that a spokesman for the Saudi Arabian wealth fund declined to comment. Mubadala said discussions are continuing on whether or not any investment will take place. Additionally, a spokesman for Abu Dhabi’s sovereign fund, said “the suggestion we have made any decisions on the size or timing of a potential investment is simply unfounded.”

However, The Wall Street Journal had previously reported that Saudi Arabia’s sovereign wealth fund wasn’t planning to be a significant investor in the new fund but may still make a more modest commitment.

Tyler Durden

Mon, 09/16/2019 – 20:45

via ZeroHedge News https://ift.tt/2QgwAkL Tyler Durden