Nomura Exposes “Gap-Up Or Shock-Down” Scenarios In Play Post-Quad-Witch

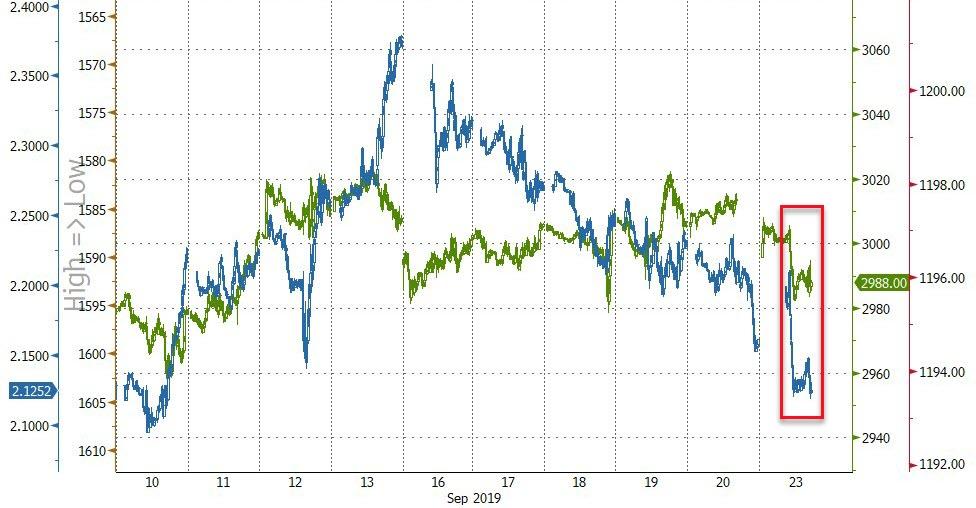

Friday’s trade headlines spoiled the typical Quad-Witch option expiration party but the machines did their best to ramp the S&P back to 3,000’s pin by the close (but failed).

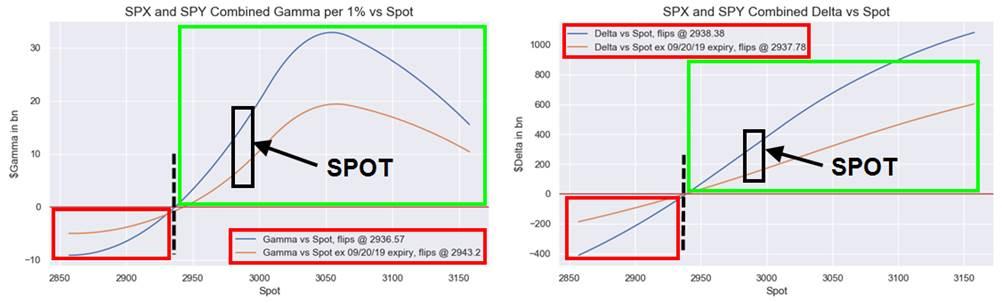

Hope-filled weekend headlines on trade sparked a rebound early but US and European data (and oil chaos) ruined that party again, sending S&P notably back below 3,000 as Nomura’s Charlie McElligott notes, after Friday’s options expiration, the S&P is “unshackled” with ~ 34% of the overall $Gamma across all strikes coming-off, in particular with the enormous “Long $Gamma” which was pinning-us ~3000 in SPX for the past few weeks.

This, McElligott warns, opens the market up to his “peak into Op-Ex then fade thereafter into Month-End” thesis:

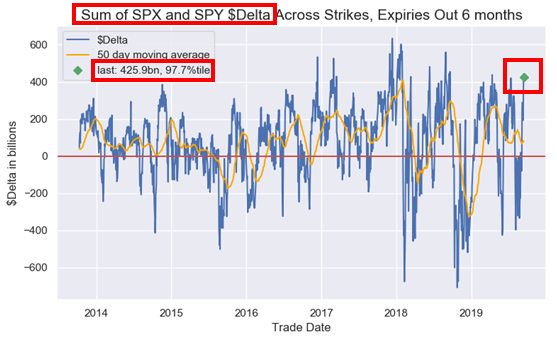

…the “typical” post- September Op-Ex seasonal then sees SPX trade meaningfully LOWER out over the next 1-2w, largely as the “demand flows” from Overwriters and Corporates then disappear following Expiration and “buyback blackout” respectively – and especially in the context of the back-test on 1m forward returns coming out of the Sep Op-Ex, when $Delta is so extremely “long” (currently at 97.7th %ile)

However, the urgency of the $funding drama at the start of last week “shocked” a new macro-catalyst in place to alter this aforementioned seasonal “SPX LOWER“ flow, and instead, introduced an idiosyncratic “Fed policy escalation” input to the mix: the inevitable re-expansion of the Fed balance sheet as a “bullish Equities” narrative.

As previously-stated, in the post-GFC regime, the muscle memory for the majority of Equities investors has conditioned them to simply think “balance sheet expansion = QE” and thus, risks a “BULLISH risk-asset sentiment shock”…at least in my mind until the color comes from Fed that, for now, the BS expansion will be something more focused on “stopping the reserve shrinkage” instead of “new incremental liquidity pumping “above and beyond”…

THUS, we are talking about a “QE-Lite” and NOT the current market misnomer of “Outright QE” to aggressively expand Reserves in the system

This set-up is why on Thursday last week I provided new “upside” and “downside” targets – because with the prior extreme in “Long $Gamma” clearing and now allowing us to move again, there is potential “gap up” / “shock down” in-play:

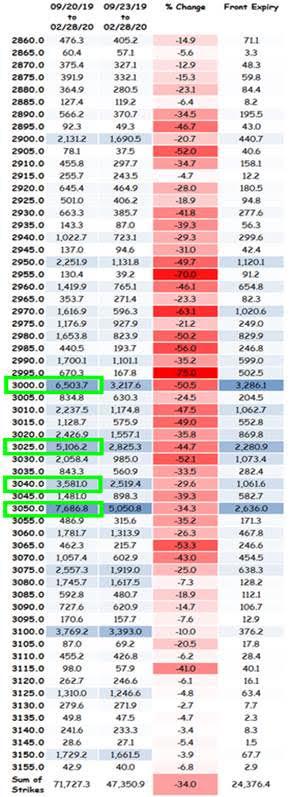

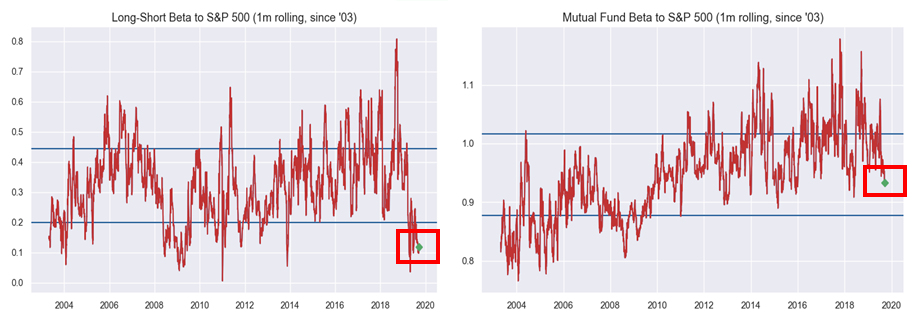

UPSIDE – technically we still see large $Gamma strikes at 3000 ($6.5B), 3025 ($5.1B), 3040 ($3.6B) and 3050 ($7.7B), which in conjunction with “under-positioning” across various fund types could drive that “chase” behavior as we approach Q4.

DOWNSIDE – we see the convergence of three “accelerant flows” in the same “clustered” price-level region approx. @ 2935-2945 (although well away from current “spot”)

-

Gamma vs Spot “Flip” level at SPX Futures 2936

-

Delta vs Spot would pivot @ ~2938

-

Nomura QIS CTA model’s current deleveraging “sell trigger” estimate for the SPX futures position sitting below 2943

So, 3050 or 2935 – which comes first? We suspect the next trade-deal headline will be the arbiter of that decision, but for now, bonds seem to be signaling the downside.

Source: Bloomberg

With 10Y Yields down for the 6th straight day – the longest streak since 2018.

Tyler Durden

Mon, 09/23/2019 – 10:47

via ZeroHedge News https://ift.tt/2l49pLp Tyler Durden