Stocks Slip, Silver Rips, Yield Curve Dips After Global Macro Data Dumps

South Korean exports collapse most since 2009… European PMIs were ugly (Germany worst since 2013)… US Services PMI Employment contracts most since 2009… but apart from that, trade-talks might or might not be going well or terribly.

This was the worst global macro data disappointment day since May and pushed it back into contraction…

Source: Bloomberg

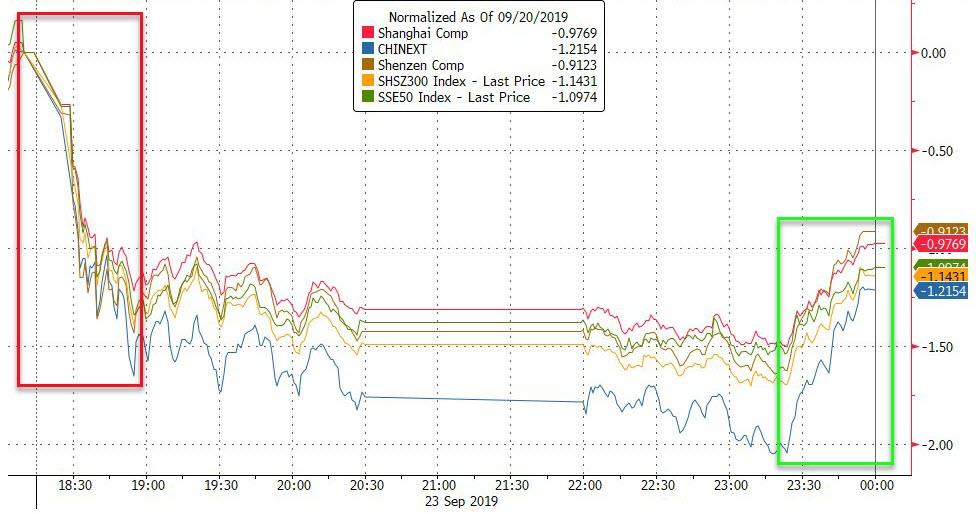

A late day buying panic made China’s stock slump look a little better, but it was ugly out there…

Source: Bloomberg

European stocks plunged on the dismal PMIs and never bounced…

Source: Bloomberg

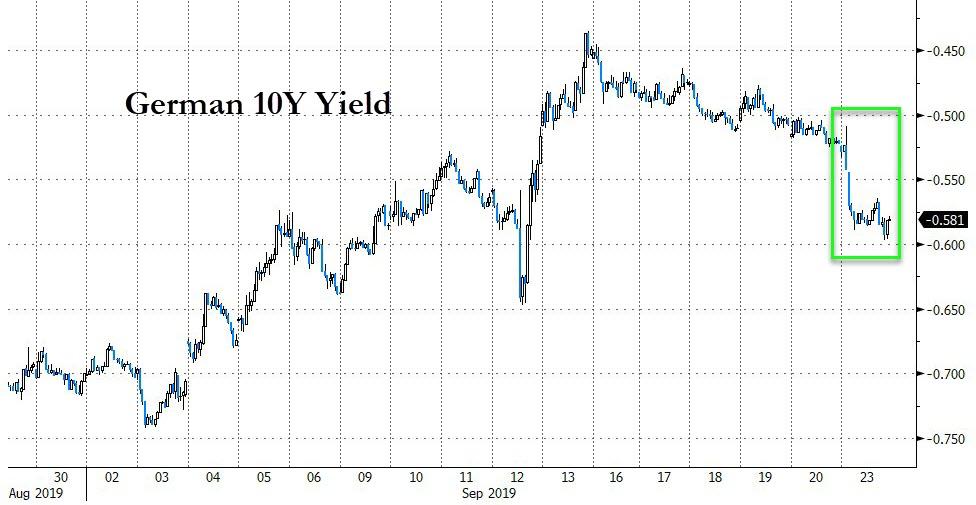

European bond yields cratered today (10Y BTPs -10bps)

Source: Bloomberg

US equity markets would not be held back by all the global (including their own) data dumps as three hours of dovish Bullard headlines finally ignited some momentum in the last hour… but that spike faded quickly into the close (only The Dow managed gains)…

Futures show the chaos best, but we note that markets remain notably lower since the farm visits were canceled…

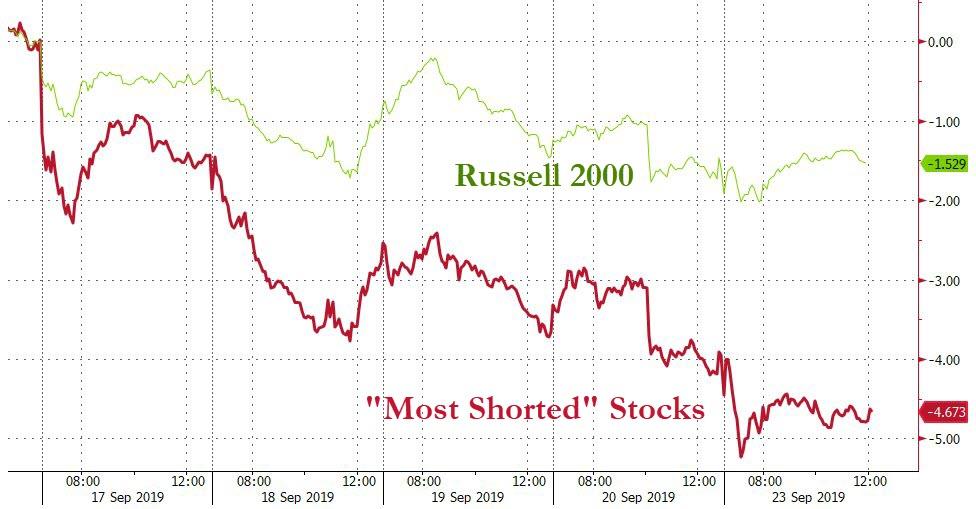

“Most Shorted” stocks down 5 days in a row – longest streak since March 2019…

Source: Bloomberg

Algos desperately pushed for S&P 500 to get back to 3,000…

Source: Bloomberg

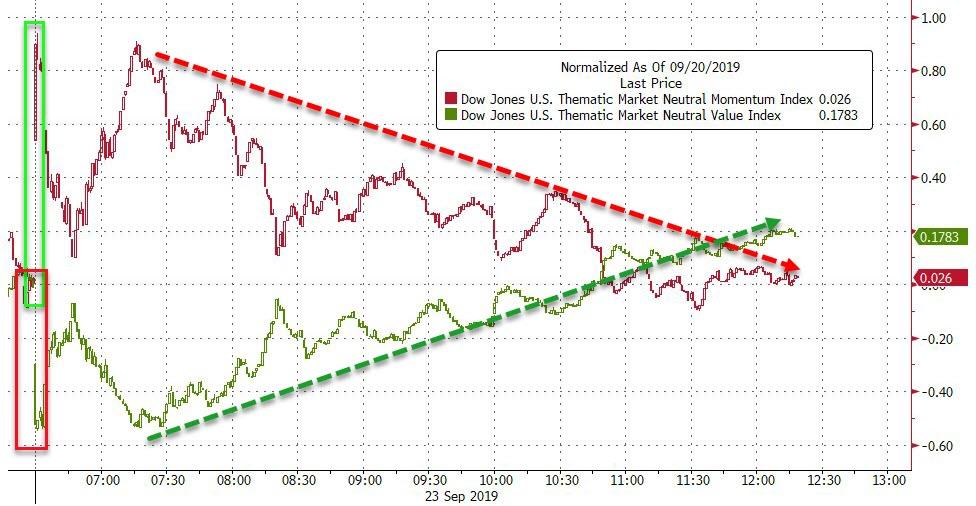

Momo managed gains out of the gate but faded as the day wore on with a bid for value…

Source: Bloomberg

Cyclicals started off rough but were bid off the lows and after Europe closed, the machines rotated from defensives to cyclicals…

Source: Bloomberg

Netflix was a bloodbath (back in the red for 2019) – despite headlines about The Emmys…

Source: Bloomberg

Leaving FANG Stocks at a key support level…

Source: Bloomberg

Treasury yields were volatile intraday, opening higher, crashing on EU PMIs, tumbling on US PMIs, then ramping back for the rest of the day…

Source: Bloomberg

10Y Yields down 6 days in a row (after 8 days up in a row)…

Source: Bloomberg

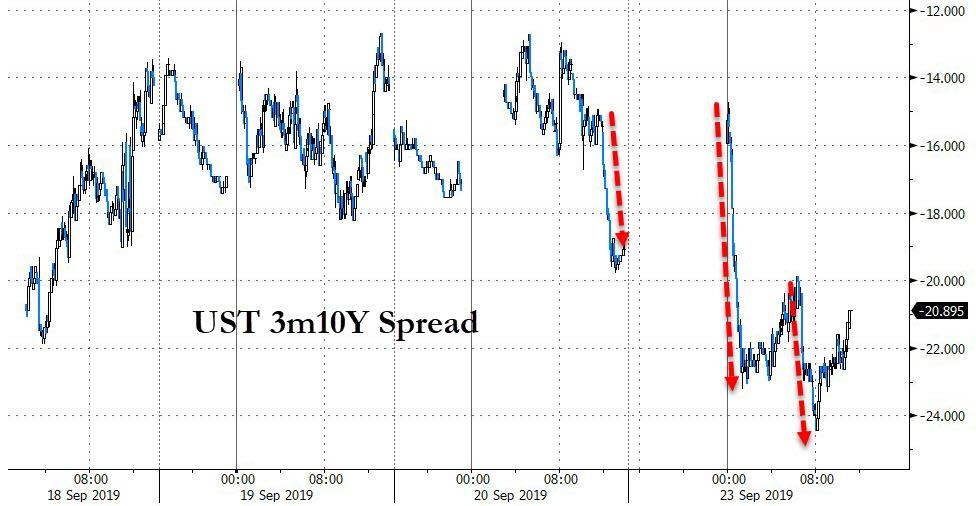

Despite The Fed’s Jim Bullard claiming otherwise, the UST yield curve inversion is getting worse once again…

Source: Bloomberg

The curve has been inverted for 85 days (bar one)…

Source: Bloomberg

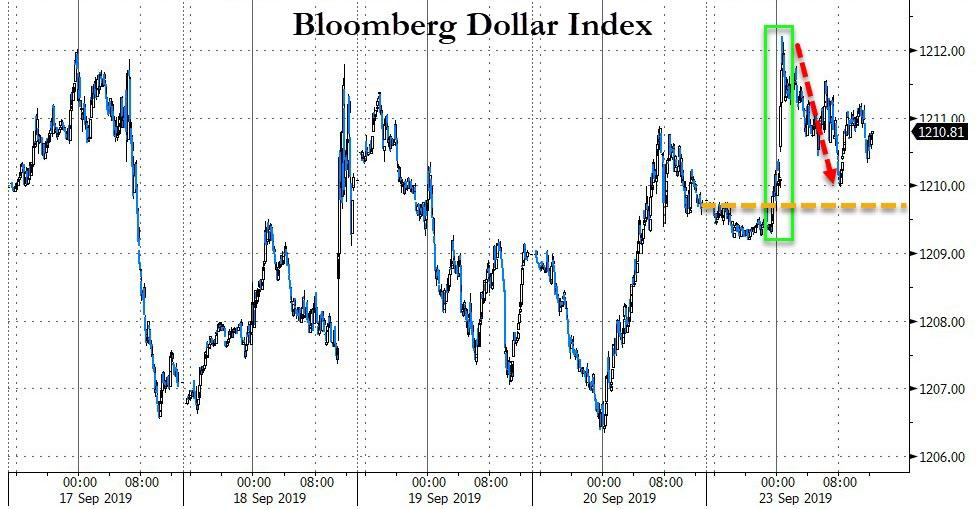

The Dollar ended the day modestly higher (spiking on EUR weakness on PMIs, then fading)…

Source: Bloomberg

Yuan ended the day higher after tumbling overnight…

Source: Bloomberg

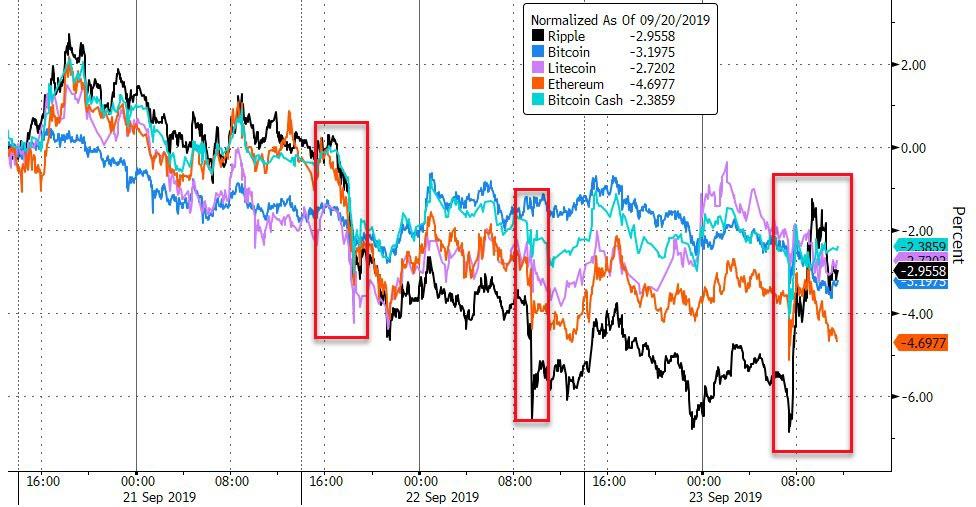

Cryptos are down from Friday’s close (not helped by some chaos today with a dump, pump, and slow dump)…

Source: Bloomberg

Bitcoin is back below $10,000 (and flash-crashed today)…

Source: Bloomberg

Commodities were all higher led by a huge surge in Silver…

Source: Bloomberg

Oil traded chaotically intraday to end unchanged after conflicting headlines about how long before Saudi production is back online (a week or eight months!)

Source: Bloomberg

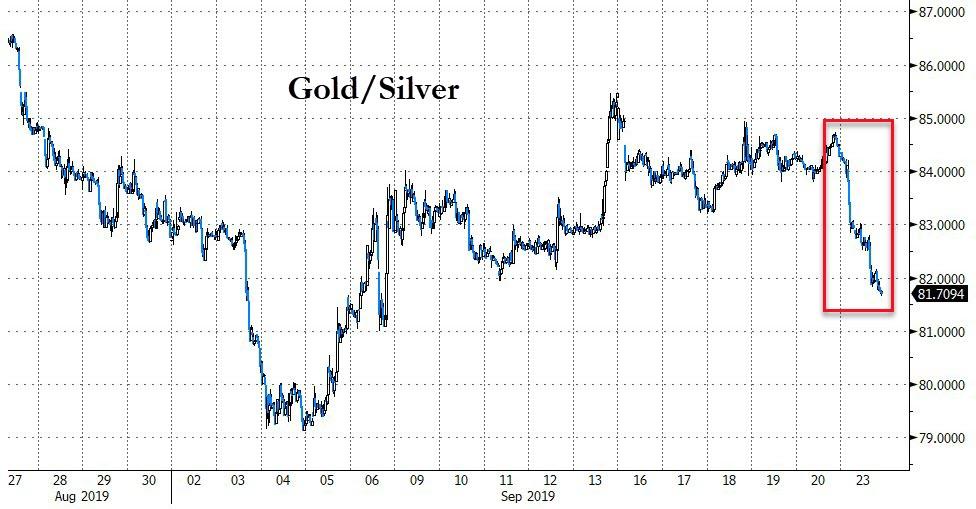

Silver exploded higher – its 3rd best day since Nov 2018… (the other 2 were also in September)

Source: Bloomberg

Silver dramatically outperformed gold…

Source: Bloomberg

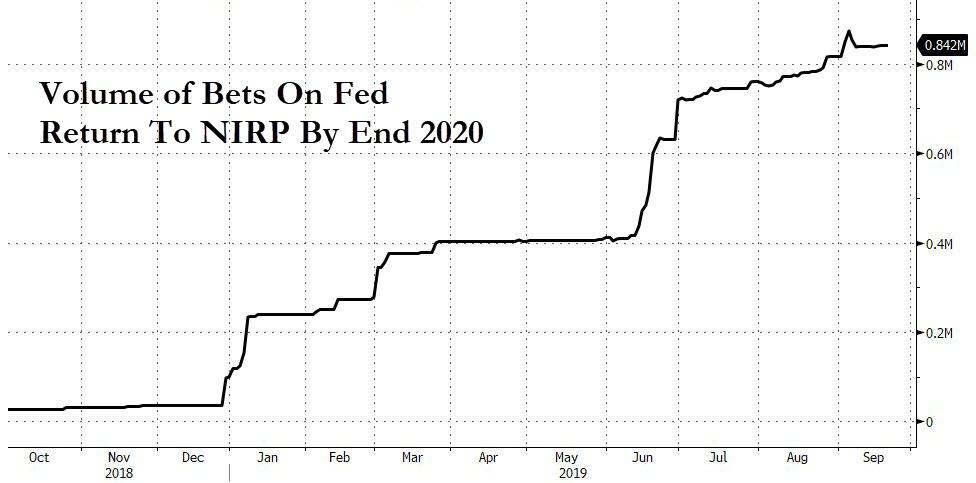

Finally, the San Francisco Fed notes that, according to new market-based estimates, the probability of a return to the lower bound by the end of 2021 is about 24%. This is roughly in line with other survey-based and model-based estimates of zero lower bound risk. In recent months, the market-based measure of lower bound risk has increased markedly. And traders are increasingly betting in NIRP being here…

Source: Bloomberg

Tyler Durden

Mon, 09/23/2019 – 16:00

via ZeroHedge News https://ift.tt/2mDIZRh Tyler Durden