CREsh Begins: London Property Market Hit As WeWork Deal Falls Through

In an ominous sign for the commercial real-estate market, a large Singaporean investment firm has walked away from an £850 million ($1.04 billion) deal to buy Southbank Place, an office building near London’s Waterloo Station that boasts one of the largest WeWork spaces in the world, the FT reports.

The deal collapsed shortly after WeWork called off its IPO, and is now scrambling to sell off businesses and assets like its corporate jet to raise capital. Since the offering was abandoned, not only is the company missing out on $3 billion that it was set to raise in the public markets, but it’s also losing out on a $6 billion loan that was contingent on the IPO.

Sources close to the deal blamed local factors like Brexit-related uncertainty and the expense of pulling out of a refinancing deal between the seller and an asset management firm that refinanced the development earlier this year. Supposedly, the seller, a firm with ties to Italy’s Agnelli family, backed out of the deal, despite having put the building on the market.

Southbank Place is located between the London Eye and Waterloo station.

But the notion that WeWork’s failed IPO didn’t factor into the decision at all is hard to believe.

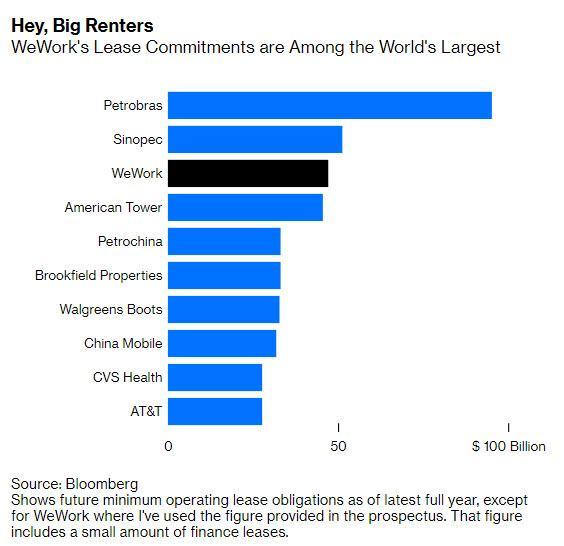

Anyone who’s about to take on WeWork as a tenant must confront the fact that the company has $47 billion-plus in lease obligations (including $10 billion in the next 5 years) that it currently has no way to meet. If WeWork falls on hard times and pushes to renegotiate, or, worse, files for bankruptcy, these landlords could be screwed out of millions, if not billions.

Southbank Place includes a 280,000-square-foot WeWork shared office space. WeWork’s space in the building is mainly subleased to big corporate tenants such as HSBC, which rents 1,000 desks. The building also houses the London headquarters of Royal Dutch Shell.

At the price quoted by the FT, the deal would have been one of London’s largest this year, at a time when the London commercial property market has been struggling with a sharp drop in deals. Sales fell by more than one-third during the first half of 2019, compared with the same period a year earlier.

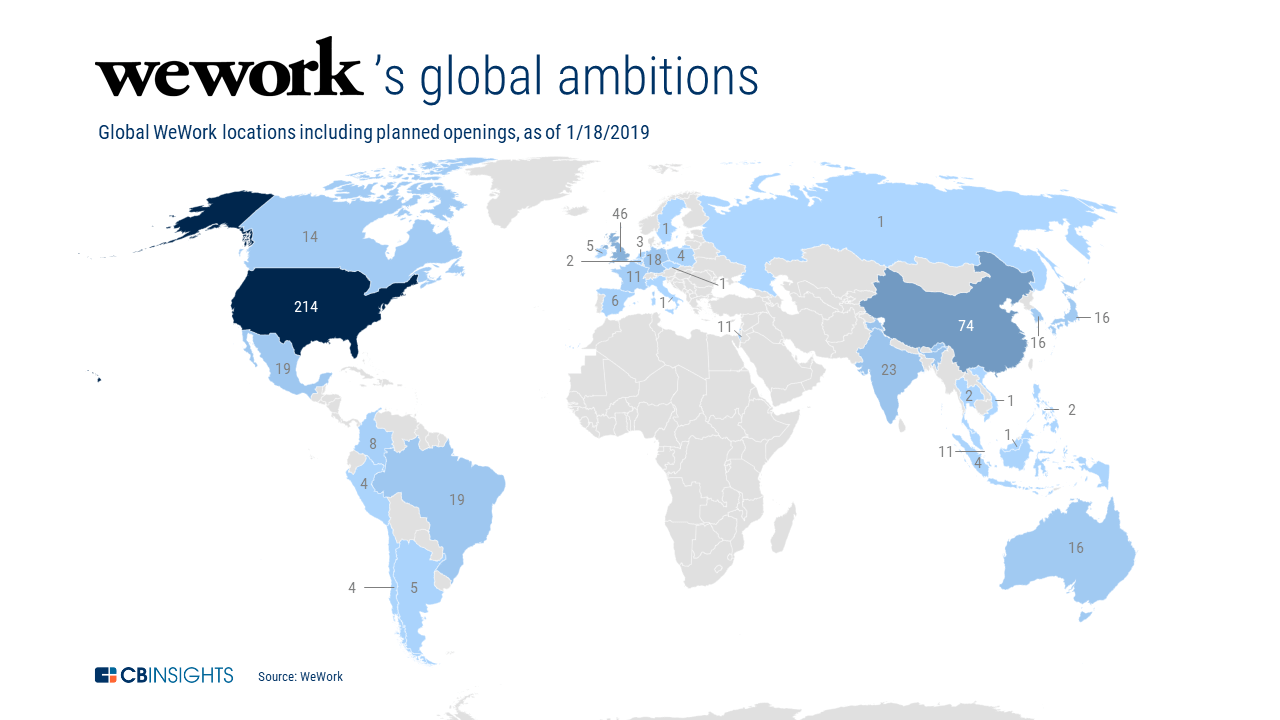

WeWork’s aggressive growth strategy has led it to open 528 locations in more than 110 cities, and the UK is one of its largest markets.

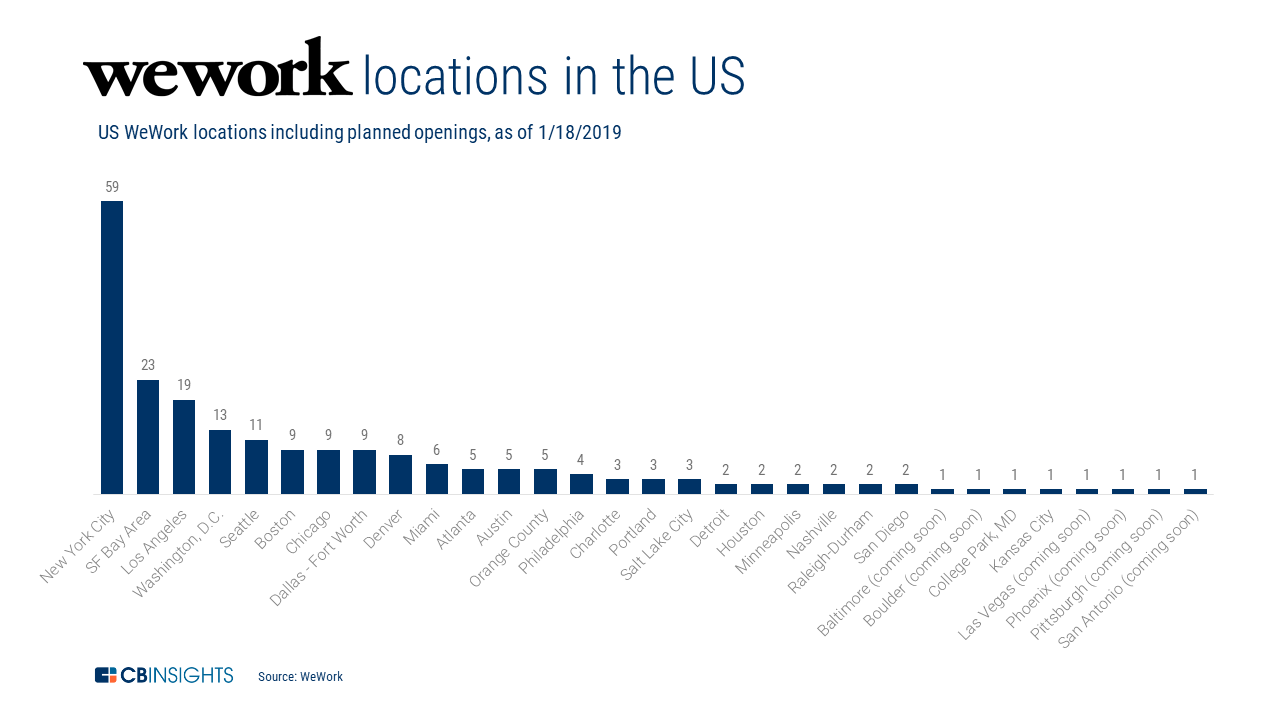

WeWork is the largest lessor of office space in NYC, Chicago, Denver, Central London and other major urban markets.

Because of this massive growth, WeWork poses a unique risk to the global commercial real-estate market. WeWork is already one of the world’s largest lessees, trailing only oil exploration giants Petrobras and Sinpec, an astonishing feat for the flexible office space provider “which was founded less than a decade ago, bleeds cash, and doesn’t plan to become profitable any time soon.”

In a WeWork bankruptcy, landlords would see their rental obligations frozen and squeezed among all the other pre-petition claims, which of course means that commercial real estate markets in cities where WeWork is especially active (see above) would suddenly find themselves paralyzed, unleashing a deflationary tsunami on one of the strongest performing markets since the financial crisis.

In case investors needed another sign of the market’s waning confidence in WeWork, the company’s bonds fell to a record low on Friday, following S&P’s decision to downgrade the company’s credit rating to B- due to “liquidity strains”.

Meanwhile, in a separate report, the FT revealed that WeWork has resumed signing leases – but at a much slower pace – since abandoning its IPO.

That’s not exactly a vote of confidence.

Tyler Durden

Fri, 09/27/2019 – 15:35

via ZeroHedge News https://ift.tt/2mnRrnX Tyler Durden