Gordon Johnson: Tesla’s Q3 China Sales Will Plunge 38.6% Sequentially

With Chinese EV maker Nio falling as much as 10% again on Friday (its sixth straight red day) to new record lows…

…the outlook for Tesla in China continues to be in focus – and it doesn’t look optimistic.

Well known Tesla analyst and skeptic, Gordon Johnson of GLJ Research says in his latest note that Tesla’s Q3 aggregated cars sold should fall 38.6% on a sequential basis, a result he simply refers to as “bad”.

Using data from the China Passenger Car Association and the China Association of Automobile Manufacturers, Johnson concludes:

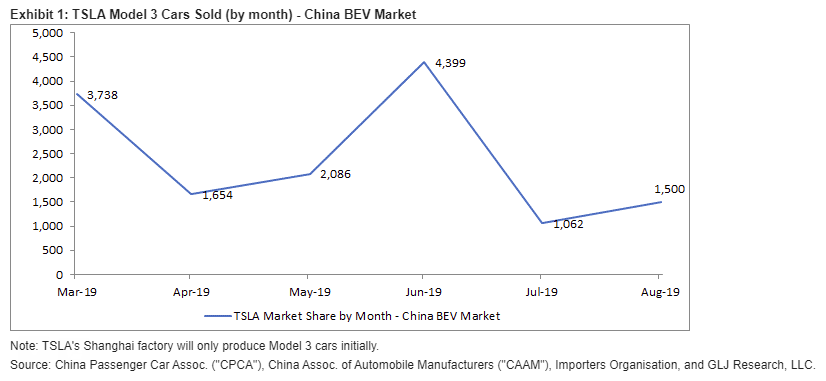

…a total of 1,062/1,736 TSLA M3/total-TSLA-cars, respectively, registered in July 2019, and 1,500/2,500 TSLA M3/total-TSLA-cars, respectively, registered in Aug. 2019. Thusly, assuming ~2.7K total TSLA cars registered in Sep. 2019, one arrives at 6.95K TSLA cars registered in China in 3Q19.

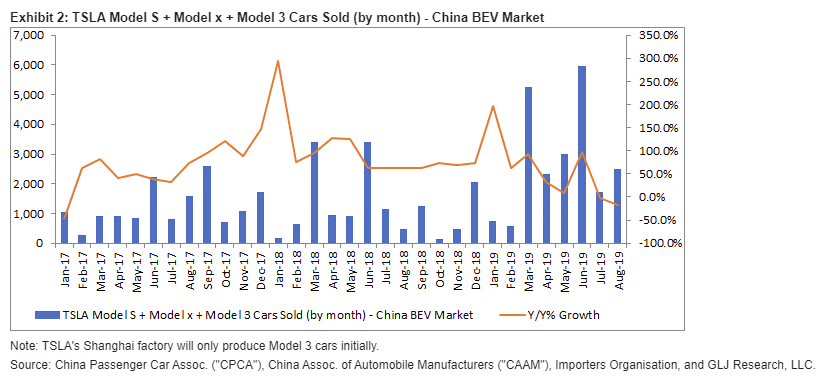

He continues, explaining that this would “represent growth of -38.6% q/q.” He says that the publicly available data rebuts those who believe that China sales will be “strong” for Q3.

He also embarrasses politely critiques the assertions of sell side analysts, who have claimed that “Tesla’s deliveries to real, actual people are still rising at a triple-digit pace, despite being hamstrung by import duties, a flagging auto market, and a historical inability to tap electric vehicle subsidies (due to a lack of local manufacturing).”

Johnson provides a chart citing public data that indicates Tesla’s sales were down -16.4% y/y, after falling -2.1% y/y in July.

Johnson also comments that Tesla may find it difficult to command a bigger share of the BEV market in China due to its price points:

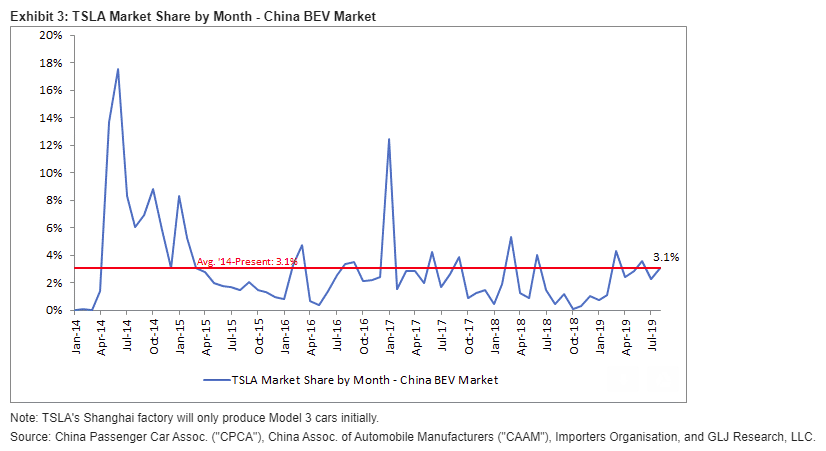

Taking the above analysis a bit further, using CPCA, CAAM, and Importers Organisation data dating back to 1/1/13, it becomes clear that while TSLA’s current share of the Chinese BEV market is just 3.1% (this figure got as high as 17.6% 6/14), it has consistently average around 3% since 2017, despite the introduction of the “mass-market” Model 3.

Why is this the case, in our view? Well, when considering BAIC controlled ~21% of the Chinese BEV market in Aug. 2019, and currently prices its best-selling Senova D50 sedan at around $20K, it seems TSLA may remain hard-pressed to sell its ~$46.336K M3 cars broadly in China (i.e., TSLA’s entry level price for the M3 in China).

Johnson estimates that Tesla has sold an average of just 2,407 cars per month since launching in China in March 2019:

Furthermore, when considering, according to CPCA, CAAM, and the Importers Organisation, TSLA has sold an avg. of just 2,407 M3 cars/month since launching in China Mar. 2019 (with Aug. sales [i.e., second month of 3Q19] of M3 cars of 1.5K -28.1% below the 2.1K cars sold in May [i.e., second month of 2Q19]), vs. its plan to produce ~12.5K M3 cars/month when “Gigafactory 3” ramps in Shanghai at the end of 2019, it would seem that the fixed cost absorption for TSLA in China will be, for lack of a better word, massive (meaning they will lose a lot of money making cars for which there is no demand – our opinion).

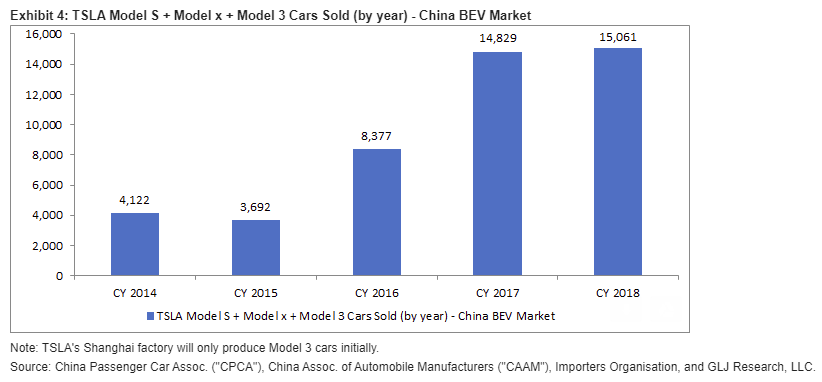

Obviously, he notes, this does not gel with the company’s plans of producing 150,000 Model 3 cars per year beginning at the end of 2019. He makes this point by providing a very simple history of Tesla’s vehicles sales in China, per year.

As you can see from Johnson’s chart, 2018 comes in about 10x below the company’s targeted Model 3 production – a huge gap for a company (not known for its operational efficiency) to make up.

Johnson concludes that Tesla’s foray into China is a “disaster of herculean proportions”:

In short, in our opinion, TSLA’s foray into the Chinese BEV market is shaping up as a disaster of herculean proportions as planned production appears to be an order of magnitude ahead of demand. We would strongly suggest our readers take some time to understand this dynamic as, based on what we’re seeing in the media, it seems many of the TSLA pundits, both on the sell-side and the media, are currently unaware of this.

But hey, “there’s this place called Shanghai…”

Tyler Durden

Fri, 09/27/2019 – 14:30

via ZeroHedge News https://ift.tt/2lFkkeU Tyler Durden