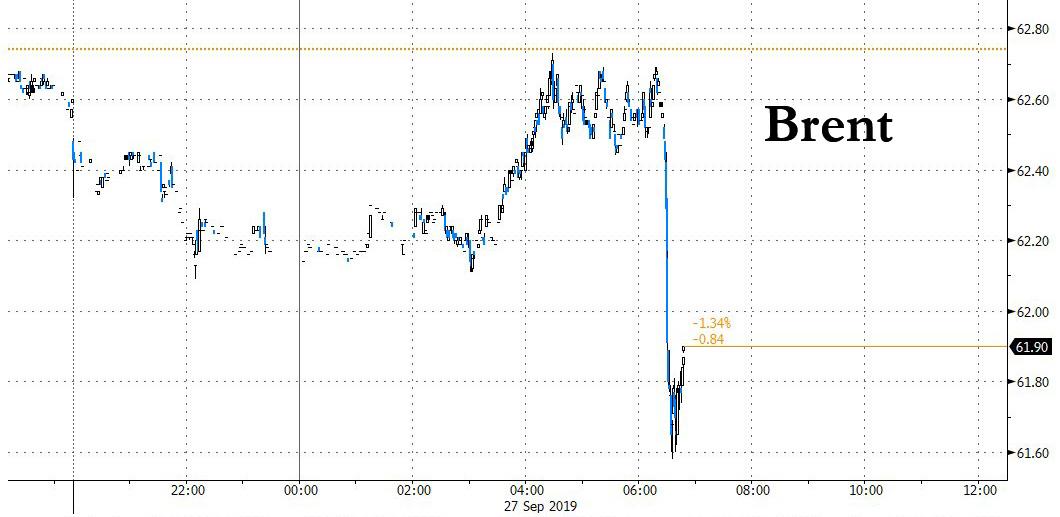

Oil Tumbles On Report Saudis Agree To Partial Ceasefire With Yemen

With the price of oil still on edge over the duration of Saudi Aramco repairs and speculation over how long until Saudi oil output is fully restored, moments ago Brent tumbled after a WSJ report that Saudi Arabia – which is hoping to come to market with the Aramco IPO in the coming weeks – is seeking to impose a partial cease-fire in Yemen, as Riyadh and the Houthi militants the kingdom is fighting try to bring an end to the four-year war that has become a front line in the broader regional clash with Iran.

Saudi Arabia’s surprise decision to de-escalate a long-running war follows a just as surprising move by Houthi forces to declare a unilateral cease-fire in Yemen last week, just days after claiming responsibility for the Sept. 14 drone and cruise missile strike on Saudi Arabia’s oil industry the WSJ notes. While the Houthis fired two missiles at Saudi Arabia earlier this week, the strike wasn’t seen by Saudi leaders as a serious attack that would undermine the new cease-fire efforts.

Houthi leaders initially said they were responsible for the attack on the oil facilities, but Saudi, U.S. and European officials have dismissed the claims as a transparent attempt to obscure Iran’s role in the strike. Yemeni fighters, these officials say, have neither the weapons nor the skills to carry out such a sophisticated strike.

In the days that followed the attack, an internal Houthi rift expanded between those who want to distance themselves from Iran and those who want to strengthen ties.

An end to the war – if sustained – would certainly be a major breakthrough for peace in the region. Yemen’s war has become a political and military morass for Saudi Arabia and Crown Prince Mohammed bin Salman, the country’s de facto ruler and original architect of the war plans. The war has eroded support for his country in Washington, where bipartisan opposition to the conflict has solidified.

The Houthis’ unilateral cease-fire last week has raised hopes in Riyadh and Washington that the Yemeni fighters might be willing to distance themselves from Tehran. The U.S. has accused Iran of providing the Houthis with missiles, drones and training they have used to target Saudi Arabia for years. Iran has dismissed the claims, but Tehran has moved to deepen its ties with the Houthi forces.

In response to the Houthi move, Riyadh has agreed to a limited cease-fire in four areas, including San’a, the Yemeni capital Houthi forces have controlled since 2014.

If the mutual cease-fire in these areas takes hold, the Saudis would look to broaden the truce to other parts of Yemen, according to people familiar with the discussions.

Of course, chances are the deal collapses quickly: the new cease-fire faces steep odds, as similar arrangements have crumbled before the WSJ notes. Both sides continue to carry out attacks, including a Saudi airstrike north of San’a on Tuesday that killed several civilians. The internal Houthi divisions could undermine the peace efforts, as they have in the past.

“Yemen needs to break from this vicious cycle of violence now and be safeguarded from the recent tension in the region that could risk its prospects for peace,” said Martin Griffiths, the U.N.’s special envoy for Yemen who brokered peace talks last December in Stockholm that helped defuse tensions and pave the way for new diplomatic initiatives.

In any case, in kneejerk reaction Brent tumbled as much as 1.8%, dropping to a session low of $61.6, down $1.00 in seconds, and erasing all of last week’s gains.

Tyler Durden

Fri, 09/27/2019 – 07:09

via ZeroHedge News https://ift.tt/2nawD3h Tyler Durden