Stocks Sink As Trade Tensions Trump Fed’s Open-Mouth (And Market) Operations

President Trump started the week with a well-timed “sooner than you think” comment on the proximity of a China trade deal, then continued to lambast China in his UN speech, raises prospect of more Huawei sanctions, and floats the idea of capital controls on China inflows. All of which prompted a response from China’s Wang, warning that “China does not cower to threats.” A few well-timed Fed headlines (mainly Bullard’s uber-dovish job interview comments) and selectively picking US data to meet the narrative helped stocks; but in the end it was an ugly week for US, China, and European stocks…

Source: Bloomberg

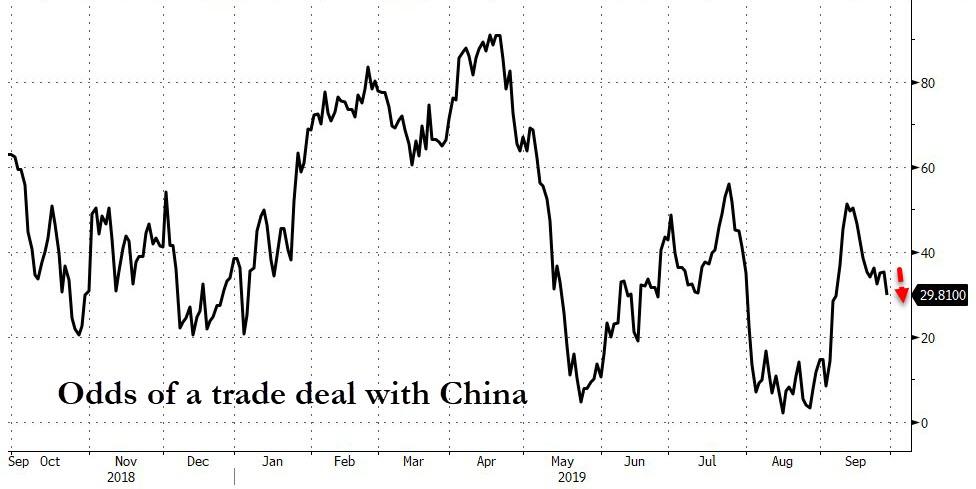

Market-implied trade deal odds slipped this week…

Source: Bloomberg

China stocks all ended lower on the week, led by the tech-heavy Shenzhen and ChiNext indices…

Source: Bloomberg

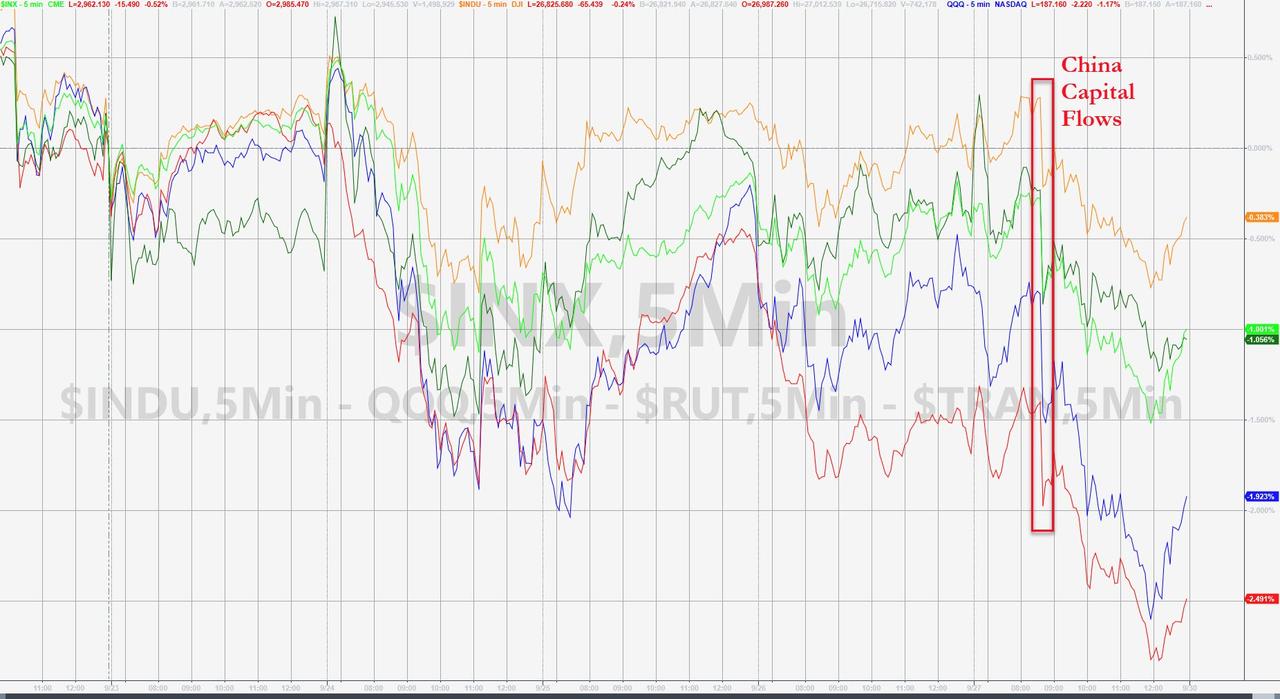

But China stocks were hit even harder today (after the cash markets above were closed) on the investment flows headlines..

European stocks ended the week lower but Spain’s IBEX managed to get back to unch by the close…

Source: Bloomberg

US stocks tumbled on the week with Small Caps leading the plunge (worst week for Russell 2000 since May)…

Source: Bloomberg

All the major indices tested or broke below key technical levels…Nasdaq below 50, 100DMA; Russell 2000 below 200DMA; S&P testing 50DMA…

Source: Bloomberg

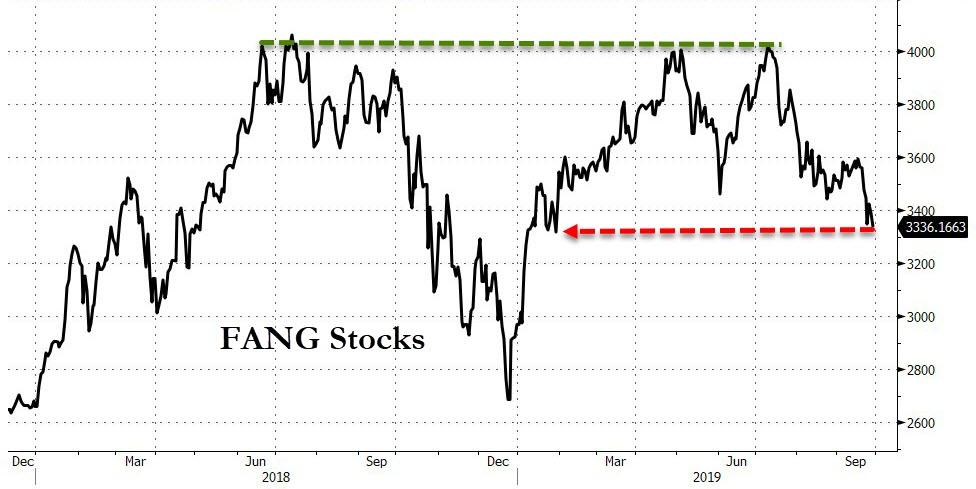

FANG Stocks were battered this week, back to their lowest since January…

Source: Bloomberg

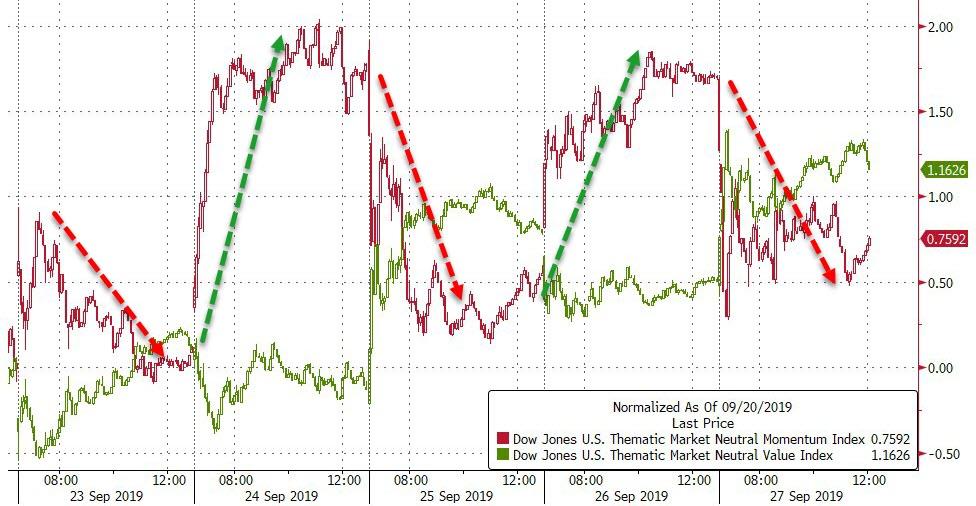

Quant funds oscillated flows all week – Momo was down, up, down, up, and down…

Source: Bloomberg

Cyclicals dramatically underperformed this week (but selling was broad-based today)…

Source: Bloomberg

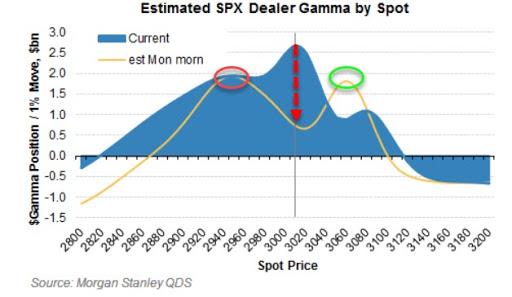

This week’s move should not be a total surprise as it was the downside pin from options gamma…

Source: Bloomberg

VIX surged almost 3 vols this week – the most in 2 months -back above 18

Source: Bloomberg

And just what triggered the biggest relative selling of Alternative Asset Managers to the S&P since Feb 2016…

Source: Bloomberg

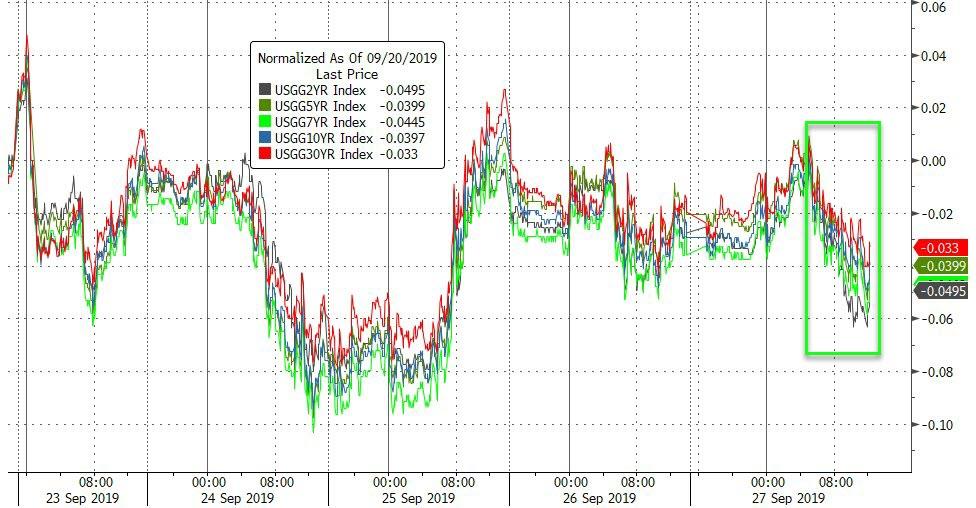

Treasury yields ended a volatile week lower…

Source: Bloomberg

10Y Yields fell back below 1.70%…

Source: Bloomberg

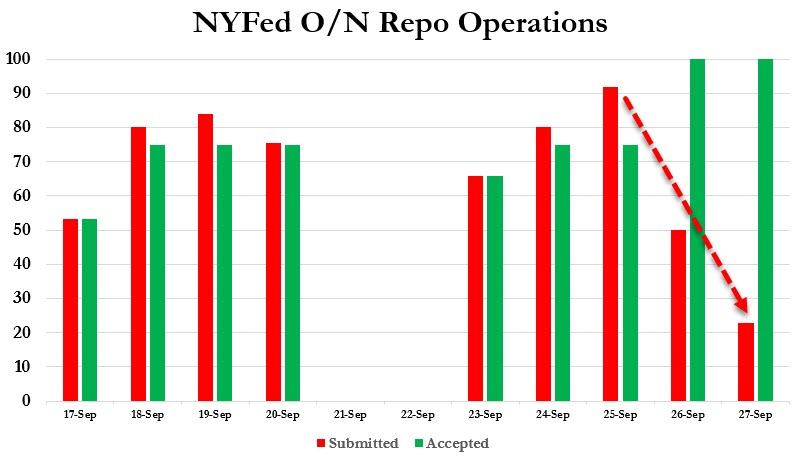

The week did see take-up for The Fed’s liquidity spigot drop, but we still have the actual month-end day (Monday) to go…

Source: Bloomberg

Before we leave bondland, here’s WeWork’s 2025 bond collapsing to record lows (and thus record high yields at 11% – quite a cost of funds!!)

Source: Bloomberg

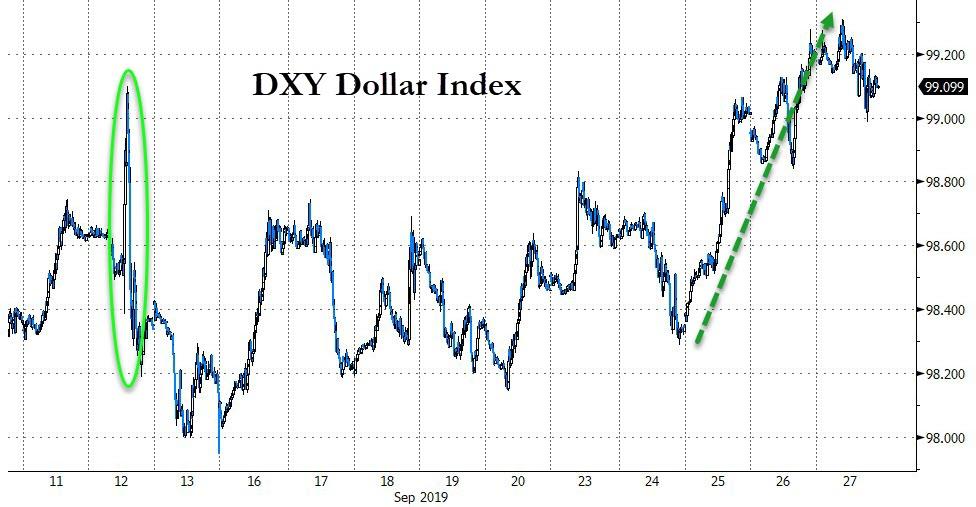

The DXY Dollar Index roared higher this week…

Source: Bloomberg

Soaring to its highest since May 2017…

Source: Bloomberg

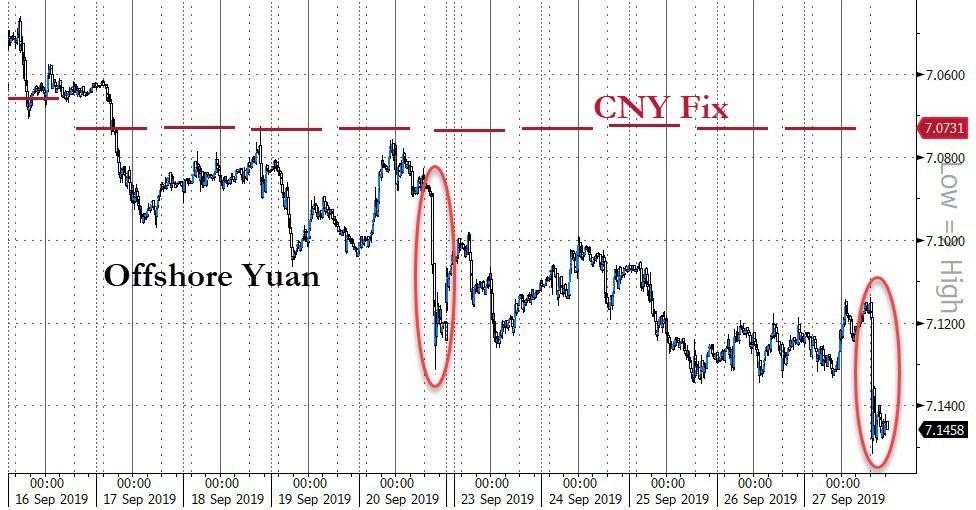

Offshore Yuan fell for the second week in a row as China heads into Golden Week…

Source: Bloomberg

Cryptos had their worst week since Thanksgiving 2018…

Source: Bloomberg

Bitcoin tumbled (on heavy volume) back to find support around $8,000 (trying to hold around its 200DMA)…

Source: Bloomberg

Commodities were broadly lower on the week in the face of USD strength…

Source: Bloomberg

Gold seems to have known where global rates would end up as negative-yielding debt accelerated once again…

Source: Bloomberg

Finally, we wonder if the ascent of Warren in the prediction markets is starting to affect stocks…

Source: Bloomberg

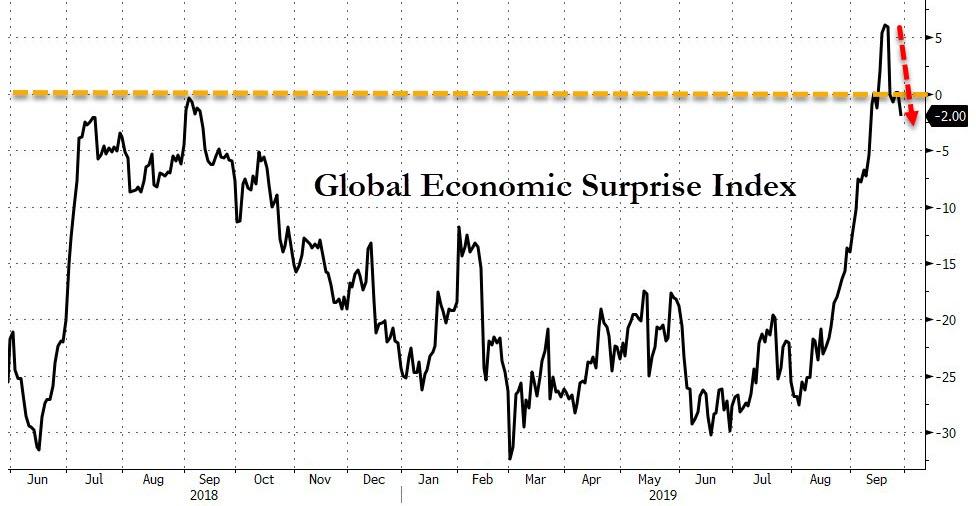

For now it seems like the Q3 surge in global economic data has ended abruptly (biggest weekly drop since June)…

Source: Bloomberg

Tyler Durden

Fri, 09/27/2019 – 16:01

via ZeroHedge News https://ift.tt/2lE34GS Tyler Durden