Galloway: “Markets Are Emerging From A Psychotic Break With Reality”

Authored by Scott Galloway via ProfGalloway.com,

Malcolm Gladwell writes about a fascinating episode in history.

Neville Chamberlain’s first plane ride was a trip to meet Adolf Hitler. The British Prime Minister was taken by Hitler’s charisma. He believed the German leader when he promised not to invade Czechoslovakia. After his triumphant return from Germany, Chamberlain took the non-aggression pact Hitler had signed and waved it from his window at 10 Downing Street. Five months later, Hitler invaded Czechoslovakia. The people who understood Hitler, who got it right, never met him.

George W. Bush, after meeting with Putin, said, “I looked the man in the eye. I found him very straightforward and trustworthy — I was able to get a sense of his soul.” Our intelligence officials, who never got to hang with Vlad, had to rely on his actions instead of his soul. They were less convinced.

The boards of Theranos and WeWork included former and future Secretaries of Defense, Supreme Allied Commanders, and billionaire CEOs of iconic firms. These individuals can assess geopolitical markers, troop movements, and business trends better than anybody on the planet, maybe in history. But put a young woman from Stanford in a black turtleneck, or a guy with great hair, in the same room, and these global leaders couldn’t recognize blatant fraud.

According to CNBC, this week the We board fired CEO Adam Neumann. No, the board didn’t fire him. The media, academics, and math fired him. The board enabled him and either was a co-conspirator in the fraud, or they were just idiots. Who did they replace him with? Art Minson, co-president and CFO, and Sebastian Gunningham, vice chair of the board. Their first act? Art and Sebastian announced they’re selling the $60 million Gulfstream 650 that they had bought/approved.

The board appointed two of their own to fix the problem of their own making. This lack of self-awareness as a governing body is evidence that We’s coworking spaces have kombucha, and the board room has MDMA. Art is the Ruth Madoff of the unicorn class. She either knew what was going on, or she’s an idiot. I’m hoping CNBC will report Ruth Madoff has been appointed managing partner for SoftBank’s Vision Fund 3.

Perhaps they are being advised by JPM, who told the board the valuation range on the IPO was $40-60 billion, or Goldman, who valued it at $60-90 billion. Goldman has been aggressively pitching me to manage my money for the last five years. They invited me to the premiere of Solo: A Star Wars Story, which is definitely worth 1 percent a year on my assets. So, as my new wealth managers, would Goldman have piled me into We stock if, on the IPO, they were able to get in at the low-low valuation of $47 billion? Is Goldman more focused on the short-term underwriting fees ($130 million) vs. serving as a fiduciary for their wealth management clients? Or are they just idiots? I’ve been trolling the worst after-hours lounges in Jersey City to track down CEO David Solomon / DJ D-Sol to find out. Mr. Solomon is an awful DJ, and a worse fiduciary.

The Yogababble Index®

The brand era manufactured the notion that inanimate objects could take on animate characteristics. Objects and companies could be personified — likable, young, cool, patriotic. Corporate comms execs began to scale the charisma and vision of the founder. Overpromise and underdeliver has become a means for access to cheap capital (“We’ll have a million autonomous Teslas on the road within 12 months”). You could fake it till you make it. The lines between charm, vision, bullsh*t, and fraud have become so narrow as to be one line.

The MDMA of capitalism is the corporate communications exec. According to LinkedIn, there are more corporate comms personnel working for Bezos at Amazon (969) than journalists working for Bezos at the Washington Post (798). When firms are still searching for a viable business model, the temptation to go full yogababble gets stronger, as the truth (numbers, business model, EBITDA) needs concealer. When I show up at MSNBC, they put some crazy foundation syrup in a plastic bottle attached to a hose, ask everyone to stand back, and spray my head as if the makeup artist were the last line of defense against reactor 2 at Chernobyl.

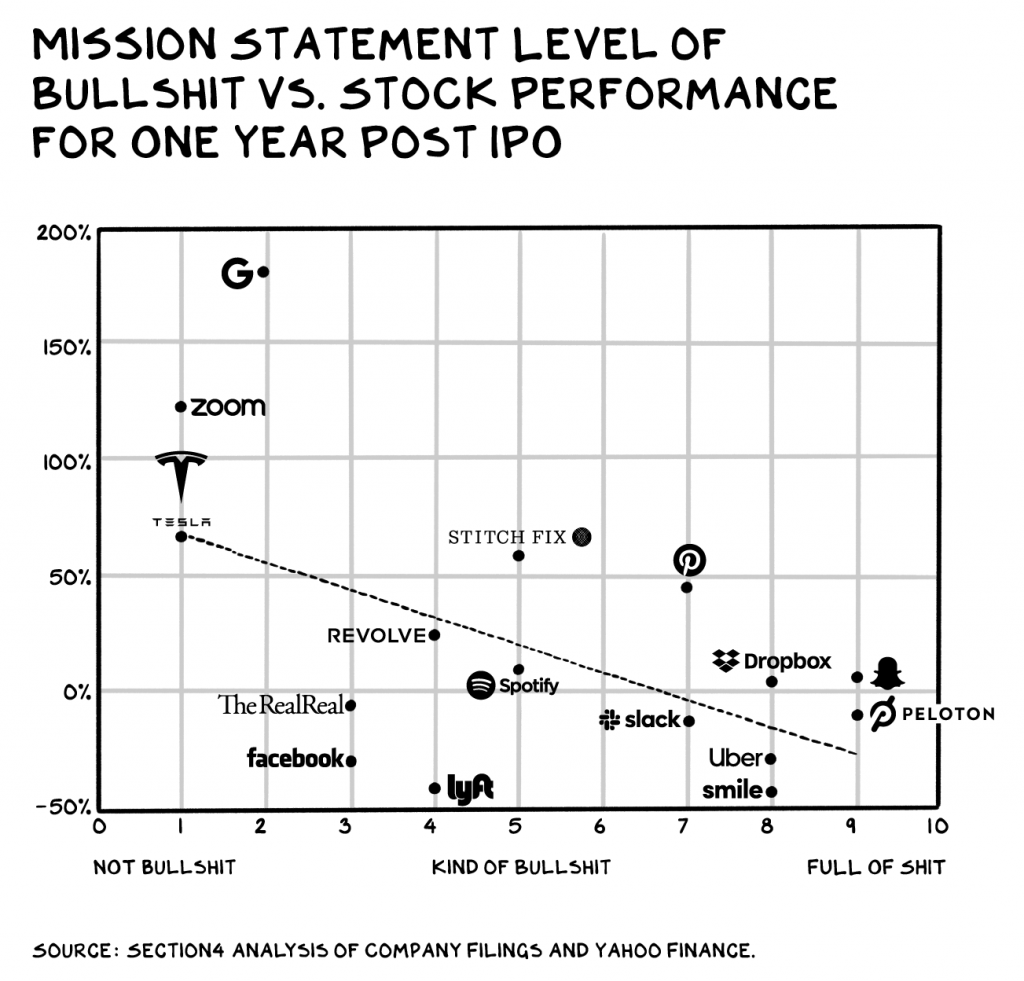

So, we looked at the S-1 language of a bunch of tech firms and made a qualitative assessment of the level of bullsh*t. Then we looked at their performance one year post-IPO. We believe there is an inverse correlation that may be a forward-looking indicator for a firm’s share performance.

Yogababble scale 1-10:

1/10: I’m a professor of marketing who likes dogs.

5/10: I’m the Big Dawg.

10/10: I am a spirit Dawg that unlocks self-actualization.

Zoom

Mission: “To make video communications frictionless.”

This is accurate. Zoom is a video communications company. It offers less friction, as demonstrated by a higher NPS score (62) than Webex (6).

Bullsh*t rating: 1/10

Stock return 6 months post-IPO: +122%

Spotify

Mission: “To unlock the potential of human creativity by giving a million creative artists the opportunity to live off their art and billions of fans the opportunity to enjoy and be inspired by these creators.”

OK, sort of. Hard to see how Celine Dion is unlocking human creativity.

Bullsh*t rating: 5/10

Stock return 1 year post-IPO: +9%

Peloton

Mission: “On the most basic level, Peloton sells happiness.”

Nope, similar to Chuck Norris, Christie Brinkley, and Tony Little, you sell exercise equipment.

Bullsh*t Rating: 9/10

Stock return 1 day post-IPO: –11%

The chart below summarizes our research.

The markets appear to be emerging from a psychotic break from reality. The ugly process of repricing risk has begun. The market’s reaction to Uber and Lyft was the Monday morning sunrise ending a young Robert Downey Jr. Miami weekend binge. The shelving of the We and Endeavor IPOs was the market preemptively taking keys away, arresting the bender before it starts.

Adam Neuman’s real innovation, so far, is cooking a drug that appears to have no hangover or side effects. WeChrist shat in the punch bowl. People in hazmat suits showed up, gave him $700 million, and asked him to leave — they’ll take it from here and try to clean up his mess. Mr. Neuman wasn’t fired, he was liberated. The con artist formerly known as Adam is leaving with more money ($700 million) than the firm is currently worth.

I can relate to the mix of hubris, success, and Christ complex that leads you to believe your business efforts deserve a vision worthy of your genius – if not to distract you and your investors from the reality of how hard it is to build an entity that takes in more money than it spends, while growing.

When the board, CEO, and bankers transfer the vicious hangover to retail investors, the distraction becomes malfeasance.

My new firm, Section4, was going to “Restore the Middle Class.” My colleagues rolled their eyes so hard I wondered if they’d been coached by my 12-year-old son. Then we were “NSFW Business Media” or “Streaming MBA.” We’re trying to figure it out. Next week, I’ll tell my board we’ve assembled a group of talented people, are producing short-form video and podcasts, and hope to educate and inform. We’ll go from there.

I’ve come to the realization that we’re not bringing joy to the universe. We are not Chipotle.

Tyler Durden

Sat, 09/28/2019 – 13:30

via ZeroHedge News https://ift.tt/2mFfmPJ Tyler Durden