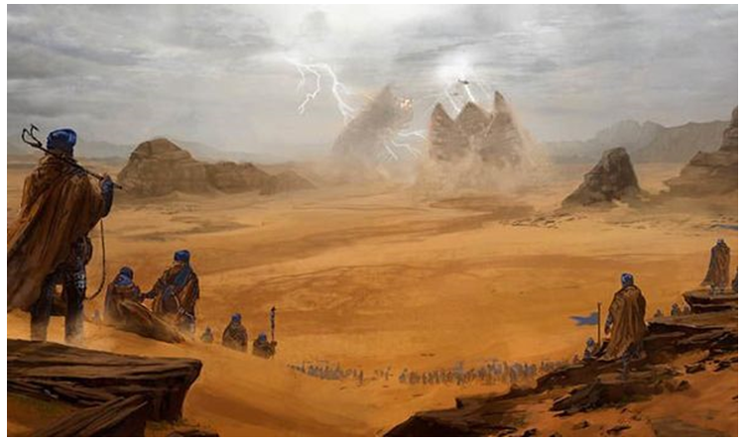

On The Great Jihad And Other Possible Futures

Authored by Ben Hunt via The Epsilon Theory,

“He had seen two main branchings along the way ahead—in one he confronted an evil old Baron and said: “Hello, Grandfather.” The thought of that path and what lay along it sickened him.

The other path held long patches of gray obscurity except for peaks of violence. He had seen a warrior religion there, a fire spreading across the universe with the Atreides green and black banner waving at the head of fanatic legions drunk on spice liquor […]

He found that he could no longer hate the Bene Gesserit or the Emperor or even the Harkonnens. They were all caught up in the need of their race to renew its scattered inheritance, to cross and mingle and infuse their bloodlines in a great new pooling of genes. And the race knew only one sure way for this—the ancient way, the tried and certain way that rolled over everything in its path: jihad.”

–Frank Herbert, Dune

Dune is easily one of the greatest works of science fiction ever written. I’d go so far as to say it’s one of the greatest works of popular fiction ever written.

That’s not to imply Dune is an easy read. Or even a pleasant one. The first couple hundred pages are incredibly taxing. But it’s all downhill from there. In fact, I’m convinced this is precisely what us Dune fans love about the book. Itsdepth rewards you for your effort. But you have to earn it. Dune is truly a book for “idea people.”

This is precisely why Dune movie adaptations inevitably disappoint. Sure, Dune has a sci-fi plot. It’s got fairly well-drawn characters. It’s got action. But the real draw are the Big Ideas—ideas about how politics, science and religion shape humanity’s evolutionary path. Ideas about how politics, science and religion are used to manipulate humanity’s evolutionary path.

At its core, Dune is all about narrative.

(Funnily enough, it seems like Jodorowsky “got it”, at least in his own loony way. But his Dune adaptation was never made)

One of the recurring images in the book is what we in finance know as a probability tree. In the world of Dune, if you are at least a little bit psychic, and you amplify that psychic ability with a generous helping of hallucinogenic “spice,” you can catch a glimpse of the branching probability tree that is the as-yet-unrealized future.

Here in the investment and financial advice businesses, we, too, seem to have reached an evolutionary crossroads. I don’t claim to know exactly what the industry will look like in ten or twenty years. But like Dune‘s protagonist, Paul Atreides, I think I can peer through the haze of a spice trance to glimpse some of the branching possibilities.

Each of these possible futures has different implications for financial markets and the financial advice business.

1. The Great Jihad

In many ways The Great Jihad is the most straightforward path. It’s just not a particularly pleasant one. Here, we as a species fail to transition from competitive games to cooperatives games. Inevitably, this leads to big wars and violent revolutions. In this future state of the world, our portfolios and advisory practices are the very least of our concerns. We’ll be much more concerned with the simple things in life. Things like not getting shot, or sent to re-education camps, or starving to death.

If you truly believe we are headed for the Great Jihad, you want to own gold, guns, crypto and seeds.

2. The Zombification of Everything

We’re pretty familiar with the playbook for this future, because it’s more or less what we’ve been living since the 2008 financial crisis. Here, growth and interest rates remain low for many, many years. Decades. What’s more, the Nudging State and the Nudging Oligarchy somehow succeed in stabilizing the social and political tensions that this state of affairs tends to create.

This is a policy controlled world of zombie companies, zombie investors and zombie civic institutions.

From an investing standpoint, cheap, beta-oriented strategies will continue to dominate the product landscape. There will, of course, be niche opportunities for traders and stock pickers to make money, but never to such a degree that the policy controlled nature of economic and market outcomes can be called into question.

As far as financial advice is concerned, this future will amplify current trends toward focusing on financial planning and even financial therapy. The role of investment selection in an advisory practice will be increasingly marginalized, and advisor compensation will increasingly be divorced from client investment portfolios. There is no need to worry about investment outcomes in a policy controlled world. Why would anyone pay a premium for investment advice in such a world?

What’s more, two “truths” will be self-evident in a zombified world:

Always be buying.

Always be long duration

This is a future without bear markets and without interest rate risk. Financial asset valuations will have “permanently” re-rated higher on the back of common knowledge that the cost of capital will always and forever remain pinned near zero, and that economic cycles have been tamed.

In this world, Ben Graham style value investors are extinct. To the extent people who consider themselves value investors still have money to manage, they will claim to adhere to “evolved” value philosophies that emphasize “quality” or GARP.

However, the Zombification of Everything does not strike me as a stable equilibrium, precisely due to the social and political tensions that must be managed to maintain it. This future isn’t so much a destination as a layover on the way to something else.

3. The Great Reset

Great Reset is a kind of middle way. It’s not quite the dystopian hellscape of the Great Jihad. But it ain’t exactly a bed of roses, either.

I see two possible paths here. The first (and more unnerving) is that of debt jubilee and MMT. Here it is common knowledge that neither debt nor deficits matter. This is a future of structurally higher inflation. It’s only a question of degree. To me, this is the highest probability future of the three examined here.

Of course, the worst possible outcome is hyperinflation and revolution (shades of The Great Jihad there). But I believe there is a “milder” way forward, too, with “merely” high single digit or low double digit inflation. After all, this kind of inflation is the most politically expedient solution to the debt burdens and unfunded liabilities borne by today’s developed market policymakers.

What does this mean for our portfolios?

Much of what we think we “know” about investing will no longer work. Stocks and bonds will be positively correlated. Conventional wisdom about asset allocation will disappoint. Long duration bets will get crushed. Equity multiples will re-rate lower as the cost of capital rises.

The differences between stocks will matter again. Why? Pricing power is why. Businesses with pricing power will survive and even thrive. Businesses without pricing power will struggle. Many will die.

Naturally, this could open the door to a renaissance in stock picking. Even a renaissance in more traditional forms of value investing.

And what of financial advisors?

We will have to get to grips with the fact that many of our investing heuristics will not be particularly effective in this regime. They may even be counterproductive.

The diversification offered by a 60/40 portfolio will disappoint. Portfolio construction and stock selection will matter again. Financial therapists whose understanding of investing is limited to the heuristic that a low cost, 60/40 portfolio is always and everywhere best portfolio will find themselves at a disadvantage versus competitors who adapt more quickly to this new economic regime.

Both the Great Reset and The Great Jihad represent explicit rejections of the Zombification of Everything. Likewise, they represent explicit rejections of the Cult of the Omnipotent Central Banker. We will probably still have central bankers after the Great Reset. But common knowledge will mark them as sorcerer’s apprentices. Everyone will know that everyone knows that policy controlled markets are a febrile delusion.

I suppose there is also a kind of Golden Path here, where the Cult of the Omnipotent Central Banker is cast down without debt jubilee or MMT. How might such a thing happen? Policymakers themselves might eventually reject the idea of policy controlled outcomes and the tired tropes that come along with it (Fed Days, forward guidance, etc.). But the Golden Path is a narrow one, and it strikes me as a low probability outcome.

I conclude with a final Dune quote worth meditating on, whenever we consider the branching possibilities in life, business or the financial markets:

“And he thought then about the Guild–the force that had specialized for so long that it had become a parasite, unable to exist independently of the life on which it fed. They had never dared grasp the sword… and now they could not grasp it. They might have taken Arrakis when they realized the error of specializing on the melange awareness-spectrum narcotic for their navigators. They could have done this, lived their glorious day and died. Instead, they’d existed from moment to moment, hoping the seas in which they swam might produce a new host when the old one died.

The Guild navigators, gifted with limited prescience, had made the fatal decision: they’d chosen always the clear, safe course that leads ever downward into stagnation.”

Tyler Durden

Fri, 09/27/2019 – 20:25

via ZeroHedge News https://ift.tt/2nRJoQz Tyler Durden