Is This The Real Driver Of Gold’s Recent Weakness?

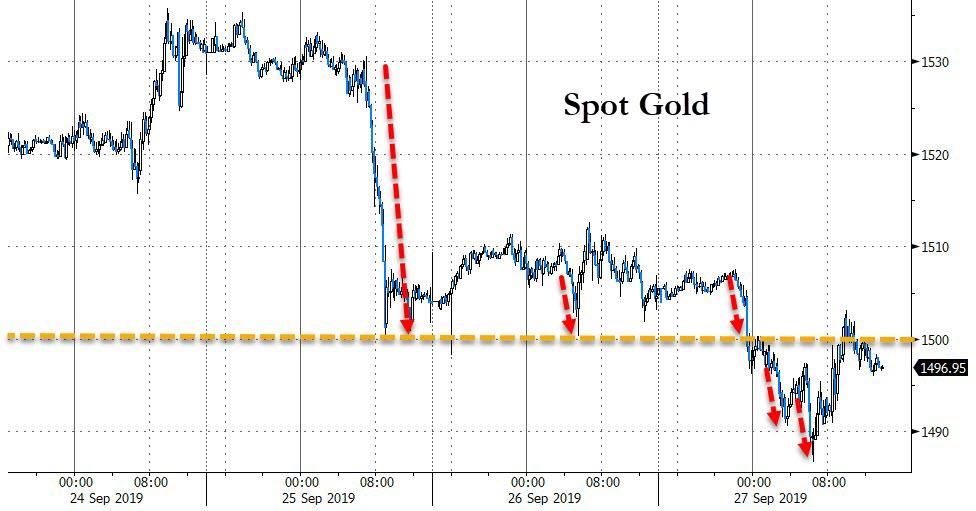

Despite uber-dovish Fed jawboning (and a re-expansion of their balance sheet), a liquidity crisis prompting repo action by NYFed, re-escalated trade tensions, a breakdown in talks with North Korea, and of course, the Trump impeachment process; safe-haven precious metals were pummeled lower the last few days, breaking back down below $1500…

Source: Bloomberg

The question on many investors minds is…why?

The answer is surprisingly simple… China’s Golden Week Holiday.

As SHTFplan.com’s Mac Slavo wrote previously, and appears to be proved correct once again… Ask the expert pundits on financial media and you’ll get a swath of explanations for how the strength of the dollar or the improving health of the global economy are to blame.

One could reasonably argue that dollar strength this week could certainly put downward pressure on the gold price. So, too, could one make the point that mainstream perspective is such that the economy is improving (which we have just explained is simply an anomaly due to use-it-or-lose-it spending patterns), which means investors aren’t in panic mode and have no reason to hold a safe haven asset. But neither of these arguments could realistically lead to the smack down we witnessed this week.

So what happened?

Well known gold and silver analyst Andy Hoffman previously suggested the answer could be much simpler than we have been led to believe.

There’s no reason… there’s not even a propaganda meme of why [gold has been dumped]… there isn’t even a such thing as negative news for precious metals anymore…

The fact is, [like the last few years, when prices collapsed], China is closed for the week.

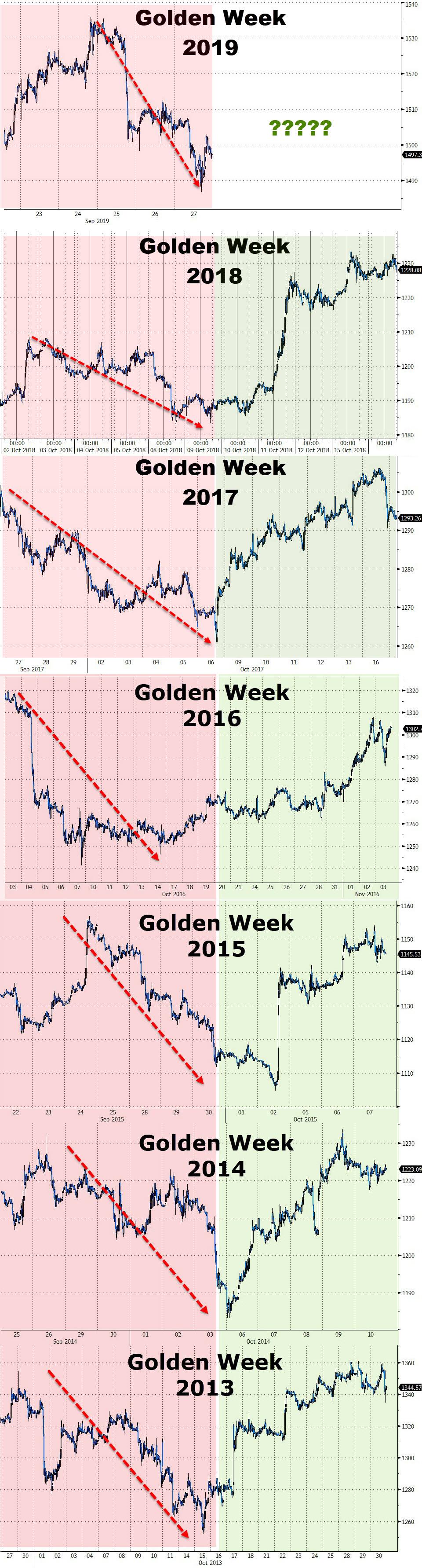

One glance at the last few years gold price action suggests he may well be correct…

Source: Bloomberg

As of Tuesday, China will be on vacation for its Golden Week National Holiday and this weakness appears to be traders front-running the traditional chaos that the rest of the world plays when China leaves the playing field.

China will be back in business on October 9th, and that means the Shanghai Gold Exchange, which opened in 2015 to counter Western manipulation of precious metals, will likely help re-balance prices to where they were before this recent takedown.

We could be wrong, but something tells us gold and silver prices won’t stay this low for much longer and that they could well see a complete turnaround when China reopens on October 9th.

Tyler Durden

Sun, 09/29/2019 – 14:30

via ZeroHedge News https://ift.tt/2nKKvRX Tyler Durden