“The Only Thing Left Is A ‘Trade Deal'” – Why The Bear Is Still Coming…

Authored by Lance Roberts via RealInvestmentAdvice.com,

Market Review & Update

Friday morning stocks rose as optimism over “trade” seemed to “trump” the ongoing antics in Washington as Democrats are once again trying to find a “smoking gun” to impeach the “Trumpster.” Then, the market tanked, as Bloomberg reported the White House is weighing limits on U.S. portfolio flows into China – which promptly tanked stocks.

“The discussions are occurring as Washington and Beijing negotiate a potential truce in their trade war that’s rattled the world’s two biggest economies and investors for more than a year. They also come as China is removing limits on foreign investment in its financial markets. A U.S. crackdown on capital flows would therefore expose a new pressure point in the economic dispute and cause disruption well beyond the hundreds of billions in tariffs the two sides have levied against each other.

Among the options the Trump administration is considering: delisting Chinese companies from U.S. stock exchanges and limiting Americans’ exposure to the Chinese market through government pension funds. Exact mechanisms for how to do so have not yet been worked out and any plan is subject to approval by President Donald Trump, who has given the green light to the discussion, according to one person close to the deliberations.”

With the Fed out of the picture for now, the market has become almost entirely dependent on “Trump tweets” for direction.

As noted last week, despite the short-term disappointment, the bulls continue to remain in charge currently, as markets cling near all-time highs. As we pointed out last week:

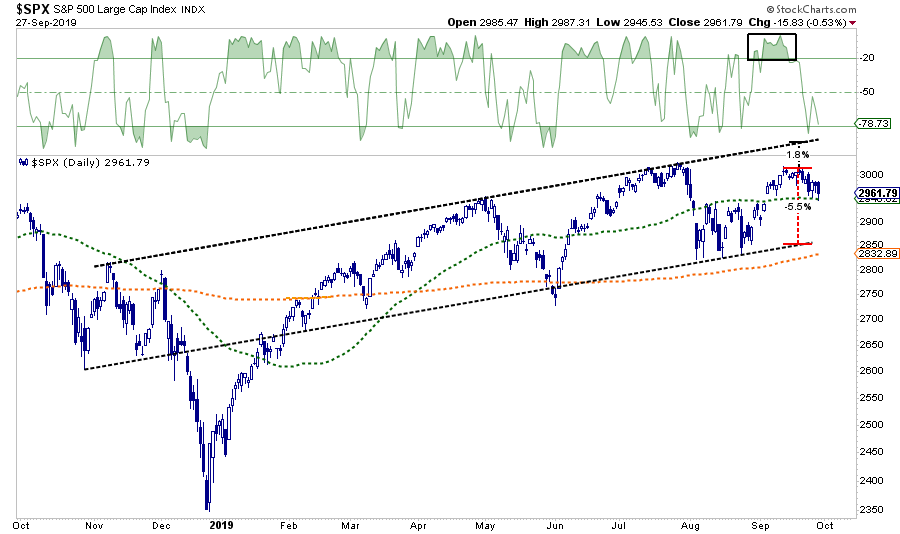

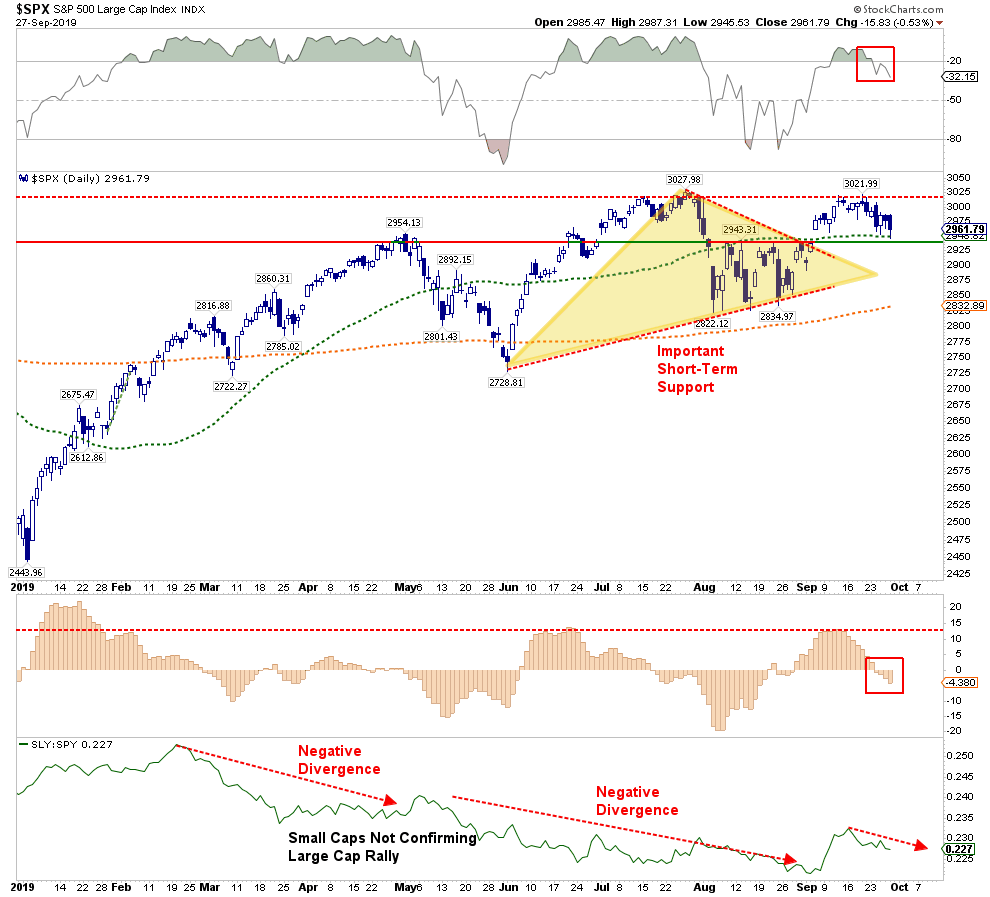

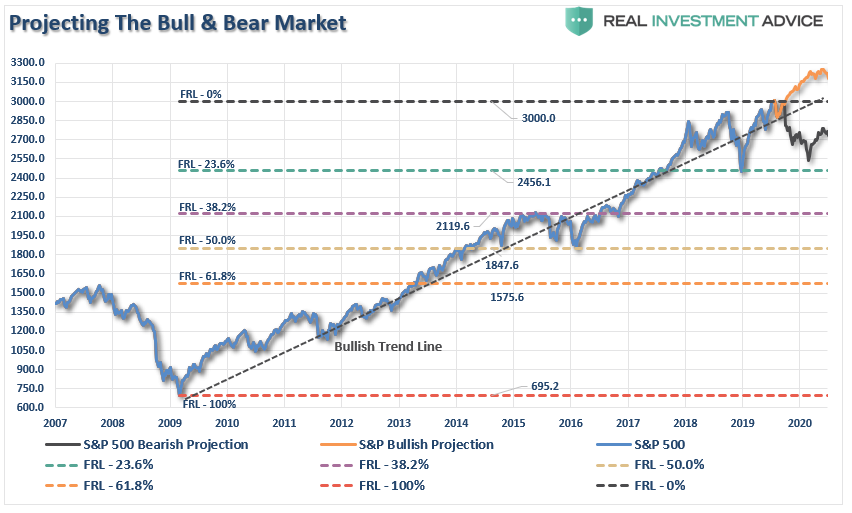

“The risk/reward does not favor the bulls short term. The market is back to very overbought conditions; the upside to the top of the bullish trend channel is about 1.9%. The downside risk is about 5.5%.”

The chart below is updated through Friday’s close. The good news is the overbought condition has been reduced while the market held support at the 50-dma. This potentially sets the market up for a rally next week, providing we get a “tweet” over the weekend confirming a “trade deal” is in progress.

However, on an intermediate-term basis, a “sell signal” has been registered, which suggests there is downward pressure on stocks over the next month. The July and September tops are nearly identical suggesting a “double top” is in progress. This also increases the difficulty of the markets moving higher in the short-term. The good news is a break above resistance will support a move to 3300 as discussed previously.

Currently, there is support at the 50-dma, which coincides with the January 2018 top, but a break of that level will put the 200-dma into focus. The negative divergence between large and small-cap stocks continues after a brief reversion week before last. Whatever that was, seems to be over for now.

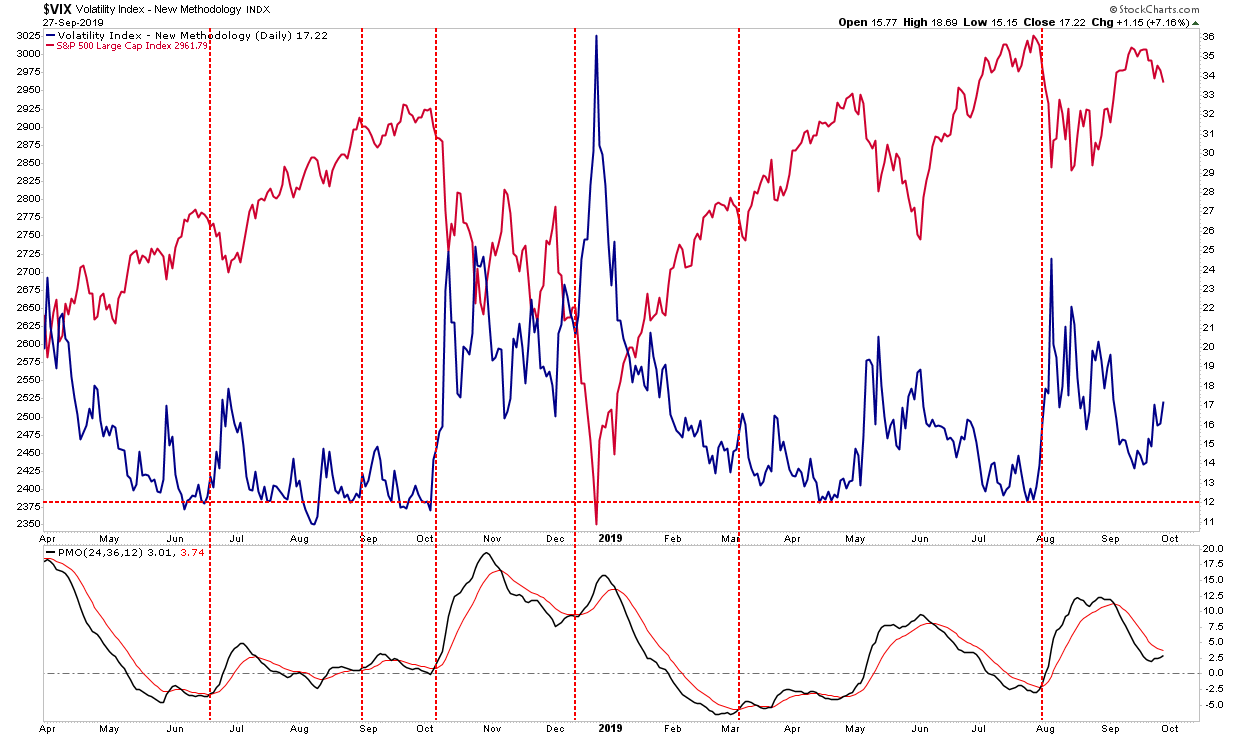

The volatility index (VIX) has also turned higher and is very close to triggering a “buy” signal. Given the non-corollary nature of the index versus the S&P 500, it suggests that further downside risk could be in the offing if a signal is triggered. Spikes in volatility, and declines in stock prices, tend to happen very quickly, so it is better to anticipate the event by adding hedges, raising cash (ie take profits), and rebalancing risks accordingly.

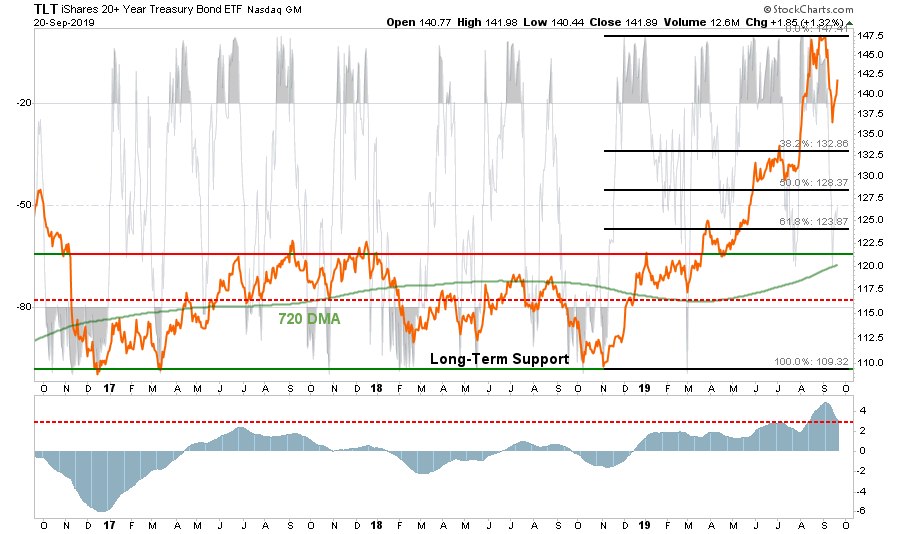

In our portfolios, last week, raised a bit of cash, and continue to remain hedged currently. While the bullish trend of the market keeps us allocated toward equity risk currently, we are doing so with defensive positioning. We also slightly increased our intermediate-term bond holdings and Gold. Cash remains a slight overweight in model allocations and equities slightly underweight..

We discussed the reasoning for an additional bond exposure with our RIAPRO subscribers this week:

- Like GLD, Bond prices finally cracked and have reversed a good chunk of the EXTREME overbought condition.As with GLD, we swapped bond positions this past week selling short-term bonds and swapping into longer duration Treasuries. We are very close to further increasing our exposure to bonds as well.

Trade Deal In Time For The Election

As noted above, on Friday, the Trump administration is putting a “review on investment limits” for China. This would potentially include:

-

Delisting Chinese companies from U.S. stock exchanges, and;

-

Limiting Americans’ exposure to the Chinese market through government pension funds.

This is a direct hit at China which has made huge strides in economic ambitions and technological advances on the back of American financing. This chart below, courtesy of Zerohedge, shows the market capitalization of Chinese companies trading on U.S. exchanges:

As noted above, this is all “talk” by the administration. While Trump has green lighted the discussion, there is reportedly no timeline for any action which suggests this is nothing more than “posturing” ahead of trade talks. While the markets didn’t like the news on Friday, this plays well into the strategy we believe Trump is setting up for the mid-October meeting with China to “negotiate a trade deal.”

This additional “threat” is being brought to the bargaining table in October, and is one Trump can easily back off of in exchange for greater market access for American companies in China. (This is something Trump has previously asked for, and China has already agreed to provide.)

However, while the Democrats are busy trying to impeach President Trump over the latest White House scandal, Trump has continued to try and keep the markets happy by promising a “trade deal is coming,” just as he told the White House press pool on Wednesday:

“They want to make a deal very badly… It could happen sooner than you think.” – Reuters

I remain unconvinced as China responded immediately afterward.

“China’s top diplomat hit back at U.S. criticism of its trade and development model in a speech on Tuesday after Trump spoke at the United Nations. Wang Yi, China’s foreign minister and state councilor, said Beijing would not bow to threats, including on trade, though he said he hoped the high-level trade talks next month would produce positive results.” – Reuters

If this all sounds rather familiar, it should, because it is the same thing they said a month ago.

“Beijing’s latest ‘gesture’ has increased the prospects for a narrow trade deal with the US. But it’s a small deal. It means that there would be no escalation of tariffs as China has agreed to make more purchases. It could provide a certain level of comfort to US farmers and give Trump something to brag about.” – Hua Changchun, economist at Guotai Junan Securities, PRC

China is indeed making “small concessions” for things they need as a country. As we noted two weeks ago:

“China, smartly, is using the opportunity to buy soy and pork products (which they desperately need due to a virus which wiped out 30% of their pig population) to restock before the next meeting.

This is a not so insignificant point.

China is out for “China’s” best interest and will not acquiesce to any deal which derails their long-term plans. In the short-term, they may “play the game” to get what they need as a country, but in the long-run, they will protect their own interests.”

However, don’t mistake China’s move as “caving” into Trump. Such is hardly the case.

While Beijing will allow Chinese businesses to purchase a “certain amount of farm products such as soybeans and pork” from the US, China has also cut a deal for soy meal from Argentina.

“China will allow the import of soymeal livestock feed from Argentina for the first time under a deal announced by Buenos Aires on Tuesday, an agreement that will link the world’s top exporter of the feed with the top global consumer.” – Reuters

The pressure is on the Trump Administration to conclude a “deal,” not China. Trump needs a deal done before the 2020 election cycle; AND he needs the markets and economy to be strong. If the markets and economy weaken because of tariffs, which are a tax on domestic consumers and corporate profits, as they did in 2018, the risk of electoral losses rise.

Trump Looking For A Fast Exit

This is an important point.

China knows that Trump needs a way out of the “trade war” he started, but that he needs a something that he can “boast” as a victory to a largely economically ignorant voter base. Here is how a “trade deal” could get done.

Understanding that China has already agreed to 80% of demands for a trade deal, such as buying U.S. goods, opening markets to U.S. investors, and making policy improvements in certain areas, Trump could conclude that “deal” at the October meeting.

It is only the final portion of Washington’s demands which have stalled negotiations so far:

-

Cutting the share of the state in the overall economy from 38% to 20%,

-

Implementing an enforcement check mechanism; and,

-

Technology transfer protections

These are the “big ticket” items that were the bulk of the reason Trump launched the “trade war” to begin with. Unfortunately, for China, these items are seen as an infringement on its sovereignty, and requires a complete abandonment the “Made in China 2025” industrial policy program.

However, Trump can set aside the last 20%, drop tariffs, and keep market access open, in exchange for China signing off on the 80% of the deal they already agreed to.

Which is precisely what Trump’s comments recently alluded to:

“Not surprisingly, as Trump said on Thursday, while he prefers a broad deal, he left open the possibility of a more limited deal to start.” – Reuters

That is code for: “Let’s get a deal on the easy stuff, call it a win, and go home.”

This is the strategy we suggested was most likely two weeks ago:

“For Trump, he can spin a limited deal as a ‘win’ saying ‘China is caving to his tariffs’ and that he ‘will continue working to get the rest of the deal done.’ He will then quietly move on to another fight, which is the upcoming election, and never mention China again. His base will quickly forget the ‘trade war’ ever existed.

Kind of like that ‘Denuclearization deal’ with North Korea.”

Would A “Deal” Change Anything

Assuming we are correct, and Trump does indeed “cave” into China in mid-October to get a “small deal” done, what does this mean for the market.

The most obvious impact, assuming all “tariffs” are removed, would be a psychological “pop” to the markets which, given that markets are already hovering near all-time highs, would suggest a rally into the end of the year.

This is not the first time we presented analysis for a “bull run” to 3300. To wit:

“The Bull Case For 3300

Momentum

Stock Buybacks

Fed Rate Cuts

Stoppage of QT

Trade Deal”

As I noted then, price momentum has been in control of the markets over the last several months. Given that “an object in motion, tends to stay in motion,” momentum is a hard thing to stop without a bigger event triggering a reversal in investor attitudes.

When I wrote the article previously, the Fed had not cur rates yet. Since that writing, they have cut rates twice, increased their balance sheet, and are hinting at the return of more “QE” if needed by letting the “balance sheet grow organically.”

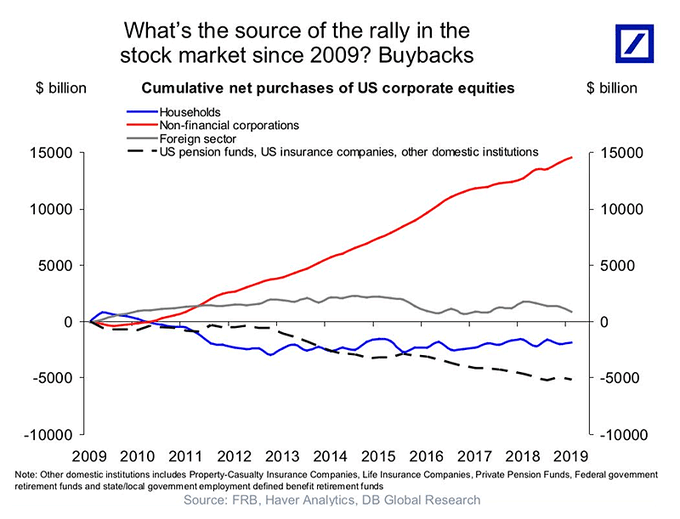

Thursday, I wrote in detail about the continuation of corporate share repurchases and the impact on the financial markets. Companies remain almost the sole source of net equity purchases.

“Between the Federal Reserve injecting a massive amount of liquidity into the financial markets, and corporations buying back their own shares, there have been effectively no other real buyers in the market.”

The only thing left is the “Trade Deal.”

A deal would alleviate some concern on corporate profitability, and as J.P. Morgan’s chief equity strategist Dubravko Lakos-Bujas previously told MarketWatch:

“If you have a trade deal, and if the trade deal coincides with one or two rate cuts from the Fed, we see an upside scenario of 3,200-3,300.”

Yep, the same number we came up with.

The Bear Is Still Coming

Just remember, bull-runs are a one-way trip.

A trade-deal only undoes the immediate negative impacts to corporate profits and the economy. However, higher interest rates from the Fed and tariffs were in place long enough to negatively impact growth, consumption, and confidence.

Furthermore, given the markets never reverted to any meaningful degree, higher prices combined with weaker earnings growth, has left the markets very overvalued, extended, and overbought from a historical perspective.

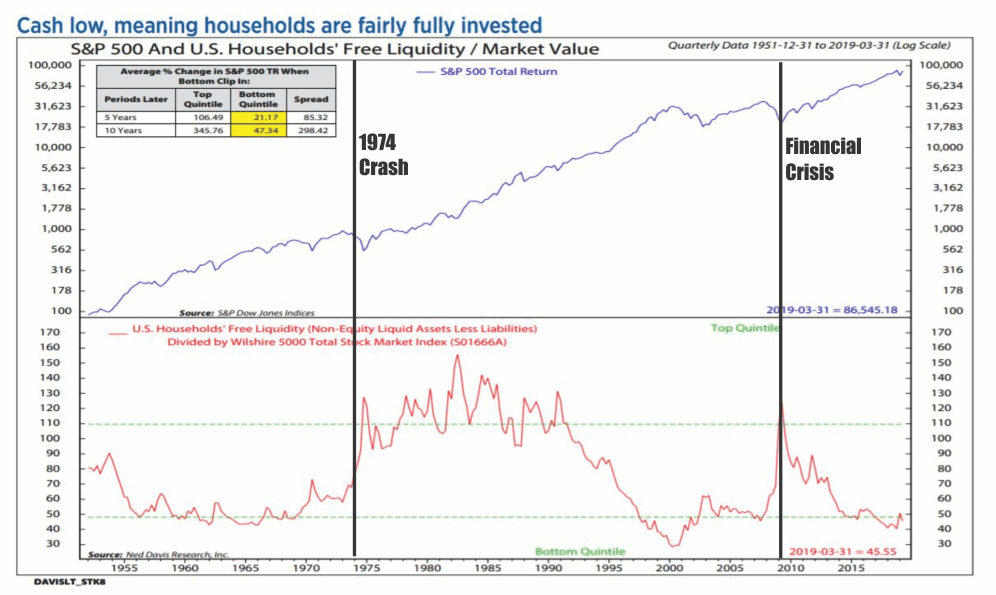

Lastly, investors are all-in already, so there is little “buying power” left to substantially drive markets higher outside of a short-term short-covering rally from any “trade deal.”

“Cash is low, meaning households are fairly fully invested.” – Ned Davis

In other words, the “pent up” demand for equities is no longer available to the magnitude that existed following the financial crisis, which supported the 300% rise in asset prices.

Most likely, if a deal is done, whatever rally comes will likely be the last leg of the bull market.

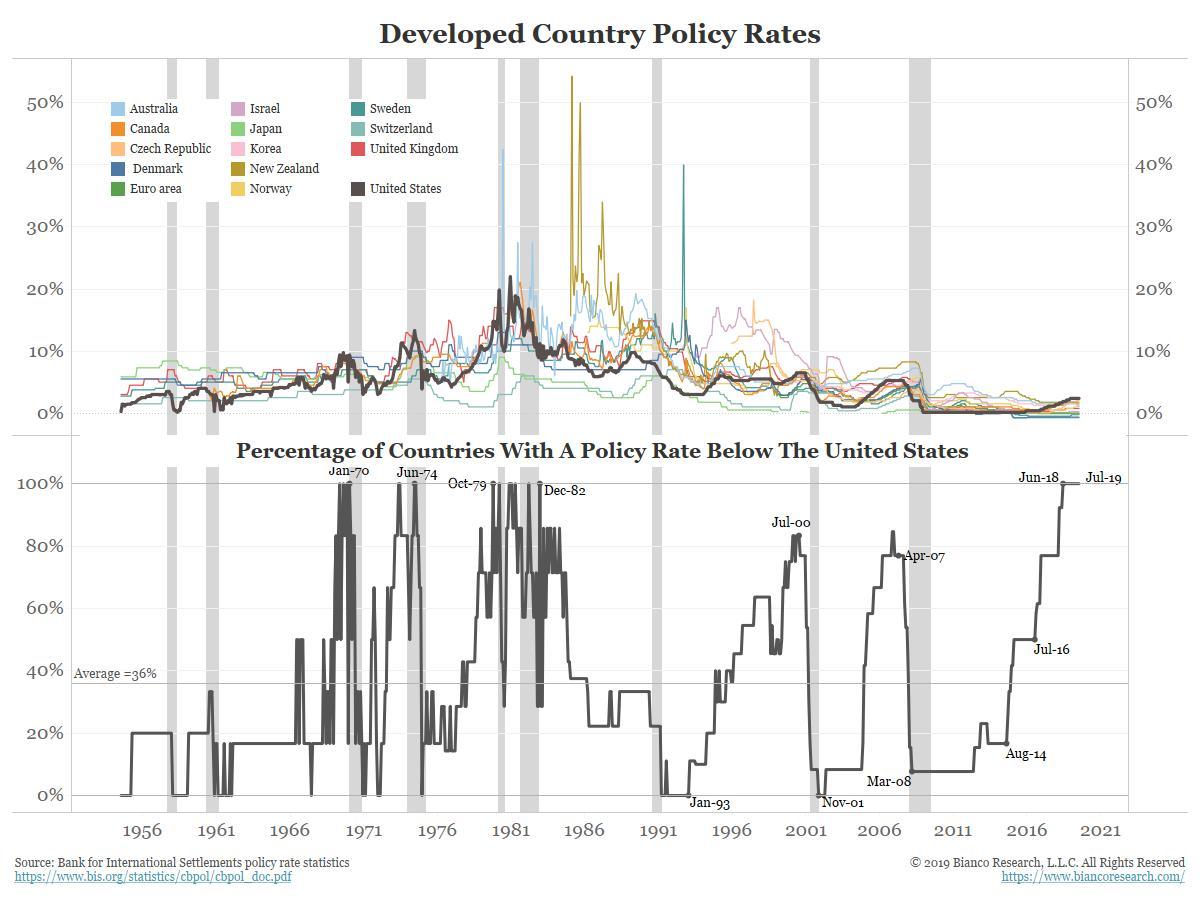

The global economy is slowing, negative rates are proliferating within sovereign debt, and there is not an inconsequential chance of a credit-related event in the months ahead. Jim Bianco showed a long-term perspective that when global rates are lower than U.S. rates, a recession has always occurred.

It is easy to get wrapped up in the bullish narrative, it is worth remembering that making up a loss of capital is not actually an investment strategy.

While the media, and bulk of the financial commentary continue to suggest “riding the bull,” they are not going to tell you when to get off. Moreover, when the ride does come to an end, the media will ask first “why no one saw it coming?”

Then they will ask “why YOU did not see it coming when it so obvious.”

In the end, being right, or wrong, does not affect the media. They don’t manage your money. Nor are they held responsible for consistently poor advice. However, being right, or wrong, has a very big impact on you.

Let me repeat:

“While our portfolios remain long currently, we do so with hedges and stops in place, a thorough methodology of analysis, and a strict investment discipline we follow to mitigate the risk of long-biased exposure. In other words, whenever the market does turn, we will sell and move to cash.”

If you are going to “ride this bull,” make sure you do it with a strategy in place for when, not if, you get thrown.

Tyler Durden

Sun, 09/29/2019 – 09:55

via ZeroHedge News https://ift.tt/2mFeOtt Tyler Durden