Green Shoots: China’s Caixin Mfg PMI Expands Fastest In 19 Months, But Doubts Remain

What a coincidence: economic green shoots appeared in China just in time for the start of the country’s National Day and Golden Week holidays, as both the official and Caixin manufacturing PMIs rose in September.

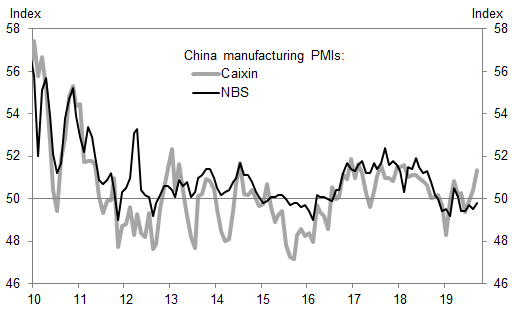

Specifically, the NBS manufacturing PMI increased to 49.8 in September and the Caixin manufacturing PMI rose to 51.4, with both readings coming in above expectations. Sub-indexes in the two surveys all pointed to stronger production, new orders and higher price pressures in the manufacturing sector. In contrast, the NBS non-manufacturing PMI edged down 0.1pp on the back of a weaker construction PMI.

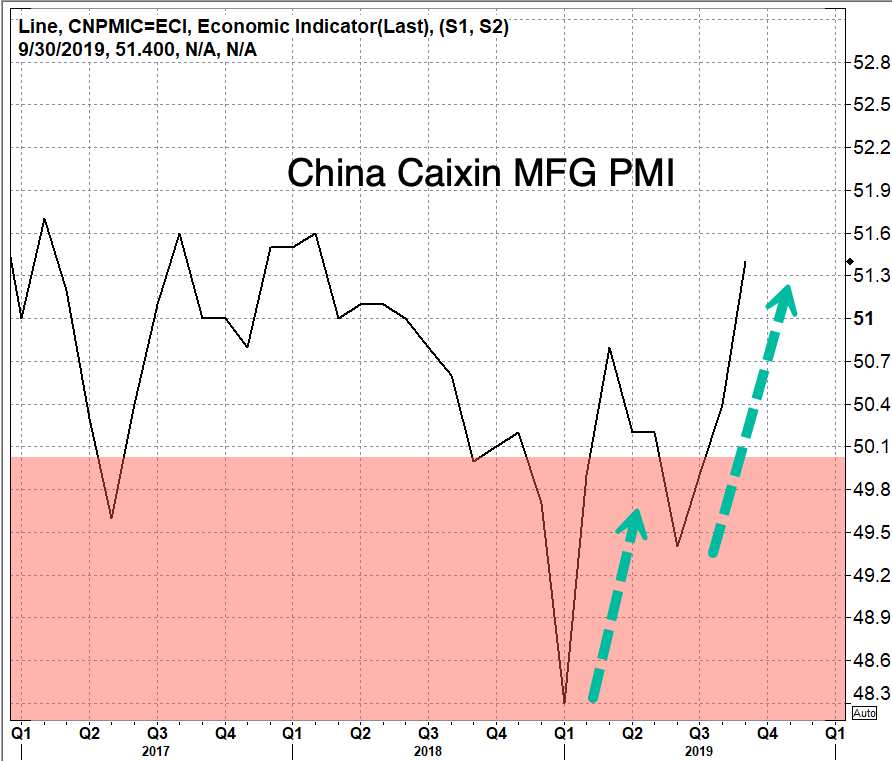

China’s Caixin manufacturing Purchasing Managers’ Index, published on Monday, and which unlike the official PMI is a measurement of economic activity at smaller, privately-owned companies, showed China’s factory activity expanded at the fastest pace in 19 months in Sept., with a reading of 51.4, up from 50.4 in Aug., the highest level since early 2018.

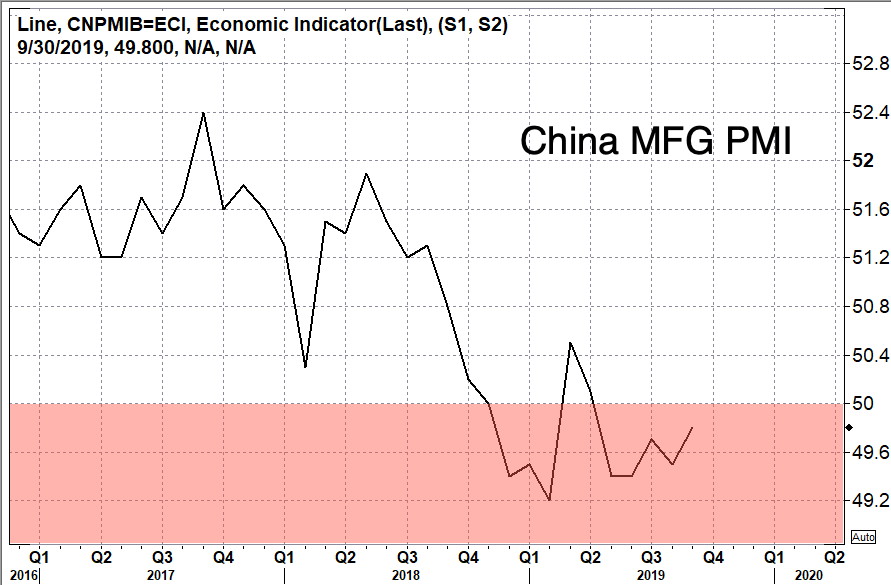

And while China’s official manufacturing PMI contracted for a fifth month in Sept, amid the ongoing threats of a China-US trade war, it printed slightly higher to 49.8, from 49.5 in Aug., if still below the 50-level that separates it from contraction and expansion.

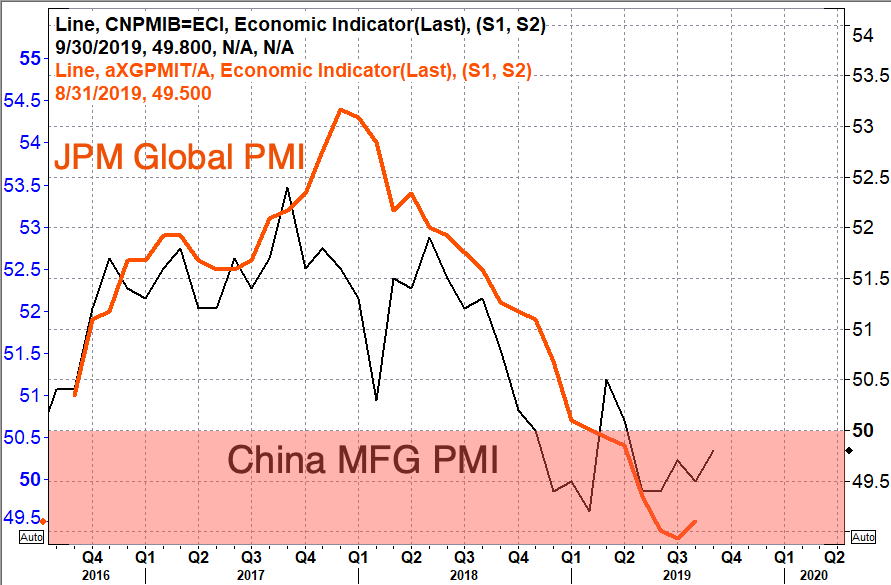

While there are conflicting signals of an economic rebound in China, and goalseeked number meant for political consumption will hardly change the narrative, manufacturers continue to deal with slowing domestic growth and an escalating trade war that has slowed global trade volumes. Trade talks between Washington and Beijing are expected to resume next week despite President Trump consideration to delist Chinese firms from US markets.

Meanwhile, economists don’t expect the slight manufacturing rebound in China to sustain into late year, but rather turn back down.

“We believe the official manufacturing PMI may decline again, the growth slowdown could gather pace and (financial)markets could become more volatile in coming months,” economists at Nomura said.

To be sure, Nomura revised its 3Q19 growth forecast for China to 5.9% and its 4Q19 view to 5.8%, decreasing from the 6.2% forecast in 2Q19. The note cited escalating trade war, slowing industrial production, waning real estate markets, and a construction slowdown.

Others were just as skeptical, with analysts at Citi saying that “even if there is a ceasefire, the damage is already partly done because of elevated business uncertainties. The government will certainly step up fiscal and monetary efforts to boost domestic demand, which we believe can help stabilize, probably not accelerate, economic growth.”

A look below the headline numbers showed that export demand remained weak, with orders sliding for the 16th straight month, an ominous sign for China’s export-heavy economy.

China’s manufacturing PMIs followed a weak industrial production print that hit 17.5-year lows last month, while factory deflation deepened.

Martin Lynge Rasmussen, a China economist at Capital Economics, said in a note that “China’s fiscal stance is unlikely to be loosened during the remainder of the year, we think the PBOC will find it an increasingly hard sell to refrain from more decisive monetary easing.”

To boost the economy, the PBOC lowered banks’ reserve requirements seven times since 2018 to spark more credit creation. China has cut its new benchmark lending rate for the second month in a row. However, economists warn that monetary policy easing in a downturn might not be as effective as before, considering China’s record debt levels, especially in the real estate market.

Furthermore, while Beijing was hoping that a strong services sector would counter the manufacturing slowdown, that appears to not be the case, with the non-manufacturing PMI in Sept. printed at 53.7, slightly down from August’s 53.8, although the convergence is so far weaker than in Europe where both the Manufacturing and Service PMIs are almost equal.

While oil dipped as China’s manufacturing, and non-manufacturing surveys remained weak, with no signs of a robust recovery but rather more slowing into the late year, futures rebounded and bond yields rose on the stronger than expected Caixin PMI. Ironically, stock in China traded lower on the PMIs, with the CSI 300 and Shanghai Composite both suffering a late session sell-off, and sliding down about 1%. Chinese shares only traded on Monday, ahead of the country’s National Day celebration that will last through Oct. 7.

China’s Yuan weakened from 7.12 to 7.14 after the PMI print. It jumped on Friday from 7.11 to 7.15 after President Trump announced new plans to delist Chinese companies from US stock exchanges.

Elsewhere, UST futures slipped on China PMI prints. The JGB curve moved higher ahead of BOJ’s Oct. buying plan announcement, while currencies were little change in the overnight session, with the USDJPY slightly firmer at 107.75.

Tyler Durden

Mon, 09/30/2019 – 06:57

via ZeroHedge News https://ift.tt/2nNGcpc Tyler Durden