Nomura Quants: “The Market Appears To Be Undergoing A Spontaneous Cooldown”

One look at the relatively calm surface of the S&P500 in recent days would leave one with the impression that traders barely have a care in mind, and indeed global stock markets have been alternately advancing and retreating with opinions on the potential for resolution to US-China trade frictions – arguably the biggest marginal unknown – mixed, however neither extreme dominating.

And yet, as Nomura’s quant Masanari Takada writes, we have seen some signs of investors unloading stocks and in other ways adjusting their positions ahead of cabinet-level talks scheduled for 10-11 October. Meanwhile, a number of key indicators of the performance of the US and Chinese economies are lined up for release between now and the end of next week, the US manufacturing and non-mfg ISM in the coming days, and the FOMC minutes on 9 October. In fact, the economic and political news over these two weeks may well have much to say about how various classes of risk assets will perform over the remainder of the year according to Takada.

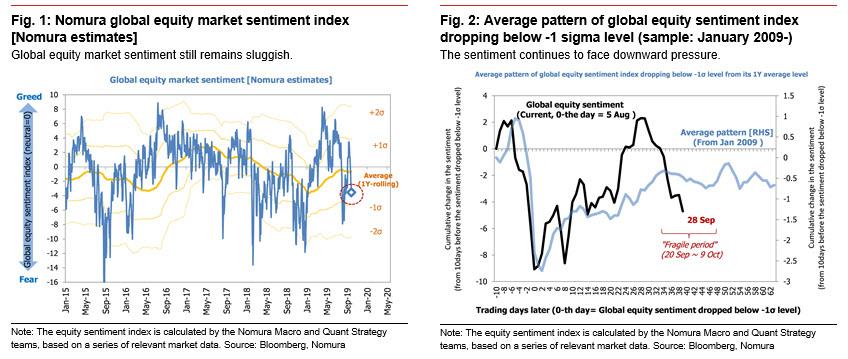

News flow aside, however, and one wouldn’t see it by simply looking at the calm surface of the market, global risk sentiment “appears to be undergoing a spontaneous cool-down” that Nomura’s model pictures as lasting from 20 September through 9 October. Cyclically speaking, “this cooldown may make the market react more strongly to negative news.”

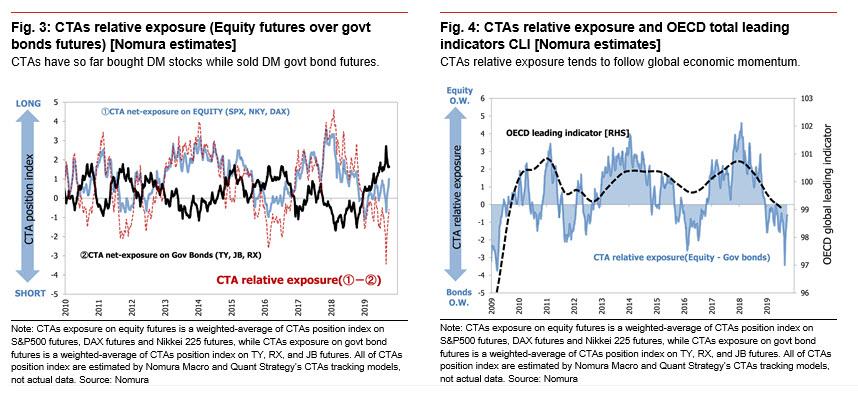

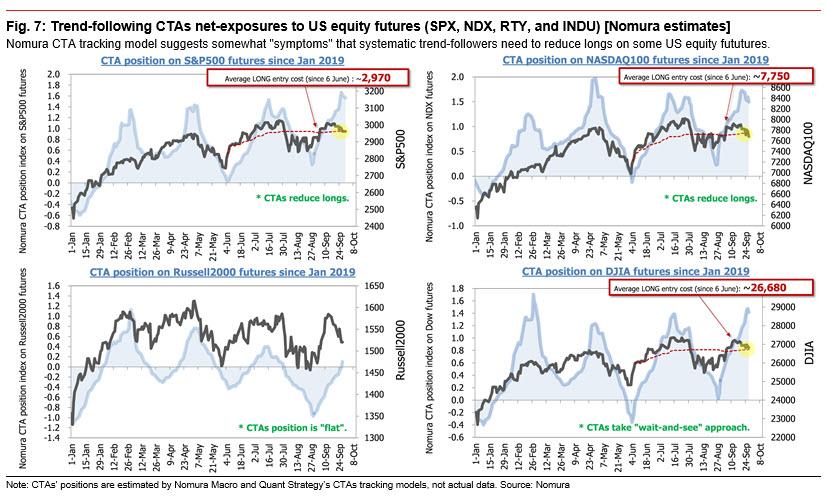

Of course, this being a note about a quant’s take on the market, a view on what CTAs are doing couldn’t be too far away, and sure enough, according to Takada, as the risk rally has died down, “quick-moving trend-chasing CTAs have reduced the pace of their net buying of equity futures.” Whereas CTAs have spent the past month adding to their net long positions in S&P 500 futures, DJIA futures, and DAX futures alike, market indices have recently worked their way down towards the breakeven lines that Nomura estimates exist at around 2,970 for the S&P 500, 26,680 for the DJIA, and 12,300 for the DAX. “This has blunted the momentum behind CTAs’ upward pursuit of the market”, according to Takeda. On the other hand, CTAs have only recently started to shift their asset allocation away from bonds toward stocks, and there is a widely held bullish view that sees them continuing to add to their equity exposure through the end of the year, which is why a key question when deciding how stocks will trade in Q4, is whether CTAs will continue increasing equity exposure and reducing their bond exposure through the end of the year.

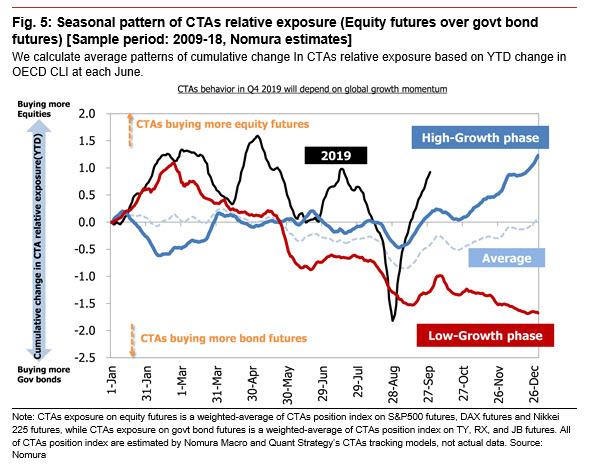

In offering its own answer to this key question, Takada says that he has gone through market data to extract the pattern in the cumulative change in CTAs’ relative exposure to equities (US stock futures, German stock futures, Japanese stock futures) and bonds (TY, JGB futures, Bund futures) for each year in the period 2009 through 2018.

Based on the correlation between this relative exposure and the OECD composite leading indicator, he then split the sample into high-growth years (when the YTD change in the leading indicator is positive as of June) and low-growth years (when the YTD change in the indicator is negative as of June). The pattern shows that CTAs tend to ramp up their buying of equity futures towards the end of each year, but in years in which the OECD composite leading indicator has spent the first half of the year trending consistently downward (as was the case this year), buying of bond futures has tended to pick up towards the end of the year.

So, all else equal, CTAs are far more likely to revert back to selling stocks and buying bonds.

That said, the stock market could easily take on a more positive tone if progress is made in the US-China talks and a resolution to the trade war starts to look more likely. In that event, Nomura would expect to see a stock market rally that bucks the historical tendency that has prevailed in years like this one. On the other hand, “a failure to wrap up the US-China tension would make it more likely that CTAs’ current buying of stocks and selling of bonds will ultimately amount to no more than a seasonal phenomenon”, according to Takada.

So how long will the current market bounce last?

In its answer, Nomura notes that the US stock market is still “experiencing a backswing from earlier optimism, albeit a mild one”, with the Japanese bank noting that it “gets a strong sense that investors are waiting for the release of key macroeconomic indicators and news on developments in the US-China talks.” As such, the dominant force in the market at the moment is probably speculators taking profits on their bullish positions in US equities, according to Nomura’s quant.

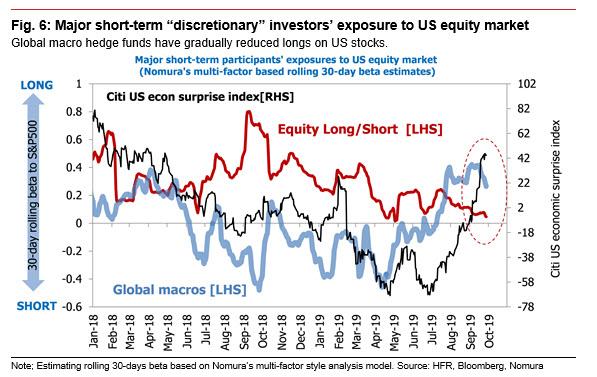

At the same time, discretionary global macro hedge funds and long/short funds are subtly downsizing their long exposure to US equities. Adding to the concerning picture, global macro hedge funds are at the same time closing out short positions in US bonds. For now at least, it seems that they are hitting the reset button on trades they had made premised on a rising stock market and rising bond yields.

And as most investor classes are phasing out their risk-on, bullish trades, CTAs meanwhile are putting a stop to their accumulation of long positions in equity futures, and are already exiting long positions in NASDAQ 100 futures in particular, as the index has undercut the trigger line that Nomura estimates exists at around 7,750.

In its conclusion, Nomura cautions that “with other hedge funds buying stocks at a slower pace now, we think conditions could soon prompt CTAs to begin paring their net long positions in S&P 500 futures and DJIA futures.”

Tyler Durden

Mon, 09/30/2019 – 15:12

via ZeroHedge News https://ift.tt/2nZYFyM Tyler Durden