Safe-Havens Beat Stocks In Q3 As Global Policy Uncertainty Hits Record High

A flip-flopping quarter ended with global stocks flat but global bond yields collapsing…

Source: Bloomberg

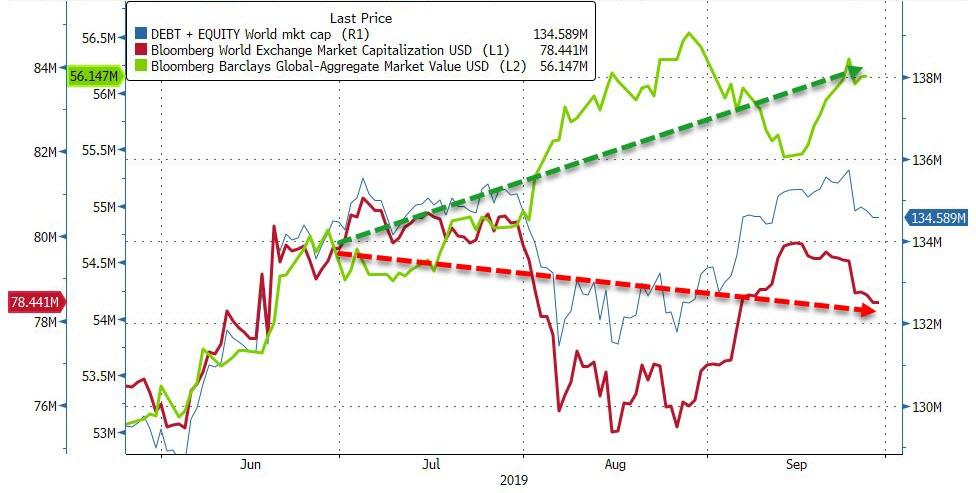

Global equity and bond market values rose $1.23 trillion in September but ended Q3 little changed as stocks lost 1.25 trillion and bonds gained $1.8 trillion…

Source: Bloomberg

As global policy uncertainty soars to a fresh all-time record high…

Source: Bloomberg

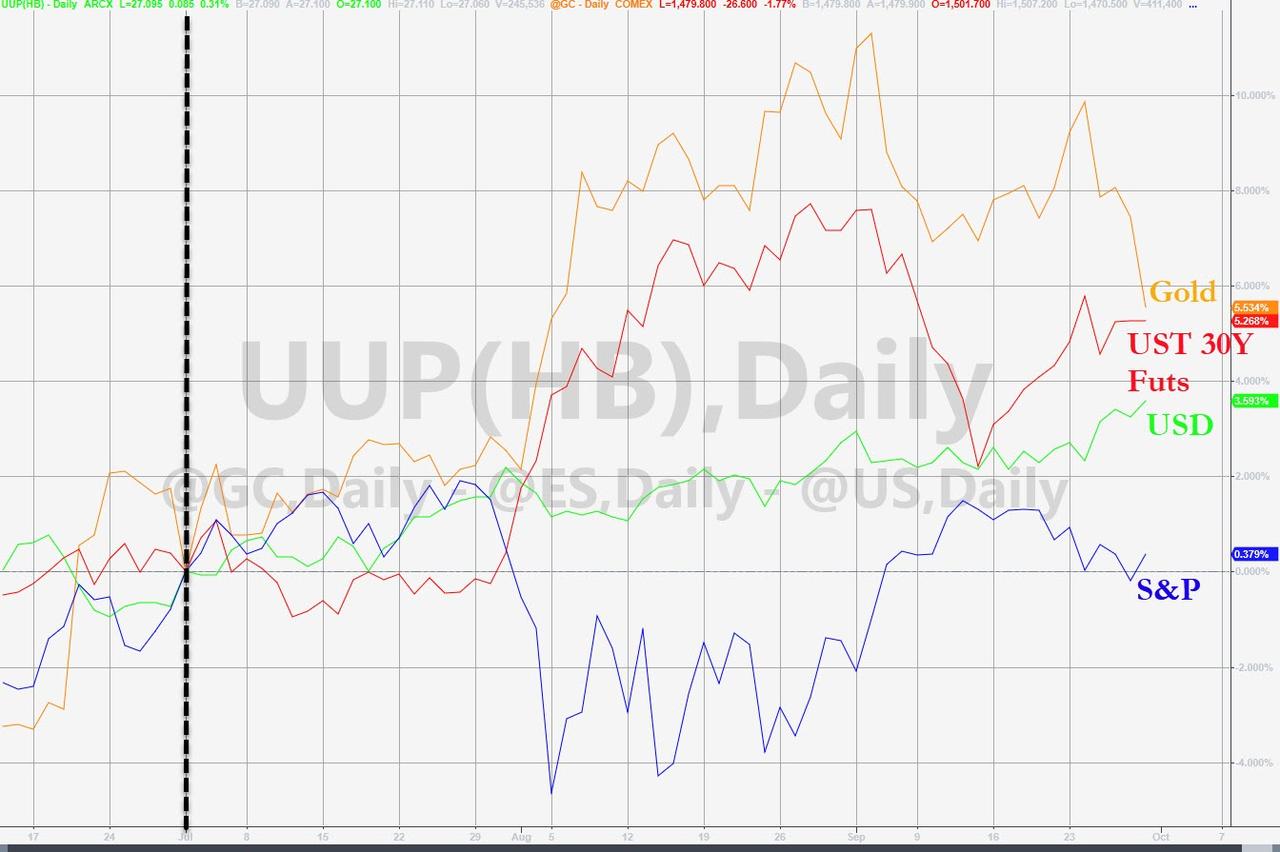

On the quarter, Bullion and Bonds were bid – safe haven flows along with the dollar – as stocks underperformed, scraping out a very small gain…

Distracted? Entertained? What’s the difference?

Stocks

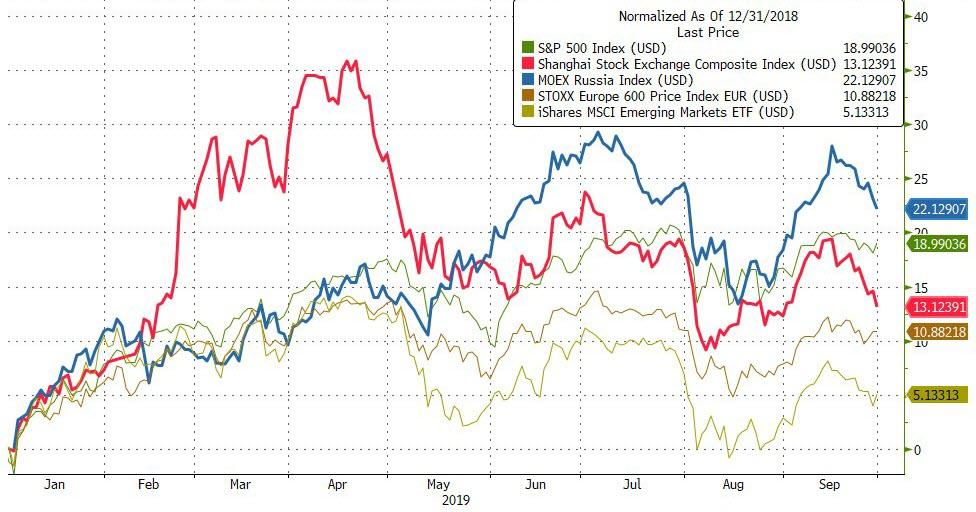

Year-to-date, Russia is outperforming China and US with EM equities underperforming…

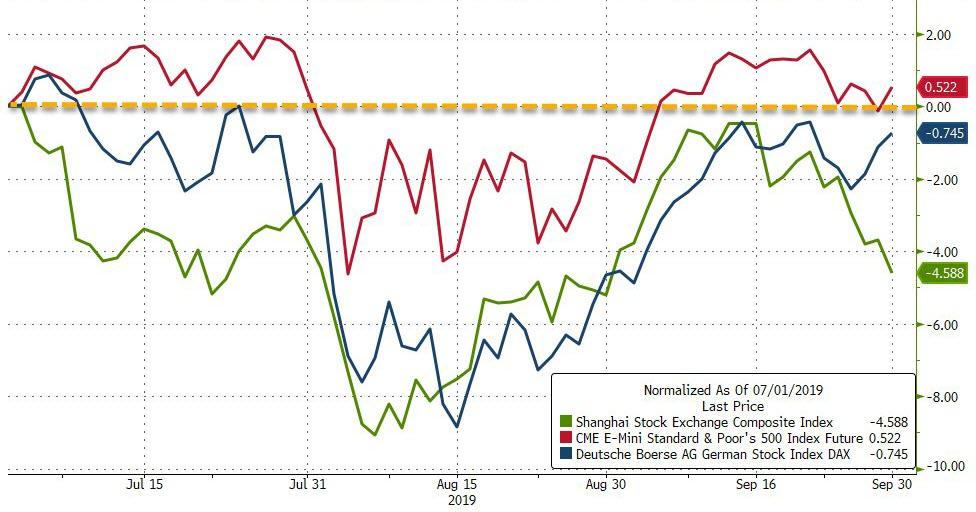

In Q3, US equities scraped out a gain but China and Europe were lower (but we note Europe outperformed US and China in September)…

Source: Bloomberg

Chinese stocks scratched out a very modest gain in September, but fell for the second straight quarter (though the small-cap, tech-heavy ChiNext managed gains in Q3)…

Source: Bloomberg

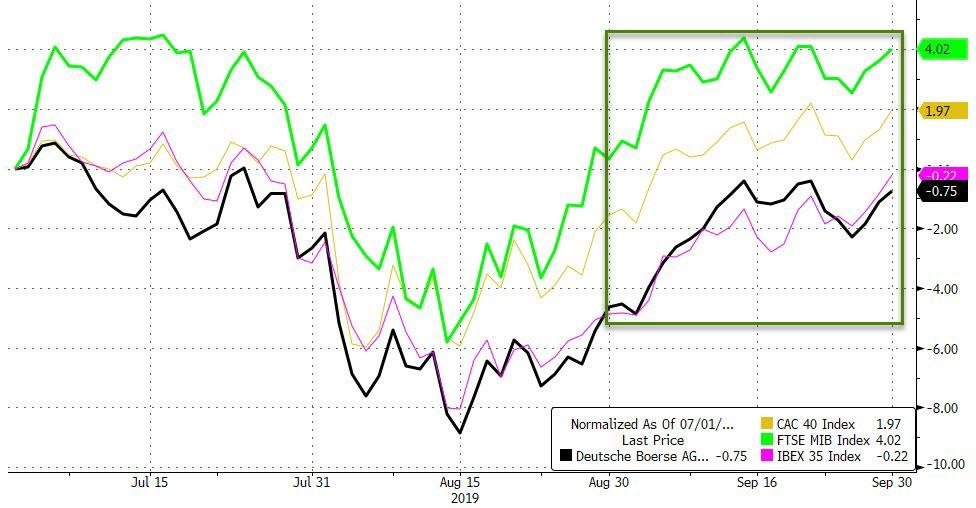

European equities managed gains for the second quarter in a row, led by strong gains in Italy (Germany was down in Q3)…

Source: Bloomberg

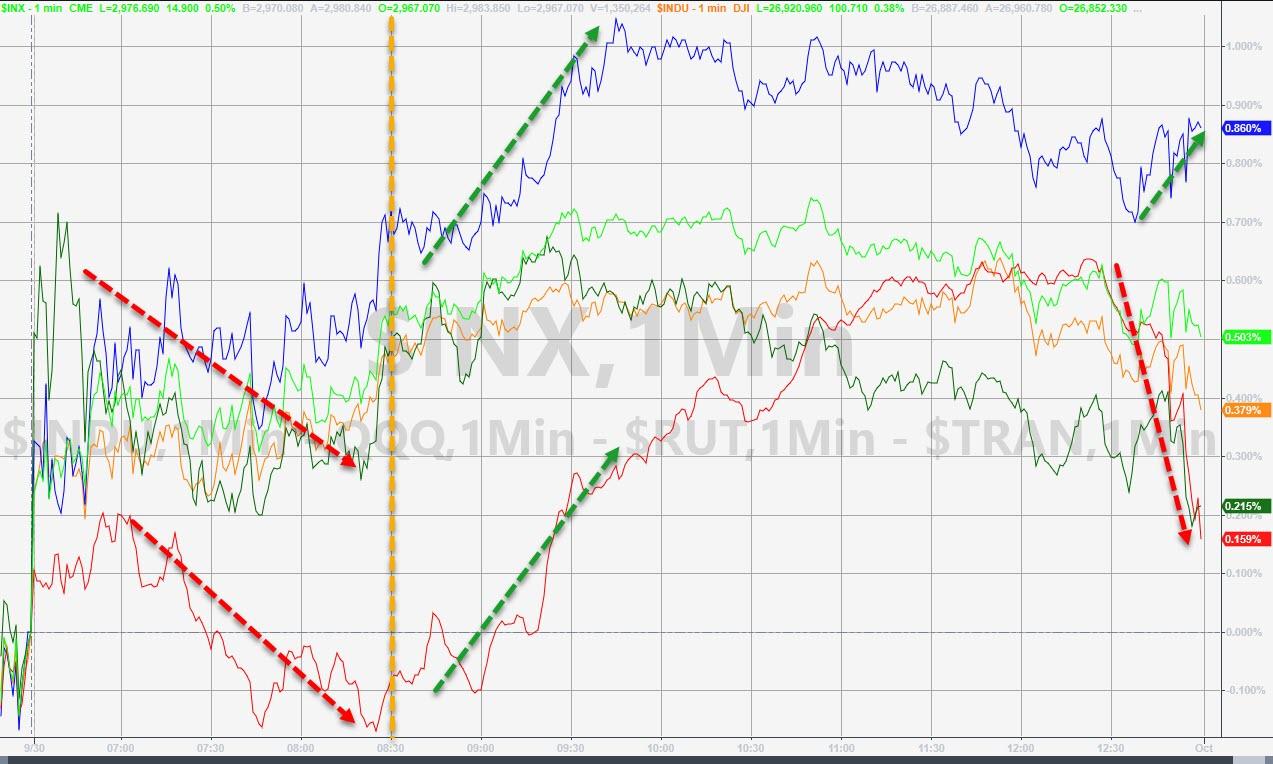

In the US, thanks to a pumpathon today, The Dow and S&P were up for 3rd straight quarter (while Small Caps lagged most)…

Source: Bloomberg

On the month, US equities ended green (barely) with Nasdaq Composite rebounding today, to avoid a second monthly drop in a row…

Source: Bloomberg

US stocks were all higher on the day (month/quarter-end flows?) – ugly close for small caps though

Source: Bloomberg

Despite the quant carnage in momo exposure in September (worst monthly drop since Aug 2009), both value and momo managed modest gains for Q3…

Source: Bloomberg

Q3 gains were dominated by flows into Defensive stocks; Cyclical stocks lost in Q3 (but outperformed in September)…

Source: Bloomberg

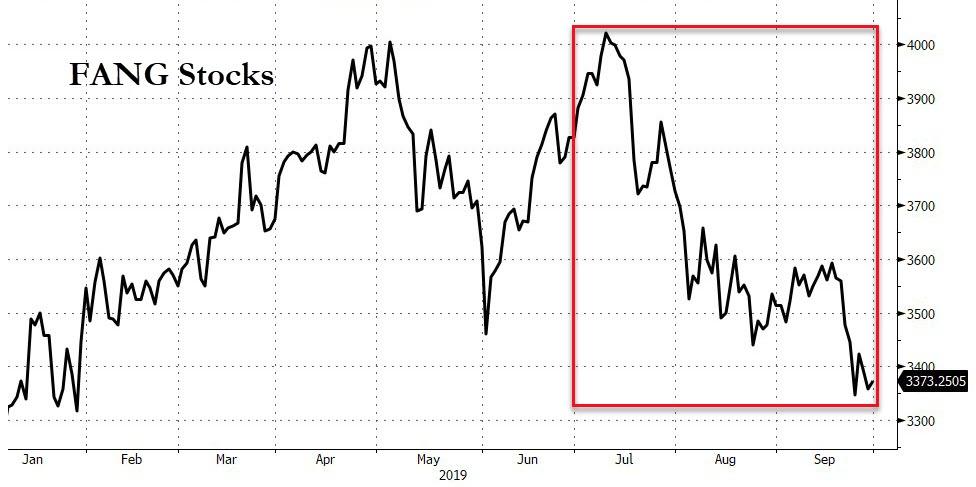

FANG Stocks fell for the 3rd straight month in September, the worst quarterly drop since Q4 2018’s collapse…

Source: Bloomberg

Bonds

US Treasury yields crashed in Q3 (for the 4th straight quarter), dropping the most since Q4 2014…

Source: Bloomberg

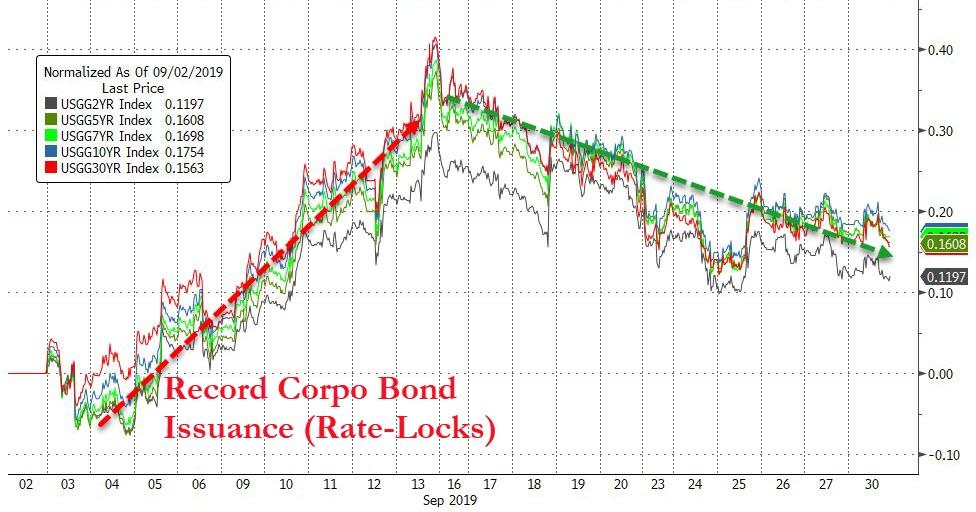

But September saw US Treasury yields rebound notably from August – among the worst months since Dec 2016 (post-Trump Election)…

Source: Bloomberg

Despite steepening dramatically in September (biggest monthly steepening since Nov 2016 – Election), the yield curve collapsed in Q3 (for the 6th consecutive quarter)…and remains notably inverted…

Source: Bloomberg

30Y Yields fell today…

Source: Bloomberg

FX

Q3 was the best quarter for the dollar since Q2 2018…

Source: Bloomberg

The Dollar managed to ramp this week to end higher for the 3rd month in a row (highest monthly close since March 2017)…

Source: Bloomberg

With China closed for Golden Week, the dollar waited until Europe opened to be panic bid…

Source: Bloomberg

Source: Bloomberg

Before we leave currency-land, it’s worth noting that Q3 was an ugly one for cryptos with Litecoin down a stunning 57%…

Source: Bloomberg

September was mixed though with Ethereum and Ripple positive but Bitcoin (3rd monthly drop in a row) and Litecoin notably lower…

Source: Bloomberg

Commodities

Q3 was a big winner for silver (best quarter since Q1 2017) while WTI fell for the 2nd quarter in a row…

Source: Bloomberg

WTI plunged again today, dropping back below the pre-Saudi spike levels…

Source: Bloomberg

Despite a great quarter, September saw Silver suffer its biggest monthly loss since Nov 2016 (election)

Source: Bloomberg

Gold rose for the 4th straight quarter, ending Q3 at the highest since Q1 2013… But September was gold’s weakest month since June 2018 (after 4 straight months higher) after losing $1500 following multiple saves…

Source: Bloomberg

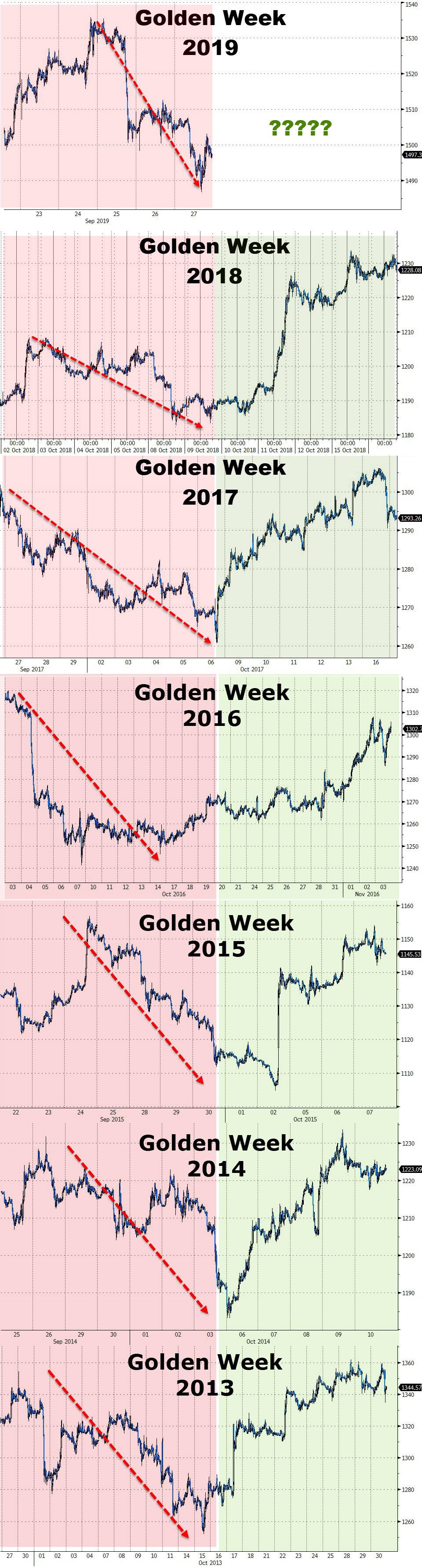

And the recent weakness should not be a surprise… It happens every Golden Week…

Source: Bloomberg

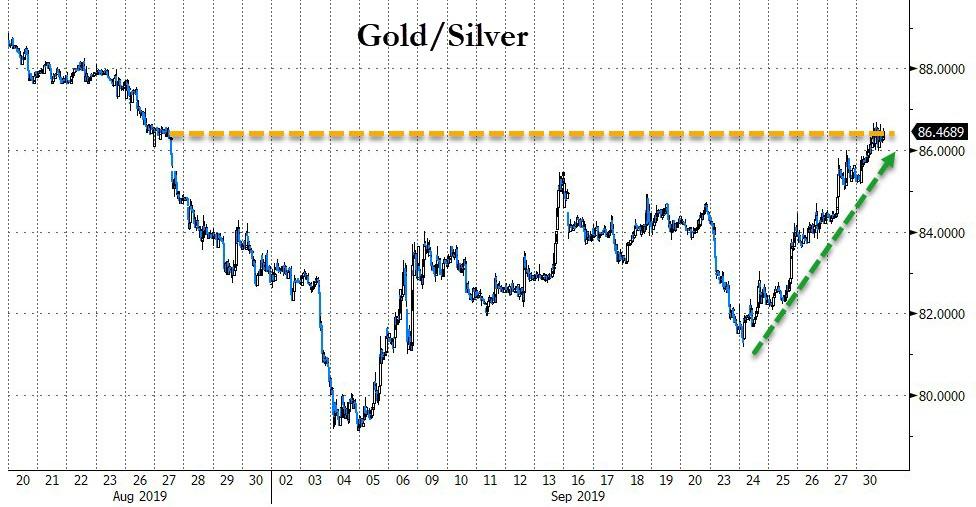

Silver outperformed gold in Q3 by the most since Q2 2016; but after a big drop, gold outperformed silver by the most since Oct 2018 in September…

Source: Bloomberg

Finally, we note that September saw the biggest surge in positive economic surprise data since Jan 2009…

Source: Bloomberg

Don’t forget, stocks are rising on fun-durr-mentals…

Source: Bloomberg

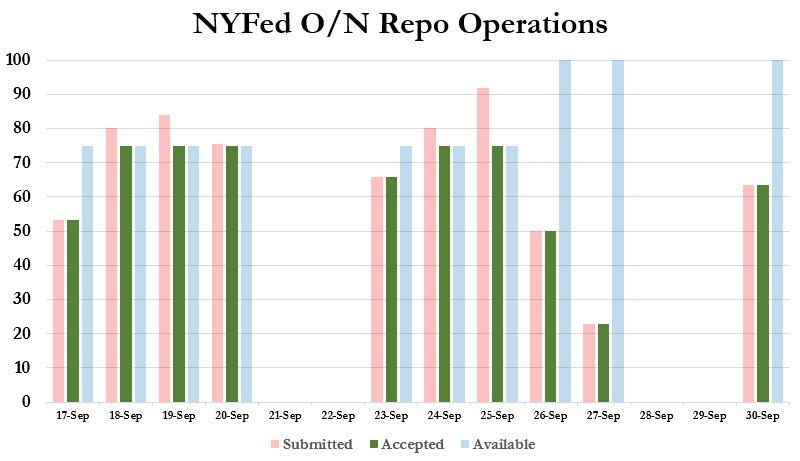

And let’s not forget what The Fed is doing everyday…

“probably nothing”

Tyler Durden

Mon, 09/30/2019 – 16:01

via ZeroHedge News https://ift.tt/2nbnGHn Tyler Durden