The Real ‘Inconvenient Truth’ – Exposing The Wall Street “Beats” Con

Authored by Lance Roberts via RealInvestmentAdvice.com,

Earnings results for the third quarter is fast approaching, and investors are getting excited for the “beat the estimate” game where Wall Street continually lowers estimates so companies can beat them. As I noted previously:

One of the reasons given for the push to new highs was the ‘better than expected’ earnings reports coming in. As noted by FactSet:

“78% have reported actual EPS above the mean EPS estimate…The percentage of companies reporting EPS above the mean EPS estimate is above the 1-year (76%) average and above the 5-year (72%) average.”

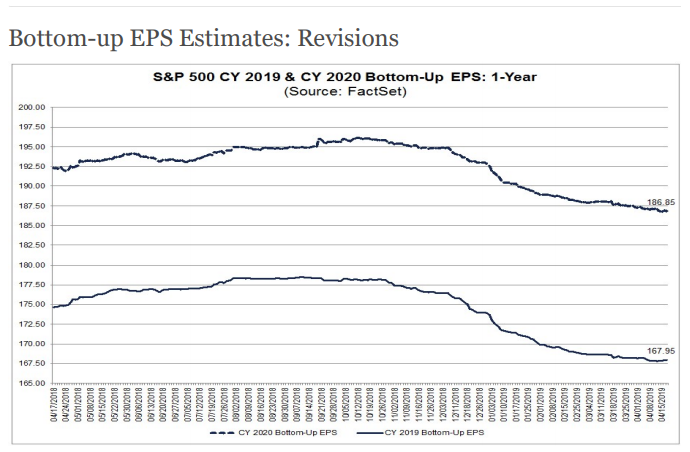

The problem is the “beat rate” was simply due to the consistent ‘lowering of the bar’ as shown in the chart below:

Beginning in mid-October last year, estimates for both 2019 and 2020 crashed.

This is why I call it ‘Millennial Soccer.’

Earnings season is now a ‘game’ where scores aren’t kept, the media cheers, and everyone gets a ‘participation trophy’ just for showing up.

You also can’t turn on financial television, or read a financial website, without the continual droning from a Wall Street analyst about why the markets are destined to go higher, or why you should be buying XYZ stock.

The mainstream press, most financial advisers, and the average investor, unfortunately take this information as “fact,” and use it as a basis for portfolio investment decisions.

But why wouldn’t you?

After all, Carl Gugasian of Dewey, Cheatham & Howe just rated Bianchi Corp. a “Strong Buy.” That rating is surely something that you can “take to the bank,”right?

Maybe not.

For many years, I have counseled individuals to disregard mainstream analysts, Wall Street recommendations, and even MorningStar ratings, due to the inherent conflict of interest between the firms and their particular clientèle. Here is the point:

- YOU, are NOT Wall Street’s client.

- YOU are the CONSUMER of the products sold FOR Wall Street’s clients.

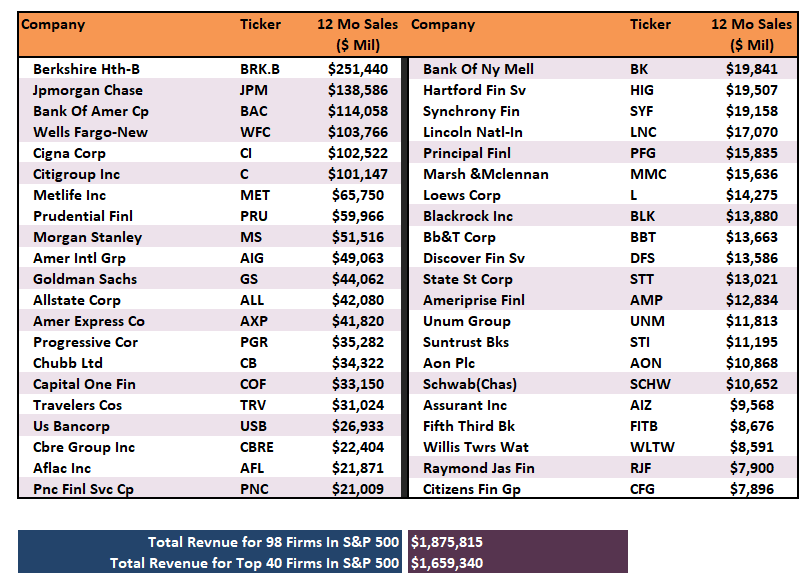

Major brokerage firms are big business. I mean REALLY big business. As in $1.8 Trillion a year in revenue big. The table below shows the annual revenue of 40 of the largest financial firms in the S&P 500.

(The revenue of the 40 largest firms was in excess of $1.65 Trillion, or 88% of the total revenue generated by all 98 financial firms comprising the S&P 500 financial sector.)

Like all businesses, these companies are driven by the needs of increasing corporate profitability, on an annual basis, regardless of market conditions.

The Conflict Arises

When it comes to Wall Street profitability, the most lucrative transactions are not coming from servicing “Mom and Pop” retail clients trying to save their way into retirement.

Wall Street is not “invested” along with you, but “uses you” to generate income.

This is why “buy and hold” investment strategies are so widely promoted. As long as your dollars are invested the mutual funds, stocks, ETF’s, etc, brokerage firms collect fees regardless of what happens in the market. These strategies are certainly in their best interest – just not necessarily yours.

However, those retail management fees are a “rounding error” compared to the really big money.

Wall Street’s real clients are multi-million, and billion, dollar investment banking transactions, such as public offerings, mergers, acquisitions and bond offerings which generate hundreds of millions to billions of dollars in fees for Wall Street each year.

You know, companies like Uber, Lyft, Snapchat, Tesla and WeWork.

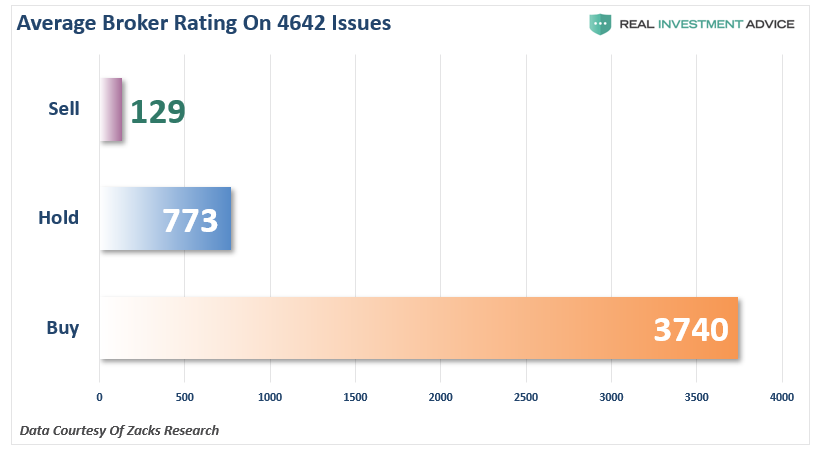

For Wall Street firms to “win” that very lucrative business, they must cater to their prospective clients. Not surprisingly, it is difficult for a firm to gain investment banking business from a company they have a “sell” rating on. This is why “buy” ratings are so prevalent versus “hold” or “sell,” as it keeps the client happy. I have compiled a chart of 4642 rated stocks ranked by the number of “Buy”, “Hold” or “Sell.”

There are just 2.8% of all stocks with a “sell” rating.

Do you believe that out of 4642 rated companies, only 129 should be “sold?”

You shouldn’t.

But for Wall Street, a “sell” rating is not good for business.

The conflict doesn’t end just at Wall Street’s pocketbook. Companies depend on their stock prices rising as it is a huge part of executive compensation packages.

Corporations apply pressure on Wall Street firms, and their analysts, to ensure positive research reports on their companies with the threat that they will take their business to another “friendlier” firm. This is also why up to 40% of corporate earnings reports are “fudged” to produce better outcomes.

As the Associated Press exposed in “Experts Worry That Phony Numbers Are Misleading Investors:”

“Those record profits that companies are reporting may not be all they’re cracked up to be.

As the stock market climbs ever higher, professional investors are warning that companies are presenting misleading versions of their results that ignore a wide variety of normal costs of running a business to make it seem like they’re doing better than they really are.

What’s worse, the financial analysts who are supposed to fight corporate spin are often playing along. Instead of challenging the companies, they’re largely passing along the rosy numbers in reports recommending stocks to investors.“

Where Do You Rank

Still think Wall Street might be looking out for you?

In a study by Lawrence Brown, Andrew Call, Michael Clement, and Nathan Sharp it is clear that Wall Street analysts are not that interested in you. The study surveyed analysts from the major Wall Street firms to try and understand what went on behind closed doors when research reports were being put together. In an interview with the researchers John Reeves and Llan Moscovitz wrote:

“Countless studies have shown that the forecasts and stock recommendations of sell-side analysts are of questionable value to investors. As it turns out, Wall Street sell-side analysts aren’t primarily interested in making accurate stock picks and earnings forecasts. Despite the attention lavished on their forecasts and recommendations, predictive accuracy just isn’t their main job.”

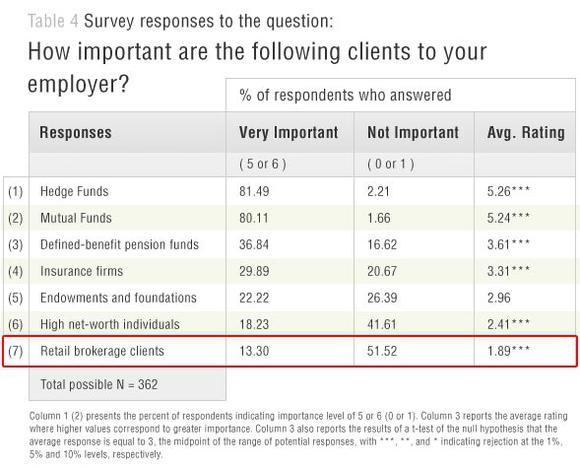

The chart below is from the survey conducted by the researchers which shows the main factors that play into analysts compensation. It is quite clear that what analysts are “paid” to do is quite different than what retail investors “think” they do.

“Sharp and Call told us that ordinary investors, who may be relying on analysts’ stock recommendations to make decisions, need to know that accuracy in these areas is ‘not a priority.’ One analyst told the researchers:

‘The part to me that’s shocking about the industry is that I came into the industry thinking [success] would be based on how well my stock picks do. But a lot of it ends up being “What are your broker votes?”‘

A ‘broker vote’ is an internal process whereby clients of the sell-side analysts’ firms assess the value of their research and decide which firms’ services they wish to buy. This process is crucial to analysts because good broker votes result in revenue for their firm. One analyst noted that broker votes ‘directly impact my compensation and directly impact the compensation of my firm.’”

The question really becomes then “If the retail client is not the focus of the firm then who is?” The survey table below clearly answers that question.

Yep, there you are.

At the bottom of the list.

The incestuous relationship between companies, institutional clients, and Wall Street is the root cause of the ongoing problems within the financial system. It is a closed loop that is portrayed to be a fair and functional system; however, in reality, it has become a “money grab” that has corrupted not only the system but the regulatory agencies that are supposed to oversee it.

Why You Need Independence

So, where can you go to get “real investment advice” and a true consideration of the value of YOUR money?

Thankfully, starting at the turn of the century, the rise of independent, fee-only, financial advisers, private investment analysts, research, and rating firms began to infiltrate the system.

Here is an example of the difference.

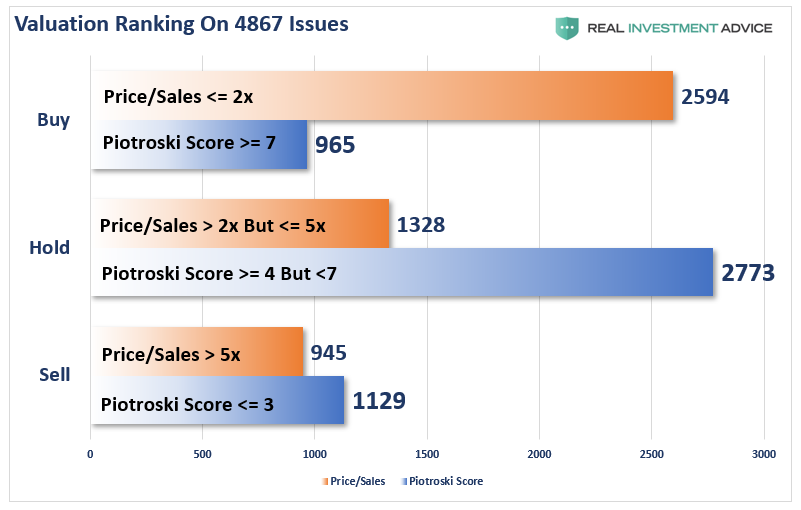

As an independent money manager, I use valuation analysis to determine what equities should be bought, sold or held in client’s portfolios. While there are many measures of valuation, two of my favorites are Price to Sales and the Piotroski f-score among others. I then sorted the entire Zacks Research equity universe of 4867 issues and ranked them by these two measures.

See the difference. Not surprisingly, there are far fewer “buy” rated, and far more “sell” rated, companies than what is suggested by Wall Street analysts.

Here is something even more alarming.

Just after the “dot.com” bust, I wrote a valuation article quoting Scott McNeely, who was the CEO of Sun Microsystems at the time. At its peak the stock was trading at 10x its sales. (Price-to-Sales ratio) In a Bloomberg interview Scott made the following point.

“At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company.

That assumes zero expenses, which is really hard with 39,000 employees.That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate.

Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes.

What were you thinking?

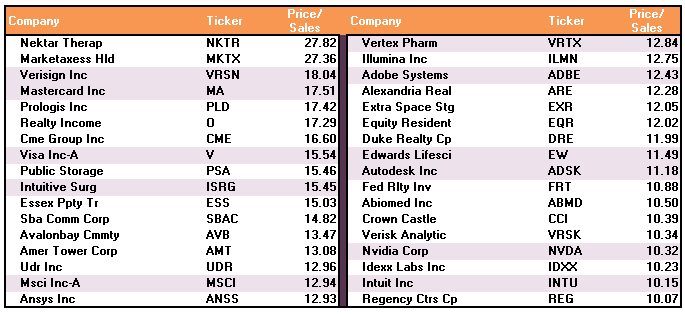

How many of the following “Buy” rated companies do you own that are carrying price-to-sales valuations in excess of 10x?

So, what are you thinking?

As more and more “baby boomers” head into retirement the need for firms that can do organic research, analysis, and make investment decisions free from “conflict,” which are also in the client’s best interest, will continue to be in high demand in the years to come.

This is particularly the case when the next downturn occurs and the dangers of passive ETF indexing and robo-advisors are readily exposed.

Independent advice can help remove those emotional biases from the investing process that lead to poor investment outcomes over time. There are a raft of advisers with the right team, tools, and data, who can spend the time necessary to manage portfolios, monitor trends, adjust allocations, and protect capital through risk management.

The next time someone tells you that you can’t “risk manage” your portfolio and just have to “ride things out,” just remember, you don’t.

Tyler Durden

Mon, 09/30/2019 – 09:30

via ZeroHedge News https://ift.tt/2mmqUaE Tyler Durden