Submitted by Marc Cohodes

I’ve been a short seller for over 30 years. Mostly, I identify companies that are engaged in fraud, illegal conduct, or questionable accounting, I investigate, and I go public with what I’ve learned. I put my money where my mouth is: I sell the shares short knowing that I will lose money if I’m wrong, but also knowing I’ll make money if I’m right. I’ve got a very good track record at uncovering frauds. You don’t have to take my word for it – you can read about me in Bloomberg and elsewhere.

MiMedx is a company that sells wound care treatments made from placentas to patients, many of whom are at veterans hospitals. In 2017, I learned MiMedx was forcing products on its distributors in phony sales (“channel stuffing”), manipulating revenue, selling products that were unsafe or ineffective, coaching doctors on how to charge Medicare for its unnecessary treatments, improperly paying doctors to promote its products, discriminating against employees, and bullying, intimidating, and retaliating against employees who came forward to demand that illegal behavior stop. After I challenged the CEO Pete Petit, management, and the board with the information I had gathered, they responded with more false statements and personal attacks on me.

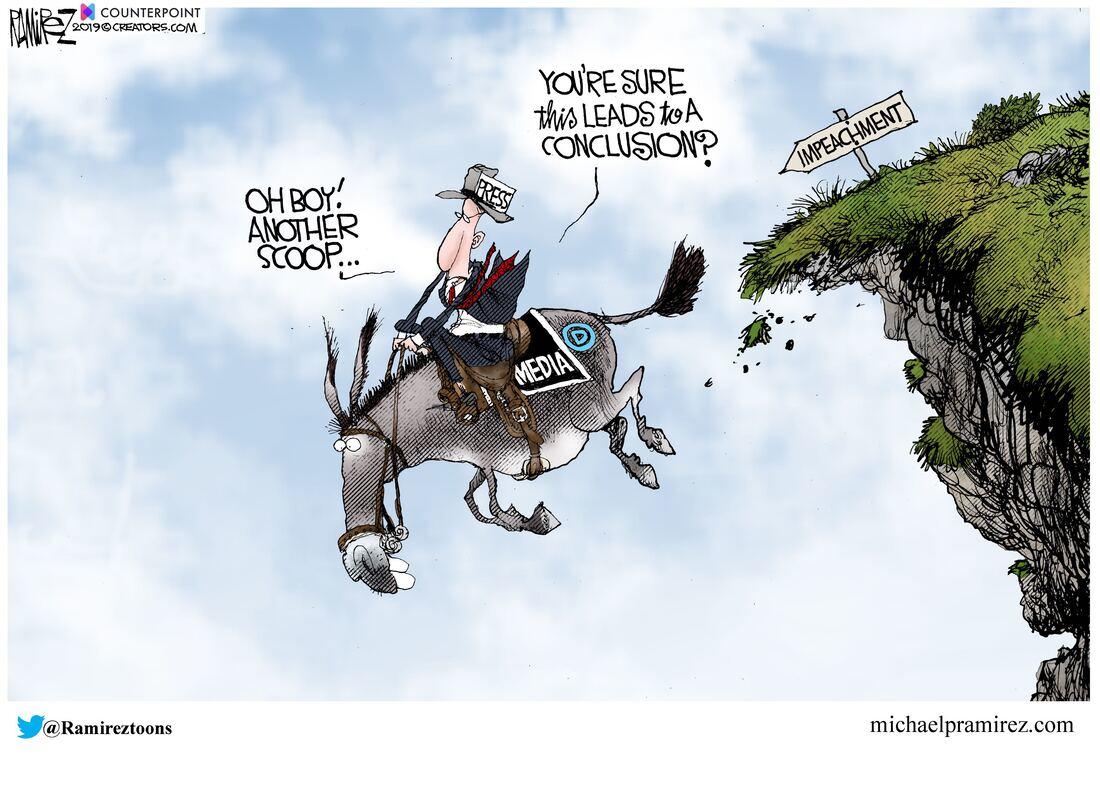

When you expose people who are doing bad things, they often lash out. MiMedx, Petit, company management, and their backers were no exception, and they weren’t the first, either. I expect that and it’s part of the job. But I admit I was surprised to see Joe Nocera and Bloomberg pick up the MiMedx flag on behalf of people trying to make money off of unsuspecting investors, and by doing so, they have neutralized the previous Bloomberg news articles documenting the illegal and unscrupulous conduct at MiMedx.

On August 19 and August 22, Nocera wrote a couple of articles about me and MiMedx. The first article claimed that I was basically wrong about MiMedx, the company wasn’t so bad, and I went too far. The second claimed that the company has now cleaned up its act, but that I am still conducting a “smear campaign” to destroy the company unfairly.

Nocera’s two articles were sloppy, shallow, and consistently wrong. I sent detailed letters pointing out the factual errors, but Bloomberg refused to correct the articles and even refused to publish this Op-Ed piece.

I’m not going to try to correct every mistake Nocera made. There are length limits for Op-Ed pieces, and we are talking about a reporter so careless that he once wrote an entire Bloomberg article headlined “Correction: A Column Based on the Wrong Memo,” and who was reprimanded by The New York Times’s Public Editor for a serious ethical lapse in failing to disclose a conflict of interest. But I’ll point out some of the big mistakes.

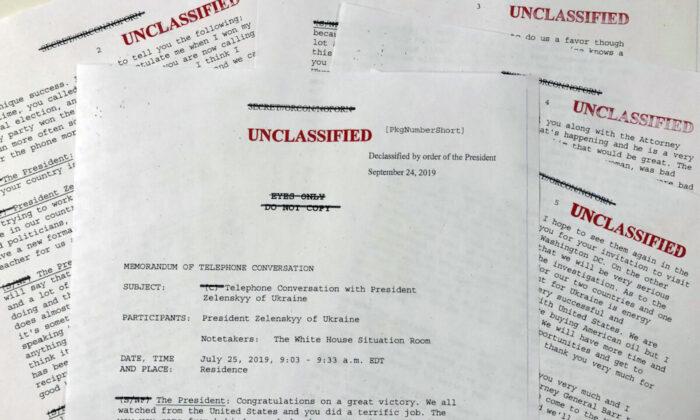

For starters, I was right about MiMedx all along. MiMedx has admitted that six years of financial statements could not be relied on, three VA employees were indicted for taking bribes from MiMedx, the company’s CEO Petit, CFO Senken, COO Taylor, and Controller Cranston all were fired (and the Board is suing them to return their bonuses), MiMedx’s auditors at E&Y abruptly resigned, the stock was de-listed, the Wall Street Journal and Bloomberg reported that MiMedx had lied to the FDA about correcting thirteen health and safety violations; and the VA announced it would stop buying certain MiMedx products because they do not appear to be effective.

On top of all that, in May 2019 the company filed a summary of an independent investigation, which confirmed senior management knowingly deviated from its distributor contracts in ways that caused the company to inflate revenue; the company knowingly manipulated revenue to meet guidance; Petit, Senken, Taylor, and Cranston all made material false statements to the SEC and auditors about the company’s revenue recognition practices; and the company engaged in a pervasive course of retaliation against employees who raised concerns about those unlawful practices.

That’s a lot of evidence you don’t see in Nocera’s articles, yet he opines that I overstated things and it wasn’t so bad at MiMedx. According to him, the company’s investigation “strongly implied” some channel stuffing, but there was “no proof that MiMedx officials had bribed doctors, as Cohodes had alleged. Nor was there any evidence of Medicare fraud.” Likewise, Nocera relies on someone named Eiad Asbahi, who told Nocera “the company’s critics had ‘failed to produce any smoking guns to support their claims of massive fraud.’” (More on the undisclosed relationship between Asbahi and Nocera below.)

Nocera would know better if he read the public summary of the company’s own investigation. That report – in addition to all the really bad stuff I described above – says MiMedx’s lawyers are still investigating allegations that the company violated the Anti-Kickback (a form of bribery) statute, the lawyers have already identified “certain customer accounts that present potential compliance risks and warrant additional review,” the lawyers are still evaluating the company’s “legal risk,” and the company “expects there to be additional departures in connection with the Investigation.”

Nocera would also know better if he read, well, Bloomberg, which reported last year that, “MiMedx Group Inc. paid bribes to three Veterans Affairs Department health-care workers to promote the biotech firm’s products” according to the federal indictment. Nocera also could have read that indictment, which charged the VA employees under the federal bribery statute. Or Nocera could have read the company’s prospectus from May, which discloses that there are still ongoing federal investigations by the SEC, the US Attorney’s Office in the Southern District of New York, the VA Office of the Inspector General, the US Attorney’s Office in the Southern District of Georgia, as well as two separate pending False Claims Act lawsuits, brought by former employees. And then there’s the Bloomberg and WSJ reports that the company lied to the FDA about the safety and efficacy of its products, and the VA’s decision to stop buying them. So yeah, it was really bad at MiMedx, and it’s still really bad.

So, did I go too far, like Nocera says? No. I accused people at MiMedx of doing very bad things, and while the original bad actors are gone, there are still bad actors at the company – and there are still whistleblowers working at the company who say so. Originally, Petit and his cohorts tried to intimidate the brave employees who spoke out, as well as the professional skeptics like me. For example, Petit sued analysts who reported the facts that the company itself has now admitted. Petit boasts about his political connections, and especially to his local Senator Jonny Isakson, and then convinced Isakson to convince the FBI to send agents to my home to try to intimidate me. Actual Bloomberg reporters wrote about Petit’s intimidation attempt and how extraordinary it was. A real journalist would take a dim view of that sort of thing, but Nocera leaves out the details and tells the story like Petit was a victim of a mugging, scared for his own safety (Nocera also never mentions Petit’s secret video surveillance system designed to retaliate against whistleblowers.)

Did I scare off MiMedx’s auditors at Ernst & Young, like Nocera says? Seriously? It’s silly to suggest that an auditor as large and experienced as E&Y would be scared off by a letter I wrote, or that it wouldn’t do its own investigation. But more importantly, the company and E&Y explained why E&Y resigned in an 8-K. E&Y had a disagreement with MiMedx’s (by then fired) senior management. E&Y could not rely on statements by those discredited executives or even statements by their successors, because the new executive team “would have needed to rely on representations from certain legacy management personnel still in positions that could affect what is reflected in the Company’s books and records.” E&Y was out because it realized it couldn’t trust MiMedx, not because I told them – correctly – that MiMedx couldn’t be trusted.

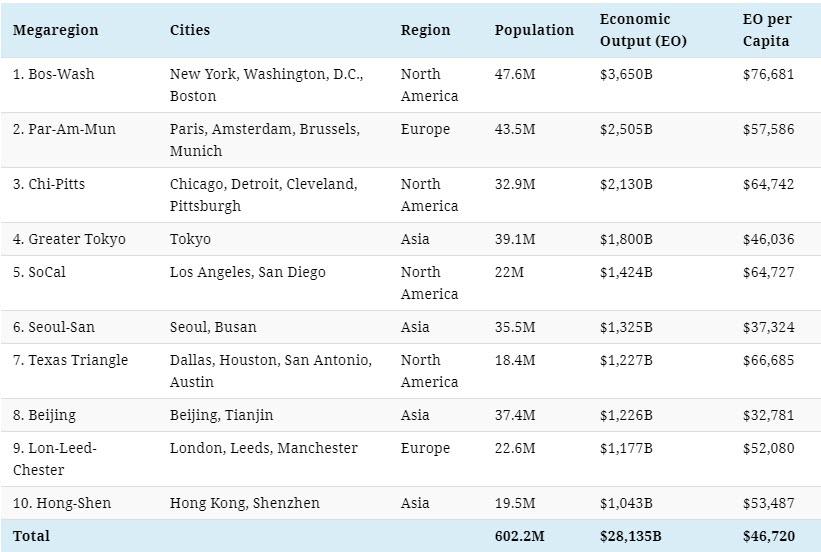

So, is everything fine at MiMedx now? According to Nocera and Asbahi, it is. And who is Asbahi, anyway? Asbahi controls a groups of companies (Prescience Point) that together now own about 7% of MiMedx. Bloomberg readers would want to know there is a relationship between Nocera and Prescience Point. Zach Kouwe is Prescience Point’s public relations agent in matters related to MiMedx. Kouwe previously worked as Nocera’s researcher on a book and co-wrote articles with Nocera at The New York Times (prior to Kouwe’s abrupt resignation in a plagiarism scandal). Journalists are expected to disclose these kinds of relationships, as Nocera knows, since he was criticized for violating them when he was at the Times. Nocera didn’t mention his relationship with Prescience Point’s PR agent, probably because he figured it would interfere with his anti-Marc Cohodes thesis.

So, Asbahi has his own bias, and Nocera has a connection to Asbahi’s firm, but is Asbahi wrong? Yes. Nocera talks about a “research report” Asbahi published in January 2019 that supposedly found that “MiMedx products were ‘legitimate and sustainable’; that it had positive cash flow; and that, while ‘channel stuffing’ to improperly boost revenue at the end of the quarter had taken place, the company’s critics had ‘failed to produce any smoking guns to support their claims of massive fraud.’” Before he wrote his articles, I told Nocera there were many reasons why the Asbahi report was wrong, and I could explain it to him. He wasn’t interested. Here’s what I would have told him.

There are at least four big problems with Nocera’s reliance on the Asbahi report.

One, when Asbahi published it in January, there were no MiMedx financial statements that anyone could rely on. Even in May 2019, E&Y resigned saying it could not rely on the successor CEO and CFO because they were still dependent on unreliable statements by “legacy management personnel.”

Two, at the same time that Asbahi said the company’s products were “legitimate and sustainable” (and it is never a good sign that people feel the need to say that), the company’s regulatory consultant, Lachman Consultants, found that MiMedx had failed to correct thirteen health and safety violations for which the FDA had cited it. Lachman recommended that MiMedx admit its failure to address violations identified by the FDA, but MiMedx refused to do so, and continued to market and sell noncompliant products. The company has now admitted that it falsely told the FDA that it had resolved those defects.

Three, it was premature at best to say there was “no smoking gun” four months before MiMedx’s audit committee released its damning report; but to repeat that statement, three months after the report, is false and misleading to investors. When the company admits that its C-Suite lied to the SEC, it will have to restate six years of financials, its auditor has abruptly resigned, it had a secret surveillance program to punish whistleblowers, it has identified accounts that pose risk for violations of the Anti-Kickback law, and it expects additional terminations as a result of its ongoing internal investigations; and the company’s own consultants find (and the company admits) the company lied to the FDA about correcting safety violations; and there are multiple federal agencies with active ongoing investigations; and there are multiple False Claims Act lawsuits pending; and the VA has stopped buying MiMedx products because there is insufficient evidence they are effective – I’d say the gun is smoking.

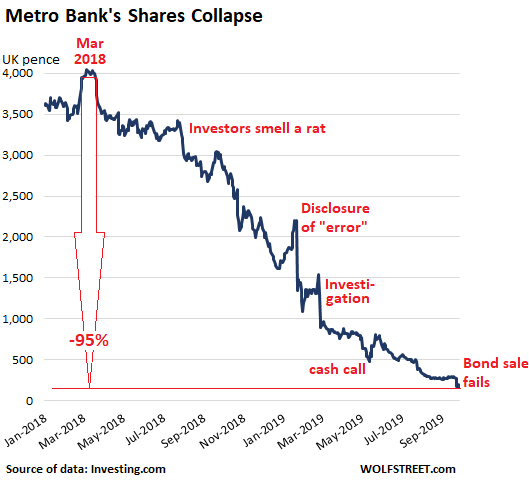

Four, Nocera ignored the suspicious timing of Asbahi’s January 2019 report. Prescience Point purchased millions of shares of MiMedx between August and December 2018, drove the price up with a large block purchase late in the day on December 31, 2018, and then, when the stock had been delisted, published a glowing report saying the stock could exceed $18 per share. Then Prescience Point sold about 2.25 million MiMedx shares in January 2019. When somebody publishes a report that says everything is rosy despite the company’s own disavowal of its prior financial statements, that contradicts what the company’s own consultants were saying about the products’ safety and efficacy, and that contradicts the findings by the company’s own lawyers of widespread unlawful conduct – right before dumping millions of shares – that’s reason alone to be skeptical.

And that brings me to my last point. I’ve been critical of Asbahi and his report, and I have accused Prescience Point of engaging in a “pump and dump” scheme. On behalf of his old colleague’s client, Nocera says that’s “ludicrous.”

So, is it ludicrous? Nope. Nocera ignores the main reasons I actually gave him for concluding this was a pump and dump (like the implausibility of the report, and the timing of Prescience Point’s trades). Instead, he tried to prove that I was way off when I said I understood Prescience Point bought stock at $6-10 per share prior to January 2019. I was right; Nocera was wrong (again). Nocera claims that Prescience Point’s current cost basis for its MiMedx common stock holdings is about $2.60 based on a 13D from May 6, 2019. That may be true, but it’s irrelevant because my point was that in 2018, Prescience Point purchased millions of dollars’ worth of shares on days that the stock traded at prices above $6. (You can see that in the Schedule 14A Prescience Point filed May 29, 2019.) By pumping up the stock in late December 2018 and in January 2019, Prescience Point reduced its losses somewhat when it sold about 2.25 million shares at about $2.50. Then it bought back in at the lower prices reflected in the 13D that Nocera reviewed with his blinders on. As a result, Prescience Point’s current cost basis is lower than what it was in January 2019, but the MiMedx share price has to rise significantly above that cost basis for Prescience Point to realize any gain from its total MiMedx common stock purchases. That’s why it looks to me that Asbahi was engaged in a pump and dump scheme in January, and that’s why I suspect Nocera’s sloppy, poorly researched articles only help Asbahi’s manipulation.

All of this winds up with an accusation by Asbahi, adopted by Nocera, that I am engaged in a “smear campaign” to destroy MiMedx. That’s false. I’m engaged in a campaign to get at the truth about MiMedx, and I’m winning. This company’s troubles are far from over, and with defenders like Nocera and Asbahi, they can only get worse fast.

Marc Cohodes

Penngrove, CA

September 26, 2019