US Stock Futures Levitate, Ignore Bond Market Blowout

In a session market by fireworks in the bond market, stocks were relatively tame and well-behaved as we officially entered the last quarter of the year.

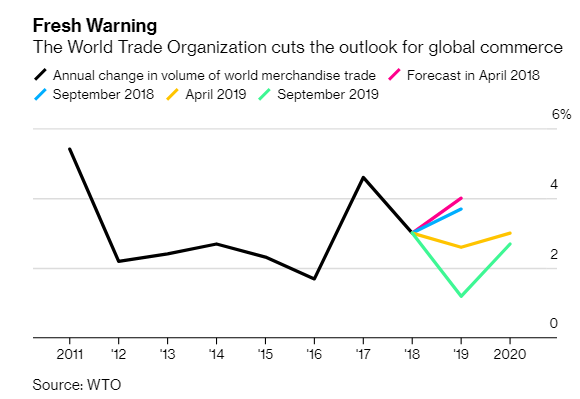

S&P e-mini futures gained on Tuesday as trade talk optimism returned, and ahead of the release of key US manufacturing data as investors looked for fresh signs of domestic demand in the world’s largest economy amid softening global growth. The ISM’s PMI data is expected to show the manufacturing sector rebounded to 50.0 in September after contracting for the first time in 3-1/2 years to 49.1 in August. The US ISM data comes on the heels of euro zone data, which showed manufacturing activity in the bloc contracted at its steepest rate in almost seven years as the global economy flashed clearer warning signs as a wave of data showed manufacturing stuck in a slump, exports falling and sentiment sliding: as the trade war between the U.S. and China rages, industry executives from Japan and Russia to Germany and Italy complained of contracting business, while the World Trade Organization cut its forecast for commerce to the lowest in a decade.

The latest dismal European numbers only added to the gloom for investors facing a laundry list of threats just now, including everything from the drawn-out trade war and Brexit to protests in Hong Kong and an impeachment probe of President Trump; they even barely blinked at the news of the first shot protesters in Hong Kong. Nonetheless, stocks continue to ignore the looming threat in what has been yet another perplexing risk-on start to the week (propelled by more stock buybacks ahead of the blackout period), perhaps because the outcome of each risk seems impossible to predict and the safest assets are looking expensive.

The overnight session started with subdued Asian markets as Hong Kong and China were closed for holidays. Japanese shares rose about 1%, while Australia’s dollar slid after the central bank cut its benchmark interest rate to a record low.

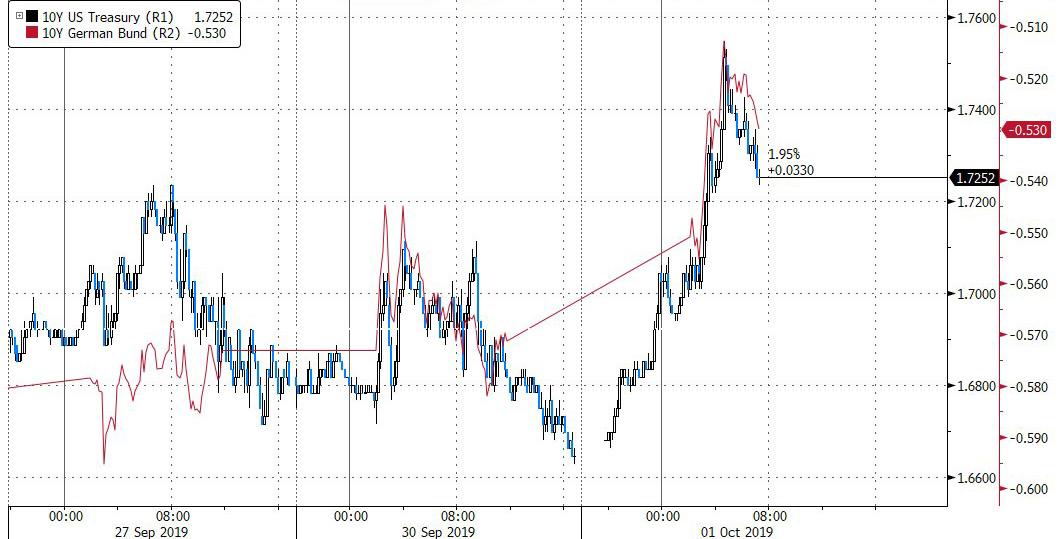

Yet while European stocks slipped amid the disappointing factory and inflation data, global stocks generally ignored the latest dismal manufacturing data, bonds were rather active, and as noted earlier, Japan’s 10Y JGBs suffered the biggest drop since August 2016 on a trifecta of negative developments, following a BOJ warning it would further trim its bond purchases, the GPIF saying it would shift to offshore bond purchases, and the ugliest 10Y bond auction in three years; the violent plunge set off a brief margin call which only made the selloff worse.

Treasuries and bunds then promptly joined the JGB selloff which gradually spread across the world.

The yield on 10-year U.S. bonds headed for the first increase in four days in the wake of the Japanese fiasco.

In FX, the Bloomberg dollar index rose for a second day, while the pound fluctuated as British Prime Minister Boris Johnson prepares to present his blueprint for a new Brexit deal to the European Union.

The Australia dollar tumbled as Australia’s central bank was dragged further into the global easing tide as it cut interest rates for the third time this year, to a new record low, even as it risks refueling excesses that Governor Philip Lowe warned against just weeks ago. The Reserve Bank reduced the cash rate by 25 basis points to a record-low 0.75% and said it may ease even further, venturing deeper into levels where unconventional measures may need to be adopted. The move is in part designed to prevent a rebound in the depreciating currency that might have been triggered if it stood pat while global counterparts eased. “The global race to the bottom is, in a sense, dragging the RBA along,” said Michael Blythe, chief economist at the Commonwealth Bank of Australia. “Failure to participate could see the Australian dollar move higher.”

In other geopolitical news, Chinese President Xi said no force can stop the Chinese people and the Chinese nation forging ahead, must uphold path of peaceful developments. Xi added that the central government would “maintain long-term prosperity and stability of Hong Kong and Macao.”

Gold extended recent declines and West Texas oil climbed.

On today’s calendar, expected data include PMIs and construction spending. McCormick and Stitch Fix are reporting earnings

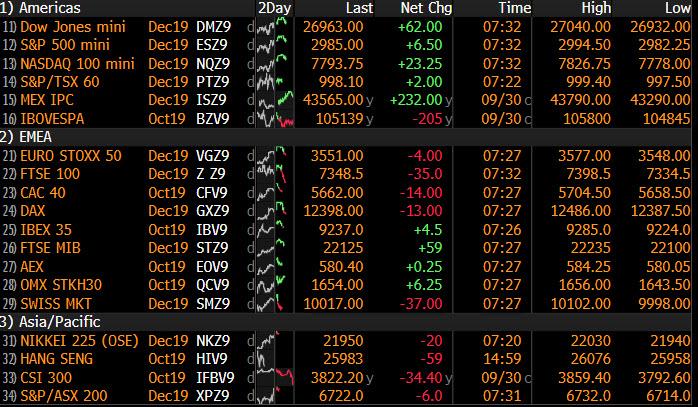

Market Snapshot

- S&P 500 futures up 0.3% to 2,987.25

- STOXX Europe 600 down 0.07% to 392.86

- MXAP up 0.2% to 156.70

- MXAPJ down 0.03% to 501.93

- Nikkei up 0.6% to 21,885.24

- Topix up 1% to 1,603.00

- Hang Seng Index up 0.5% to 26,092.27

- Shanghai Composite down 0.9% to 2,905.19

- Sensex down 1.6% to 38,050.80

- Australia S&P/ASX 200 up 0.8% to 6,742.85

- Kospi up 0.5% to 2,072.42

- German 10Y yield rose 4.5 bps to -0.526%

- Euro down 0.06% to $1.0893

- Italian 10Y yield fell 0.2 bps to 0.484%

- Spanish 10Y yield rose 4.4 bps to 0.189%

- Brent futures down 1.5% to $59.90/bbl

- Gold spot down 0.6% to $1,464.37

- U.S. Dollar Index up 0.1% to 99.50

Top Overnight News from Bloomberg

- British Prime Minister Boris Johnson will present a new plan for a Brexit deal to the European Union within days but there are signs that it may fail. While some purist euro-skeptics in Johnson’s ruling Conservative party are willing to compromise, the Irish government has said his proposals so far for resolving the Brexit impasse are a non-starter

- The euro area’s manufacturing sector slumped in September as German factories experienced their worst month since the depths of the financial crisis. IHS Markit’s index for manufacturing in the euro region came in at 45.7 last month, slightly higher than the initial estimate of 45.6, but still the lowest level since October 2012

- Police shot tear gas volleys at protesters as simultaneous rallies raged across Hong Kong, including a march through the city center, hours after celebrations for a holiday marking 70 years of Communist rule in China began in Beijing

- Gold sank to an eight-week low as investors weighed the impact of a stronger dollar — which traded near the highest level since 2017 — together with unfavorable chart patterns and prospects of renewed, high-level U.S.-China trade talks next week

- Japanese bond traders just had a taste of what it’s like when the nation’s central bank and pension fund aren’t there to support them. Bond futures tumbled by the most since 2016, triggering margin calls for investors, after the worst 10-year debt auction in three years. Yields across the curve climbed, while the sell- off also spilled into Treasuries and European debt.

Asian equities traded higher across the board after Wall Street wrapped up the third quarter with a session in the green ahead of principle-level US-Sino trade talks in Washington next week. In terms of Q3 performance, the S&P and DJIA both advanced for a third consecutive quarter, rising in excess of 1% each, whilst the Nasdaq dipped 0.1% Q/Q. Upside in the ASX 200 (+0.8%) was capped as base and precious metal miners bore the brunt of softer prices, whilst Nikkei 225 (+0.6%) cheered favourable currency moves and largely side-lined the planned sales tax hike which came into effect today. Elsewhere, the KOSPI (+0.5%) conformed to the risk appetite despite South Korean exports declining for the tenth straight month and semi-conductor exports slumping 31.5% Y/Y, albeit inflation metrics fell short of forecasts. As a reminder, Mainland China and Hong Kong markets were closed today due to National Day Holiday, although protests were underway in Hong Kong whilst China celebrated the 70th anniversary of the People’s Republic with a military parade. Finally, 10yr JGB futures were softer amid the risk-sentiment, however downside was more pronounced after the Japanese 10yr auction was received poorly as results showed a bid-to-cover at multi-year lows, which pressured UST and Bund futures in sympathy, Japan Securities Clearing Corporation then said an emergency margin call has been triggered on JGB futures.

Top Asian News

- Japan’s GPIF Positions Itself for More Foreign Debt Buying

- Marubeni Is Said to Sound Out Potential Buyers for Gavilon

- Taiwan Dollar Is a Surprise Winner From U.S.-China Trade War

- Japan Post Favors CLOs for U.S. Loan Purchases Over Mutual Funds

Major European bourses (Euro Stoxx 50 -0.1%) pared initial gains, following a positive AsiaPac lead, where stocks took impetus from a solid Wall Street session and better than expected Japanese Tankan manufacturing data. The FTSE 100 (-0.3%) is a marginal laggard, amid Sterling strength on renewed Brexit deal hopes and after the second reading of September’s Manufacturing PMI data proved not as grim as expected, while Switzerland’s SMI (-0.4%) is also lower amid weakness in some of its heavyweights. Negative ticks were seen across European bourses (although most pronounced in the DAX [-0.1%]) after the second reading of Germay’s Manufacturing PMI data, which although coming in better than expected, confirmed a deterioration in the sector in the month of September. Amid the initially firmer risk tone, defensives (Utilities (-0.3%), Health Care (-0.6%) and Consumer Staples (-0.9%)) are on the back foot while Tech (+0.3%) is in the lead. In terms of individual movers; MediaSet (+1.3%) was buoyed after posting decent earnings. PostNL (-2.7%) sunk on the news that the Co. is to combine its network with Sandd, in a deal worth EUR 105mln. ASML (+1.8%) advanced after the Co. was reiterated buy at UBS. Ryanair (+3.1%) and Air France (+2.7%) both moved higher after the Co’s were upgraded to buy at BAML. Atlantia (-2.3%) after Italy PM Conte said the process to revoke highway concessions is underway.

Top European News

- Euro-Area Manufacturing Slump Deepens in Worst Month Since 2012

- Euro-Area Inflation Slows, Adding to Case for ECB Stimulus Move

- U.K. Mulls Help-to-Buy Future to Avoid Shock End for Developers

- U.K. Factories Extend Slump Even as Brexit Preparations Resume

In FX, it has been a lively start to the new month and Q4 amidst ongoing Greenback strength, but with independent weights exacerbating declines and underperformance. The Aussie rebounded initially after the RBA cut rates by a further 25 bp and inserted a relatively upbeat line in the accompanying statement about a gentle turning point in the economy, but with guidance for further easing retained recovery gains were short-lived and Aud/Usd subsequently slipped below 0.6700, while Aud/Nzd retreated from another test of resistance around 1.0800 even though the Kiwi eventually succumbed to contagion and Nzd/Usd reversed through 0.6250 again to a 0.6220 low following another downbeat NZ business sentiment survey overnight. Meanwhile, the Swedish Krona slumped in wake of a significantly weaker than forecast sub-50 manufacturing PMI that was compounded by a downward revision to the previous month, and its Scandinavian counterpart has fallen in sympathy as Norway’s manufacturing sector only just escaped contraction and decelerated sharply from almost 54.0 in August. Eur/Sek has tested 10.8000 following a breach of technical resistance circa 10.7742 and Eur/Nok rallied beyond 9.9550 from lows of around 9.9080 and just below 9.8850 at one stage on Monday.

- USD – The Dollar continues to prosper, partly at the expense of others, but also as US Treasury yields rebound and curves re-steepen with some extra impetus via Fed’s Evans advocating a policy pause after the 2 insurance cuts administered in July and September. Accordingly, the DXY has forged a fresh ytd high and breached 99.500 in the process, at 99.590, eyeing the Markit PMI, ISM and more Fed speakers for further direction.

- CHF/CAD/JPY – The Franc has also bowed to disappointing Swiss macro news in the form of retail sales and deeper manufacturing PMI recession, with Usd/Chf up through parity and Eur/Chf crossing 1.0900 even though the single currency is struggling to cope with the aforementioned broad Buck advance and its own frailties. Elsewhere, the Loonie is still pivoting 1.3250 and awaiting Canadian GDP and/or Markit’s manufacturing PMI for extra inspiration, while the Yen appears more attuned to the latest gains in UST yields rather than a post-auction plunge in JGB futures that triggered emergency Japanese SCC margin calls. Indeed, Usd/Jpy has extended gains above 108.00 towards 108.50, with upside chart levels at 108.43 (Fib) and 108.48 (September’s peak) proving tough to break convincingly, thus far.

- GBP/EUR – Relative G10 outperformers, or at least putting up a fight against the Greenback with the aid of an unexpected bounce in the UK manufacturing PMI and a steady pan Eurozone final print thanks to a German upgrade from the dire preliminary reading. However, Cable is still not making much headway beyond 1.2300 and Eur/Usd has waned just above 1.0900, with the former down through the 55 DMA (1.2279), Fib support (1.2271) and a late September base before the Brexit re-stocking PMI recovery and latter having another close look at bids at 1.0880 that are protecting a deeper retracement to 1.0864 (strong Fib support).

- EM – Blanket losses vs the Greenback, and with sub-50 manufacturing PMIs across the region, bar Turkey, not helping, as the Lira loses more ground amidst rebounding oil prices and further investor disenchantment with the Finance Minister’s latest grand economic plan.

- The RBA cut its cash rate by 25bps to 0.75% as expected. RBA reiterated that it is reasonable to expect that an extended period of low interest rates will be required in Australia to reach full employment and achieve the inflation target. RBA added “A gentle turning point, however, appears to have been reached”. The Central Bank noted the low level of interest rates, recent tax cuts, ongoing spending on infrastructure, signs of stabilisation in some established housing markets and a brighter outlook for the resources sector should all support growth, but repeated that the Board will continue to monitor developments, including in the labour market, and is prepared to ease monetary policy further if needed to support sustainable growth in the economy, full employment and the achievement of the inflation target over time.

In commodities, the crude complex is consolidating, with both benchmarks having found support around their 12 September lows around USD 54.00/bbl for WTI and USD 59.00/bbl for Brent respectively, following yesterday’s steep declines which were exacerbated by bearish supply signals re. Saudi Aramco’s recovery to full output. News flow on the Middle Eastern geopolitical front has been light, although reports that Iran has sentenced one person to death for spying for the US could be providing some support to the complex. However, further details regarding who the person is and what the wider implications, if any, may be are scant. Elsewhere, amid continued constructive risk tone and possible technical selling after it convincingly lost its grip on the USD 1500/oz handle yesterday, Gold continues to move lower. The fall in Gold prices comes despite continued escalations in protestor/police tensions in Hong Kong, as markets more broadly remain seemingly unperturbed by developments for now. Meanwhile, Copper futures remain unable to derive support from the more constructive risk tone, and have extended on their overnight declines after broking below short-term resistance around USD 2.572/lbs.

US Event Calendar

- 8:50am: Fed’s Clarida Makes Brief Remarks at AI Conference

- 9:30am: Fed’s Bowman Speaks at Community Banking Conference

- 9:45am: Markit US Manufacturing PMI, est. 51, prior 51

- 10am: ISM Manufacturing, est. 50, prior 49.1

- 10am: Construction Spending MoM, est. 0.5%, prior 0.1%

- Wards Total Vehicle Sales, est. 17m, prior 17m

DB’s Jim Reid concludes the overnight wrap

Welcome to Q4 and only 85 days until Xmas. Craig has just published the Sept/Q3/YTD performance review. Q3 ended up being relatively positive for global assets with 29 of our 38 asset sample finishing with a positive total return although only 14 did so in dollar adjusted terms owing to the stronger greenback. September saw 23 out of 38 (22 in dollar terms) higher and reversed a tough August where only 18 of the 38 saw positive returns (14 in dollars). See Craig’s full review here .

I am on an advisory board for a research centre at the University of Warwick where I studied Economics (the no.1 place in the UK to study it according to last week’s Sunday Times). It’s called CAGE (Competitive Advantage in the Global Economy) and has published many interesting pieces over the years helping to shape policy and debate. However on a more fun theme it has very recently been associated with a report that debunked an old assertion that winning the lottery doesn’t make you happy. It’s been in a lot of newspapers over the last few days with the new research suggesting (using a much bigger sample than earlier work on this topic) that it absolutely does make you happier and the bigger the better. This made me smile as our new house was commissioned over a hundred years ago by someone that won a small lottery in the UK around the time of WWI. However much of the infrastructure (windows, plumbing, electrics, drainage etc.) hadn’t been touched since and as such I now feel like I’ve lost a lottery renovating it. However I’m blissfully happy living there so I can confirm that spending money you don’t have can also make you very happy – well at these interest rates it can.

One part of the world that’s not very happy at the moment is the global manufacturing sector and today brings the final PMIs/US ISM on this front with Europe’s numbers the most important. Ahead of that, the Chicago PMI yesterday wasn’t indicative of strong activity. Indeed the 47.1 reading for September compared to expectations for an even 50.0 and the print represented a decline of 3.3pts from August. Yesterday’s number tied for the third worst reading in this cycle although it did hit as low as 44.4 in July, although that means the three-month average is just 47.3. More concerning were some of the details though with the employment component at 45.6 which means the quarterly average of 44.1 is the lowest since Q4 2009. Our US economists also made the point that the ISM adjusted for the Chicago PMI was 46.2 and the lowest since 2009.

This comes ahead of today’s September US ISM manufacturing report. A reminder that the August reading fell into contractionary territory at 49.1 for the first time since August 2016. The consensus today is for a slight rebound back to 50.0 and our US economists expect a 50.8 reading. The Chicago number is a worry though.

Ahead of the European PMIs remember that the flash Euro Area reading fell to just 45.6 while Germany hit 41.4. France also only just stayed in expansionary territory at 50.3. We’ll also get a look at the non-core with Italy expected to print at 48.1, while here in the UK the consensus expects a 47.0 reading.

So a rare chance to focus on the data following what feels like nothing but politics for the past few weeks. As for markets, the partial walk back over the weekend of the US restricting capital to China story helped the S&P 500 and NASDAQ to gains of +0.50% and +0.75% respectively last night. Markets got a further boost after Peter Navarro said that the reports about capital controls were “inaccurate.” He’s one of the biggest China hawks in the White House, so his denial carries more weight. On the impeachment front, there weren’t any major new developments, though President Trump’s personal lawyer Rudy Giuliani was subpoenaed by the House Intelligence Committee. Our economists did note, that amid the heightened political noise, the Baker, Bloom, Davis economic policy uncertainty index has risen to 6-year high. Meanwhile, overnight the New York Times reported that President Trump pushed the Australian prime minister during a recent telephone call to help Attorney General William P. Barr gather information for a Justice Department inquiry that Trump hopes will discredit the Mueller investigation.

This morning in Asia markets are largely up in thin trading as Chinese and Hong Kong markets are closed. The Nikkei (+0.76%), Kospi (+0.53%) and ASX (+0.09%) are all higher. Elsewhere, futures on the S&P 500 are up +0.41% while yields on 10yr JGBs are up +5.6bps to -0.170% as a 10yr note auction saw the weakest demand since 2016 in the wake of a steady cutback in bond purchases by the BoJ. Yields on 10Y USTs are also up +3.6bps this morning. As for overnight data releases, Japan’s final September manufacturing PMI came out in line with the initial read of 48.9 while the Q3 Tankan survey results were largely better than expected. Meanwhile, South Korea’s September manufacturing PMI came in at 48.0 (vs. 49.0 last month) while CPI came in at -0.4%yoy (vs. -0.3%yoy expected) and exports printed at -11.7%yoy (vs. -9.6%yoy expected) with imports standing at -5.6%yoy (vs. +0.8% yoy expected).

In terms of markets, Europe also had a good day yesterday with the STOXX 600 (+0.35%) rising to its highest closing level in more than 16 months. It was a quiet quarter end for bond markets with 10y Treasuries and Bunds little changed by the end of play although Treasuries did rally a couple of basis points after that Chicago PMI data. Meanwhile, the dollar rallied (+0.27%; up a further +0.11% this morning) to its strongest level in 29 months, to the disadvantage of both oil (-1.83%) and gold (-1.59%).

Meanwhile on Brexit, Irish broadcaster RTE reported overnight that the UK has proposed customs checks five to 10 miles away from the Irish border with PM Johnson likely to present his plans to Brussels later this week. The Irish finance minister has already responded to the reports and said this plan would be a “non-starter”. The Daily Telegraph reported late last night that PM Johnson will unveil his detailed Brexit plan to EU leaders within the next 24 hours. The report added that the plan is expected to be based on the creation of an all-Ireland “economic zone” which would allow agricultural and food products to move between Ulster and the republic without checks at the border, and on customs the plan is expected to rely on technology and “alternative arrangements,” such as trusted-trader schemes and exemptions for small businesses. Elsewhere, the Times reported that PM Johnson is likely to ask the EU to rule out a further extension as part of a new Brexit deal. Assuming there is a deal agreed which still appears a Herculean effort, this would force MPs to back this deal or risk crashing out with no deal. It would put pressure back on the MPs desperate to avoid no deal. However to get to such a scenario remains a very big ask.

Moving to fiscal, late yesterday Italy released its new budget outlook document which sets a target for a 2020 deficit at 2.2% of GDP and aims to boost growth to 0.6%. This means that the structural deficit will worsen by 0.1pp next year, instead of the 0.6pp improvement that Italy had committed to, while debt will rise to 132.5% in 2019 and start declining only slowly in the following years. Finance Minister Roberto Gualtieri wrote in the outlook document that ”The debt rule would not be satisfied in any of its configurations. But the reduction in the debt-to-GDP ratio in 2022 compared to the previous year would be significant, at 2.2 percentage points.”

In other news, the overnight speech by Chinese President Xi fell shy of delivering any remarks on trade and instead focused on national unity and Xi reiterated the commitment towards China’s complete unification. Meanwhile, Japan’s planned sales tax hike to 10% from 8% takes effect today.

Back to yesterday where the other US data release was the September Dallas Fed manufacturing survey which nudged down to 1.5, albeit slightly better than the consensus for 1.0, but still down 1.2 points. Meanwhile in Europe the data included German retail sales, which were in line with expectations at 0.5% mom, though the previous figures were revised up meaningfully. Also, the German unemployment rate stayed steady at 5.0%, while Italy’s jobless rate fell to 9.5%, its lowest level since 2011, though almost all of the most recent decline was due to declining labour force participation rates rather than higher employment.

Looking at the day ahead, the focus this morning will be on the aforementioned PMIs while other data releases in Europe include September house prices data in the UK and September CPI for the Euro Area. In the US this afternoon we’ve got the September ISM manufacturing, manufacturing PMI and August construction spending. Later today we’re also expecting September vehicle sales. Away from the data we’re due to hear from the Fed’s Evans this morning at a Bundesbank conference while later this afternoon Clarida and Bowman will speak. We’ll also hear from the Bundesbank’s Weidmann this evening.

Tyler Durden

Tue, 10/01/2019 – 08:08

via ZeroHedge News https://ift.tt/2nu7rFx Tyler Durden