Breakdown

Authored by Sven Henrich via NorthmanTrader.com,

I’ll aim to do a proper technical update this weekend, but wanted to share some thoughts on this market breakdown this week. I’ll focus on the big picture here not on the intra-day action.

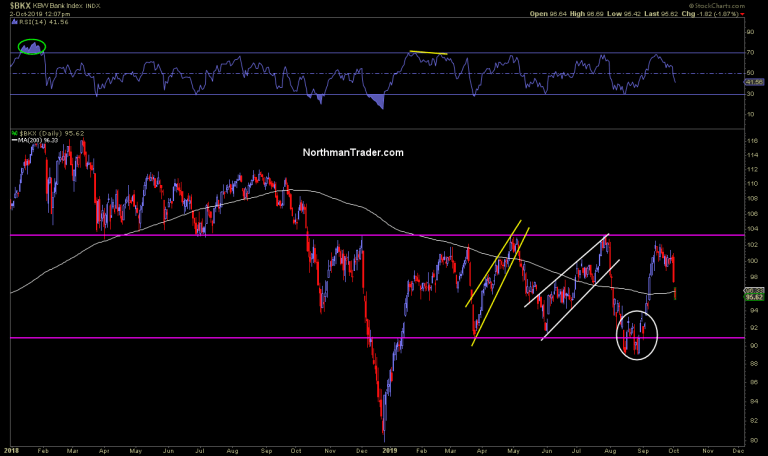

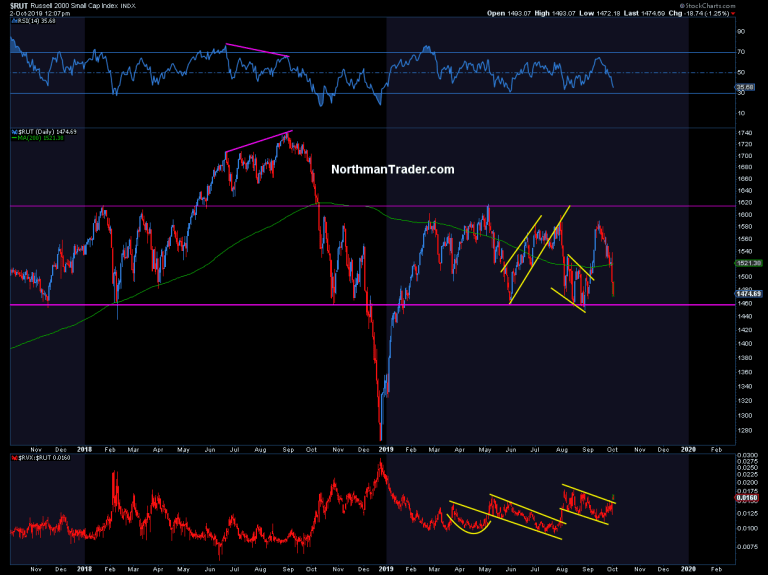

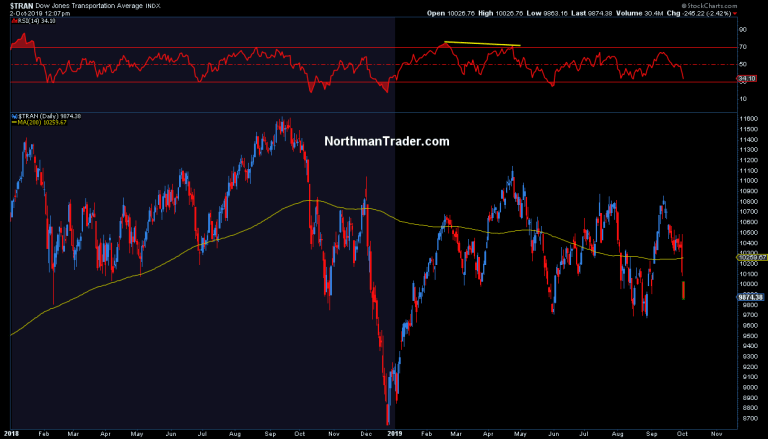

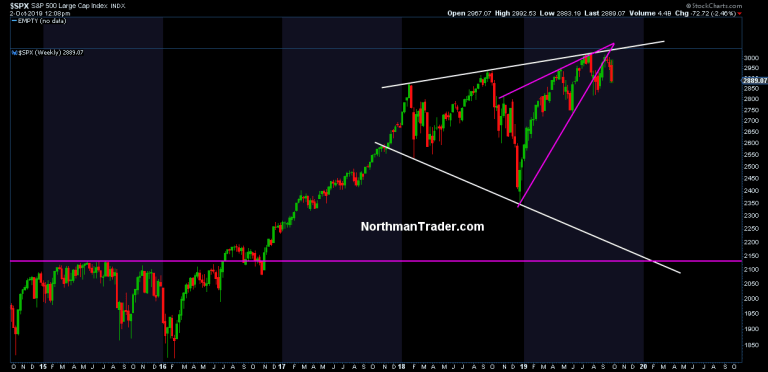

Look, markets are a journey, the bigger picture versus the daily noise. If you are familiar with my work I’ve been harping about building risks to markets for months. We’ve outlined the Sell Zone 3000 – 3050 at the end of June which produced an over 200 handle drop into August, I pointed toward the 2019 trend break and highlighted that the September rally may simply have been a back test of the trend. I suggested that for a rally to convince small caps, banks and transports needed to break above resistance. They never did, the bounces were once again sold. I mused about a replay to 2018 (strength in September being a selling opportunity) as so many technical factors were lining up similarly. But I also made clear upside risk persisted but the sell zone once again took hold and I pointed toward a renewed $VIX breakout setting up.

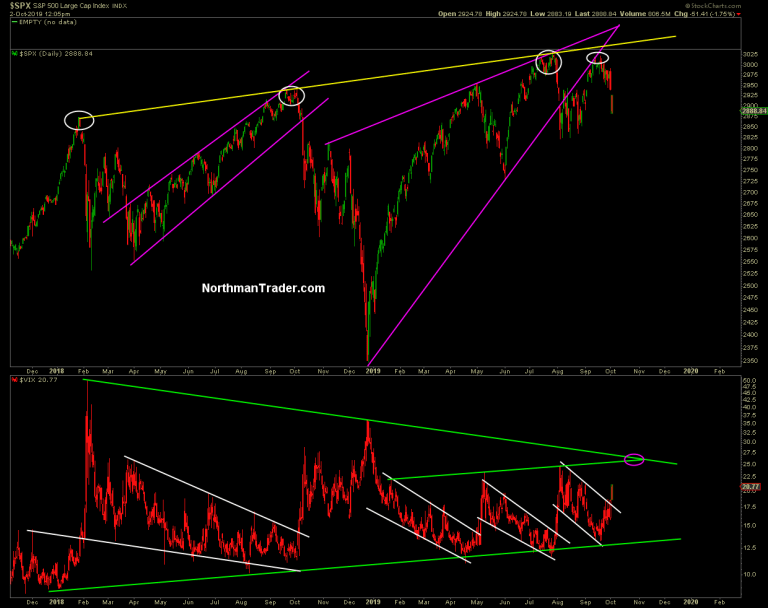

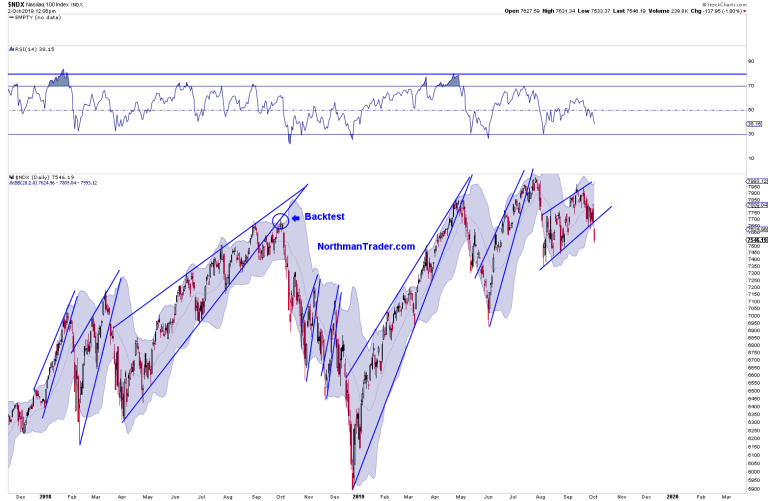

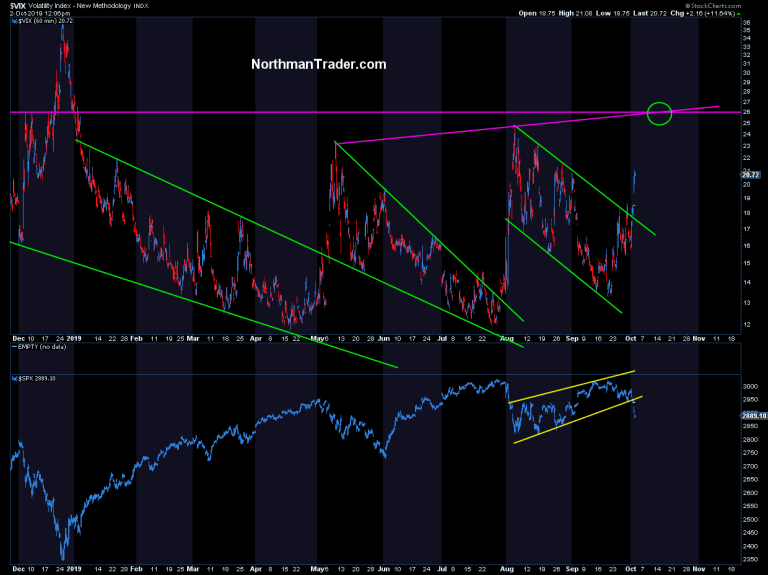

Making a bear case in a bullish environment is never easy, but of course when you have trade optimism and central banks rate cuts galore it is especially hard, but once again technicals cut through the noise. But now we got the breakdown and the $VIX breakout:

With the weaklings completely breaking down again, but staying still inside their ranges:

Key facts:

-

All new highs have been sold forming a very clean resistance trend.

-

The 2019 uptrend was broken in August.

-

In September the break was backtested and failed to recapture the trend.

-

Worse: $SPX made a lower high versus July while volatility has formed another potential bullish pattern that could target the 25-28 area.

-

Such a spike may set up for a buyable market dip for a year end rally.

-

But no new lows have been made yet either and so markets remain in tradable ranges.

-

But note this market continues to fail to make to make sustained new highs, lacks participation and remains at risk of a sizable reversion.

-

Without a substantive trade deal result that will bring about lasting confidence and will inspire companies to expand capex and business investment recession risk is rising rapidly.

-

Get such a trade deal then markets can look toward a substantive rally into Q4. But a potential interim deal may not be enough beyond a temporary sugar high rally.

-

The global slowdown is real and risk continues to rise.

Here’s my general view on all this now:

Markets need to see earnest progress during the October 10 trade negotiations or are at risk that the deteriorating macro data will spill over into the consumer.

Markets have ignored weakening data all year and have lived on multiple expansion only driven by the central bank put and continued trade optimism.

But now we’ve seen macro data matter as worsening manufacturing data seems to show a building manufacturing recession globally and markets have finally shown sensitivity to the macro data.

I highlighted some of this in my interview today on CNBC:

This breakdown is happening despite 2 rate cuts by the Fed and dozens of rate cuts by central banks across the globe.

As a matter of fact each time the Fed has cut rates this year markets have sold off, which brings us to the question of efficacy. As of now there is precious little evidence that central bank easing is producing a growth spurt.

Now Q3 earnings will show negative EPS growth making real progress on the trade front absolutely essential, because without it confidence will be further shaken.

Companies are facing deteriorating profit margins and employment growth has been slowing and it appears only a matter of time before margin compression will spill into the labor market as companies hold back in hiring or, worse, will begin to commence reduction in work forces.

Hence key to watch for Q4 are:

-

Trade progress

-

Earnings reports

-

Consumer confidence

-

Labor market

For now we’re in the middle of an apparent repeat of 2018, a rally into September OPEX, early October sell-off, that script was advertised in Replay in early September.There is risk of a double top with far reaching consequences as the big megaphone structure remains in play and has not been invalidated:

But the broken trend backtest has clearly failed.

Bottomline: Markets, despite all the noise, respect technicals as the action has unfolded per the technical view we presented. Now markets are getting short term very oversold and bounces will of course be part of the make up. A substantive trade deal next week may be a must for these markets to make sustained new highs to avert last year’s script and while an interim deal or easing of tariffs may produce sizable relief rallies, the alternative, no deal, no progress, may be too much for this market to bear, especially as it has run on hopium as opposed to substance. Central bank rate cuts have so far resulted in selloffs and given continuing declining data trends central bank efficacy must be questioned. Indeed, let me highlight this: The fact we’ve made a lower high on a second rate cut by the Fed should make everyone ponder. More this weekend…

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

Tyler Durden

Wed, 10/02/2019 – 17:55

via ZeroHedge News https://ift.tt/2o03lVV Tyler Durden