Auto Loans Stretch To Eight Years To Accommodate Irresponsible Car Buyers

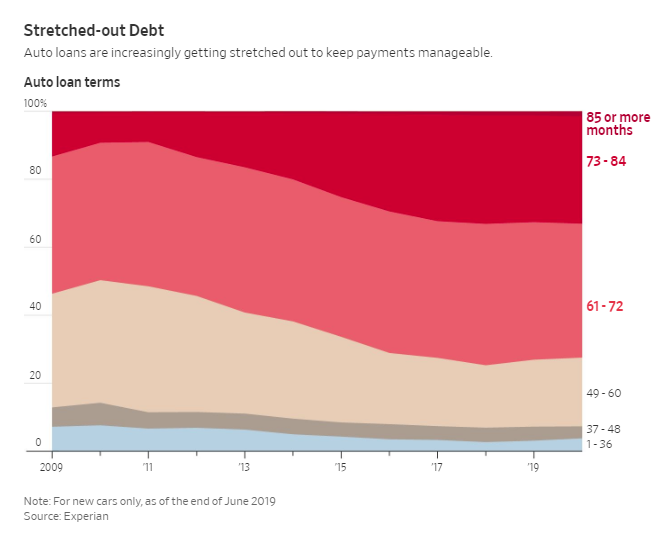

About a third of all US auto loans issued today are stretching out to seven years, according to the Wall Street Journal. By comparison, a decade ago, the seven-year loan only made up about 10% of all loans.

Why? Because that’s the only type of loan increasingly more Americans can afford to amortize.

The longer loan durations are a clear sign that the American middle class is growing broker by the day, and, as we pointed out in our recent article about millennials putting items like sneakers and sweaters on installment plans, the US consumer’s creeping debt burden is, among other things, the result of auto prices growing rapidly while real incomes have barely budged. It is also the result of little to no financial education piled on top of a pathological shopping addiction.

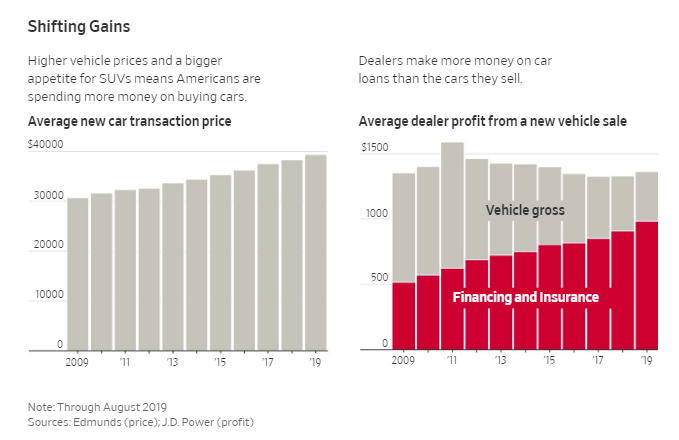

Despite so-called hedonic adjustments, new safety and technological features being included with vehicles, like larger and more intricate multimedia displays, have made even the most basic vehicles unaffordable… without the help of debt that is. And of course, in true debt-laden American fashion, broke consumers are also drifting towards higher priced vehicles, like SUVs.

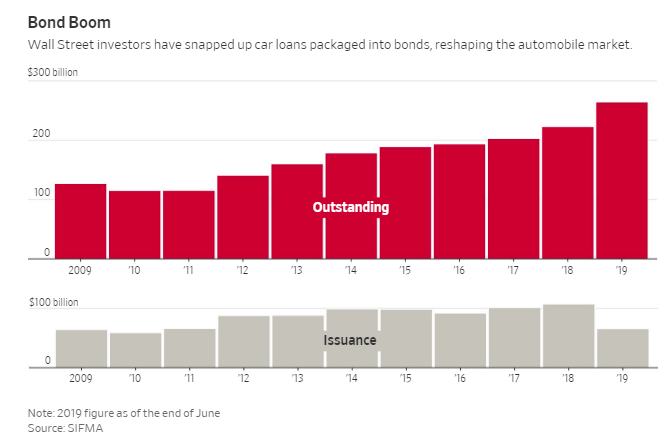

Meanwhile, as already cash-starved Americans seek ever-larger loans, the yield-starved Wall Street machine has responded to demand for vehicle loans in style: investors have been snapping up longer-term loans which are ultimately bundled into bonds and various structured products, allowing buyers to take out loans with a 7 and even 8 year term. In fact, dealers are at the point where they make more money on the loans than on the cars that they sell.

Meanwhile, the seven-year loan creates the illusion of affordability for many Americans, due to its longer amortization term and “smaller” monthly payment. It has also helped fuel car purchases that never would’ve happened with more traditional car term loans like three, five or six years.

Thanks to this menu of loans, Bronson Argyle, a professor at Brigham Young University said: “People can get into very expensive cars. Households are taking on, on average, more risk.”

Take Deven Jones: he walked into his local Honda dealership in early 2017 and walked out with a gray Honda Accord with heated leather seats. He wound up taking out a 72 month loan that cost him more than $500 a month. He had initially taken out the loan with his girlfriend, but when they split up, the monthly payment became his sole responsibility.

And despite paying $27,000 for the car, Jones took out a $36,000 loan with an interest rate of 1.9% to cover not only the purchase price, but debt on two other vehicles he had bought as a teenager. Why a teenager (!) would need to buy not one but two cars was not explained, even though that’s precisely the core issue here.

We probably don’t have to explain why so many Americans have to resort to debt just to buy a car: the reason is simple – only 18% of US households have enough liquid assets to cover the cost of a new car. The median income US household with a four year loan, 20% down and a payment under 10% of gross income – a fairly standard budget – can afford a car worth $18,390, excluding taxes.

And yet, that is only about half the size of the average new car loan over the last decade, which has grown to about $32,100 as car prices have risen. To make payments more manageable, the industry hasn’t lowered prices, why should it – instead, it has simply added more and more months to the end of auto loans.

As a result, the average loan now stretches for about 69 months, which is a record. In the first half of 2019, 1.5% of auto loans for new vehicles had terms of 85 months – 7 years – or longer. Just five years ago, these 8 or 9 year loans were “practically nonexistent”.

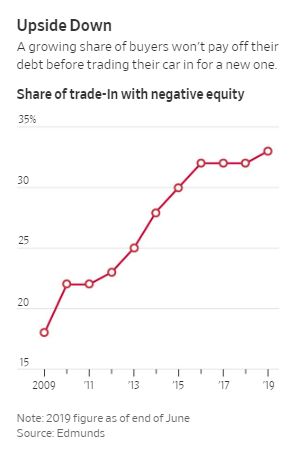

All this means is that more car buyers won’t pay off the debt before they trade in their car for new ones. About 33% of new car buyers who trade in their cars rollover debt from old vehicles into their new loans, according to Edmunds. That is up from about 25% before the financial crisis.

Understandably, auto debt has exploded since the financial crisis. US consumers now hold a record $1.3 trillion of debt tied to their cars, which is nearly double from $740 billion a decade ago.

As usual, we have the Fed to thank for this latest debt bomb. Even though the industry’s rebirth after the global financial crisis took place at a time when consumers didn’t have much cash to go car shopping, lower interest rates made it much easier to finance vehicles. This put buyers into showrooms and Wall Street was encouraged to buy the loans, as treasuries were heading towards 0%. The combination of low interest rates and investors looking for yield helped bring the auto industry back to life.

In other words, this is all the Fed’s fault, as lower rates served as a second type of bail out for the entire auto industry.

Last year, investors bought $107 billion in bonds backed by car loans, the first issuance record since 2005 and nearly triple the amount it bought two decades earlier. The outstanding pile of auto bonds has swollen to a record $264 billion.

This year, dealerships are making an average of $982 per new vehicle on financing versus $381 per vehicle on the sale. A decade earlier, financing brought in $516 per car and the sale made dealers $837.

The article explained how the debt enslavement process works, noting that financing companies spend extravagant resources focused solely on collecting:

Westlake Services LLC is among the biggest. Its owner, billionaire Don Hankey, started lending four decades ago when, as a dealer, he realized subprime buyers needed somewhere to get their financing. Westlake is still focused on these borrowers, but it has pursued more creditworthy customers as it has grown in recent years.

Much like a dealership, the company is obsessed with results. An automated system sends emails to employees with an image of a winking robot when they are late to work, unproductive or exceed expectations. Workers get monthly bonuses based on how they stack up against their goals. Screens around the office display auto loan applications as they come in.

Westlake needs to make sure the monthly payments on its auto loans keep flowing. Late borrowers can expect calls from the company immediately. Roughly 40% of its employees focus exclusively on collecting.

Some dealerships like Earl Stewart Toyota in North Palm Beach, Florida, walk each customer through every add-on before offering them financing. But Petrov Degan, the dealership’s financing manager, said he has seen other finance managers quote prices where the add-ons are already included. This is known as “packing the payment” in the industry.

Outside of the industry, it’s known simply as conning people.

Jose Mercado is an example of another customer who has overspent. He spent six months doing research on the Toyota RAV4 he wanted to buy, but ultimately was convinced by the dealership’s finance manager to take on $100 a month more in loans by buying options.

“I wish my research would have been deeper to be more ready,” he said, after falling victim to the hard sell.

You can read the Wall Street Journal’s full longform article here.

Tyler Durden

Wed, 10/02/2019 – 21:55

via ZeroHedge News https://ift.tt/2oAQiu7 Tyler Durden