Coddled By Monetary Manias – A Millennial’s Myopic View Of The Market

Authored by Michael Lebowitz and Jack Scott via RealInvestmentAdvice.com,

“Those who cannot remember the past are condemned to repeat it.” – George Santayana

Current investors must be at least 60 years old to have been of working age during a sustained bond bear market. The vast majority of investment professionals have only worked in an environment where yields generally decline and bond prices increase. For those with this perspective, the bond market has been very rewarding and seemingly risk-free and easy to trade.

Investors in Europe are buying bonds with negative yields, guaranteeing some loss of principal unless bond yields become even more negative. The U.S. Treasury 30-year bond carries a current yield to maturity of 2.00%, which implies negative real returns when adjusted for expected inflation unless yields continue to fall. From the perspective of most bond investors, yields only fall, so there’s not much of a reason for concern with the current dynamics.

We wonder how much of this complacent behavior is due to the positive experience of those investors and traders driving the bond markets. It is worth exploring how the viewpoint of a leading investor archetype(s) can influence the mindset of financial markets at large.

Millennials

The millennial generation was born between the years 1981 and 1996, putting them currently between the ages of 23 and 38. Like all generations, millennials have unique outlooks and opinions based on their life experiences.

Millennials represent less than 25% of the total U.S. population, but they are over 40% of the working-age population defined as ages 25 to 65. Millennials are quickly becoming the generation that drives consumer, economic, market, and political decision making. Older millennials are in their prime spending years and quickly moving up corporate ladders, and they are taking leading roles in government. In many cases, millennials are the dominant leaders in emerging technologies such as artificial intelligence, social media, and alternative energy.

Their rise is exaggerated due to the disproportionately large baby boomer generation that is reaching retirement age and witnessing their consumer, economic, and political impact diminishing. An additional boost to millennials’ influence is their comfort with social media and technology. They are digital natives. They created Facebook, Twitter, Snapchat, Instagram, and are the most active voices on these platforms. Their opinions are amplified like no other generation and will only get louder in the years to come.

Given millennial’s rising influence over national opinion, we examine their experiences so we can better appreciate their economic and market perspectives.

Millennial Economics

In this section, we focus on the millennial experience with recessions. It is usually these trying economic experiences that stand foremost in our memories and play an important role in forming our economic behaviors. As an extreme example, anyone alive during the Great Depression is generally fiscally conservative and not willing to take outsized risks in the markets, despite the fact that they were likely children when the Depression struck.

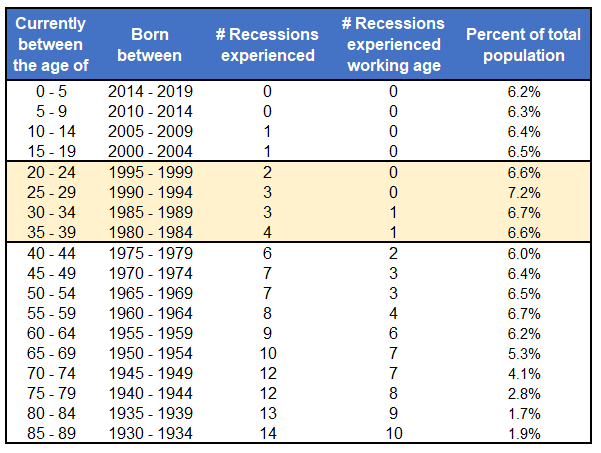

The table below shows the number of recessions experienced by population groupings and the number of recessions experienced by those groupings when they were working adults, defined as 25 or older.

Data Courtesy US Census Bureau – Millennial Generation 1981-1996

About two-thirds of the Millennials, highlighted in beige, have only experienced one recession as an adult, the financial crisis of 2008. The recession of 1990/91 occurred when the oldest millennial was nine years old. More Millennials are likely to remember the recession of 2001, but they were only between the ages of 5 and 20.

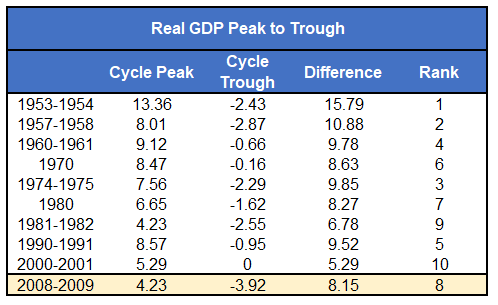

Unlike most prior recessions, the recession of 2008 was borne out of a banking and real-estate crisis. Typically, recessions occur due to an excessive buildup in inventories that cause a slowing of new orders and layoffs. While the market volatility of the Financial Crisis was disturbing, the economic decline was not as severe when viewed through the lens of peak to trough GDP decline. As shown in the table below, the difference between the cycle peak GDP growth and the cycle trough GDP growth during the most recent recession was only the eighth largest difference of the last ten recessions.

Data Courtesy St. Louis Federal Reserve

One of the reasons the 2008 experience was not more economically challenging was the massive fiscal and monetary stimulus provided by the federal government and Federal Reserve, respectively. In many ways, these actions were unprecedented. When the troubles in the banking sector were arrested, consumer and business confidence rose quickly, helping the economy and the financial markets. Although it took time for the fear to subside, it set the path for a smooth decade of uninterrupted economic growth. A decade later, with the expansion now the longest since at least the Civil War, the financial crisis is a fleeting memory for many.

The market crisis of 2008 was harsh, but it did not last long. It is largely blamed on poor banking practices and real-estate speculation issues that have been supposedly fixed. Most Millennials likely believe the experience was a black swan event not likely to be repeated. One could argue there’s a large contingent of non-millennials who feel likewise. Given the effectiveness of fiscal and monetary policy to reverse the effects of the crisis, Millennials might also believe that recessions can be avoided, or greatly curtailed.

Half of the millennial generation were teenagers during the financial crisis and have few if any, memories of the economic hardships of the era. The oldest of the Millennials were only in their early to mid-20s at the time and are not likely to be as financially scarred as older generations. In the words of Nassim Taleb, they had little skin in the game.

No one in the millennial generation has experienced a classical recession, which the Federal Reserve is not as effective at stopping. With only one recession under their belt, and minimal harm occurring as a result of their relatively young age, recession naivete is to be expected from the millennial generation.

Millennial Financial Markets

As stated earlier, the dot com bust, steep equity market decline, and the ensuing recession of 2001 occurred when the millennial generation was very young.

The financial crisis of 2008-2009 occurred when millennials were between the ages of 12 and 27. More than half of them were teenagers with little to no investing experience during the crisis. Some older Millennials may have been trading and investing, but at the time they were not very experienced, and the large majority had little money to lose.

What is likely more memorable for the vast majority of the generation is the sharp rebound in markets following the crisis and the ease in executing a passive buy and hold strategy that has worked ever since.

Millennial investors are not unlike bond traders under the age of 60 – they only know one direction, and that is up. They have been rewarded for following the herd, ignoring the warnings raised by excessive valuations, and dismissing the concerns of those that have experienced recessions and lasting market downturns.

Are they ready for 2001?

The next recession and market decline are more likely to be traditional in character, i.e. based on economic factors and not a crisis in the financial sector. Current equity valuations argue that a recession could result in a 50% or greater decline, similar to what occurred in 2008 and 2001. The difference, however, may be that the amount of time required to recover losses will be vastly different from 2008-2009. The two most comparable instances were 1929 and 2001 when valuations were as stretched as they are today. It took the S&P 500 over 20 years to recover from 1929. Likewise, the tech-laden NASDAQ needed 15 years to set new record highs after the early 2000’s dot com bust.

Those that were prepared, and had experienced numerous recessions were able to protect their wealth during the last two downturns. Some investors even prospered. Those that believed the popular narrative that prices would move onward and upward forever paid dearly.

Today, the narrative is increasingly driven by those that have never really experienced a recession or sharp market decline. Is this the perspective you should follow?

Summary

“Those who cannot remember the past are condemned to repeat it.”

We would add, “those who remember the past are more likely to avoid it.”

The millennial generation has a lot going for it, but in the case of markets and economics, it has lived in an environment coddled by monetary policy. Massive amounts of monetary stimulus have warped markets and created a dangerous mindset for those with a short time perspective.

If you fall into this camp, you may want to befriend a 60-year old bond trader, and let them explain what a bear market is.

Tyler Durden

Wed, 10/09/2019 – 09:39

via ZeroHedge News https://ift.tt/2ASY3OS Tyler Durden