First Rule Of QE Club, Don’t Call It QE

Submitted by Mark Orsley, head of macro strategy at PrismFP

- Fed makes the full dovish pivot – deeper rate cuts and asset purchases coming – cycle end in sight

- Emboldens long duration and tactical curve steepener calls – 2s10s can now steepen

- UER hits cycle lows but AHE reversal is more troublesome – initial signs of layoffs

It’s safe to say the Fed has capitulated. After a (super) brief stint in “neutral” that put the uptrend in Eurodollars at risk just a week or two ago Fed officials have fully pivoted back to dovish after the dreadful ISM data last week.

With regards to rate cuts, first was the Evans flip flop we discussed last week and then the mother of all hawks, Rosengren, even flipped on Friday:

Evans – now indicating rate cuts once again:

THEN -> Sept 30th: “After rate cuts, the Fed should leave policy on hold for some time”

NOW -> Oct 3rd: “ISM was a confirmation of FOMC view and I am concerned; open minded about the October meeting”

Oct 8th: “Could well be reasons for another 25bps cut; wouldn’t mind another cut”

Rosengren – downgrading growth and turning open minded (monumental shift):

THEN -> Sept. 20th: “additional accommodation is not needed”

NOW -> Oct 4th: “open minded on monetary policy; data is coming out weaker than expected; I thought growth would be 2% but I’d now say it looks closer to 1.7%”

With regards to the balance sheet, we then had Clarida give us the first indication that “don’t call it QE” was coming back:

Clarida:

Oct 3rd: “we will discuss balance expansion in October”

Then Powell put any and all question to bed where the Fed is taking monetary policy:

Powell:

Oct 8th: “As we indicated in our March statement on balance sheet normalization, at some point, we will begin increasing our securities holdings to maintain an appropriate level of reserves. That time is now upon us.”

Note, Powell specifically references the growth of “currency in circulation” as the reason for “don’t call it QE.” CiC (currency in circulation) would equate to a meager $8-9b/month of purchases. Not very meaningful, but the signaling back to “don’t call it QE” is significant. Let’s see what the actual purchases amount will be at the Oct meeting. If it’s more than $9b/month, then the Fed is clearly adding additional liquidity due to the economic slowdown.

In the Q&A, Powell took it to the next level, BOJ style.

Powell:

Oct 8th: “Short-term yield curve control is something worth looking at when the time comes”

The YCC comment should not shock us. Brainard warned us this was on the Fed’s radar back in May:

Brainard:

May 8th: “Another idea I would like to hear more about involves targeting the yield on specific securities so that once the short-term interest rates we traditionally target hit zero, we might turn to targeting slightly longer-term interest rates”

Lastly on the Fed, the largest question in my mind has been how the Fed will respond to rising inflation pressures (stemming from the supply side – ie: the wrong type of inflation) in the face of slowing growth (stagflation). Powell tidied this up nicely yesterday:

Powell:

Oct 8th: “tariffs are a one-time increase in prices and is different from inflation”

That means they will write off any inflationary pressure as “tariff transitory” which is important in front of the CPI report tomorrow. Therefore, don’t short the fixed income market or put on downside if we get CPI beats this quarter. The Fed will still cut as adding supply side inflation to the end of a cycle where wages were already compressing profit margins is economically damaging.

All the above Fed commentary leads us to a few very important points:

- This is not a mid-cycle adjustment – the Fed has tried to spin it that way since July but all the rhetoric above speaks of a deeper cutting cycle (as well as the forward looking data, more on that below)

- The Fed essentially just ended the cycle – this is the start of the eventual move to sub 1% rates “for long” and asset purchases.

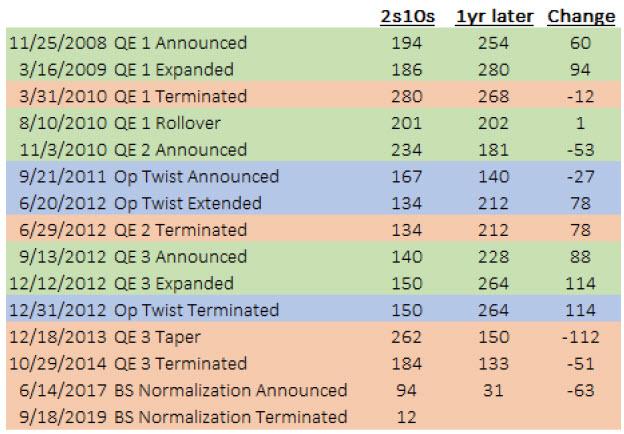

- End of cycle means steeper curves – in this case, the curve steepener gets further emboldened with “reserve management” QE which is really a precursor to eventual LSAP (and who knows maybe even ultra issuance?). As you can see here, every time a QE program gets announced, rolled over, or expanded; one year later the curve is steeper…

- 2s10s steepener is now in play – we have discussed 5s30s recently as a way to avoid the massive coming bill supply but the Fed just said its going to focus purchases on bills which will finally allow short end spreads like 2s5s, 2s10s to steepen

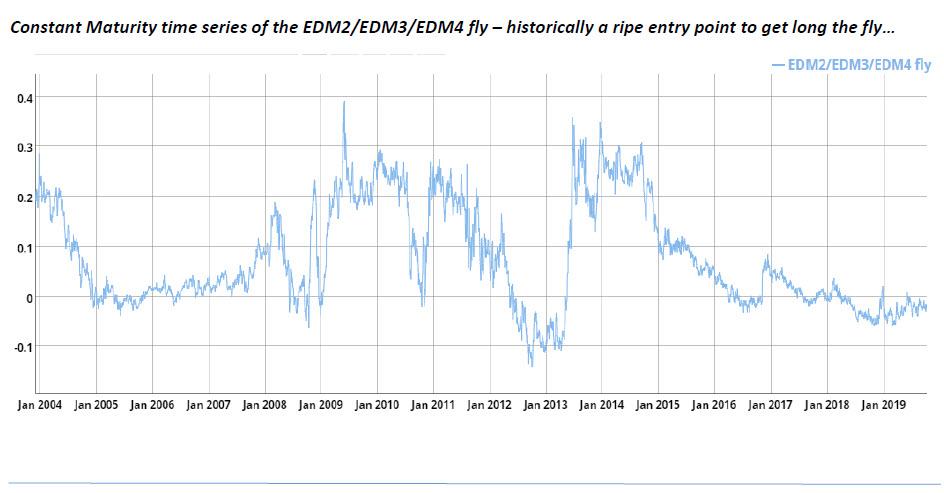

- Although the curve can steepen initially, it won’t steepen out as far as past cycles – temper you expectations as we are starting from an absolute lower level of rates and more importantly; the Fed is now thinking YCC. So this will be a two speed trade where you play the steepener now and the flattener later. Therefore, you can think about buying Eurodollar flies like EDM2/EDM3/EDM4 (which is an EDM2/EDM3 steepener + EDM3/EDM4 flattener). This has a positive 1.7bps of 3m carry.

Back to our regularly scheduled data deterioration theme.

The labor report on Friday gave the market a collective sigh of relief after the disastrous ISM reports. While not robust, it was good enough to stave off a panicky fixed income rally.

The positive in the report was the UER (the most lagging indicator) ticked to a new a cycle low. This is what happens at the end of the cycle:

Labor market gets tight (in this case some labor shortages) -> inability to hire causes productivity to decline -> firms eventually have to go the other way and layoff.

On the layoff front, I am starting a running list as of the last week. If economic theory holds, this list should start to grow substantially:

- Kroger Is Eliminating Hundreds of Store Employees

- Lazard axes 7% of jobs from asset management unit

- Sports Illustrated’s New Operator to Lay Off More Than 40 Employees

- Domtar To Cut 100 Jobs In Arkansas, Michigan As Its Shuts 2 Paper Machines

- WeWork leaders tell staff that job cuts are coming this month

- HP Inc. to Cut as Much as 16% of Workforce Amid Print Unit Woes

- Bonobos to Cut Several Dozen Jobs; Employs About 600 People

- HSBC to Cut Up to 10,000 Jobs in Cost-Cutting Drive: FT

- Lay-offs at GM edge close to 60,000 after talks with car workers break down

- Schwab said it was cutting 3% of its workforce

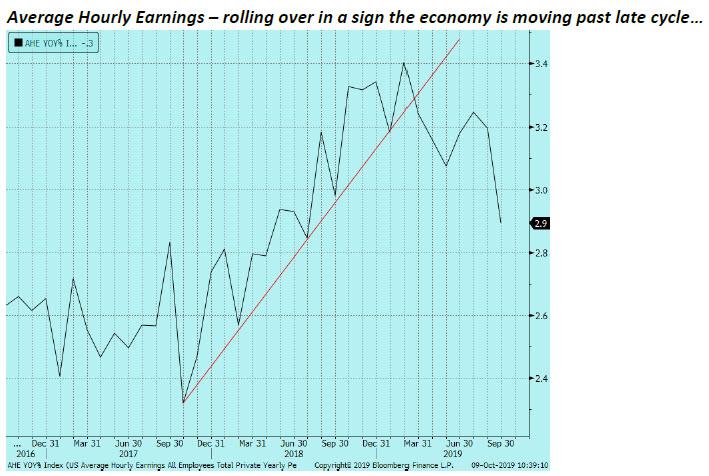

The most troublesome part of the labor report Friday was the rollover in Average Hourly Earnings. Again, at the end of the cycle, wages are supposed to be rising: labor market gets tight -> employers are forced to pay up.

Therefore, the fact that wages are now reversing is a sign the economy is going past late cycle.

Bottom line: the Fed rhetoric that implies end of cycle is being confirmed by the continued data deterioration. The Fed got behind the curve, and now they are now attempting to catch up.

Long the front end, curve steepeners, long equities, and long gold (real yields will go negative) are the ways to position for this stage of the cycle. At a later date, the flattener and short equities will be the position, but not yet.

Tyler Durden

Wed, 10/09/2019 – 15:25

via ZeroHedge News https://ift.tt/33eLWHZ Tyler Durden