China Bond Markets Shrug Off Soaring Hyper-Pig-flation (For Now)

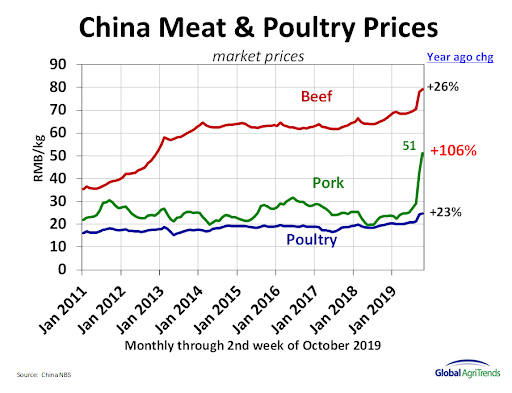

As we detailed previously, African swine fever (‘pig-Ebola’), which has been raging across China, and Asia, has decimated pork supplies.

Since we first reported on China’s ‘pig Ebola’ epidemic, China pork prices have doubled for 1.4 billion people.

As @AgriTrends notes, “hyper-inflation is here…”

And as we detailed here, that has filtered through to soaring consumer price inflation overall – at its highest since 2013…

Source: Bloomberg

But, with Chinese bond yields shrugging off the inflationary push…

Source: Bloomberg

Real China bond yields are set to go negative for the first time in seven years…

Source: Bloomberg

Bloomberg notes that while extraordinarily low yields – adjusting for inflation or not – have become the norm across the developed world, it’s rare in emerging markets.

By contrast with China, South Korea’s 10-year bonds offer 2% real yields. Bondholders in India are getting more than 2.5% after accounting for inflation running at almost 4%.

“The bond market understands that this is purely supply, it’s not a general wage inflation or inflation in the economy,” said Edmund Ng, chief investment officer at Eastfort Asset Management, who previously worked at the Hong Kong Monetary Authority.

“The African swine fever will not last forever.”

Indeed, National Bureau of Statistics spokesman Mao Shengyong said Friday that pork prices should gradually return to a “normal range,” and played down concerns about inflation.

But, not everyone is buying that propaganda.

Pork prices are likely to remain elevated for some time, said Betty Wang, a senior economist at ANZ. She said farmers had culled so many pigs that it would take a while for supplies to build up again.

“If people feel that food inflation is going up, it may spur policy actions,” she added, although it wasn’t clear just how Beijing can find a quick and easy substitute to domestic farms.

The apparent trade truce between China and the US could be what China needs to stabilize its pork supplies.

“The market is more concerned about other macro factors,” said Li Haitao, deputy director of fund investment at Hexa AMC, most notably, the collapse in its economic growth…

Source: Bloomberg

Tyler Durden

Tue, 10/22/2019 – 19:05

via ZeroHedge News https://ift.tt/2BBrlBM Tyler Durden