Stimulus Doesn’t Stimulate: The Case Of Japan

As SchiffGold.com notes, last week, Keynesian extraordinaire Paul Krugman called for more fiscal stimulus in the form of a “government investment program.” Mike Maharrey poked fun of him in his Fun on Friday column. But while it might be amusing to crack jokes at the expense of Keynsians and their obsession with both fiscal and monetary stimulus, the policies they promote are actually quite pernicious.

In fact, the do the exact opposite of what they’re supposed to.

In simplest terms, the idea is that stimulus will boost demand by incentivizing borrowing and spending. Ultimately, that will spur economic growth. And it works in the short-term. Economic stimulus creates the illusion of prosperity — that is until the bubbles inflated by the easy money pop.

Stimulus – especially the monetary variety – also has a longterm effect. As economist Dr. Mihai Macovei explains in an article originally published at the Mises Wire, efforts to stimulate growth actually end up hampering growth over the long haul. Macovei uses the case of Japan and its long-running stimulus program to illustrate this point. As you’ll see, the results of decades of stimulus are less than inspiring.

Authored by Mihai Macovei via The Mises Institute,

Efforts to stimulate growth end up hampering growth. The Austrian Theory of the Business Cycle (ATBC), pioneered by Ludwig von Mises, explains this seeming paradox. Government reduction of interest rates below the would-be market rate triggers an expansion of fiduciary credit in the context of fiat currency and fractional-reserve banking. It leads to a boom whose main features are both malinvestment and overconsumption. The former squanders factors of production in business activities less urgently needed by consumers while the latter undermines the replenishment of the capital stock. Both processes undermine long-term productivity and sustainable growth.

Nevertheless, the public would like the illusion of prosperity during the boom to last indefinitely. Instead of letting the recession cure the misallocation of resources from the boom, governments push for more expansion of fiduciary credit and public spending. This worsens the depletion of capital, lowering future living standards.

Following this pattern, most economies rushed to implement successive growth stimuli since the 2008/2009 Global Financial Crisis. At the same time, government-sponsored pundits and academics tried to brush aside all dissenting voices and arguments. In the meantime, it has become obvious that the global economy is trapped in a vicious circle of monetary stimulus, ever-growing debt and steadily deteriorating long-term growth prospects.

One glaring example of this is Japan whose growth prospects crumbled after almost three decades of ill-conceived growth-stimulus programs.

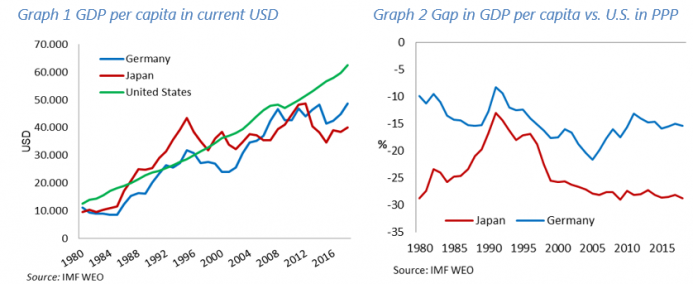

Following the burst of an asset bubble in the early 1990s Japan has stubbornly tried to revive growth with ultra-loose monetary and fiscal policies. Japan’s “lost decade” eventually extended to almost three decades of sub-par growth. Real GDP growth dropped dramatically from about 4% in the 1970s and 1980s to less than 1% on average since 1991. At the same time, GDP per capita nose-dived relative to other advanced economies, both in current U.S. Dollars (Graph 1) and adjusted for the purchasing-power-parity, i.e. for the inflation differential (Graph 2).

In the aftermath of its crisis, Japan did everything possible to keep the boom going and maintain an inflated level of wages and prices. It was the first among major economies to experiment with zero interest rate policy already in 2001 and introduce quantitative easing and negative interest rates during 2013/2014, part of the Abenomics’ drive to stimulate growth even harder. Yet, neither growth nor inflation picked up, because the allegedly growth-supporting measures were actually preventing the liquidation of malinvestments and price distortions from the boom.

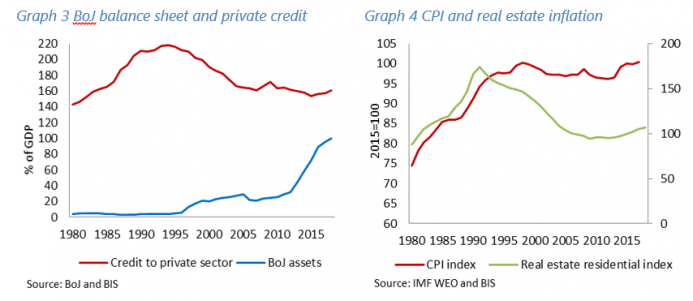

First, it took Japan more than 15 years to clean-up the balance sheets of its banks and open the credit channel to new firms. Bank of Japan (BoJ) has tried to reflate the economy in vain as banks refused to lend because of the bad debt overhang. BoJ expanded its balance sheet from about 4% of GDP in the early 1990s to 100% of GDP in 2018, primarily by purchasing Japanese government securities. At the same time, credit to the private sector declined by about 60 pps of GDP towards its 1980 level (Graph 3).

Second, non-viable and over-indebted “zombie firms” have been kept alive to this day via very low interest rates and public support in the form of favourable lending conditions to SMEs and classification of restructured loans. It depressed corporate investment, kept wages high and prevented the allocation of economic resources to activities that are more productive.

Third, unsound macroeconomic policies and inflated domestic wages and prices depressed investor confidence and capital investment. Therefore, large and profitable companies preferred to invest in domestic or foreign financial assets, including outward FDI, which picked up from about 0.5% of GDP per year in the 1990s to almost 4% of GDP recently.

What remained a mystery to many mainstream economists was Japan’s inability to ignite inflation despite its massive monetary easing experiment. Many of the explanations put forward such as traditional consumers’ thrift, aversion to risk and changes in consumption patterns driven by population aging remain unconvincing compared to the deflationary pressure that set in when the credit boom stopped after a sizeable increase in consumer and real estate prices during the 1980s (Graph 4). Japan’s “war on deflation” has actually prevented the adjustment of relative prices distorted in the boom, thus perpetuating the misallocation of factors of production and undermining market-driven investment.

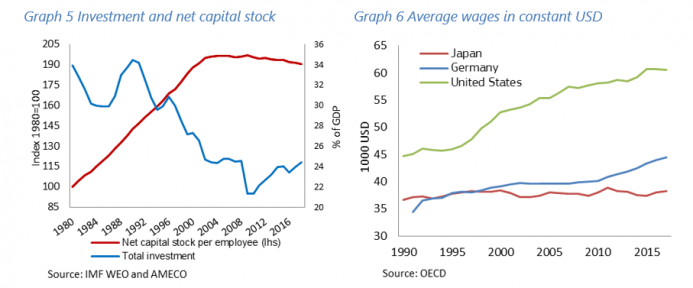

The investment-to-GDP ratio dropped by more than 10 percentage points since 1980 and flagging investment could not ensure the full replacement of the amortised capital. As a result the net capital stock per worker started falling since the early 2000s (Graph 5), causing labour productivity to decline to nearly a quarter below the top half of OECD countries (OECD, 2019) and more than a third below the U.S. As a result, real average wages remained flat for almost three decades while the gap relative to the U.S. or German wages widened significantly (Graph 6). This affects also the future income of retirees, in particular as the gross pension replacement rates represent only about 58% of individual earnings in Japan vs. 71% in the U.S. (OECD, 2017).

In conclusion, by successive rounds of monetary expansion and deficit spending which inflated the gross public debt to almost 240% of GDP, Japan has not allowed a curative recession to liquidate malinvestments after the 1980s boom. The price paid for procrastinating the adjustment of relative prices and structure of production to market needs has been a gradual erosion of the capital stock per worker and labour productivity. In line with the Misesian theory of the business cycle, it ultimately led to relative impoverishment in terms of stagnant real wages and lower pension levels. This undesirable outcome can serve as a wake-up call for other countries engaged on the same path of recurrent growth stimuli and would like to avoid the “Japanification” trap.

Tyler Durden

Tue, 10/22/2019 – 17:25

via ZeroHedge News https://ift.tt/33SsAJ2 Tyler Durden