What Elon Forgot To Mention: Tesla’s US Sales Crashed An Astonishing 39% In Q3

The release of Tesla’s 10-Q this morning has revealed some very unflattering truths behind last week’s “stunning”(ly massaged) Q3 earnings report, which prompted a massive short squeeze and a nearly 30% jump in the company’s stock since last Thursday.

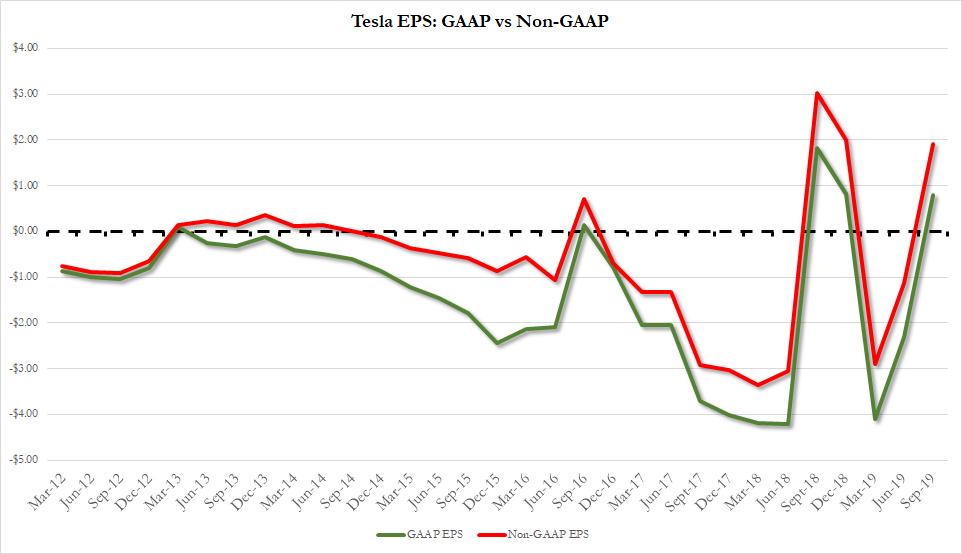

The company’s surprise “profit” disclosed last Wednesday shocked investors and left skeptics of the company befuddled as to how to explain the jarring swing back to “profitability”.

Many skeptics suspected that the 10-Q would shine light on variables like warranty reserves, capex and A/P being juked to produce an impressive, yet unsustainable, earnings print.

And while most suspicions were proven accurate with the release of today’s 10-Q, there was one truly staggering indicator that far from soaring, Tesla stock – when stripped of all the accounting magic and potential fraud – should be plunging.

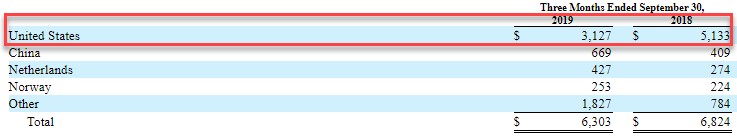

Presenting exhibit A: Sales by region, and specifically the US.

Behind all of the fancy financial engineering, Tesla’s U.S. sales fell off a cliff to $3.13 billion in the third quarter from $5.13 billion a year earlier. This marks an astonishing 39% drop that would have resulted in the immediate termination of any other auto CEO.

Because when it comes down to unadjusted bottom line, this is what the unbiased truth looks like outside of a glossed up press release, PowerPoint slides and Elon Musk’s spin on the narrative: demand is collapsing.

China, the Netherlands, Norway and a black box called “Other” all saw sales rise modestly.

And although Tesla said that global deliveries for the quarter rose 1.9% to 97,000 vehicles, there was an ugly lining to that narrative, as well: most of the growth came from sales of the Model 3, the company’s lowest margin vehicle (although at this point one has to wonder just what revenue recognition fraud was involved in the company hitting this bogey).

Tesla also admitted in the regulatory filing that it was able to cut costs for the quarter due to unspecified “commercial negotiations with suppliers.” In other words, the company is likely stretching out payment terms and temporarily stiffing suppliers (although Panasonic did not respond to Bloomberg’s requests for comment).

It also got a one time $55 million benefit from revising warranty provisions.

And while most sellside lemmings were quick to express their adoration of Elon after the company’s earnings report – without even having read the 10Q – Roth Capital’s Craig Irwin, was one of the few to see through the smoke and mirrors and downgrade the stock this morning to “Sell” from “Neutral” stating that its margins remain unsustainable: “The filing from Tesla shows warranty adjustments and other one-time items are a large driver of perceived strength.”

Meanwhile, as long as the SEC continues to allow Musk to get away with outright criminal fraud, and direct the narrative by saying whatever he wants without fear of any punishment, while doing whatever he wants from an accounting standpoint, expect the company’s lies and fabrications to only get bigger and greater until one day the house of cards falls under the weight of its own lies.

Tyler Durden

Tue, 10/29/2019 – 14:18

via ZeroHedge News https://ift.tt/31XY7bd Tyler Durden